Key Points:

- As of late April, no job sector is seeing growth in new postings relative to last year.

- However, new postings in nursing and software development have seen declines far less steep than the national average decline of 45.5%.

- Competition for new job opportunities has increased, as unemployment climbs and new job opportunities dwindle.

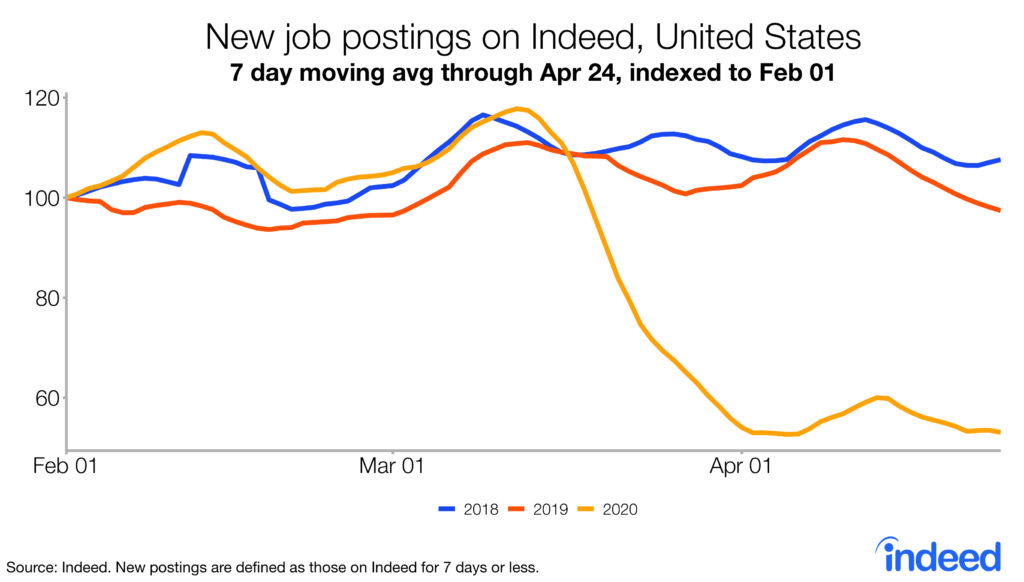

New postings have tumbled nationally

The global pandemic has had a severe impact on the US economy. As of April 24th, new job postings on Indeed, defined as those on Indeed for seven days or less, have slowed by 45.5% compared to the same time in 2019. The fall has been shockingly swift. The growth trend first turned negative on March 17th, just a little more than a month ago.

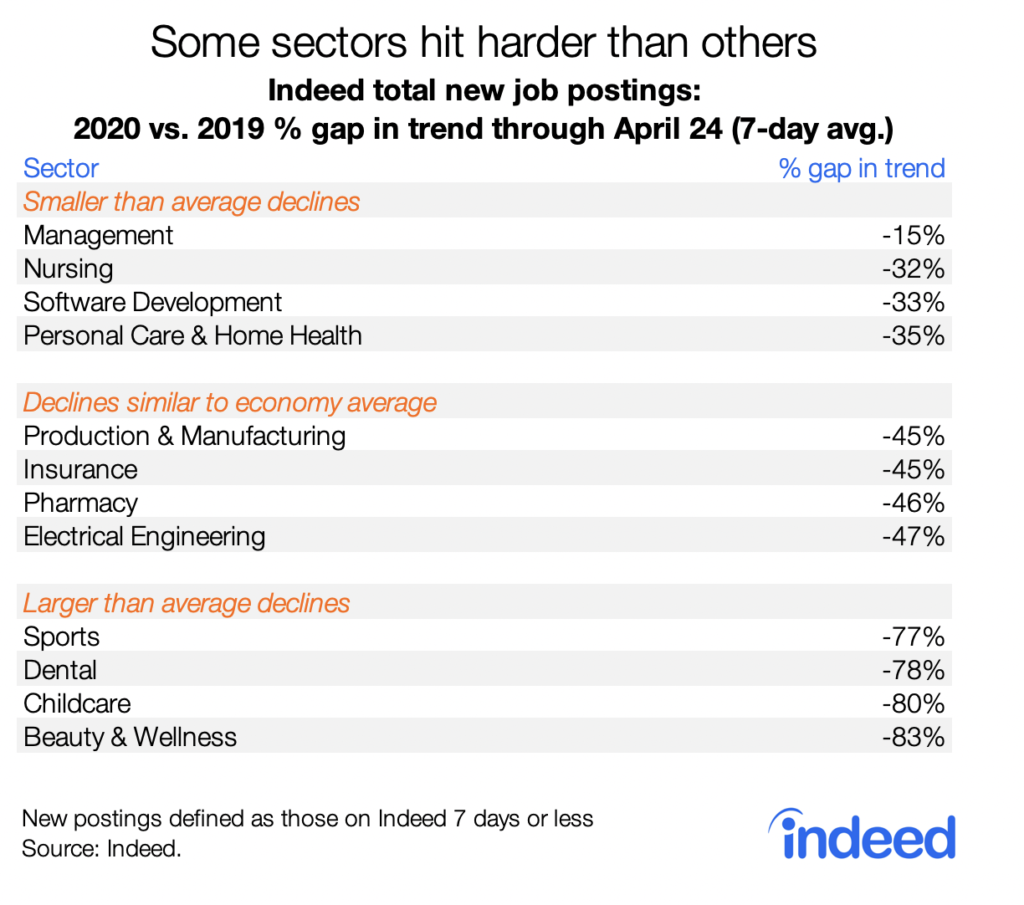

Impact of coronavirus differs by job sector

The impact of the pandemic has been widespread. As of April 24th, no job sector is seeing growth in new postings relative to last year. Yet the severity of the impact differs by industry.

New postings in healthcare and tech, like those for nursing (-32%) and software development (-33%), have seen declines far less than the national average decline of 45.5%. Software development, for instance, is faring better given it doesn’t require face-to-face interaction.

The situation is mixed for new healthcare jobs. While demand for medical professionals was already high prior to COVID-19, the instability of the current crisis is dampening new job openings in healthcare. While medical professionals are needed, hospital budgets have been hit hard in this crisis too.

New postings in highly exposed job sectors like childcare and beauty & wellness have seen the steepest drop in new postings growth, which makes sense since these industries have a near-constant level of face-to-face interaction.

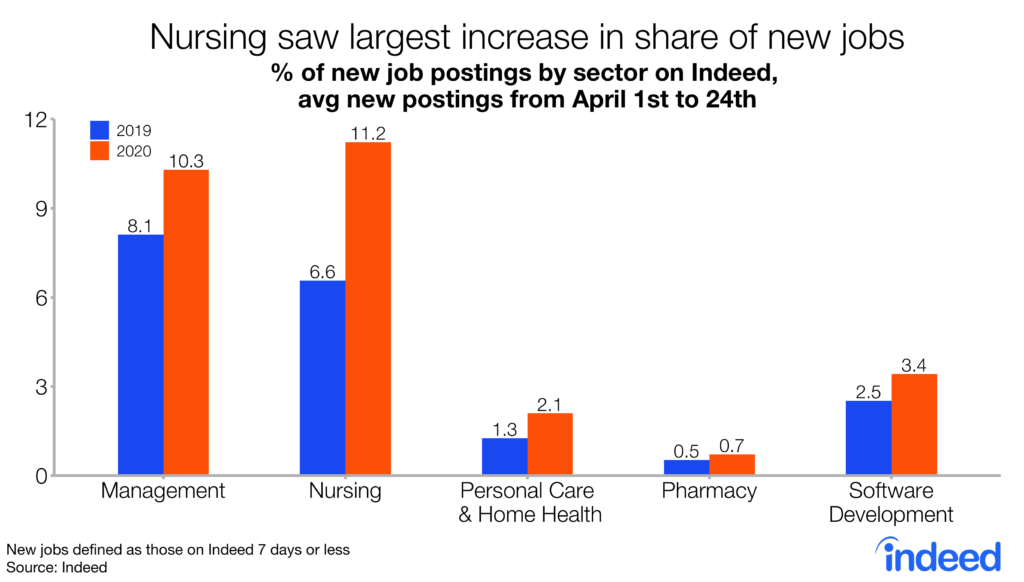

Mix of new job postings has changed

The divide between highly exposed industries and the healthcare sector is evident in the mix of new jobs postings on Indeed. The mix of new job postings looks at the makeup of these new jobs on Indeed by determining the percentage of each sector as a part of all job postings on Indeed.

Comparing the new postings mix from April 1st to 24th to the same time last year, healthcare now has a larger piece of the pie. Last April, nursing made up 6.6% of new jobs whereas of this April, it makes up 11.2%. This is a year-over-year increase of 69.7%, the highest increase seen in any job sector. Healthcare-related job sectors such as personal care & home health, which includes jobs like home care aide, and pharmacy also gained. The software development sector also saw an increase, rising from 2.5% to 3.4% this year.

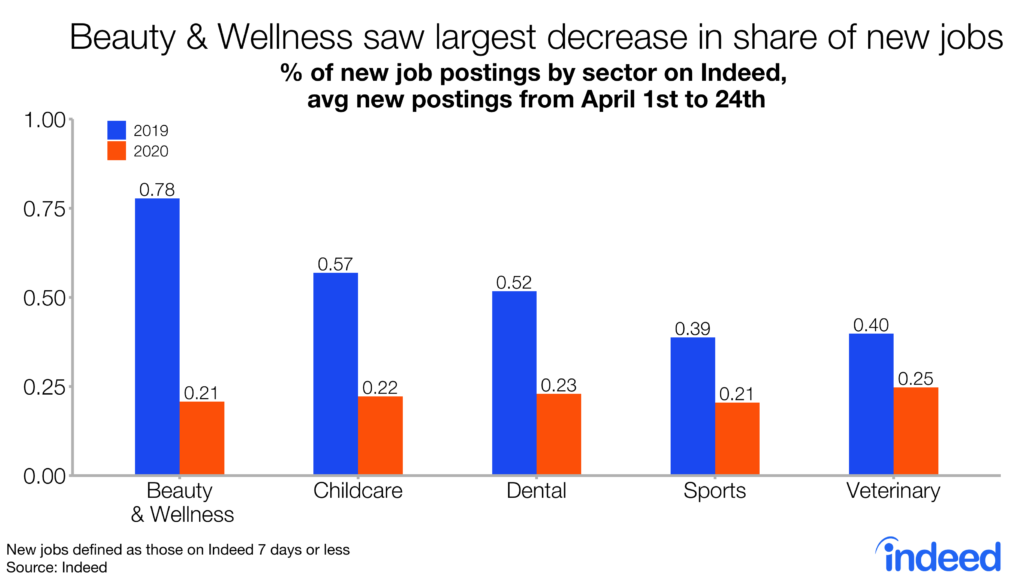

Of job sectors that see the sharpest year-over-year decline in their share of total new job postings, beauty & wellness dropped the most. As hair salons and spas remain closed across the country, it’s unsurprising that their share of new job postings has fallen. Other job sectors’ whose share has dwindled include childcare and sports, two sectors that are currently at a standstill given closed daycares and suspended sporting events.

Competition for new opportunities rises

Competition for new opportunities has escalated across a number of job sectors. As of April 24th, job seeker interest in marketing increased by 72% relative to last year. Media & communications was close behind at 71%, with sales also gaining by 53% year-over-year. Yet hiring in these sectors has slowed as marketing budgets are being slashed and companies are struggling to sell. Job seekers are now competing for a smaller number of available new jobs, which is often the case in times of rising unemployment. And the timing of the rise in clicks per new posting points to this. The year-over-year growth for these job sectors started to rapidly accelerate in late March, early April right when unemployment insurance claims started to soar.

So will job seekers shift toward less competitive sectors in the coming weeks? It appears unlikely. Some of these sectors, like veterinary, required highly specialized skills honed over time. Others, like food preparation & service, have been battered by coronavirus and are unlikely to rebound any time soon. Consequently, it’s improbable to see a sudden shift in job seeker activity toward less competitive sectors. As the crisis continues, the competitiveness gap between sectors may widen.

Conclusion

No job sector has remained insulated from the havoc coronavirus is waging on the US economy. The impact of coronavirus varies by job sector, with healthcare and tech holding up better than others. Job sectors with high face-to-face interaction like childcare and hospitality & tourism have seen their new job opportunities tumble.

The crisis has resulted in increased competition for new job opportunities. Yet job seeker behavior is unlikely to suddenly shift toward less competitive job sectors, like veterinary or social science, that require specialized skills. Depending on how long the coronavirus crisis persists, competitiveness could continue to rise resulting in difficult choices for job seekers and negative long term consequences for the US labor market.

Methodology

New postings are defined as having been on Indeed for seven days or less.

To measure the trends in new job postings, we calculated the 7-day moving average of the number of new US job postings on Indeed. We index each day’s 7-day moving average to the start of that year (Feb 1, 2020 = 100 for 2020 data, and so on), or another date if specified on the chart. Military job postings are excluded.

We report how the trend in job postings this year differs from last year, in order to focus on the recent changes in labor market conditions due to COVID-19. For example: if job postings for a country increased 30% from February 1, 2019, to April 16, 2019, but only 20% from February 1, 2020, to April 16, 2020, then the index would have risen from 100 to 130 in 2019 and 100 to 120 in 2020. The year-to-date trend in job postings would therefore be down 7.7% on April 16 (120 is 7.7% below 130) in 2020 relative to 2019.

For the new job mix on Indeed, we calculate the average share by job sector from April 1st through April 24th from the 7-day moving average.

To examine job seeker interest by sector, we looked at the number of clicks a new Indeed job postings received. Fewer clicks on a posting indicates less job seeker interest in that position.

Information based on publicly available information on the Indeed US website (and other countries named in the post), limited to the United States, is not a projection of future events, and includes both paid and unpaid job solicitations.