Key Points:

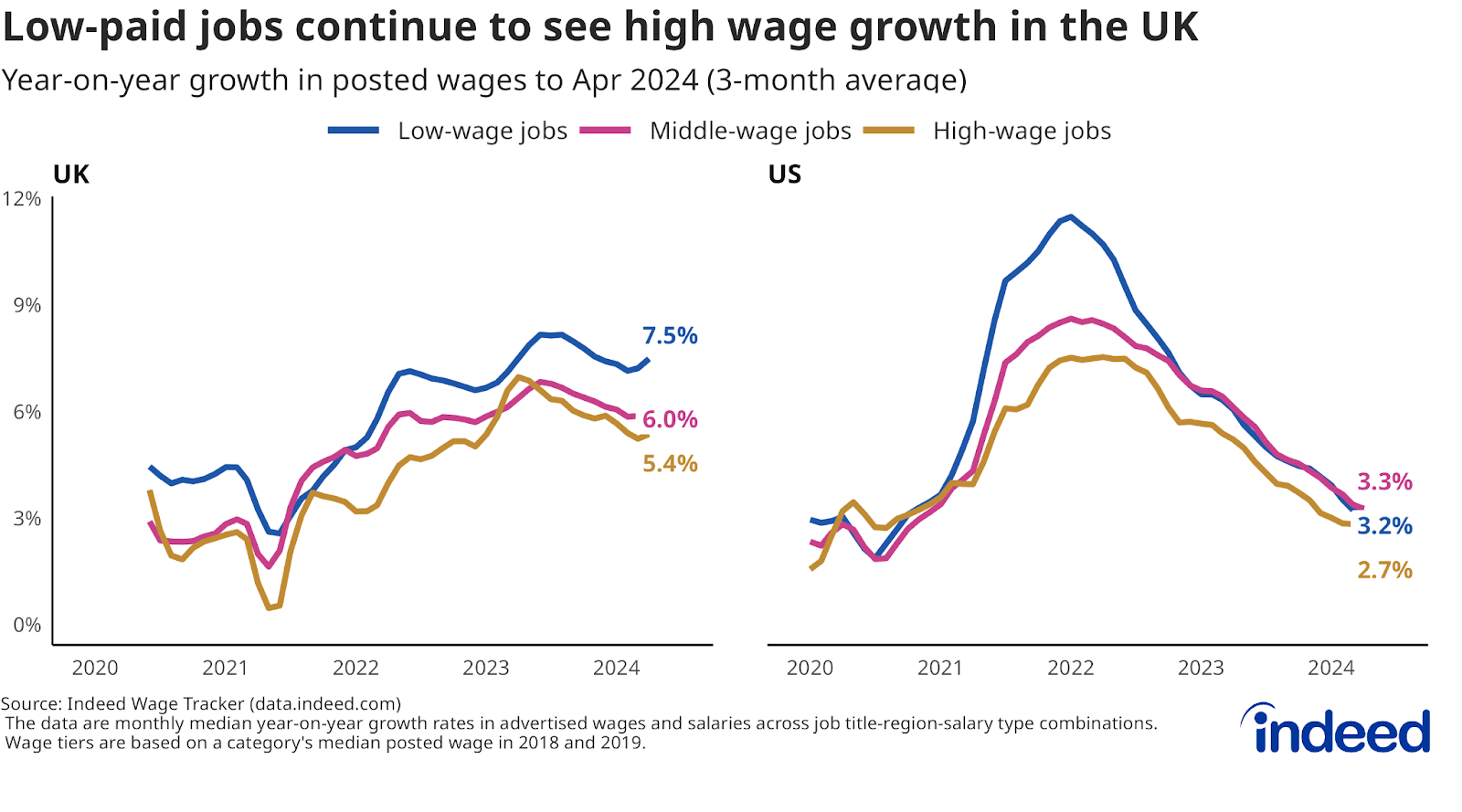

- Annual UK wage growth remains strong, led by low-paid occupations.

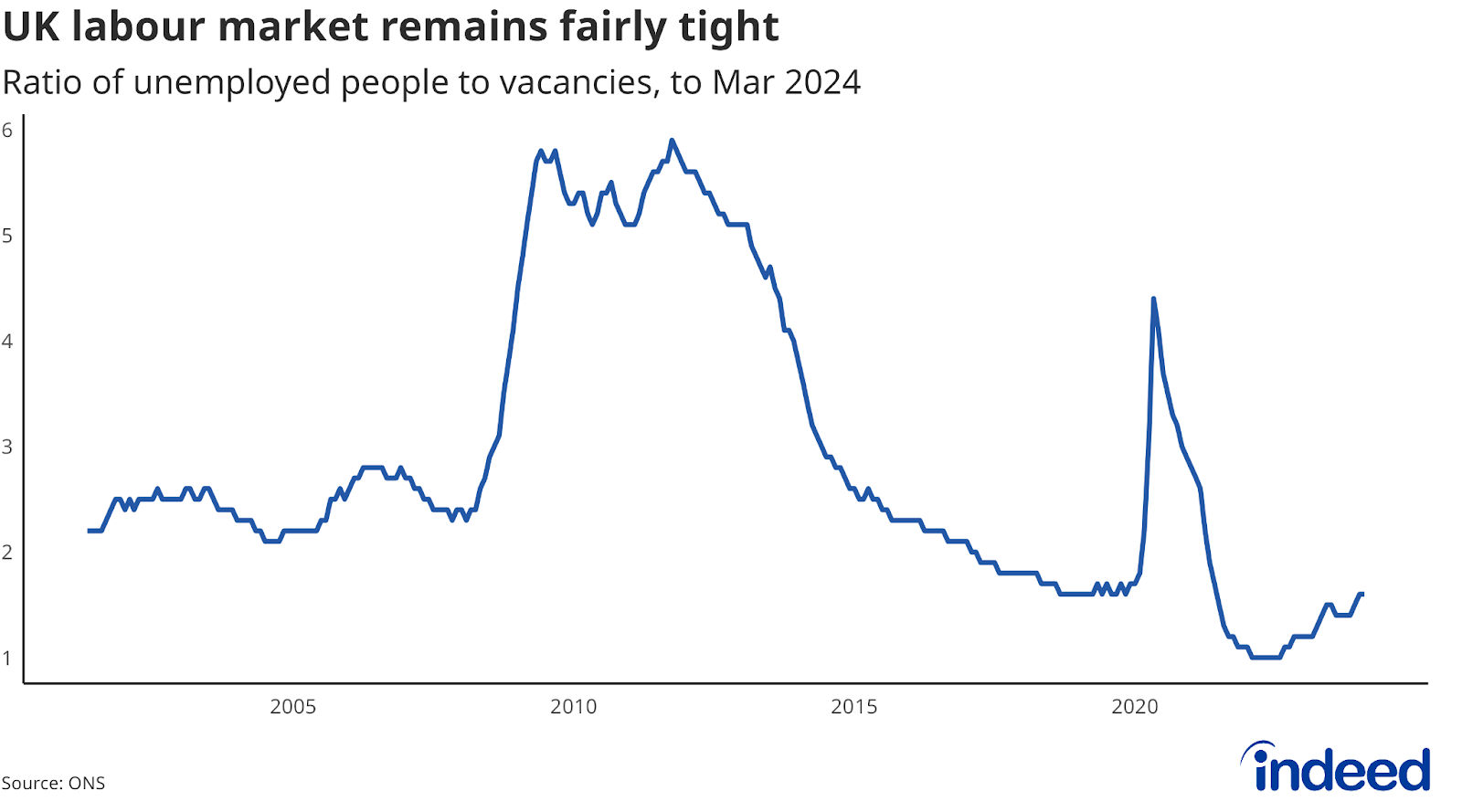

- The UK labour market remains fairly tight despite having weakened.

- UK job postings have normalised but some categories like healthcare and education have defied the broader slowdown.

The UK labour market continued to cool through early spring, though it remains fairly tight and continues to support strong wage growth.

Spotlight: Low-wage jobs continue to see high pay-growth

Posted annual wage growth in the UK remains strong, accelerating to 6.4% year-on-year in April, up from 6.3% in March. Wage growth continues to be particularly high in typically lower-paying sectors, with annual wage growth in the lowest-paying group of jobs rising to a 7.5% annual pace last month. A 9.8% hike in the national minimum wage took effect on 1 April, helping to further drive up wages for the lowest-paying roles alongside a tightening in hiring conditions for these occupations. By contrast, wage growth for lower-paying jobs in the US is roughly on par with growth in higher-paying sectors after briefly surging at the peak of post-pandemic hiring challenges in 2021 and 2022.

Labour Market Overview

The latest official figures showed a continued softening of the labour market, but still-strong wage growth. Ongoing data quality concerns surrounding the Labour Force Survey continue to make it difficult to get a clean read on precisely how fast the labour market is cooling. But tightness in the labour market continues to gradually ease, with the unemployment rate ticking up to 4.3% in the January-March quarter (from 3.8% in Q4 2023) and vacancies falling to 898,000 (though still 102,000 above the pre-pandemic level). The ratio of unemployed people to vacancies now stands at 1.6, up from a low of 1 in mid-2022 but still well below its average over the past two decades (2.9).

Inactivity rose further in the three months to March. The inactivity rate now stands at 22.1%, up 1.6 percentage points from pre-pandemic levels. That equates to more than one million additional working-age people that are currently outside the labour force than pre-pandemic, and represents a significant constraint on labour supply. One of the key drivers of this growth in inactivity has been rising rates of long-term sickness: More than 2.8 million people now claim to be impacted by long-term illness, up by 708,000 from pre-pandemic levels.

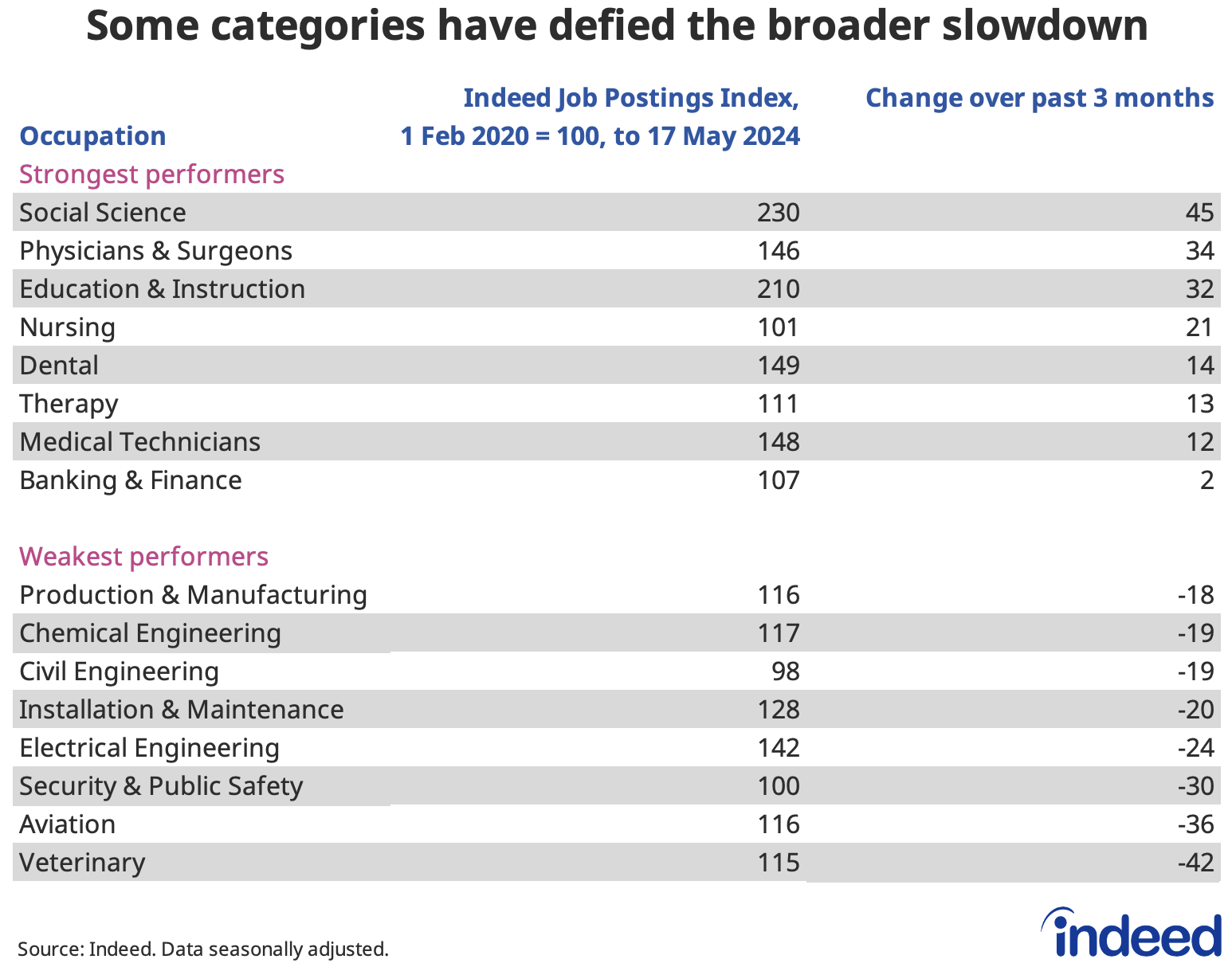

Job postings have continued to slow

Job postings on Indeed have also continued to cool in recent months. The Indeed Job Postings Index (JPI) stood at 100.8 on 17 May 2024, signalling that postings were just 0.8% above their 1 February 2020, pre-pandemic baseline. JPI is down from a peak of 169.3 reached on 31 March 2022 and 161.7 on 31 December of that year, having signalled a gradual normalisation of hiring demand.

Though job postings have fallen in most categories recently, a handful have seen growth. Social science, a sector that includes psychologists, environmental health officers and researchers, has seen the biggest gain. Certain public sector-driven categories including healthcare and education have also seen growth over the past quarter.

Conclusion

Though the labour market has clearly softened and job postings have normalised, that doesn’t necessarily mean hiring is easy. Unemployment has risen but remains low, while high inactivity means lots of potential workers are outside the labour force.

Meanwhile, the combination of strong wage growth and stubbornly high services inflation could delay Bank of England interest rate cuts, which will depend on policymakers’ confidence in the likelihood of a more-sustained decline in both measures.

Though headline inflation fell to its lowest in almost three years at 2.3% in April, the latest figure was slightly above expectations. The details of the inflation report showed that service sector inflation — a key indicator for rate setters at the Bank — barely eased to a 5.9% annual rate from 6.0% in March.

Inflation and interest rates are likely to remain in focus during the run-up to the recently announced 4 July general election.

Hiring Lab Data

Job postings data is available on our Data Portal. We also host the underlying job-postings chart data on Github as downloadable CSV files. Typically, it will be updated with the latest data one day after this blog post is published.

Methodology

Data on seasonally adjusted Indeed job postings are an index of the number of seasonally adjusted job postings on a given day, using a seven-day trailing average. Feb. 1, 2020, is our pre-pandemic baseline, so the index is set to 100 on that day. We seasonally adjust each series based on historical patterns in 2017, 2018, and 2019. We adopted this methodology in January 2021. Data for several dates in 2021 and 2022 are missing and were interpolated. Non-seasonally adjusted data are calculated in a similar manner, except that the data are not adjusted to historical patterns. Note that we have recently restated the historical JPI data for several countries, including the UK, due to a methodology change.

To calculate the average rate of wage growth, we follow an approach similar to the Atlanta Fed US Wage Growth Tracker, but we track jobs, not individuals. We begin by calculating the median posted wage for each country, month, job title, region and salary type (hourly, monthly or annual). Within each country, we then calculate year-on-year wage growth for each job title-region-salary type combination, generating a monthly distribution. Our monthly measure of wage growth for the country is the median of that distribution.

The number of job postings on Indeed.com, whether related to paid or unpaid job solicitations, is not indicative of potential revenue or earnings of Indeed, which comprises a significant percentage of the HR Technology segment of its parent company, Recruit Holdings Co., Ltd. Job posting numbers are provided for information purposes only and should not be viewed as an indicator of performance of Indeed or Recruit. Please refer to the Recruit Holdings investor relations website and regulatory filings in Japan for more detailed information on revenue generation by Recruit’s HR Technology segment.