Key Points:

- Job gains remained solid in February as employers added 275,000 new jobs over the month.

- The unemployment rate rose to 3.9% as the labor force participation rate held steady.

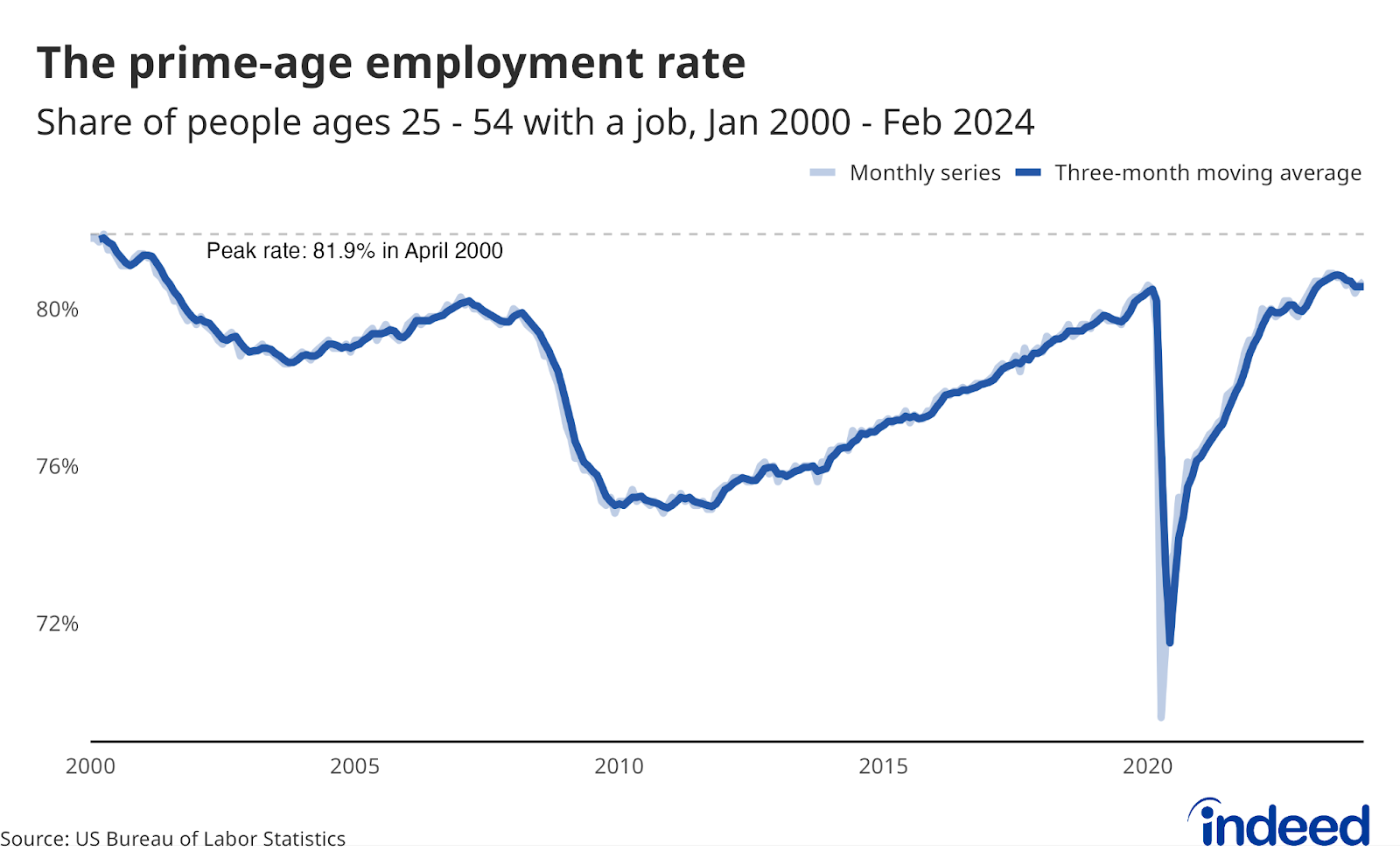

- A look into the more detailed data shows more encouraging signs as the share of workers ages 25 – 54 with a job rose for the second month in a row.

Today’s jobs report may look somewhat confusing on the surface. Job gains were solid in February, but the unemployment rate jumped. The two surveys that power this report are somewhat at odds, but under the surface, there is a lot to like. The rise in unemployment appears to have been driven by movements on the periphery, as the prime-age employment-to-population ratio stays on the rise and job losses remain low. The rate at which currently unemployed workers are finding new work does appear to be slowing, but remains generally robust. For those worried about signs of unwelcome heat in the market after the past few months, this report is a welcome cooling breeze. And if you’re concerned about a labor market on unsteady ground, you shouldn’t be too frightened.

The establishment survey is chock full of encouraging data this month. Not only did payroll growth remain robust, but the gains were spread through the labor market. The diffusion index — a measure of how many industries added jobs over the month — came in at 62.6, its third straight month above 60. In other words, almost two-thirds of sectors added jobs last month. So while health care and social assistance once again provided the lion’s share of job gains (almost a third in February), many industries are increasing their payrolls.

On the other hand, the household survey looks troubling at first glance. The unemployment rate rose and the labor force participation rate held steady for the third straight month. But the details are more encouraging. The employment-to-population ratio for workers ages 25 to 54 increased in February and is now reversing the decline we saw near the end of last year. A similar story is true for participation rates for these prime-age workers, particularly women. After flagging somewhat towards the end of last year, the participation rate for prime-age women jumped for the second straight month by 0.3 percentage points, an encouraging return of momentum for a key group that has led the way throughout the recovery.

The Federal Reserve should be content with this report as well, as not only is employment holding up but wage growth is slowing down. After picking up in recent reports, average hourly earnings growth is trending down once again. After a few months of head fakes, it looks like the labor market is returning to last year’s familiar moderating trend. Let’s hope that keeps up.