UK wage growth came in hotter than expected in the first quarter of 2024, even as other indicators showed the labour market continuing to soften. Annual regular pay growth excluding bonuses remained at 6.0% year-on-year in March, well above the annual rate of consumer price inflation (3.6% in the three months to March), meaning real wage growth is now running at a two-and-a-half-year high of 2.4% year-on-year.

That’s good for workers, but the mixed labour market signals could cement divisions on the Bank of England’s Monetary Policy Committee (MPC) ahead of June’s vote on interest rates. MPC officials have signalled summer rate cuts may be on the way, but their timing remains dependent on if and when the economic data gives rate setters confidence that conditions are falling into place for keeping inflation at target at lower interest rates.

Doves on the MPC will point to weakening labour demand — employment and vacancies are falling and unemployment is rising — to support the case for an interest rate cut. But hawks will focus on resilient wage growth to help press the case to wait for more evidence. If the MPC doesn’t cut rates in June, the next opportunity to do so would be in August when they would have more data on the effects of April’s minimum wage uplift and public and private sector pay deals.

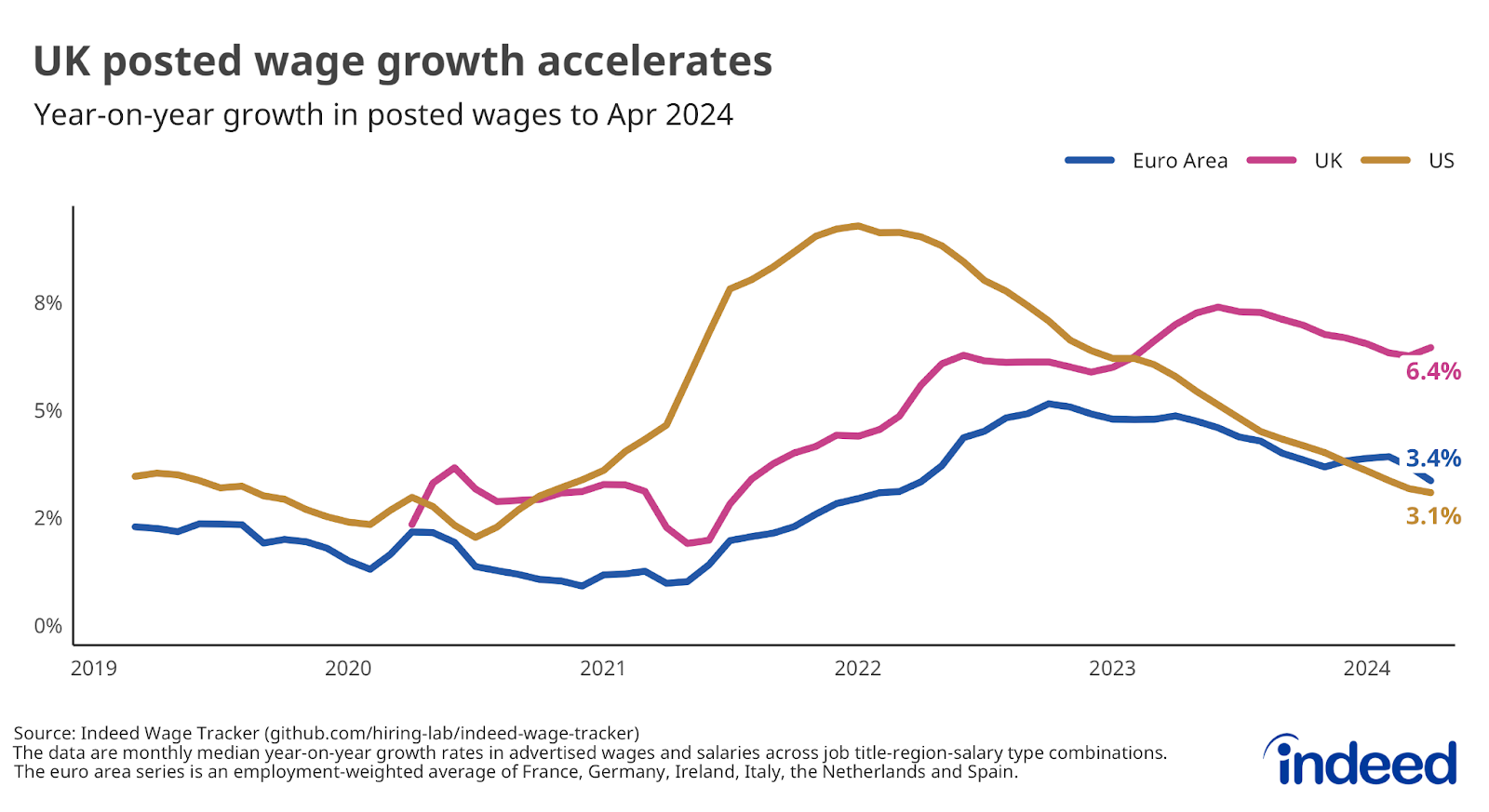

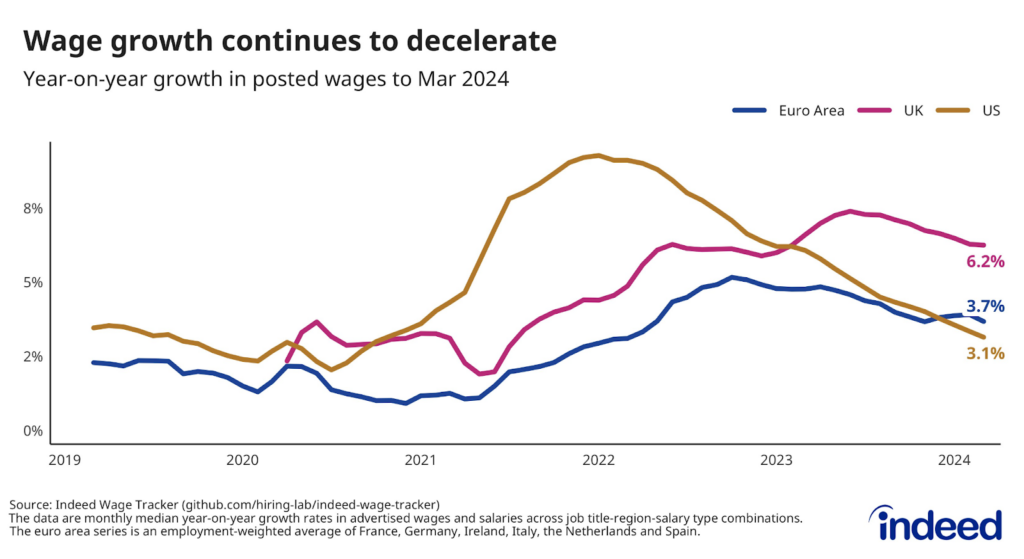

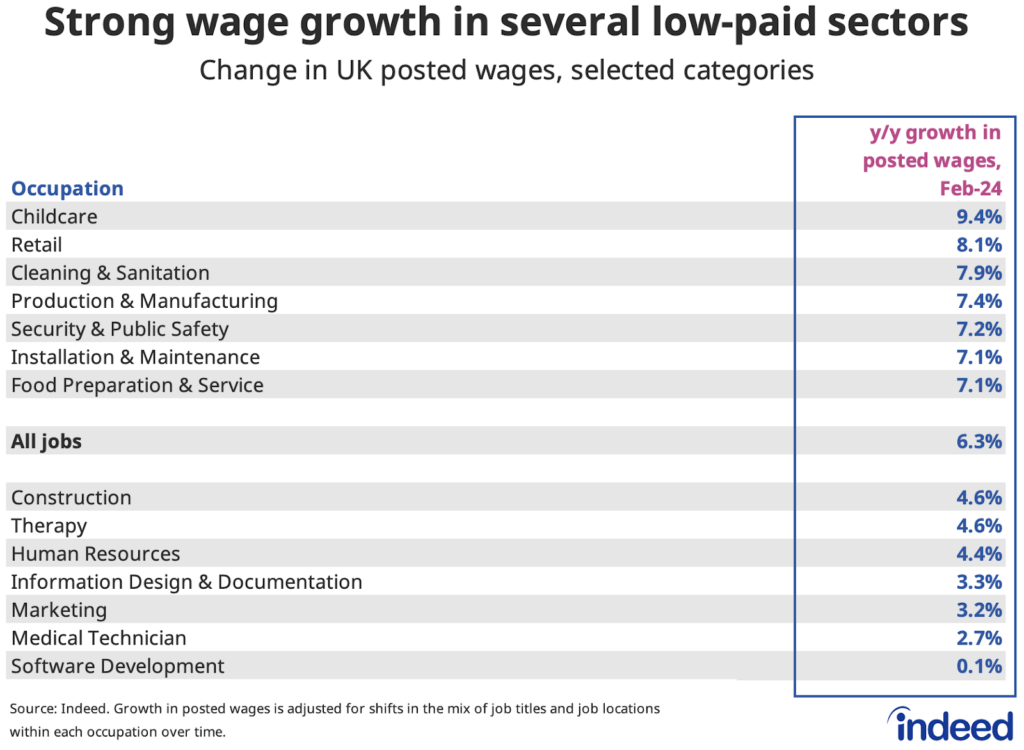

The Indeed Wage Tracker signalled a reacceleration of posted wage growth for new hires in April, rising to 6.4% year-on-year from 6.3% in March. With the National Living Wage having risen by 9.8% on 1 April, posted wage growth remains strong in several lower-paid occupations led by retail (9.1%), childcare (9.0%) and cleaning (8.4%). Annual wage growth is also running above 7% in the security, manufacturing, hospitality, maintenance and warehousing sectors.