Key Points:

- Job openings rose in April to 10.1 million, up 358,000 from a month prior. However, more than half of this increase came from the Retail Trade sector alone.

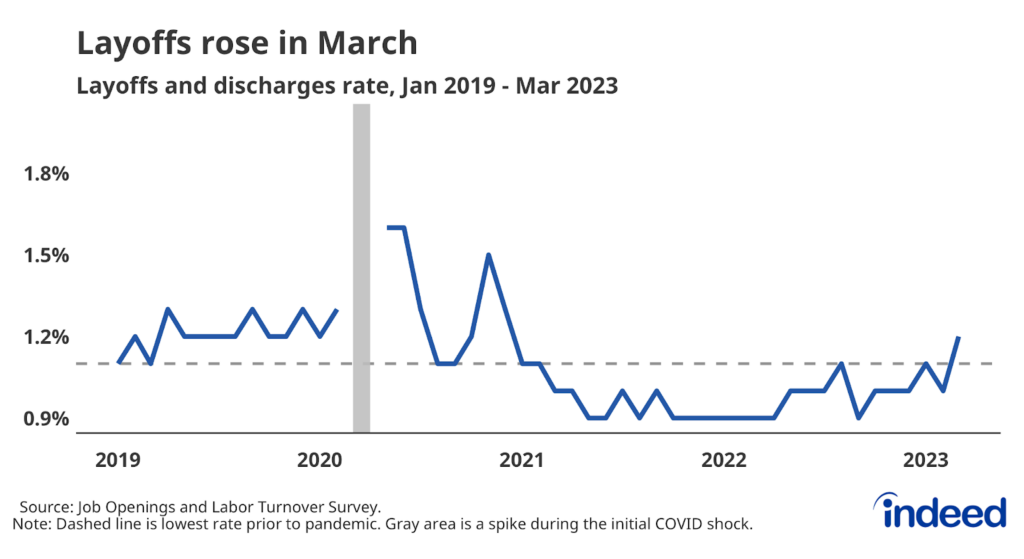

- The layoff rate reversed its spike last month and returned to 1% in April, a rate that would have set records prior to the pandemic.

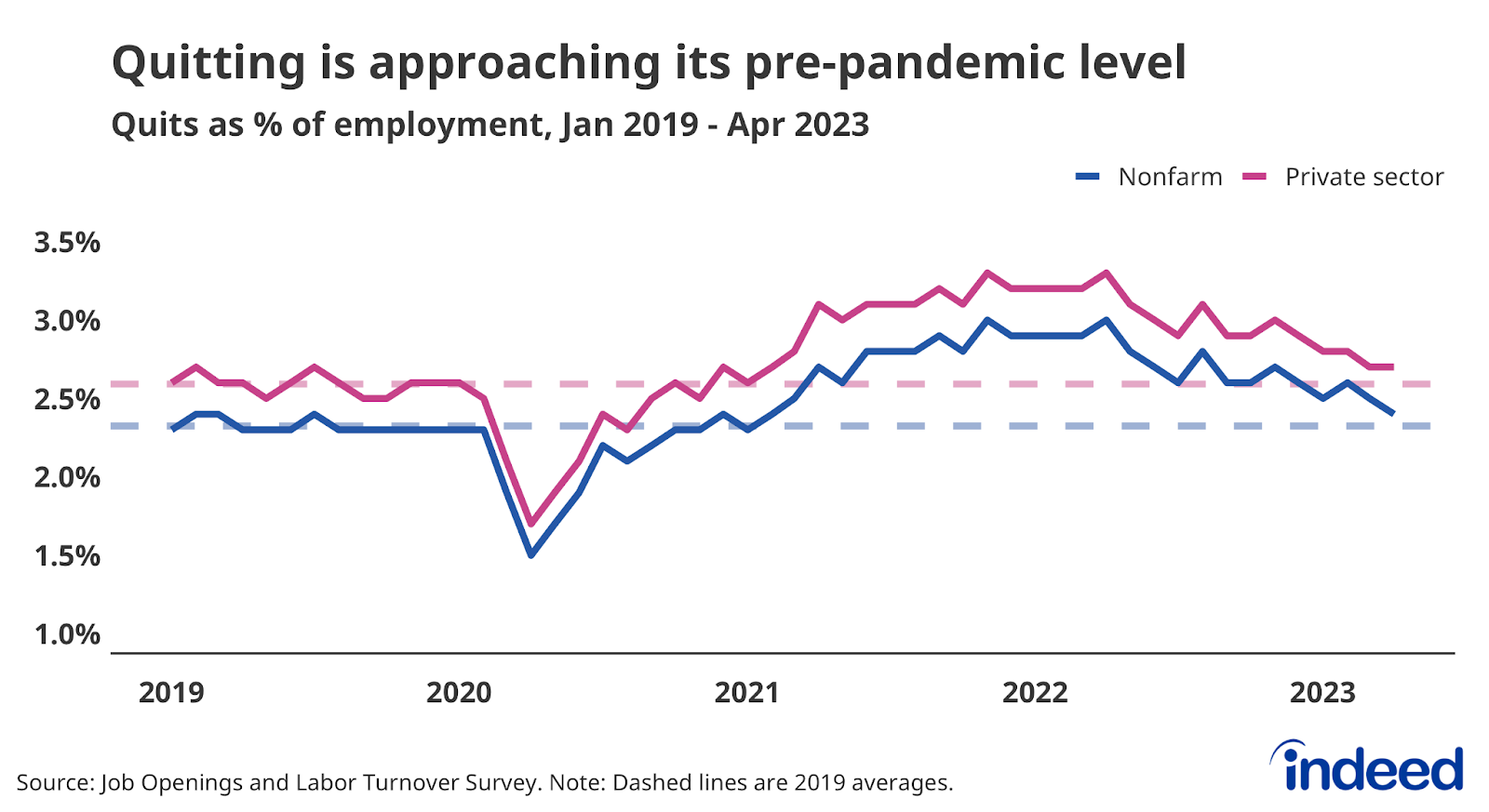

- Job-hopping continues to moderate as the quits rate ticked down to 2.4%, a level just above its average in 2019.

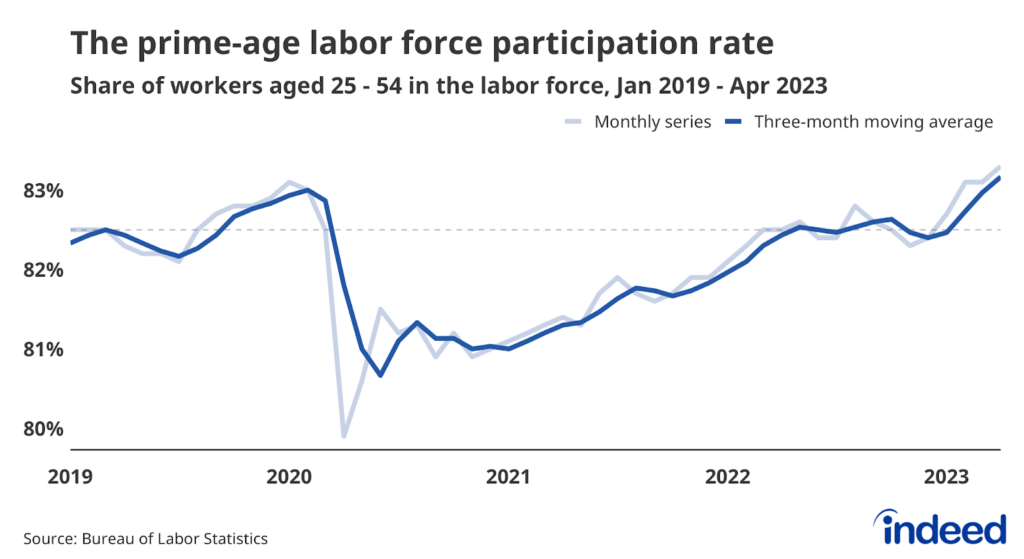

If you look past the unexpected rise in job openings, today’s JOLTS report contains a bevy of data showing a resilient yet moderating labor market — confirming the months-long slowing trend. Openings are still elevated, but workers are becoming less likely to quit their old jobs and take new ones. Additionally, layoffs remain low, reversing their spike in March. In other words, the demand for workers is still strong and the labor market is largely continuing to chug along nicely as it finds a more sustainable balance between workers, job seekers, and employers.

Look at the rise in job openings in April with a skeptical eye — more than half of the increase in April job openings came from the Retail Trade sector alone. Job openings data has been particularly volatile during and after the pandemic, while other measures of employer-hiring intentions, including the Indeed Job Postings Index, show a continued moderation. But a longer view shows that openings are down a stark 16% from their March 2022 peak. Over that same time period, the number of unemployed workers was down more than 5%.

One of the reasons why unemployment continues to drop is that layoffs are still very low. At 1%, the layoff rate in April was lower than the series’ low prior to the pandemic. Last month’s unexpected rise in layoffs seems to have been driven by volatility in the Construction industry which was reversed in April. Outside of a few sectors, layoffs are not currently a concern for the US labor market.

Quitting continues to moderate as the overall quits rate ticked down to 2.4%, just a shade above its 2019 average of 2.3%. The elevated quits rate has been a key signal of job seeker confidence over the past several years. As the quits rate approaches its pre-pandemic level, workers may find they can no longer squeeze bigger wage gains from employers. This dour news won’t be welcome to job seekers, but policymakers at the Federal Reserve will be cheered.

The past few years have been a strange time for the labor market, by virtually any measure. But today’s report shows that the market is finding something that more closely resembles “normal” — a labor market in which job seekers and employers can smoothly find a match that works for them.