Key points:

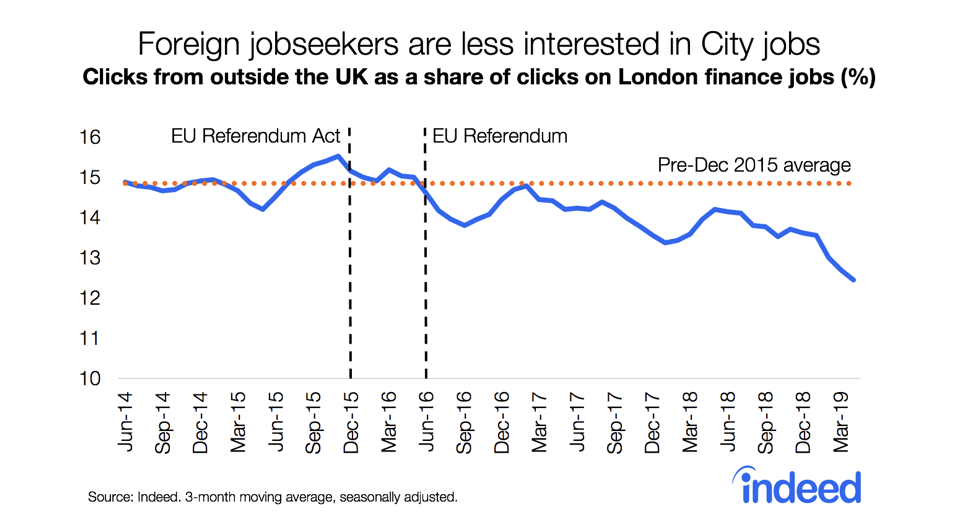

- Foreign jobseeker interest in London finance jobs has fallen during the Brexit process as measured by clicks on Indeed.

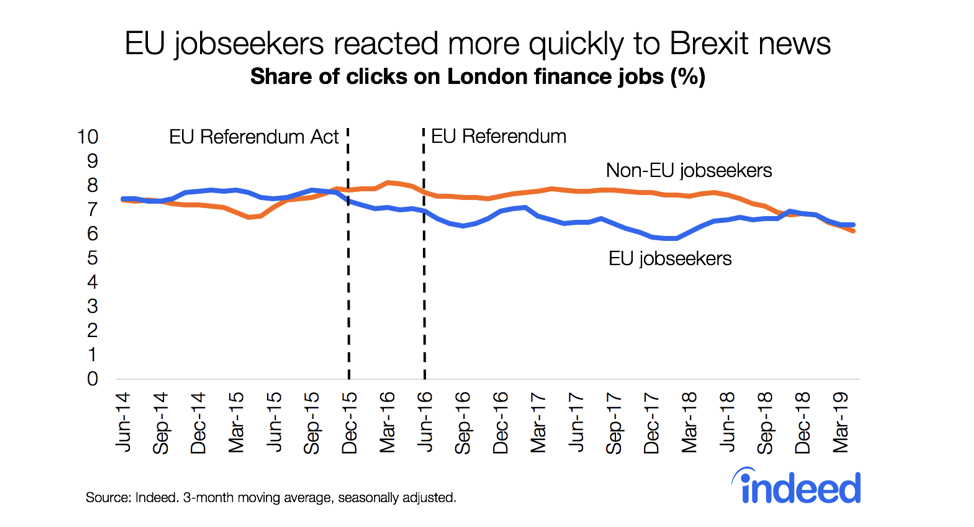

- While clicks from EU-based jobseekers started to fall immediately after the Brexit referendum in 2016, the vacuum was initially filled by jobseekers from non-EU countries, including the US, Australia and India.

- Despite Brexit uncertainty, London finance jobs still attract more interest from foreign jobseekers than the typical UK job.

Many bankers and politicians fear that Brexit will undermine London’s position as a leading global financial centre by impairing international banks’ ability to serve European clients from their City hubs. Banks are concerned that the lack of clarity about the nature and timing of Brexit generates an uncertainty that can be particularly dangerous for financial institutions. Recent surveys and press reports suggest that some banks have already started pulling out by moving staff or assets from the UK to other countries, such as Ireland. Others are drawing up plans to relocate operations if the UK leaves the EU without a deal.

How are financial professionals reacting to this uncertainty? To measure how interest in London’s finance jobs has changed since 2015, when the Government decided to press ahead with a referendum on EU membership, we looked at the trends in clicks on Indeed’s UK site by jobseekers from abroad. We found that the interest of foreign jobseekers in London finance jobs has fallen. In the first four months of 2019, jobseekers outside the UK accounted for 12.9% of all clicks on London’s finance jobs, lower than the 14.7% registered in the first four months of 2015. That represents a 12% decline in the contribution of jobseekers from abroad to London’s potential supply of financial professionals.

Brexit’s role in the decline

Two things suggest that Brexit played a decisive role in this decline. First, the percentage hovered around 15% before the referendum, but dropped immediately afterward. Second, jobseekers in EU countries other than the UK reacted much more quickly than those from outside the EU, probably because they had the most to lose from possible barriers to the free movement of people. Between the first quarter of 2015 and the first quarter of 2018, when the Brexit negotiations were well under way, EU jobseekers’ share of all clicks on London finance jobs fell from 7.8% to 5.9%, a change of almost two percentage points.

One piece of good news was that interest from outside the EU remained stable for some time, supported mainly by clicks from the US, Australia and India — countries whose citizens had no freedom of movement rights to lose. Another positive was that interest from EU jobseekers recovered somewhat in 2018, perhaps because both the UK and the EU said they were committed to allowing those who moved to the UK before the end of 2020 to remain. But the trend for non-EU workers has resumed its downward path in recent months in what may be a reaction to political turmoil during the run-up to the original March 2019 Brexit deadline. The period has been marked by greater talk of a no-deal exit, raising uncertainty for the financial sector.

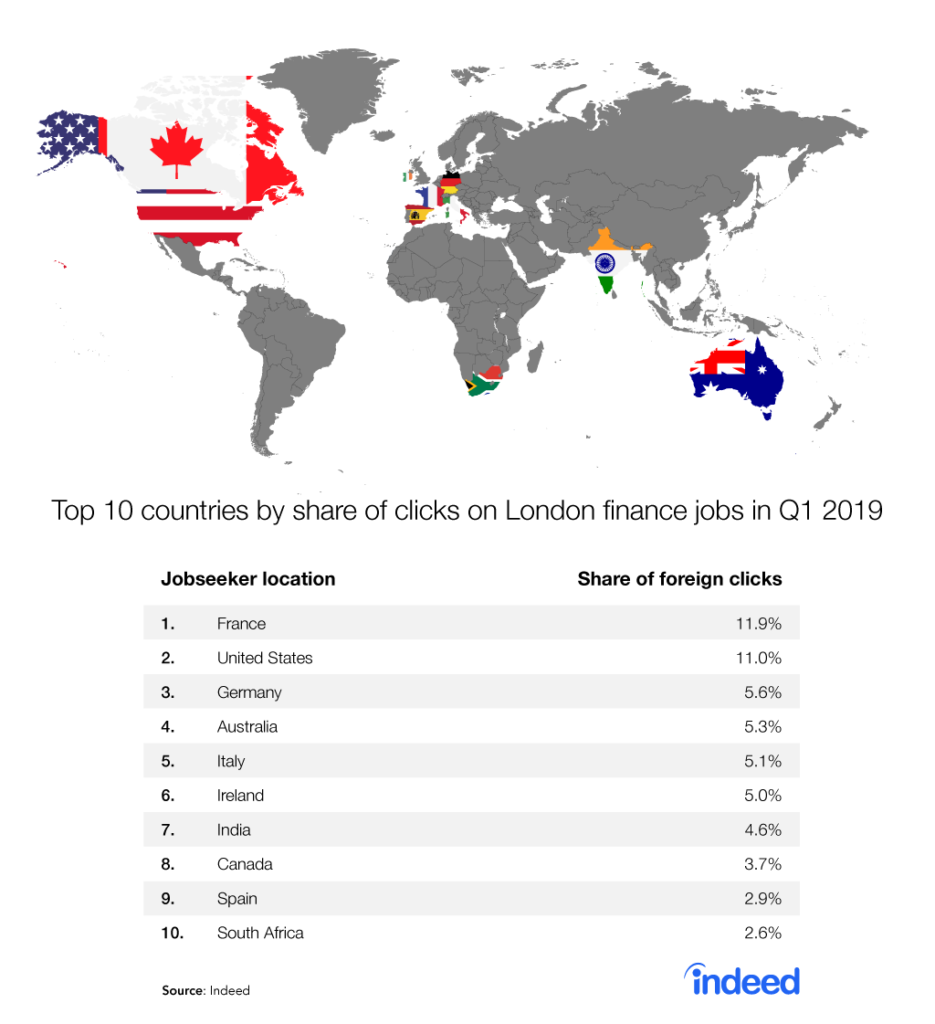

Which foreign jobseekers are most interested in London finance jobs?

In the first quarter of 2019, the top country of origin for clicks on London finance job postings was France, followed by the US and Germany. Next was a mix of EU and non-EU countries, including several English-speaking ones. Overall, the top ten countries accounted for almost 8% of all clicks on London finance jobs. Despite the downward trend, the interest of international talent in London’s financial sector remains well above the typical 3% of clicks that UK job postings on Indeed receive from overseas. Foreign jobseekers continue to contribute substantially to job search activity in London’s financial sector despite the Brexit process dragging on and the uncertainty banks face regarding post-Brexit regulation of financial services.

Methodology

We examined the clicks of people searching for jobs on Indeed in the United Kingdom between 2014 and 2019. We defined a foreign click as one in which the user’s IP address was outside the UK. We use “EU” as shorthand for all countries whose citizens benefit from the European Union’s freedom of movement rules and therefore have the right to move to the UK for work. This includes Switzerland and countries in the European Economic Area that are not part of the EU, such as Norway, Iceland and Liechtenstein.