Key Points:

- In the wake of the coronavirus shock, job seekers have quickly shifted their searches toward jobs that can be done during a pandemic, such as jobs at essential services.

- Searches for a number of positions that can be done remotely, such as “telehealth nurse,” have surged since March 1.

- Job seekers are shifting away from job titles and employers that are seeing hard times during the coronavirus.

- Takeaway for employers: Employers that are still hiring should do their best to publicize these offerings as job seekers are quick to react.

The coronavirus has been a sudden and significant shock to the US labor market, resulting in millions of workers losing their jobs and employers drastically slowing down their planned hiring. Job seekers on Indeed have reacted quickly by shifting their searches on the site in response to the virus. Since the beginning of March, job searches have shifted toward job titles and terms that are more compatible with work during a pandemic, such as “online” and “telehealth.” On the flip side, searches for job titles and employers that have been hit hard by the virus have dropped. Job seekers are doing their best to adjust their plans but finding new work in these fields would be a tremendous feat.

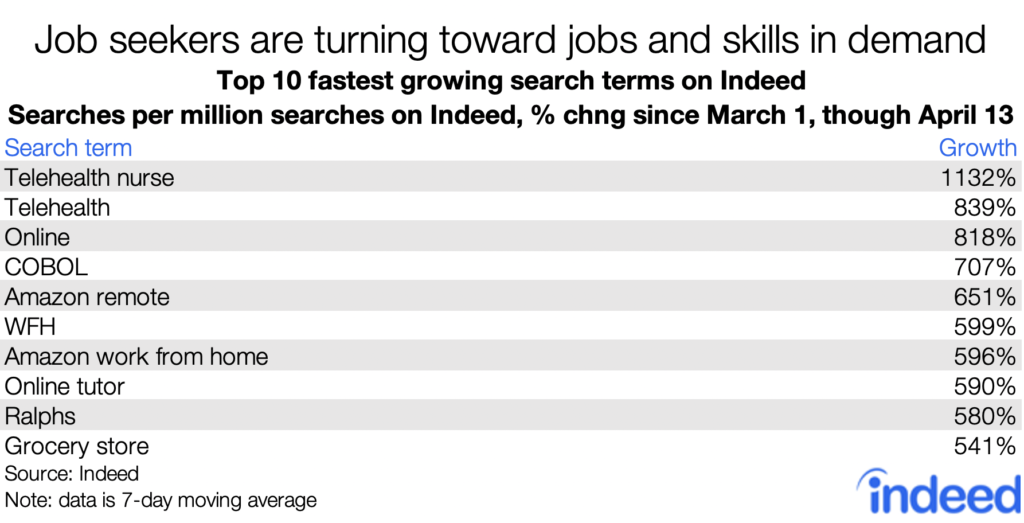

Interest turns toward positions and skills perceived to be in demand

The coronavirus’s effects on the US labor market didn’t start to show until the middle of March, so using March 1st as a baseline for job seeker searches seems reasonable. Since that day, searches on Indeed have shifted toward job titles, characteristics, or competencies jobs seekers think are in demand. Similar to the response of job seekers to announcements of planned hiring from large firms, supply is trying to meet demand.

Search terms related to remote work or job titles with remote work options standout among the terms that have spiked the most. The share of searches on Indeed for the term “telehealth nurse” grew over 1,000% in fewer than six weeks. “WFH,” an abbreviation for “working from home” was only the sixth fastest-growing term during this period, but it grew by almost 600%.

Job seekers may be more interested in remote work, but they’ll likely have a hard time finding it. Finding a remote job could be difficult for many job seekers even in good times, as only 37% of jobs could plausibly be done from home, according to one estimate. Spikes in terms such as “telehealth nurse” and “telehealth” are even less likely to result in a hire unless the jobseeker already has related experience. Rising searches for COBOL will similarly only be fruitful for the select few who know the decades-old programming language that fuels many states’ unemployment insurance systems.

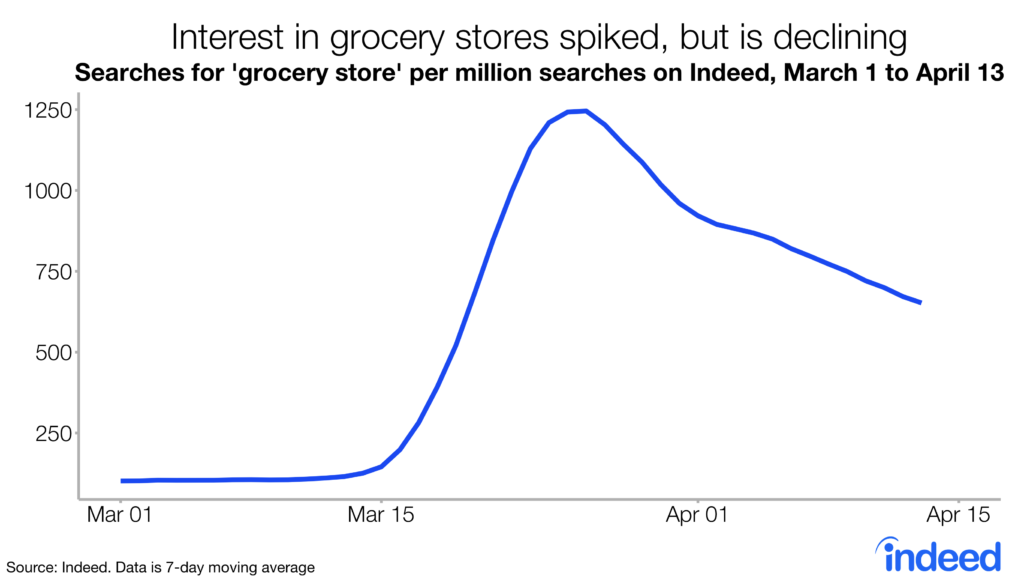

Interest in grocery stores spiked, but is declining

The rise in other terms might be more fruitful for more job seekers. Grocery stores were publicly announcing increased hiring a few weeks ago and appear to have attracted job seekers. Or at least initially. Searches for “grocery store” and the grocery chain Ralphs did spike through much of March, but job seeker interest has declined in recent weeks. People may have quickly checked out the positions and found either a job, fierce competition, or roles they are unwilling to do during a pandemic. Regardless, job seeker interest in grocery stores remains elevated.

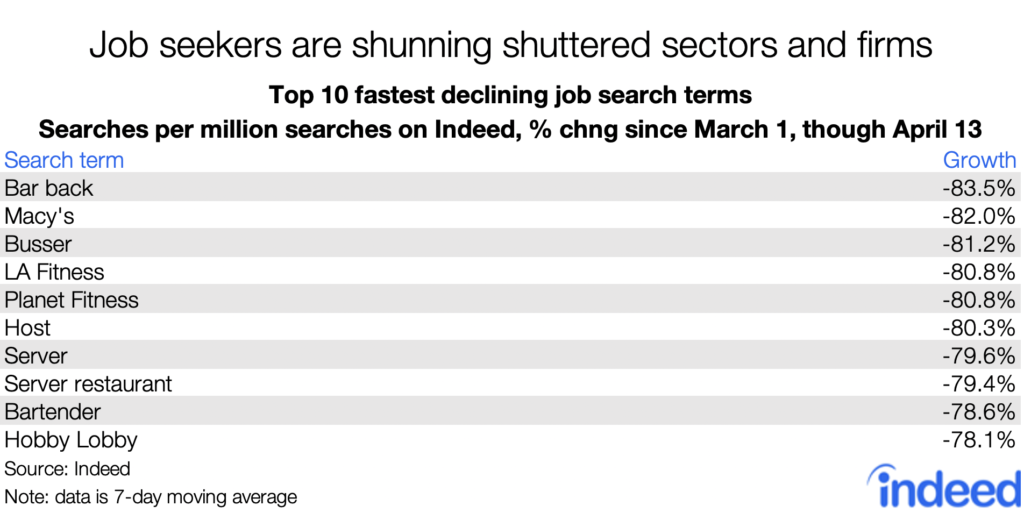

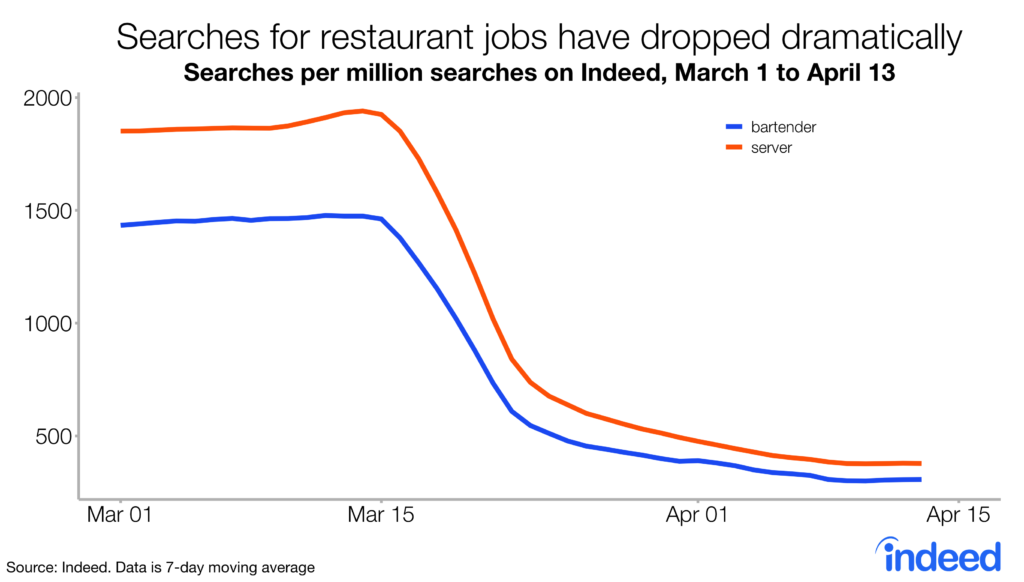

Searches for highly-impacted sectors and firms are down

Job seekers are well aware of what positions have been hit hardest by the coronavirus shock. Six of the 10 search terms that have declined the most since March 1st are related to restaurants. Searches for “bar back” was hardest hit in percentage terms, but “server” got almost 40 times the searches of “bar back” on Indeed on April 13 and has only declined slightly less since the beginning of March.

Searches for companies that have closed physical stores have dropped noticeably. Macy’s, Planet Fitness, LA Fitness, and Hobby Lobby have all closed their locations and job seekers who likely need to find a job immediately aren’t looking for these companies.

Good tactics in a tough time

Job seekers are taking the right tack in a labor market radically different from a month ago. But while they are heading for the high ground, it’s not clear how many jobs are available that can weather this storm in the short term. People looking for a job are moving in the right direction, but unless the opportunities are there, they’ll have trouble finding a new job in the near term. Employers that are looking to hire should do their best to publicize their intentions. Job seekers are likely to react quickly.

Methodology

For this analysis, we looked at the top English language search terms on Indeed in the US from March 1 to April 13th. We only continued with terms that had at least 100 searches each day during the period in order to not highlight extremely small search terms.

We then calculated the share of all English language searches on Indeed in the US for each search term. We then accounted for weekly fluctuations in search behavior by calculating the 7-day moving average of each term’s search share. Finally, we then calculated the percentage growth in each term’s share from March 1 to April 13.