This report is a tale of two surveys. The household survey shows accelerating employment gains, workers returning to the labor force, and low levels of involuntary part-time work. The payroll survey shows a significant deceleration in job growth, particularly in COVID-affected sectors.

The good news is that the unemployment rate dropped for all the right reasons. Joblessness fell quite a bit, with the employment rate and labor force participation rate going up. The prime-age employment-to-population ratio accelerated again in November, rising by half a percentage point. If it keeps up its current pace, this metric will hit its pre-pandemic level in May of next year.

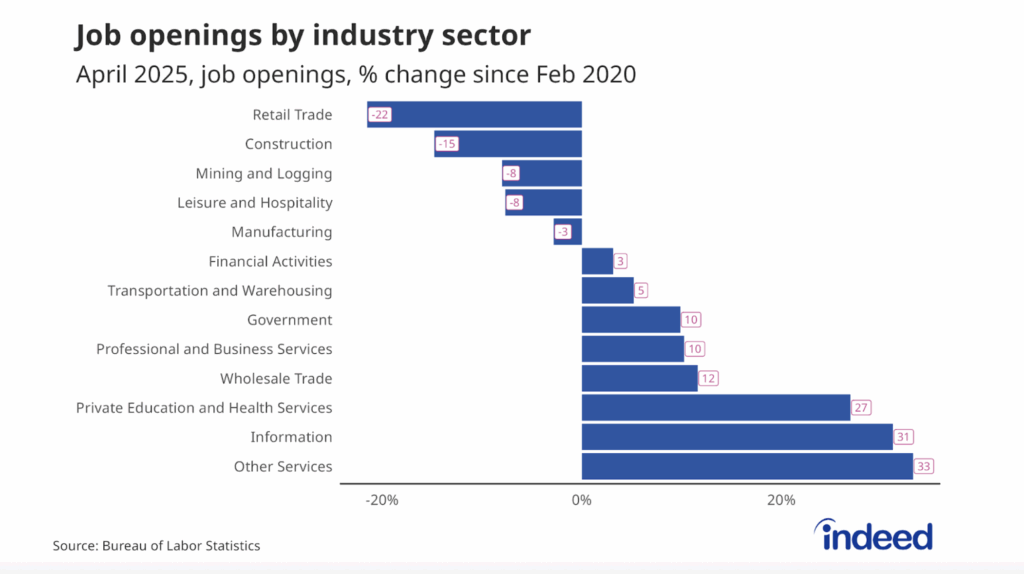

The payroll survey paints a very different picture. Job growth slowed by more than half from the previous month. The slowdown was particularly stark for the leisure and hospitality sector. Not only did job gains in the sector slow down, but the average hourly earnings for production workers in the sector declined in November. It’s unclear whether this was due to a huge drop in demand for leisure and hospitality jobs, or the result of a big shift in the job mix. Either way, it’s strange.

The underlying momentum of the labor market is still strong, but this month shows more uncertainty than expected. Of course, the omicron variant poses another major question mark. The impact of this new variant is unclear, so unfortunately we just have to wait and see. Waiting is the hardest part.