Key points:

- The unemployment rate rose to 3.8% in August, but that increase was mostly driven by a rise in people entering the labor force rather than more workers losing their jobs.

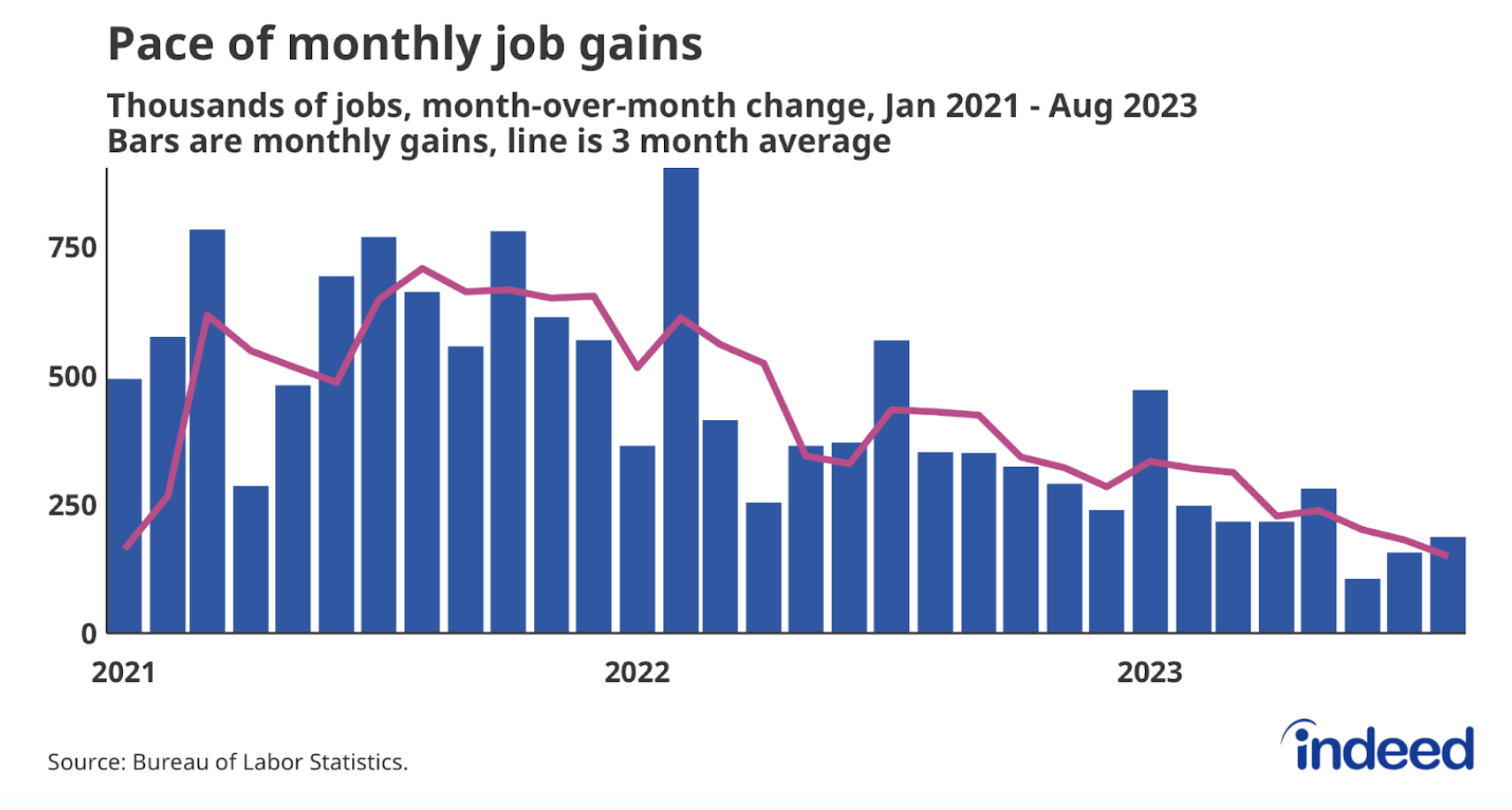

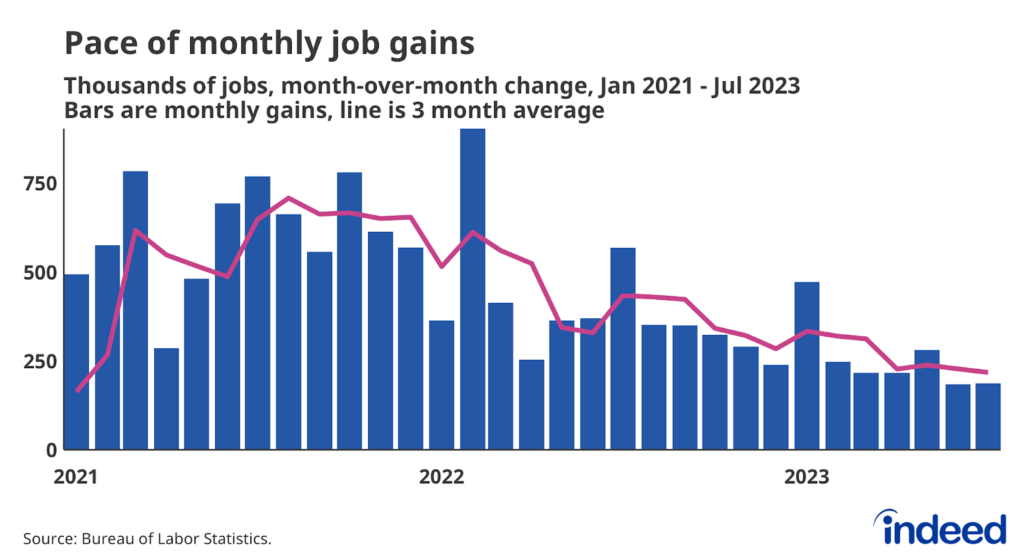

- Employers added 187,000 new jobs in August, but downward revisions to June and July’s data resulted in the three-month average gains dropping to 150,000.

- Wage growth continued to moderate, with wages for production workers growing at a 3.9% annual rate over the past three months, on the higher end of what’s likely to be sustainable given productivity growth.

- The labor market was sprinting last year and now it’s getting closer to a marathon pace. A slowdown is welcome; it’s the only way to go the distance.

Nothing in today’s jobs report should change your view of the labor market too much. The spike in the unemployment rate is likely more noise than signal, and the labor market remains solid. Payroll gains continue to slow down, wage growth is moderating slowly, and labor force participation is trending upward. Monthly payroll gains are still running faster than the neutral pace of 70,000-100,000 needed simply to keep pace with population growth, but are trending toward that threshold. Wage gains are still robust but are near the high end of a sustainable pace. And the labor force participation rate for prime-age workers is at rates similar to 2001. The labor market is slowing down, not collapsing.

Employers added new jobs at a robust pace in August, in spite of some idiosyncratic shocks that pulled the number down. The large decline in Transportation jobs can be attributed to significant layoffs in the trucking industry, while at the same time, the motion picture industry subtracted 17,000 jobs due to the ongoing Hollywood strikes. Assuming these are large one-time shocks, the August number could have been slightly higher. However, the underlying trend is clearly toward slowing payroll gains, especially after the large downward revisions to initially reported June and July data. August might have been surprisingly strong, but the labor market is losing momentum: The three-month moving average of job growth has fallen from 201,000 jobs in June to 150,000 jobs in August.

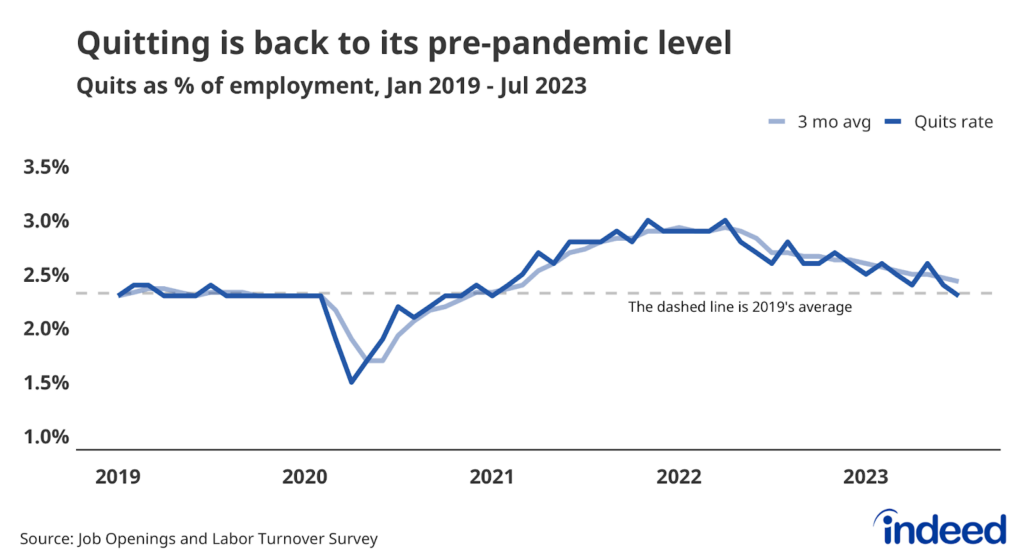

Additionally, wage gains look to be slowing again. Wages for production workers grew at a 3.9% annual rate over the past three months, higher than pre-pandemic levels of 3.5%, and on the higher end of what’s likely to be sustainable given productivity growth. This rate, along with continued payroll gains north of 100,000, is too quick for the Fed’s liking. But there are signs that wages will continue to slow down as quitting has moderated and posted wages continue to decelerate. A wage-price spiral is less and less of a concern moving forward.

The US labor market continues to come back to earth, but from a very high peak. Payroll gains were never going to keep up their over 400,000 jobs a month pace from last year. Wages weren’t going to grow indefinitely at an over 6% annual rate. The labor market was sprinting last year and now it’s getting closer to a marathon pace. A slowdown is welcome; it’s the only way to go the distance.