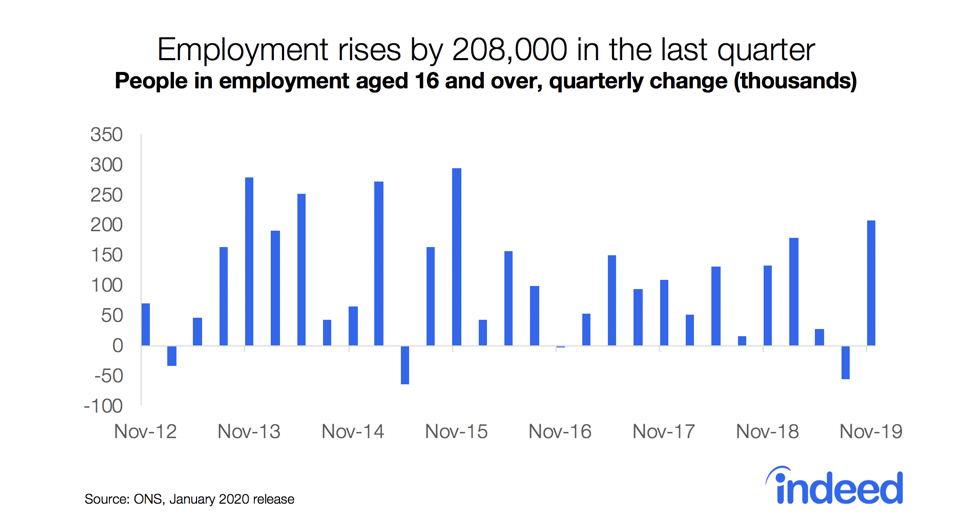

Britain’s labour market may finally be running out of steam. With the jobs boom slipping into the rear view mirror, the number of new jobs being created has slowed substantially: just 31,000 over the past quarter, a number so small it is within the statistical margin of error.

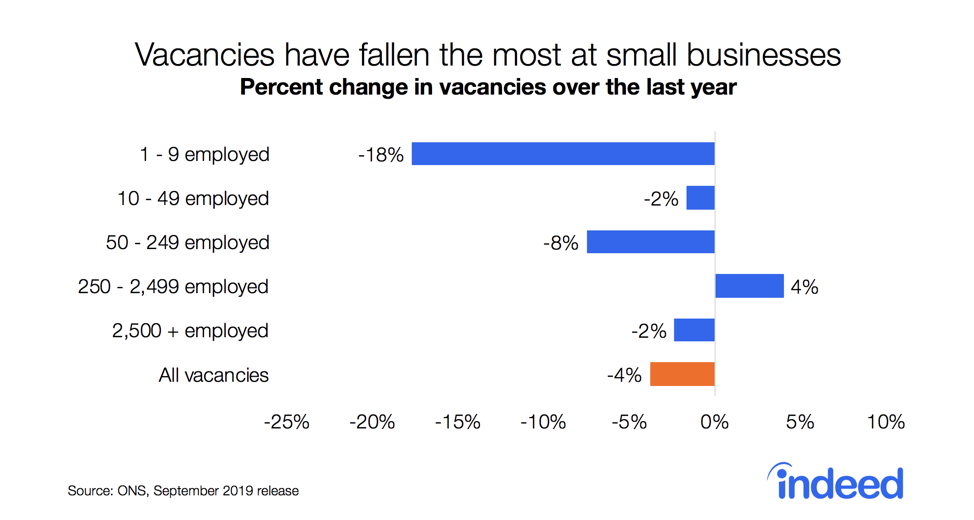

But this is not yet a decline – more a pause for breath. Both the employment and unemployment rates held steady compared to the previous quarter. That is a significant achievement against the backdrop of a stagnant economy and risk-averse employers, who are growing increasingly reluctant to hire. The total number of vacancies has been falling steadily since January, as employers – particularly small businesses – fret about the economic outlook.

Overall demand from employers for staff remains fairly high relative to historical levels, however, with data through the end of August showing an estimated 812,000 vacancies. The battle for talent is still raging on the recruitment front line. One standard metric of hiring difficulties, the number of unemployed people per vacancy, remains very low at 1.6, suggesting many open positions remain hard to fill.

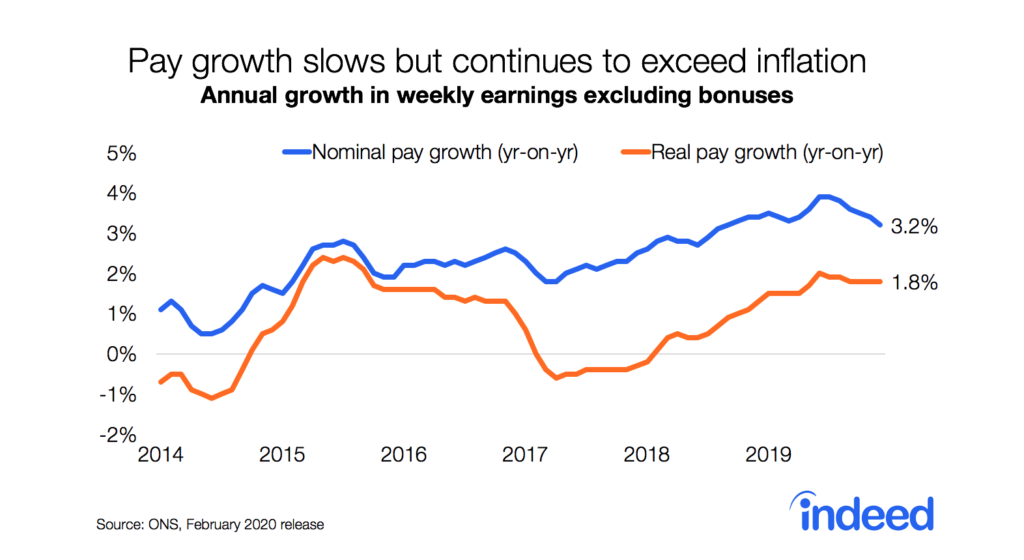

As a result, it’s ‘steady as she goes’ on the jobs numbers and workers are reaping the dividends of this tight labour market in their paypackets. Average weekly earnings excluding bonuses rose by a relatively brisk 3.8% over the past year, driving pay adjusted for CPIH inflation back up to within just £3 of their pre-crisis peak of £473 per week, reached in 2008. With the economy clearly hovering at the full employment mark, wage inflation is likely to continue in the near future. But to see sustained pay increases over the medium term we will need to see stronger productivity growth – and, of course, steer clear of a recession.