Editor’s Note: May 2023 data marks a new release of the Indeed Wage Tracker, a measure of wage growth in job postings in eight countries. Indeed Hiring Lab is committed to delivering reliable, trustworthy and comprehensive data and analysis of the global labour market. An upgrade to our internal salary data platform and enhancements to the ways Indeed classifies job titles in certain countries over the past several months delayed our usual publication of the wage tracker. These efforts, aimed at improving the quality of the data, led to small changes in the historical wage growth series compared with previously published data, but did not impact the fundamental trends.

Wage growth series are available for download here. For details about the data and methodology, please see our working paper, “What do wages in online job postings tell us about wage growth?”

Key points

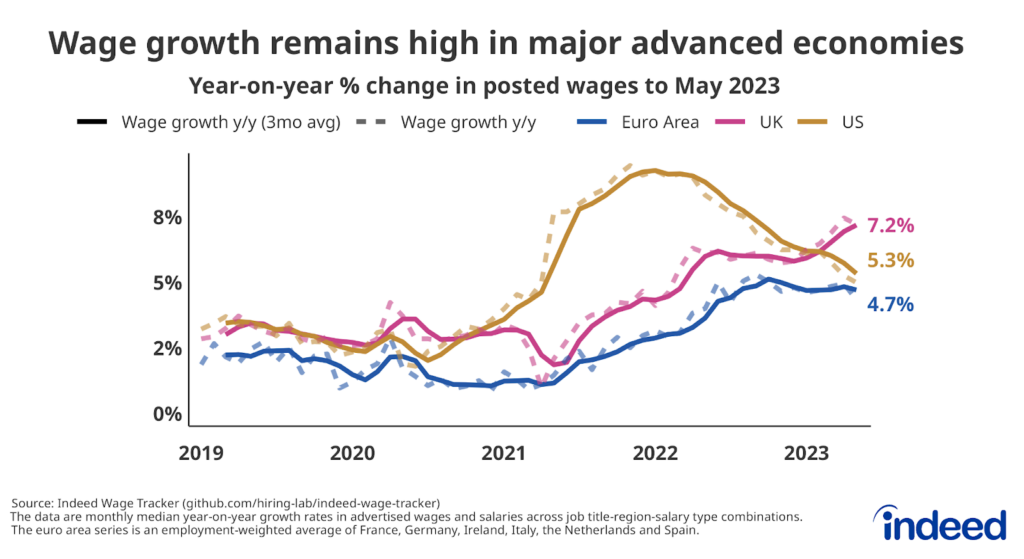

- UK wage growth accelerated to a historic high of 7.2% year-on-year in May 2023, reflecting minimum wage increases that boosted advertised pay rates in low-paid jobs in April and pay deals in occupations including nursing.

- Average annual wage growth in the euro area (across the six countries tracked) was 4.7% in May and has held steady throughout 2023.

- Annual growth in advertised wages in the US wage growth was 5.3% in May, a continued slowdown from the highs recorded in early 2022.

- Growth in advertised wages remains significantly above historical levels in all eight countries we track, as inflation stays high and labour markets remain fairly tight.

With few exceptions, annual growth in advertised wages has largely flattened out or declined somewhat across the EU and US over the past year after peaking in 2022, but has continued to rise and hit new records in the UK in 2023. The pace of wage gains is a critical indicator followed closely by central banks the world over as policymakers continue to fight high inflation by focusing on dampening a global labour market that largely remains resilient and tight.

Wage growth picks up in the UK, holds steady in the euro area, and slows in the US

In the UK, year-on-year growth in advertised wages hit 7.2% in May 2023, the highest pace ever recorded in Indeed data dating to 2019. Since the start of the year, the pickup in UK wages was strongest in nursing and lower-paid occupations including retail, customer service, cleaning, and food preparation and service. These recent gains likely reflect newly agreed-upon pay deals for nurses as well as the 9.7% increase in the National Living Wage announced in April.

But at the same time as wage growth has been accelerating in the UK, it has held fairly steady on average across the six countries tracked by Indeed across the euro area. The employment-weighted average annual wage growth across these six countries clocked in at 4.7% in May, down slightly from a peak of 5.1% reached in October. By comparison, annual wage growth in the US fell to 5.3% in May and has been slowing gradually for more than a year since peaking at 9.3% in early 2022 (see our US analysis for more details).

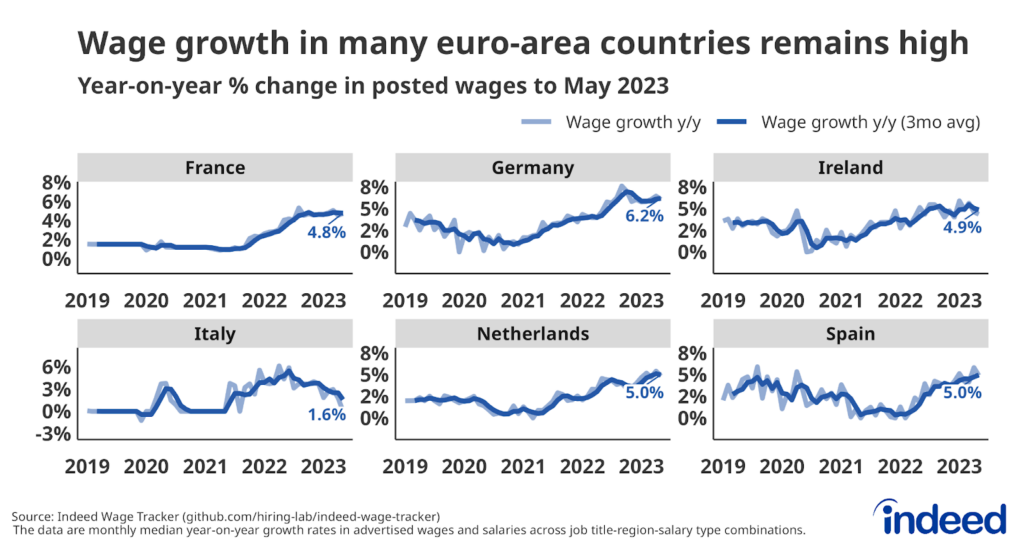

Trends do diverge across countries within the EU, though with the exception of Italy, wage growth remains well above historic norms in most areas. Among EU countries tracked by Indeed, overall annual wage growth was highest in May in Germany, at 6.2%—down from a recent peak of 7.0% reached in October. Year-on-year growth in advertised wages in Spain and the Netherlands both accelerated to 5.0% in May, while Ireland and France held steady at 4.9% and 4.8%, respectively. In Italy, annual wage growth has slowed dramatically to just 1.6%, more in line with its low historical growth rates.

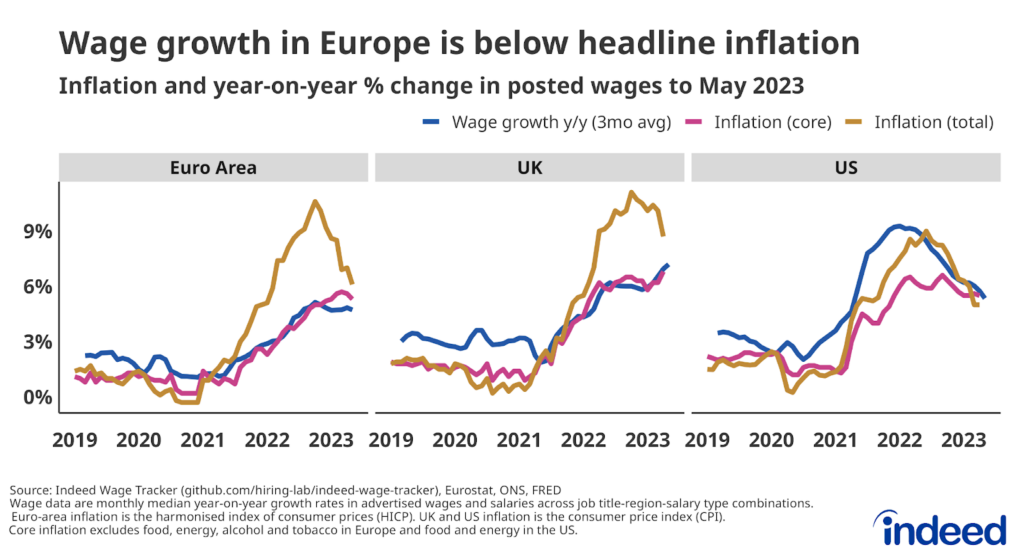

European Wage Growth Lags Headline Inflation

Despite historically high growth rates, posted wage growth in the UK and euro-area countries remains below the headline rate of inflation, though it has closely tracked core inflation, which excludes food and energy prices. However, there has been some convergence in recent months as inflation has started to fall.

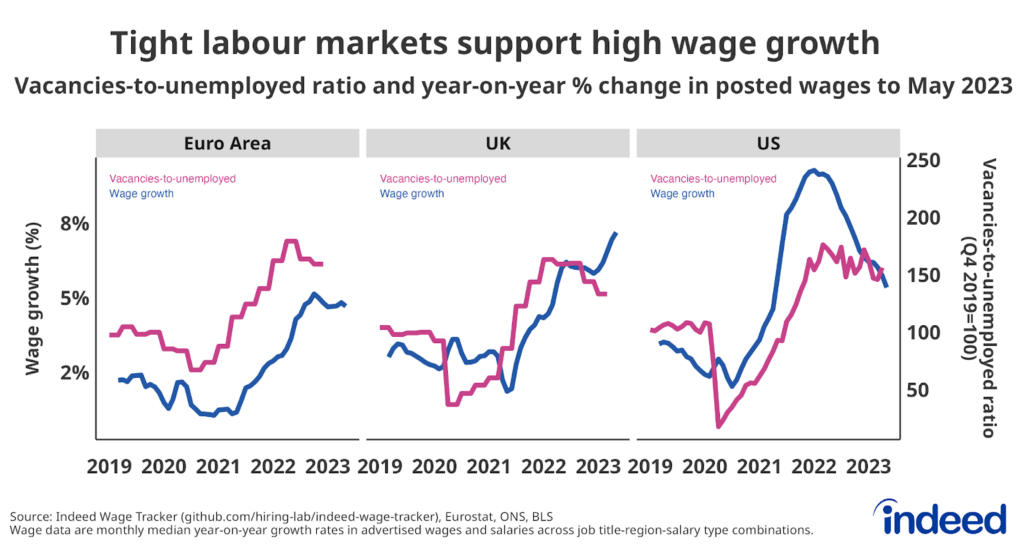

Wage growth is supported by labour markets that remain tight despite falling vacancies

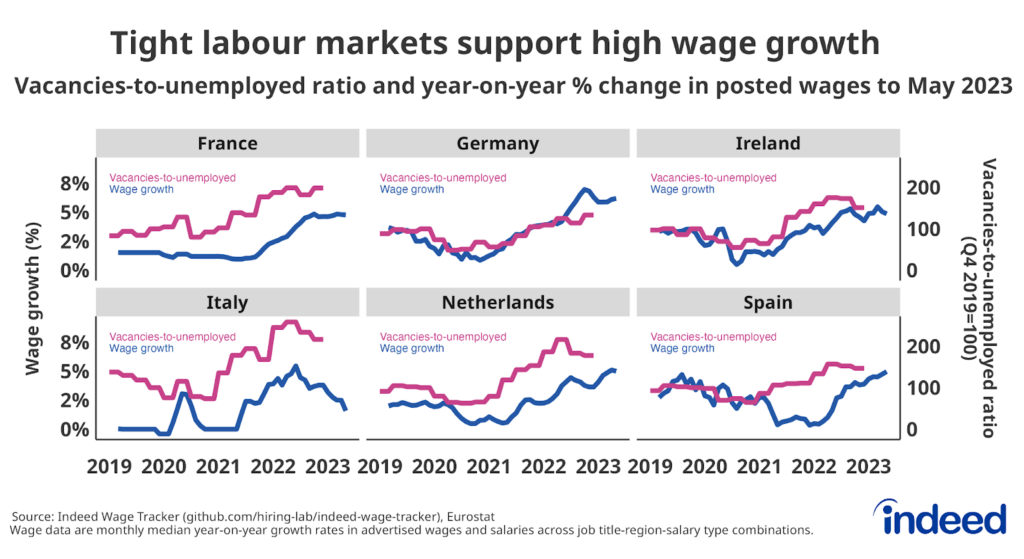

Despite a broadly uncertain economic growth outlook for the EU and UK, along with strong headwinds as a result of higher interest rates and tighter monetary policy from policymakers engaged in the inflation fight, unemployment rates remain at or near historic lows. While job vacancies have gradually fallen in most countries, they are still high relative to historical levels, leading to a fairly tight labour market overall as measured by the ratio of job vacancies to unemployment (which is still high).

A high ratio of vacancies to unemployment—essentially, when there are more jobs available than workers to fill them—increases workers’ bargaining power, putting upward pressure on wages. We observe a strong positive correlation between this ratio and growth in advertised wages in most of the countries tracked by Indeed.

But through the first five months of 2023, the UK has been an exception to this pattern. The vacancies-to-unemployment ratio has fallen, but wage growth has accelerated. Likely drivers include recent public-sector pay deals, a substantial increase in the minimum wage, and worker demands for pay to catch up to persistently high inflation.

Conclusion

Growth in advertised wages remains well above historical levels in the UK and most of the euro-area countries we track. Central bank policymakers have made it clear that wage growth slowing down to levels more in line with historic norms will be one of the criteria used to decide when to readjust monetary policies and stop raising interest rates. Wage growth that continues to come in at or near record levels will make those decisions more difficult.

Methodology

To calculate the average rate of wage growth, we follow an approach similar to the Atlanta Fed US Wage Growth Tracker, but we track jobs, not individuals. We begin by calculating the median posted wage for each country, month, job title, region and salary type (hourly, monthly or annual). Within each country, we then calculate year-on-year wage growth for each job title-region-salary type combination, generating a monthly distribution. Our monthly measure of wage growth for the country is the median of that distribution. Alternative methodologies, such as the regression-based approaches in Marinescu & Wolthoff (2020) and Haefke et al. (2013) produce similar trends.

The euro-area figures are an employment-weighted average of growth rates in France, Germany, Ireland, Italy, the Netherlands, and Spain. The weights for the most recent months are revised periodically as new employment figures are published by Eurostat. We updated the weights to Q4 2022 in June 2023.

More information about the data and methodology is available in our working paper, “What do wages in online job postings tell us about wage growth?”