Key Points:

- There were 10.8 million job openings in the US as of the end of January, down 410,000 from December and down roughly 6% from a year ago, according to data released today by the U.S. Bureau of Labor Statistics.

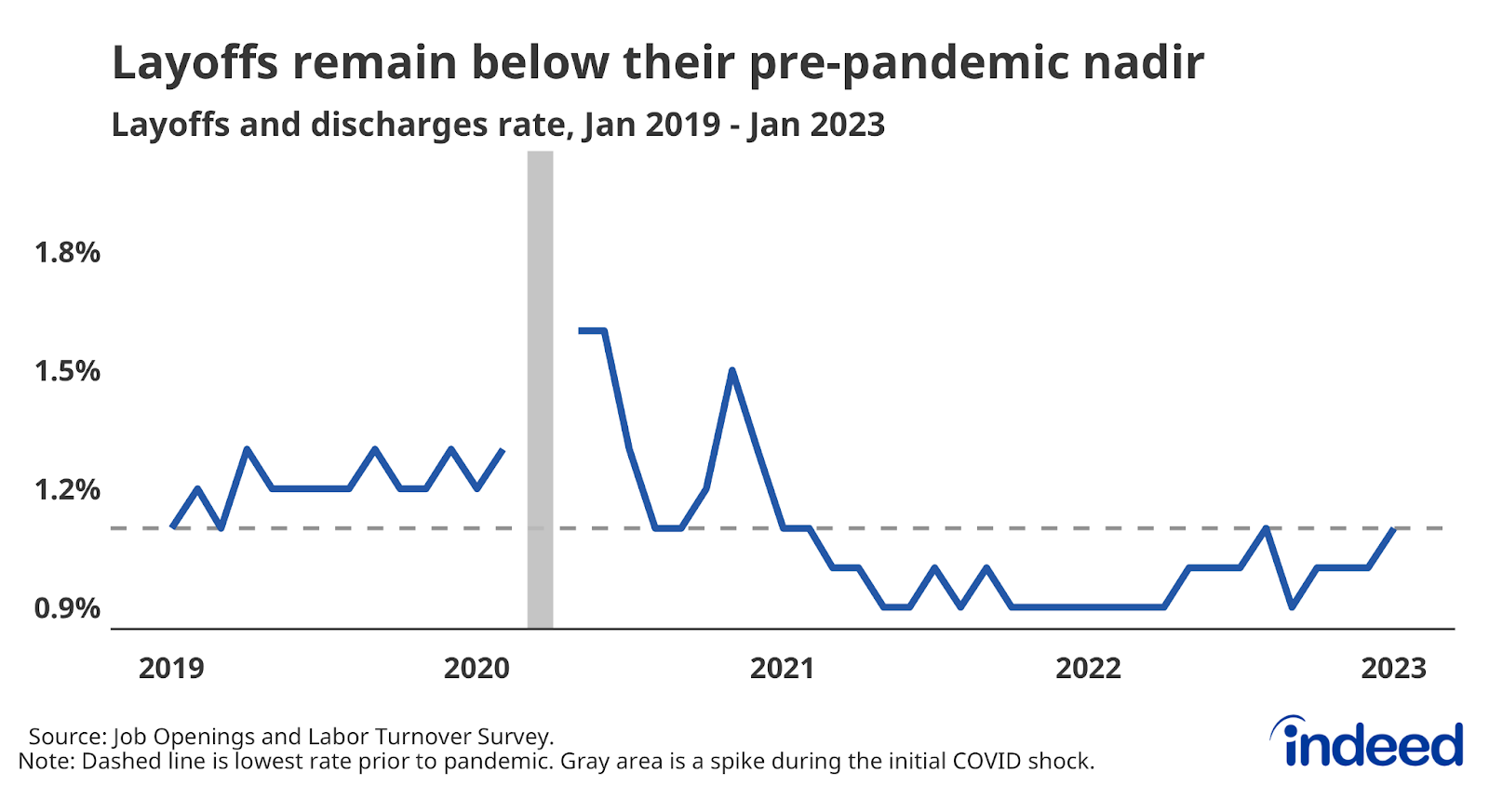

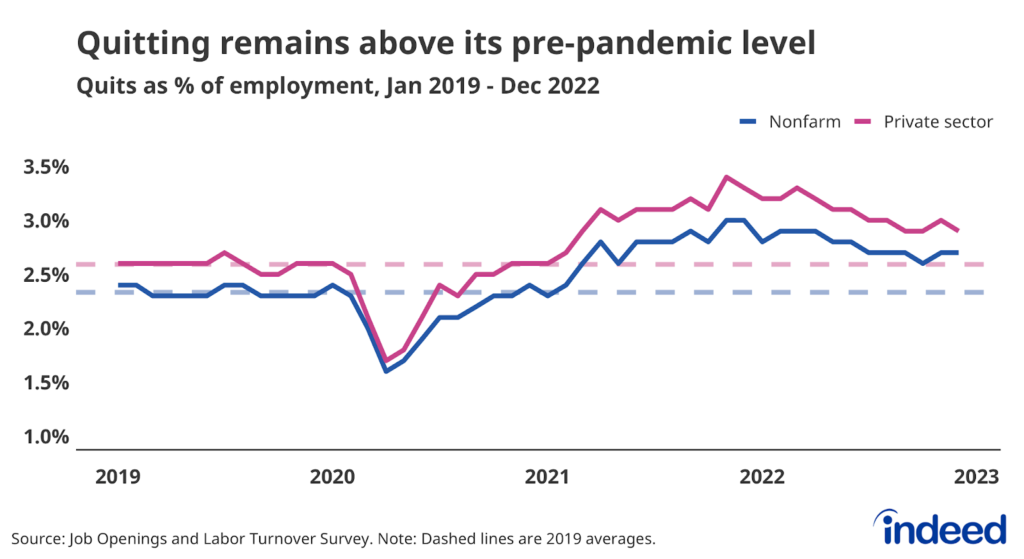

- Revisions to last year’s data show slightly more layoffs and fewer quits than previously thought but both metrics still show a tight, hot labor market in January.

- The labor market may continue to moderate, but demand for workers remains strong.

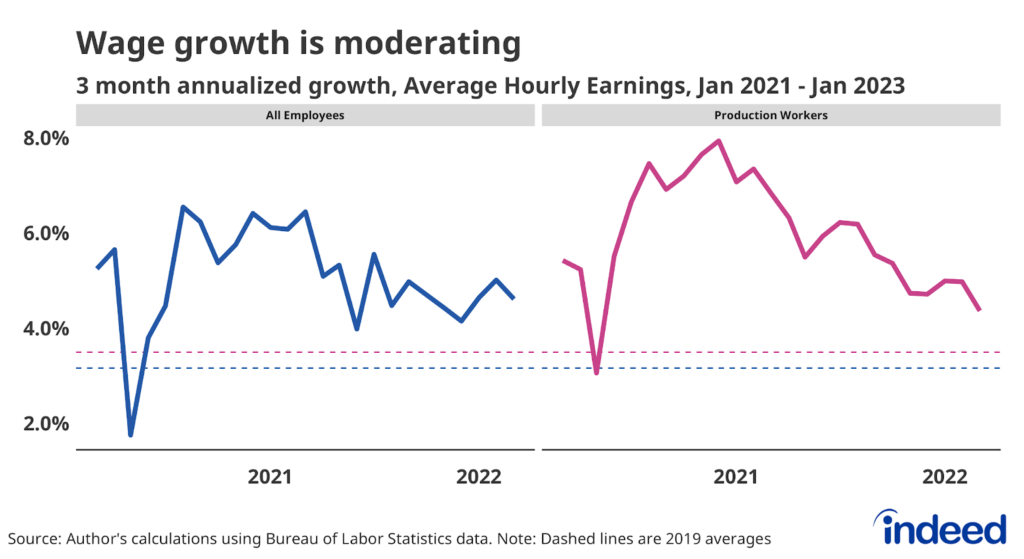

Today’s data from JOLTS not only gives us new information about January 2023 but also updates our understanding of 2022’s labor market. Last year’s labor market may not have been as advantageous to workers as we thought, as quits were revised down and layoffs were revised up. But by any standard, both measures showed a tight, hot labor market. The moderation in the January data may be a sign of further loss of momentum, but demand for workers is still speeding along.

The data on quitting is the most suggestive of a moderating labor market. The annual revisions to the data show that quitting was slightly lower in 2022 than we had previously thought. The January data also shows quitting ebbing; however, all of the decline can be explained by the drop in Professional and Business Services. Quitting still remains elevated in sectors such as Leisure and Hospitality and Retail Trade.

On the flip side, layoffs were slightly higher than we thought last year. The new data on layoffs and discharges show a slight increase during the second half of 2022. Yet even with this new data and the uptick in January, the layoff rate is just equal to its all-time low prior to the pandemic. And the layoff rate for Construction, a sector under pressure from high mortgage rates, remains below its February 2020 level.

Looking forward, demand for workers is likely to continue to moderate as job postings on Indeed declined throughout February. If job openings grew at the same rate as postings last month, there were 10.3 million job openings at the end of February. That would be another drop of about 500,000 openings. Yet openings would still be 47% higher than they were before the pandemic. The labor market is cooling, but it’s still warm.