Key points:

- The non-EU share of clicks on UK jobs has increased this year as the Brexit transition nears completion.

- A surge in Hong Konger interest represents about one-third of the increase.

- The biggest rises are occurring in high-paid occupations.

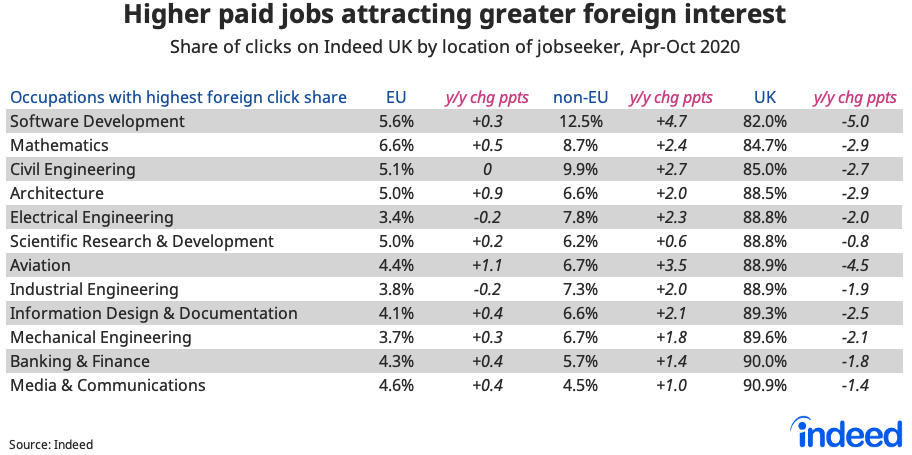

For the first time in seven years, the average job on Indeed UK is attracting greater interest from non-EU jobseekers than from those from EU countries. A number of occupations, typically at the higher end of the pay scale, have seen significant uplifts in non-EU click shares in 2020 compared with last year. In contrast, EU click shares have generally changed only modestly.

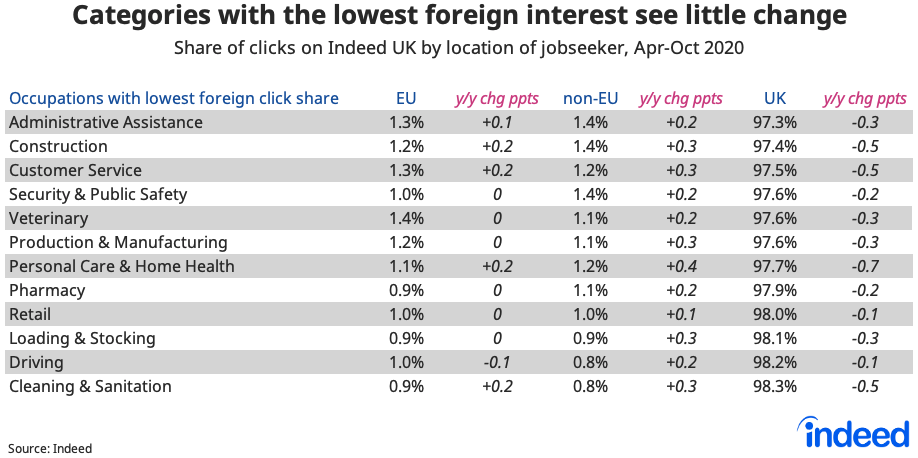

This pattern suggests that non-EU candidates are becoming increasingly available to meet the skills requirements of employers in sectors like tech, engineering and finance. But this trend is not taking place in sectors that typically see lower levels of foreign interest, including social care and construction, reinforcing concerns that some jobs in these areas may be hard to fill.

With the end of the Brexit transition phase imminent, a new UK immigration regime will come into force on Jan. 1, 2021. Free movement from the EU will end, to be replaced with a points-based system which aims to reduce overall levels of migration and prioritise ‘those with the highest skills’. EU and non-EU citizens will be treated equally, with the visa application system having gone live last week.

Changing international jobseeker interest

Against this backdrop, data show changing international jobseeker interest on Indeed. The share of clicks on UK jobs from outside the EU has increased around 20% compared to last year, from 1.52% to 1.82%, the highest level since 2014. To be sure, this represents only a small fraction of total jobseeker clicks. But it is a very large number considering that there have been over one billion job searches this year on indeed.co.uk. Meanwhile, the share of clicks on UK jobs from EU-based jobseekers has stayed flat this year, edging up from 1.54% in 2019 to 1.56%. EU citizens who want to live and work in the UK under existing rules must be already residing in Britain by Dec. 31.

Spike in searches from Hong Kong

One factor that contributed to the rise in the non-EU click share was a spike in job searches from Hong Kong after the UK government offered citizenship to around three million Hong Kongers in July. Around one-third of the 0.3 percentage point uplift in the non-EU click share this year reflects increases from users based in Hong Kong, which has been buffeted by political turmoil following the Chinese government’s tightening of control over the special administrative region.

Pandemic, Brexit disrupting mobility

International mobility has been heavily disrupted by the COVID-19 pandemic and the number of migrants registering to work in the UK has fallen precipitously. Brexit also appears to be playing a role though. National Insurance number registrations by EU nationals were down a staggering 99% in the third quarter versus a year ago compared with a much smaller 65% drop in non-EU national registrations.

Even before the pandemic, job search patterns on Indeed indicated that a shift related to the 2016 Brexit referendum was under way. In 2014 and 2015, the share of clicks from EU jobseekers was around 0.4 percentage points higher than the non-EU share. Subsequently, the gap narrowed to around 0.1 percentage points or less.

High-skill sectors driving increased jobseeker interest from outside EU

It’s not surprising that the categories that attract the highest share of clicks from outside the UK are largely high-skilled. The higher salaries these jobs generally command are attractive to foreign jobseekers, while the type of candidate looking for these roles typically wants to secure a position before moving. Lower-paid jobs tend to be more plentiful and jobseekers looking for them might be more inclined to move first and then look for work.

From April to October 2020, software development was the occupation with the highest combined share of EU and non-EU clicks. Clicks on software development jobs from outside the EU posted a particularly marked jump from the same period last year, boosting their share of total clicks to 12.5%. Mathematics, a category dominated by analysts and data scientists, was second. Several engineering occupations feature in this list, as well as architecture, scientific research & development, aviation, and information design & documentation, a category that includes business intelligence analysts, and user experience and technical specialists. Banking & finance and media & communications round out the top 12.

Conversely, those categories receiving the lowest foreign share of clicks have changed relatively little this year. All the bottom 12 occupations have seen slight declines in UK click share in 2020 offset by modest gains from abroad, especially from non-EU jobseekers. But the changes are much smaller than for the top 12 categories. Particular concern has been raised around social care, which is typically low-paid and already facing substantial gaps. Construction occupations, including bricklayers and welders, are another area where the Migration Advisory Committee has identified specific skill shortages.

Two-speed market for foreign workers?

With post-Brexit migration policy pivoting from the EU to the rest of the world, employers and policymakers may be reassured that non-EU jobseekers are showing increasing interest in UK jobs. But the picture is not uniform across sectors. While a number of higher-paid occupations may be well positioned to tap into these global pools of skilled labour, other sectors could face recruitment challenges.

Methodology

We calculated the shares of all clicks on job postings from the UK, EU and countries outside the EU, assigned to the IP location of the jobseeker.

Hong Kong search data are based on the share of inbound foreign searches for UK job postings based on jobseeker IP location.