Key Points

- The labor market recovery accelerated last year as strong demand for workers turned into fast job growth and rising nominal wages.

- The return of many job seekers could accelerate in the year ahead and labor demand could fade.

- The pace at which consumers shift spending back toward the pre-pandemic mix of goods and services will determine which sectors see stronger growth in 2022.

- Remote work is set to endure well beyond the COVID-19 crisis, as demand for and interest in such arrangements remain elevated.

2021 was a transition year. The widespread rollout of vaccines early in the year raised the prospect that the end of the pandemic was within reach. But that didn’t materialize. Variants and uneven vaccination rates in the US and abroad have led to continued waves of COVID-19 infection. The result has been a labor market starting to emerge from the worst of the pandemic, but not yet able to fully break free. Employment has grown rapidly, as have wages. These trends could continue in 2022, perhaps in a smoother manner.

Many questions loom over the labor market this year, but we focus on a few key issues. The labor market was particularly tight in 2021, but it’s not clear how much of that strength will persist. At the same time, many pandemic changes in consumption were evident last year, meaning a return to the pre-pandemic economy hasn’t happened. Remote work will continue for many, but how common it will be is uncertain.

The answers to these questions will go a long way in determining whether 2022 will usher in a smooth transition to a strong, post-pandemic labor market.

2021: Demand for labor roared back but supply took its time

Employers want to hire, but workers have the upper hand for now

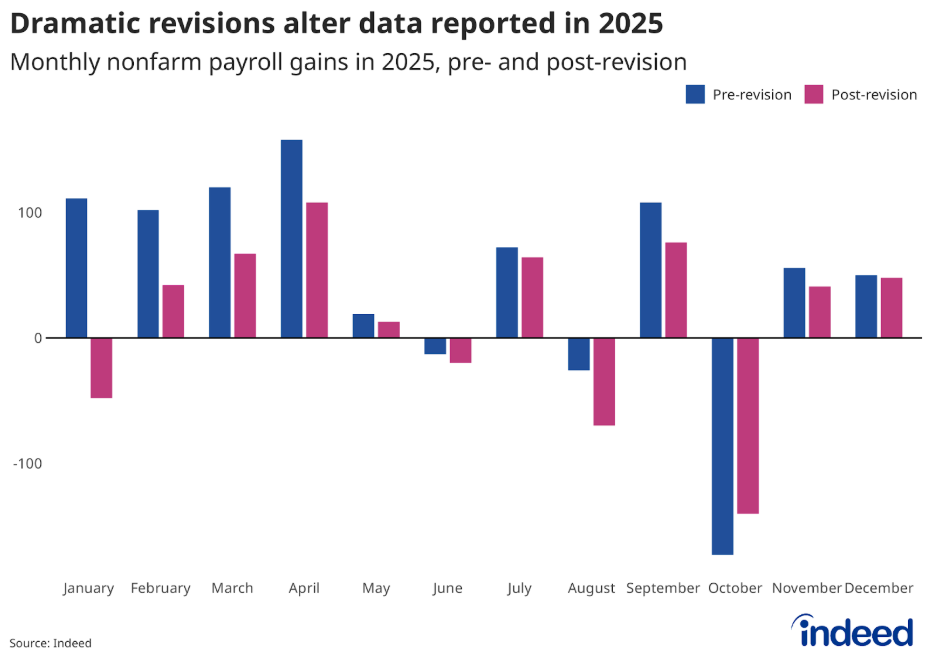

The overarching US labor market issue throughout 2021 was how the recovery of employment and the course of the pandemic remained intertwined. The three-month moving average of payroll gains accelerated during mid-spring’s widespread vaccination rollouts. But recovery slowed during late summer as the delta variant surged.

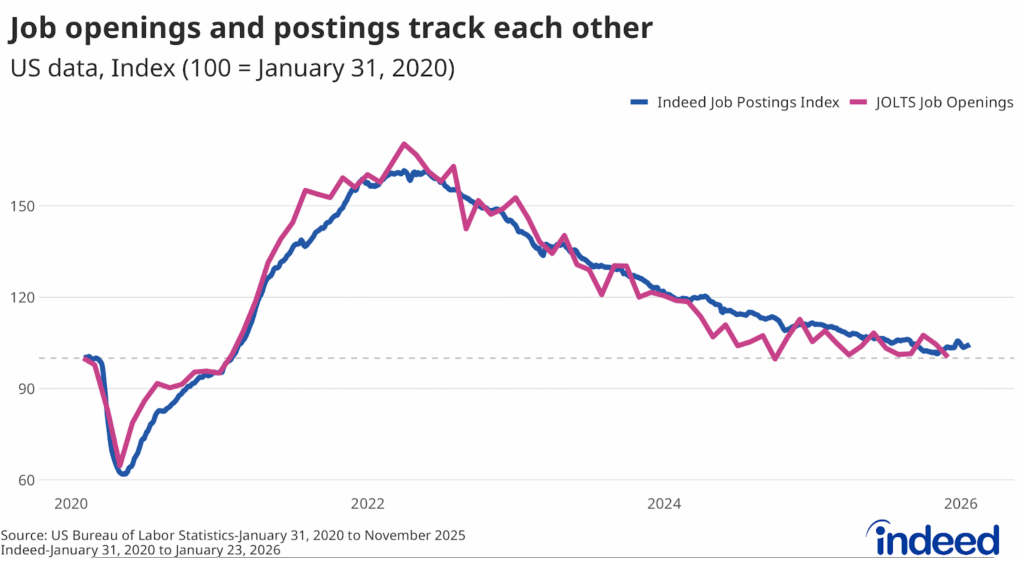

Job postings on Indeed followed a similar path. They first crossed the pre-pandemic baseline in late January and, by December 10, were more than 60% above that benchmark. The steady rise in job postings indicates that employer demand for workers has increased leaps and bounds. Still, the speed of recovery across occupational sectors remains uneven.

Extraordinarily, by the end of 2021, job postings in every occupation were above baseline. However, on one end of the scale, job postings in loading & stocking and human resources were up 110+% each. On the other end, hospitality & tourism barely notched a 20% gain.

Hiring challenges emerged

Anecdotes of hiring bottlenecks emerged in spring 2021. Employers started to use urgent hiring language more often in job descriptions, like “immediate start” or “start today.” They also stepped up advertising of hiring incentives, like signing bonuses, to attract workers. Employers were left scratching their heads. With the arrival of vaccines, where was the anticipated flood of workers?

To be sure, labor supply has picked up. But job seekers remain hesitant. Active job search, that is, people taking specific steps to land work, like responding to job ads, hasn’t budged since the summer, according to Indeed survey data. Expanded federal unemployment programs expired Sept. 6, but there was no rush of workers into the labor force. COVID-19 concerns, childcare problems, and adequate financial reserves dampened job seeker interest.

Three key questions for the 2022 Labor Market

For the labor market, the year ahead is full of uncertainties. Rather than tackle every unknown, we’re focusing our gaze on three key questions for the year ahead.

- Can the labor market continue to stay so hot?

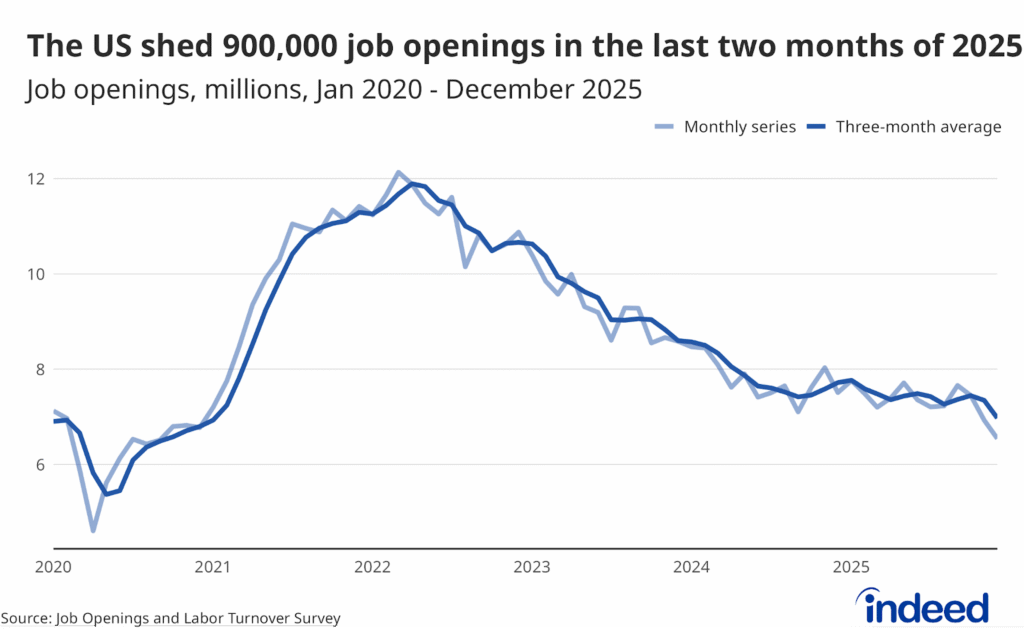

The temperature in the labor market soared in 2021 as demand for workers outran supply. But just how hot can the labor market remain in the new year? By one key measure, the market for new hires is superheated compared with the pre-pandemic period. For every 100 job openings in October 2021, only 69 unemployed workers were out there. That’s much tighter than the average of 84 unemployed workers for every 100 openings in 2019.

Whether and by how much the labor market temperature drops this year depends on how quickly the supply of workers rebounds and how robust labor demand is.

Labor supply may bounce back

The availability of workers might have disappointed employers in 2021, but some of the factors that made job seekers hesitate last year could abate in 2022. COVID-19 was a major worry for many job seekers early in the year. Virus concerns fell as vaccination rates picked up, but the pandemic still holds back many job seekers. Child care responsibilities also remain a major constraint keeping people out of the job market. Employment rates for mothers of young children have lagged those of other population groups since the beginning of the pandemic. Larger-than-usual financial cushions may also be keeping job seekers on the sidelines, though this might fade as households spend down savings.

Labor demand may slow as economic reopening continues

Job openings were off the charts in much of 2021. But it’s unclear how long this historically high demand will last. A large portion of the job surge came from sectors unleashed by the vaccine rollout, such as leisure and hospitality, and personal services. If much of the jump in demand for workers has been due to a reopening economy, at some point the economy will be fully unlocked and vacancies could drift down.

Nonetheless, strong demand for goods, as well as trucking, warehousing, and similar services that get goods into people’s hands, have undergirded strong hiring appetite in 2021. If demand for workers from manufacturing, transportation, and warehousing companies doesn’t slacken, job openings may hold up.

- Will pandemic spending habits continue?

At the beginning of the pandemic, consumer spending on goods and services plunged. But goods spending quickly rebounded far above pre-pandemic trends as consumers bought work-from-home desks, bikes, and home furnishings. Services languished and are still 1.3% below February 2020.

Spending patterns substantially influence labor market trends. If a business doesn’t have enough workers to take care of customers, it could be missing out on potential revenue. Managers of goods businesses want to ensure they have enough product to sell — and that shapes how many workers they hope to hire. The same goes for services. Sales projections determine how many people to employ.

The labor market impact of the sustained shift in spending from services to goods is evident. Transportation and warehousing employment is up 3.6% from February 2020 because online shopping is safe, while some may feel a trip to the mall is dubious. On Indeed, beauty & wellness job postings are well below the economy average. Nail salons, spas, and the like are not yet back to normal.

If the fight against COVID-19 makes more headway, consumer demand may shift back to services in 2022. But the longer the pandemic continues, the more likely it will be that current spending habits become entrenched. While there is undoubtedly some pent-up demand for services, it’s unclear if and when it will show itself. Meals at home, cooked with spiffy new kitchen appliances, may take the place of dinner out for some time to come.

- How much further can remote work extend?

One pandemic labor market trend is likely to be around even after the health crisis abates: remote work. The extent to which this pattern endures is a key question for 2022. The pandemic’s great wave of remote work is ebbing. In 2021, the share of workers doing their jobs remotely because of COVID-19 declined from 23.2% at the start of the year to 11.3% in November, according to the Bureau of Labor Statistics. Still, there are plenty of signs remote work is going to stick around. Demand for workers to fill positions that can be done remotely remains elevated.

In aggregate, job seeker interest in remote positions has also stayed high. At the end of November 2021, 5.6% of job seeker queries on Indeed contained keywords related to remote work, well up from an average of 1.3% in 2019. However, certain categories of workers are more likely to end up with these jobs. Remote work is far more common for those with college degrees. Some 21.5% of college graduates were working remotely because of the pandemic in November compared with only 5% for those without a college degree. Performing a job away from a central workplace may open a range of opportunities for workers who can get those positions. But those opportunities aren’t evenly distributed.

Remote work’s spillover effects will be important to watch in the year ahead. When people perform their jobs at home, employer hiring demand for jobs commonly found in downtown business districts is cut. Fewer office workers means fewer bartenders at downtown happy hour spots and fewer sales clerks in central business district stores. Because of this, job postings have grown less quickly in metros where more work can be done remotely. Remote work might directly affect only a minority of workers. But a sustained trend toward remote work could have substantial ramifications for the broader economy.

Conclusion: Workers may have upper hand in 2022

The short-term outlook for the labor market suggests workers are likely to continue to have considerable bargaining power in 2022. While more workers may enter the labor market if COVID-19 is put in check and childcare options become more abundant, demand for workers seems likely to be strong this year. Even a slight slackening in the labor market would still keep most job seekers in the driver’s seat.

The state of the pandemic remains the key factor in the outlook for next year. But if progress can be made, then the US labor market seems primed for continued strength. Higher employment and strong nominal wage gains could be a boon for most workers. Hopefully, the transition to a post-COVID-19 world will become much smoother in 2022.