Key points:

- Europe’s four largest capitals — Berlin, London, Madrid and Paris — have embraced the shift to remote work but lag in total job postings.

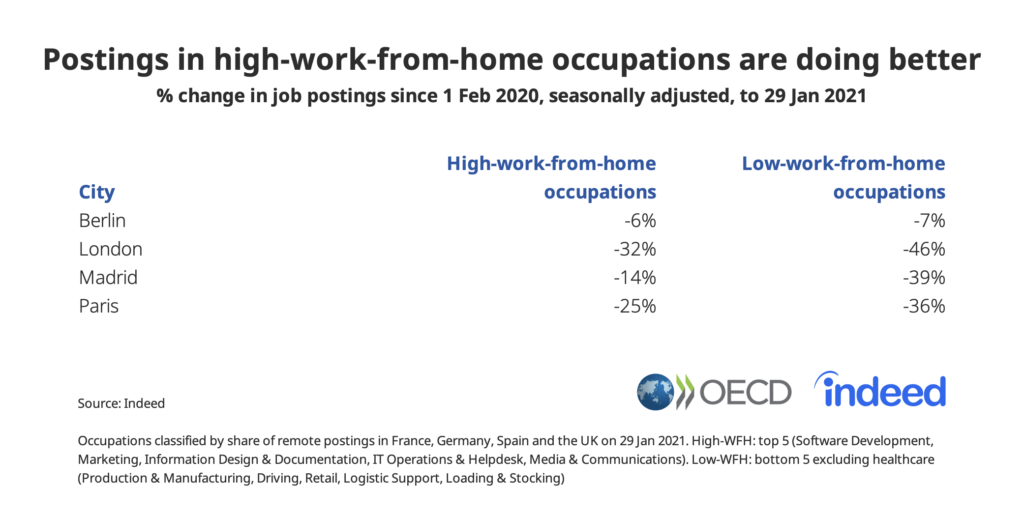

- Labour markets in these cities are being pulled apart in early 2021, with postings for higher-paid jobs performing better than those for lower-paid service jobs, aggravating inequality of opportunity.

- Postings for work-from-home jobs are more prevalent in these capitals than elsewhere and grew faster in 2020 than postings for jobs that cannot be performed remotely, even when COVID-19 restrictions were being eased.

- These trends suggest deeper and more persistent labour market shifts in major cities than in other places, raising the risk of difficult adjustments for some urban workers.

Berlin, London, Madrid and Paris — Western Europe’s superstar cities — are engines of productivity growth that have long been magnets for young and skilled workers. COVID-19 has brought this boom to a halt. Indeed job posting data offer an unparalleled view of how the pandemic has transformed labour markets in Europe’s four largest capitals at the start of 2021. These cities lead their respective countries in the shift to remote work but they lag in overall job postings, with postings for service occupations falling most. The move to remote work is greater and more persistent in these cities than in other places and may be long-lasting, suggesting a difficult adjustment period for some urban workers. These findings have significant implications for labour market policy. In Europe’s major cities, policy may need to prioritise adult learning, career guidance and digital skills to help workers navigate the pandemic’s wrenching changes.

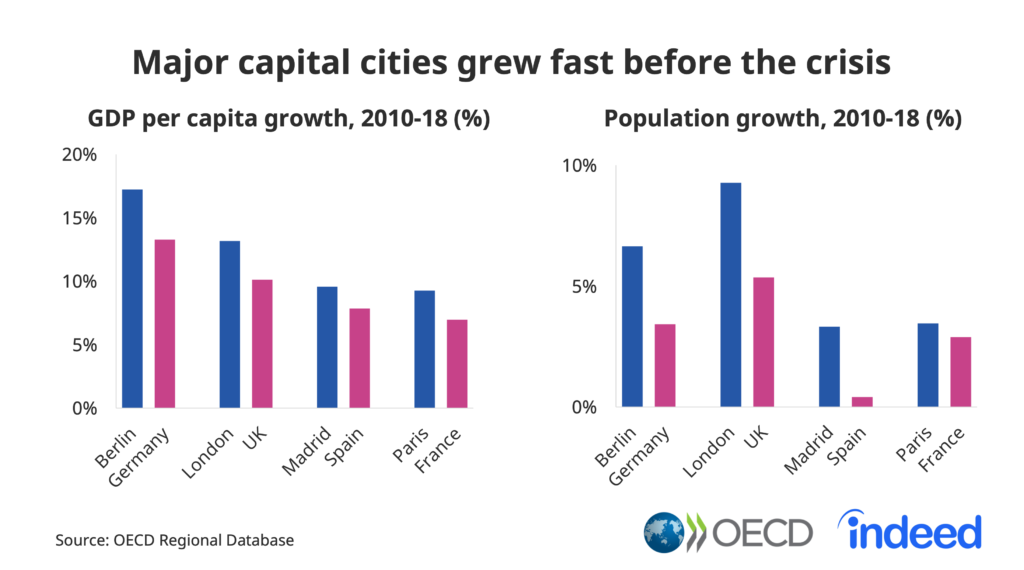

Capital cities captured a large share of economic growth before the pandemic

Over the past decade, Europe’s largest capitals boomed, recording faster population and productivity growth than their respective countries overall. On average, between 2010 and 2018, the latest available year in OECD’s Regional Database, the populations of Berlin, London, Madrid and Paris grew 6%, while those of Germany, the UK, Spain and France rose 3%. GDP per capita jumped more than 12% in these cities, almost 3 percentage points faster than national growth.

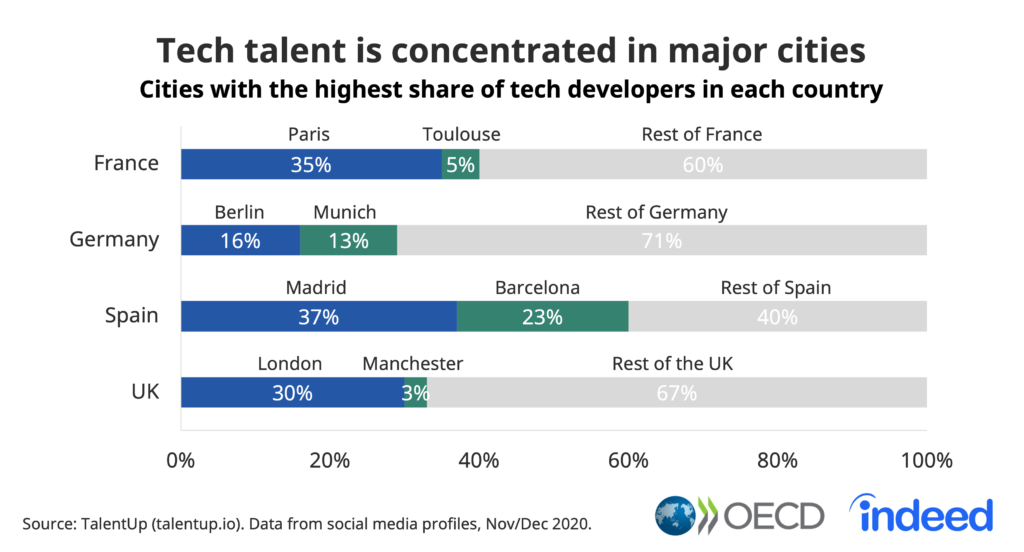

The big-city growth advantage is due in part to the concentration in these capitals of burgeoning sectors with high-paid jobs, like tech. For instance, London, Madrid and Paris account for 30% or more of all tech developers in their respective countries, data from social media profiles suggest, even though the three cities represent only 15%, 14% and 18% of their national populations. This concentration is less striking in Germany, but still,16% of German tech developer jobs are in Berlin, which is home to only 4% of the national population.

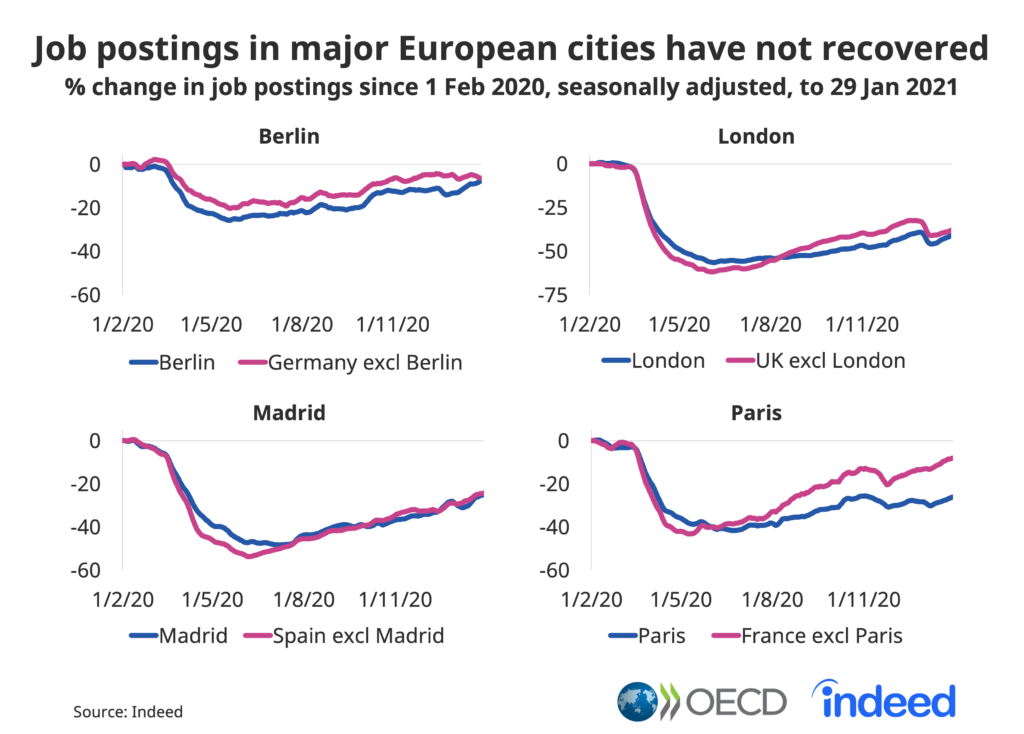

COVID-19 led to a sharp fall in job creation in major cities

Indeed job posting data show that labour markets in Europe’s biggest capitals contracted dramatically when the pandemic hit. At their low point, postings were down 26% in Berlin, 57% in London, 48% in Madrid and 42% in Paris compared with the pre-pandemic baseline of 1 February 2020. During much of the past year, postings in these cities were off more than in the rest of their respective countries, creating a widening hiring gap. This is consistent with patterns in the US, where big-city postings were hit harder than the national average.

Despite a partial recovery recently, hiring in the major European capitals remains subdued. Through 29 January 2021, job postings were down 8% year on year in Berlin, 25% in Madrid, 26% in Paris and 41% in London. Further deterioration is possible since labour markets in these cities have been significantly buoyed by short-term national support schemes.

The start of 2021 has been kinder to some of the capitals than 2020 was. Relative to the rest of Spain, Madrid has staged a recovery, which probably reflects looser health restrictions there than in many other Spanish regions. London has also substantially narrowed the gap with the rest of the UK, but this may be because postings outside London have slumped again. Despite these positive signs, postings in Madrid and London are still far below pre-pandemic levels.

Several factors drive the labour market wedge between these cities and other places. Big cities have wide-ranging service sectors with extensive face-to-face interaction — everything from cafes to hair salons — and the pandemic has hit them hard . In particular, city-centre retail and hospitality businesses have been devastated by the collapse of tourism and the sharp drop in commuter traffic. In cities like London or Paris, which before the pandemic registered hundreds of thousands of daily commuters (with long commuting times) and many millions of international visitors, the service sector may be scarred for a long time. Across the four cities, service occupations recorded the biggest job posting declines: down 25% in Berlin, 36% in Paris, 41% in Madrid and 61% in London. Many of these jobs are low paid, which means their disappearance risks widening urban inequality.

The rise of remote work: an asset or a new risk for city economies?

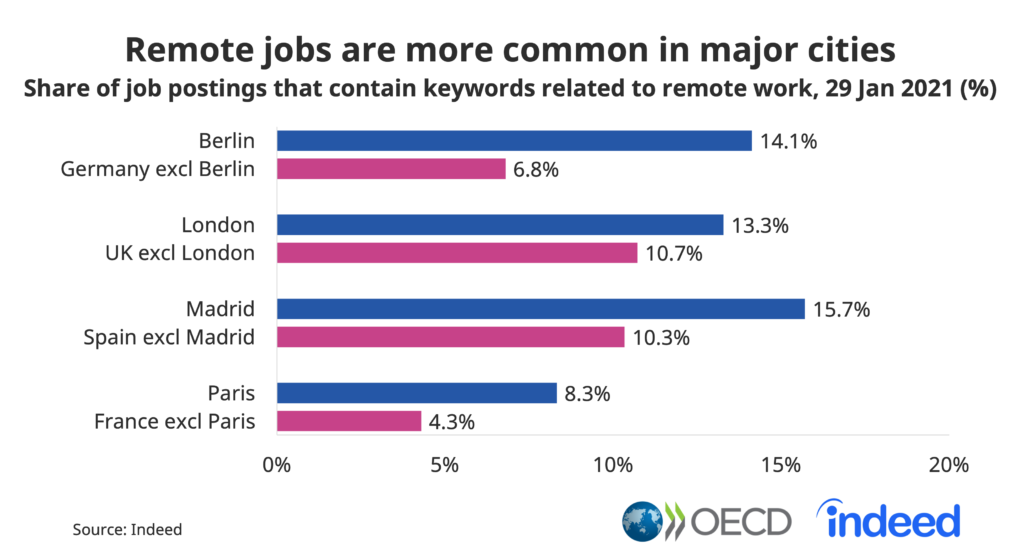

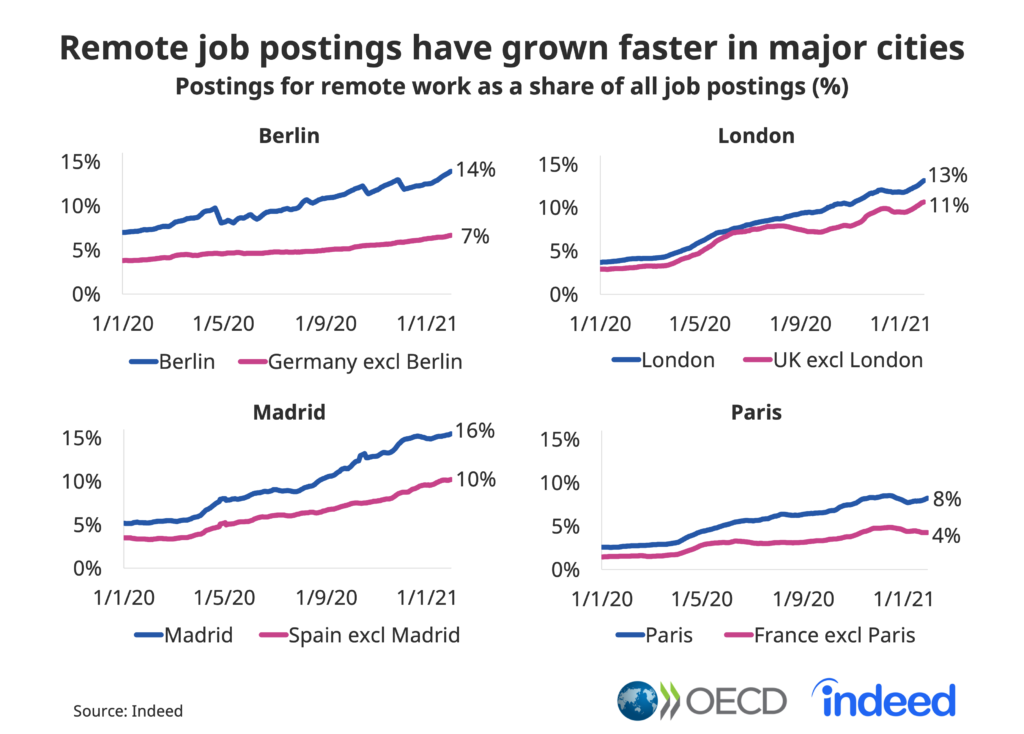

Remote work postings are much more frequent in Europe’s largest capitals than outside them. At the end of January 2021, the share of postings containing keywords related to remote work was 3 to 7 percentage points higher in these cities than elsewhere in their respective countries.

The different mix of jobs in the capitals is a key driver of this disparity. Simply put, these cities have a larger share of jobs that can potentially be performed remotely. Postings in occupations suitable for working at home, like tech, finance, law and marketing, are most prevalent in big cities. In the capitals, postings in such occupations are closer to their pre-pandemic benchmarks than postings in occupations that generally can’t be performed at home, intensifying the labour market divide.

After the pandemic, this shift to remote work might last longer in major cities than elsewhere. When most European countries significantly eased health restrictions this past summer, sectors like hospitality and retail ramped up hiring and the national shares of remote job postings in France, Germany, Spain and the UK stopped growing. But that wasn’t the case in the big cities. Despite the national trends, the shares of remote postings kept climbing In Berlin, London and Paris. Madrid did register a slowdown in remote postings share in the summer, but over the year those postings still grew more in the Spanish capital than in the rest of the country.

In the long term, the effects of the shift to remote work on city economies will depend on the ongoing working arrangements that take shape. Evidence from US housing markets shows a residential move trend from high-density to low-density areas within the same metropolitan region and little flow to other places. This suggests that an increasing share of jobs will be hybrid, with a mix of in-office and at-home work. But the picture could turn out differently in Europe because cities such as London have already experienced population declines. The pandemic is unlikely to eliminate the benefits and amenities that have drawn jobs and people to cities for decades. But the trends COVID-19 has initiated might weaken their appeal. A rethinking of the design and use of urban space may be in order.

How can cities manage the adjustment to a post-pandemic labour market?

The pandemic’s labour market effects may be temporary for some sectors, but, for others, they may last. Job posting trends suggest a difficult period of adjustment for Europe’s major cities. At the very least, the rise of remote work may shift some economic activity away from city centres to surrounding areas, especially in services that involve face-to-face customer contact. These developments coincide with long-term trends that were already transforming work, such as digitalisation and automation.

To manage the adjustment in Europe’s largest cities, policymakers should support displaced workers and those at risk of redundancy by offering comprehensive skills development strategies tailored to local conditions. Career guidance should be closely linked to adult learning programmes. Measures should also strengthen the ability of local economies to ‘rewire’ by making it easier for workers to shift industries. Such an approach facilitates economic recovery after a crisis. Finally, given the concentration of digital jobs in major cities, local governments need to help businesses manage digital transformation, ensuring that workforces develop the skills necessary in a rapidly changing world.

This post was published concurrently on the OECD Local Development Forum blog.

Methodology

Data on job postings are based on publicly available information on the Indeed websites in France, Germany, Spain and the UK, are limited to those countries, are not a projection of future events, and include both paid and unpaid job solicitations. Job posting trends are seasonally adjusted as described in our job posting tracker. Remote jobs are those that contain keywords related to remote work or working from home. We define cities as Eurostat’s metropolitan regions, which include the commuter belt around each city.