We regularly update this report to track the pandemic’s effects on the labour market. Our methodology changed at the start of 2021 — see note at end of post.

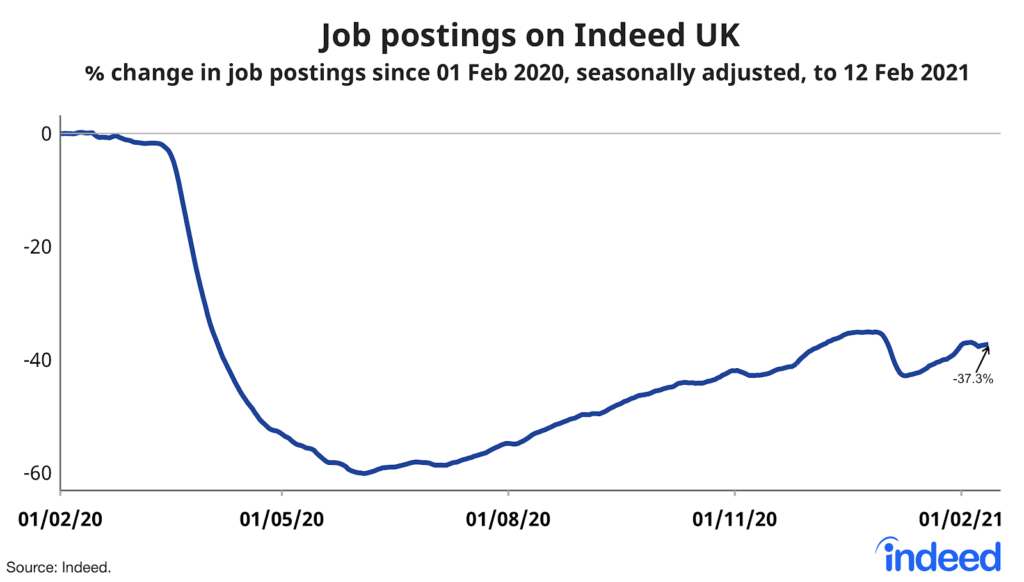

Job postings — a real-time measure of labour market activity — were 37.3% below the February 1, 2020, pre-pandemic baseline, seasonally adjusted, as of February 12, 2021. That was little-changed from a week earlier, when postings were 37.0% below the baseline.

The gap in job postings versus the pre-pandemic baseline narrowed by 5.3 percentage points (ppts) between 12 January and 12 February, but remains substantial. With the Prime Minister due to announce the UK’s roadmap out of lockdown next week, many employers will be looking at the timescale for easing restrictions as they assess their hiring plans for the coming months.

Construction jobs see growth

Looking at sectoral trends, the biggest improvement in job postings over the past month has been in construction (+17.4 ppts versus the pre-pandemic baseline). Loading & stocking, manufacturing, logistic support and security & public safety have also seen improvements.

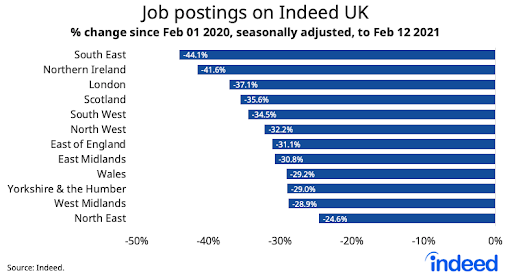

Regional trends

Regionally, job postings are down most in the South East, followed by Northern Ireland and London. The North East is closest to its pre-pandemic baseline.

We will continue to provide regular updates on these trends as the situation evolves. We also host the data behind the postings trends plots on Github as downloadable CSV files. Typically, the site will be updated with the latest data one day after the respective Hiring Lab tracker is published.

Methodology

All figures in this blogpost are the percentage change in seasonally-adjusted job postings since February 1, 2020, using a seven-day trailing average. February 1, 2020, is our pre-pandemic baseline. We seasonally adjust each series based on historical patterns in 2017, 2018, and 2019. Each series, including the national trend, occupational sectors, and sub-national geographies, is seasonally adjusted separately. We adopted this new methodology in January 2021 and now use it to report all historical data. Historical numbers have been revised and may differ significantly from originally reported values.

The number of job postings on Indeed.com, whether related to paid or unpaid job solicitations, is not indicative of potential revenue or earnings of Indeed, which comprises a significant percentage of the HR Technology segment of its parent company, Recruit Holdings Co., Ltd. Job posting numbers are provided for information purposes only and should not be viewed as an indicator of performance of Indeed or Recruit. Please refer to the Recruit Holdings investor relations website and regulatory filings in Japan for more detailed information on revenue generation by Recruit’s HR Technology segment.