Key Points

- Strength of job postings recovery varies considerably by occupation and geography, while hospitality and food service saw marked slowing over the past four weeks.

- Growth of advertised wages quickened to 4.1% year over year in December, but continues to lag price inflation.

- Inflation-busting pay growth is still limited to a handful of categories, such as food service, construction, manufacturing, nursing, distribution and software development.

We regularly update this report to track the pandemic’s effects on the labour market.

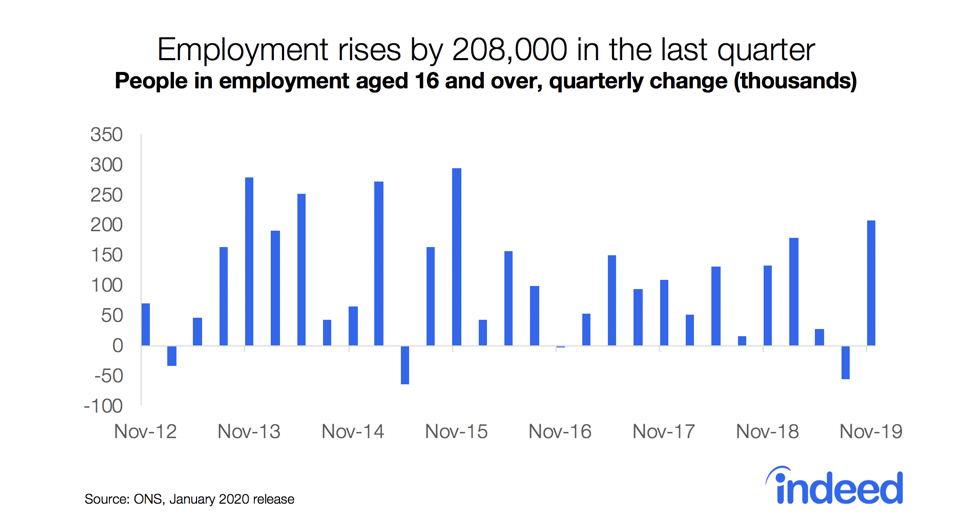

The latest Indeed job postings tracker suggests a slow start to 2022. However, the headline measure overstates the dip, as the seasonal adjustment has been impacted by the UK public holiday pattern this year. Job postings typically slow markedly at year-end, as hiring eases off over the holiday season before ramping up at the start of the new year.

With 3 January being a bank holiday, postings started to grow later than in most previous years due to the late start to the first working week. Job postings were 34% above the 1 February 2020, pre-pandemic baseline, seasonally adjusted, as of 7 January 2022. That was down from 48%, as of 31 December 2021.

Hospitality slowdown

While seasonal patterns have contributed to the dip in the headline job postings measure, there’s also evidence of an omicron effect for particular sectors like hospitality. Pub and restaurant bookings were down over the key holiday period. Most jobs at those establishments fall into the food preparation & service category. That’s now 42% above the pre-pandemic baseline, having been at a lofty 92% in mid-December. The hospitality & tourism category, which includes most hotels and travel jobs, has dropped from 45% to 17% over a similar period.

Pay is rising, but inflation-busting increases limited to a few categories

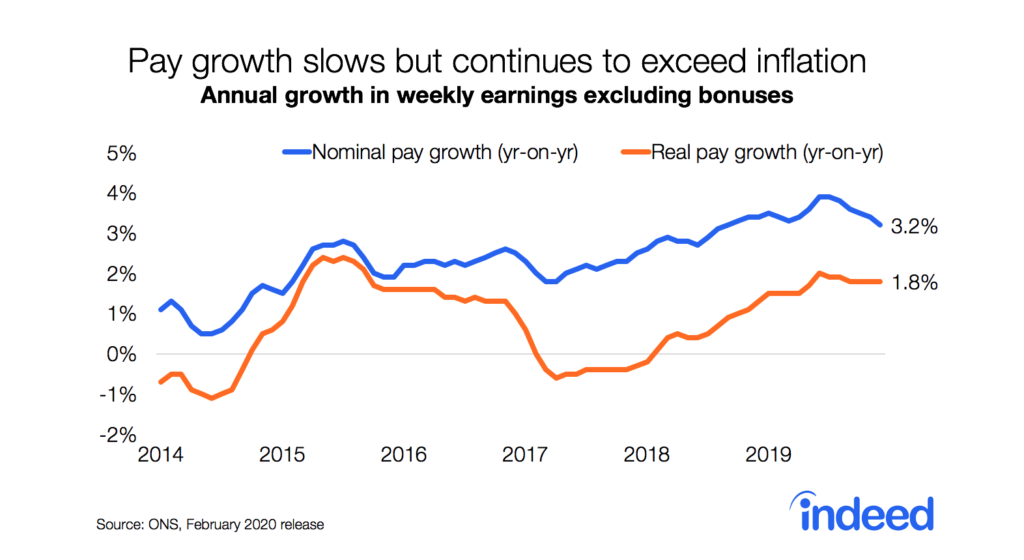

Advertised wages in job postings have been rising. Using a methodology that controls for shifts in the mix of job titles over time, annual pay growth ticked up to 4.1% in December. However, that’s still below the rate of consumer price inflation, which was running at 4.6% in November on the CPIH measure and 5.1% on the CPI measure. Amid soaring energy prices and looming tax hikes, real earnings are set to be under considerable pressure this year.

Workers in some sectors are in a position to bargain for higher wages to cushion themselves from this cost of living squeeze, but the picture is very different elsewhere.

The food preparation & service category saw strong job postings growth over much of 2021 (notwithstanding the hit to trading over the Christmas period). With the supply of candidates not keeping pace, there was upward pressure on wages. Advertised pay in food preparation & service rose 8.0% over the year to December 2021, the highest increase of all categories.

Other occupations experiencing challenging hiring conditions also saw strong pay growth. Construction saw a 7.3% rise, while production & manufacturing and nursing wages increased 6.8%. With the distribution sector running hot, loading & stocking and driving wages rose by 6.7% and 6.6% respectively. Software development also saw a notable increase of 6.7%.

But other occupations that haven’t been experiencing particularly acute worker shortages have not seen similar pay increases. Three categories — project management, legal and management — in fact saw slight falls.

Uneven sectoral recovery in job postings

Most categories surpassed their pre-pandemic level of job postings some time ago, though there remain a handful of laggards. Beauty & wellness is furthest below the baseline, perhaps reflecting caution among some people about close-contact services. Certain white-collar occupations have seen relatively weak recoveries — legal postings are still down while accounting and architecture are only slightly above the baseline. Childcare postings are down on pre-pandemic levels, perhaps due to more parents looking after children at home more. Aviation postings are also slightly below the baseline, though they have staged a recent improvement as the travel sector attempts to get back on its feet.

Job postings in other categories remain well above pre-pandemic levels, led by healthcare and veterinary professions and cleaning & sanitation. Retail and logistics and community & social service postings also remain high relative to pre-pandemic.

London and South East lag regional recovery

The North East continues to have the strongest regional recovery, with job postings 67% above the pre-pandemic level. The South East and London have the weakest recoveries, at 22% and 23% respectively.

Plymouth leads cities ranking

Plymouth has the strongest job postings recovery among cities and large towns, followed by Sunderland, Middlesbrough and Wakefield.

As we discussed in a previous post, posting recovery has generally been stronger in cities with higher shares of manufacturing, distribution, healthcare and education jobs, while areas reliant on hospitality, tourism and highly paid, white-collar, work-from-home jobs trail.

We host the underlying job-postings chart data on Github as downloadable CSV files. Typically, it will be updated with the latest data one day after this blog post was published.

Methodology

All figures in this blog post are the percentage change in seasonally-adjusted job postings since 1 February, 2020, using a seven-day trailing average. 1 February, 2020, is our pre-pandemic baseline. We seasonally adjust each series based on historical patterns in 2017, 2018, and 2019. Each series, including the national trend, occupational sectors, and sub-national geographies, is seasonally adjusted separately. We adopted this new methodology in January 2021.

The number of job postings on Indeed.com, whether related to paid or unpaid job solicitations, is not indicative of potential revenue or earnings of Indeed, which comprises a significant percentage of the HR Technology segment of its parent company, Recruit Holdings Co., Ltd. Job posting numbers are provided for information purposes only and should not be viewed as an indicator of performance of Indeed or Recruit. Please refer to the Recruit Holdings investor relations website and regulatory filings in Japan for more detailed information on revenue generation by Recruit’s HR Technology segment.

*We looked at the relationship between job postings, clicks and wages in sectors experiencing the greatest hiring difficulties in a previous post.

The relative jobseeker interest metric takes the average number of clicks per job posting for each job category relative to 1 February, 2020, divided by national clicks per posting relative to the same time period. Both clicks and job postings are 28-day moving averages of seasonally adjusted data.

A positive change means the average job posting in a category is now more attractive to job seekers relative to the average posting than before the pandemic. A negative change indicates that the category has lost interest relative to the average posting since 1 February, 2020. By construction, the national average across all sectors is zero.

Wage and salary data are extracted from job postings. Wage growth figures were calculated using regression analysis that accounted for shifts in the mix of job titles and job locations within each sectoral category over time. Further details here.