When we think of world-class tech hubs, London may not come to mind. But the city’s Silicon Roundabout is ground zero of a burgeoning technology cluster and the tech sector now accounts for 10.8% of all local jobs. London, it turns out, is not only the British technology leader, but a major international tech centre in its own right.

Yet, despite this high concentration of tech opportunities, London faces a challenge. Its tech job seekers are much more likely than the average Londoner to look for work in other British regions, presumably lured by much lower living costs. And there are options in other areas of the country—tech jobs exist throughout Britain. Indeed data based on millions of job postings and job seeker searches allows us to do a deep dive into the geography of the British tech job market. This is what we found.

Where are tech jobs today?

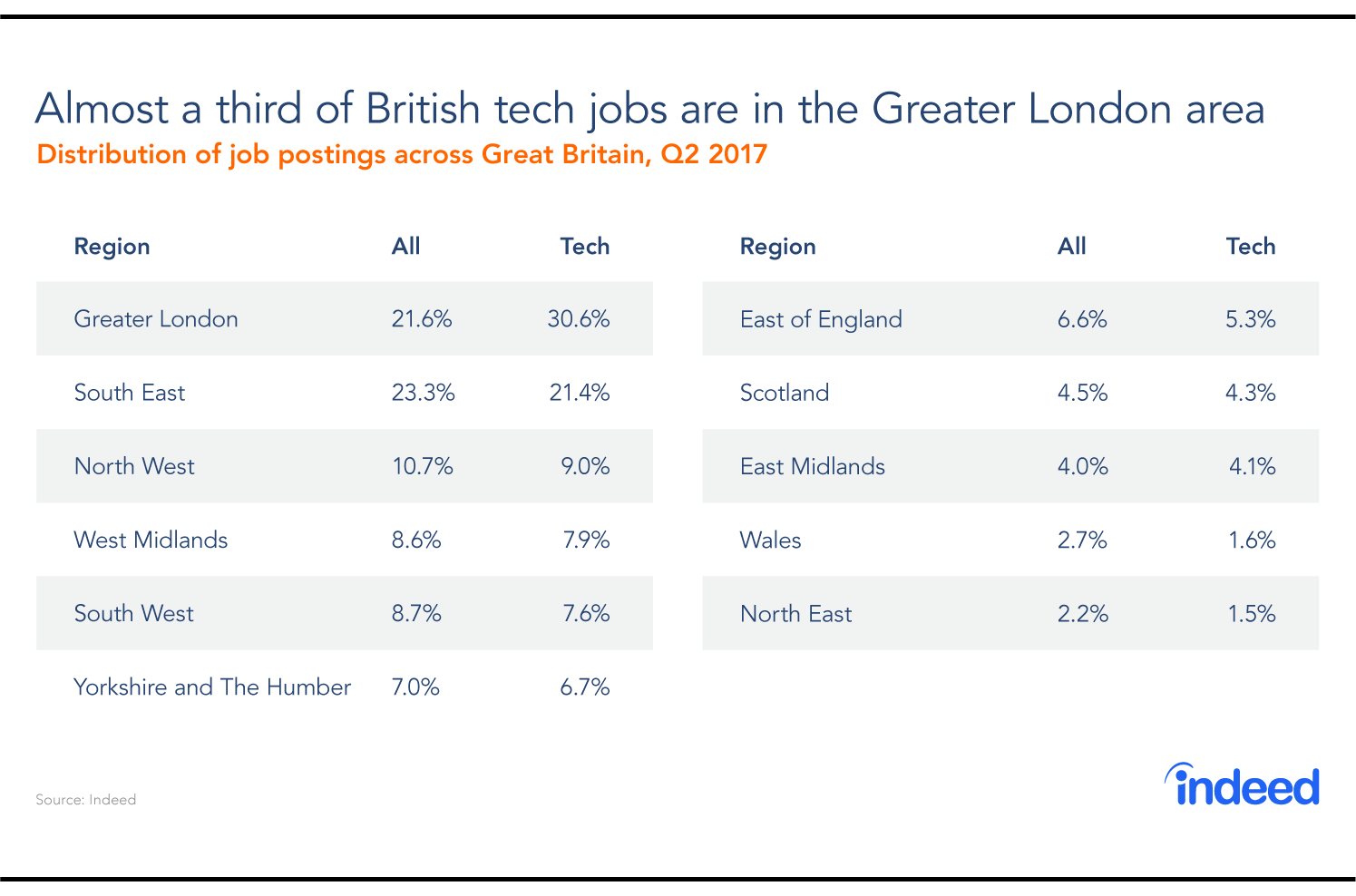

Almost a third of British tech jobs postings—30.6%—are located in the Greater London area. The South East is the second biggest hub, with a 21.4% share, followed by the North West, including Greater Manchester, with 9%. These three regions are home to 39% of the British population, but 61% of tech and 56% of all British job postings. By comparison, in the US, 27% of technology job postings are in the eight biggest tech hubs (San Jose, Washington DC, Baltimore, Seattle, Raleigh, San Francisco, Austin and Boston).

Comparing the distribution of tech jobs and all jobs, tech is significantly more concentrated in the London area. More than one in ten job postings in Greater London advertised on indeed.co.uk can be classified as tech positions. The national figure, excluding London, is 6.7%.

Other areas where job seekers are more likely to find higher concentrations of tech opportunities include Yorkshire and the Humber, Scotland, the East of England and the South East.

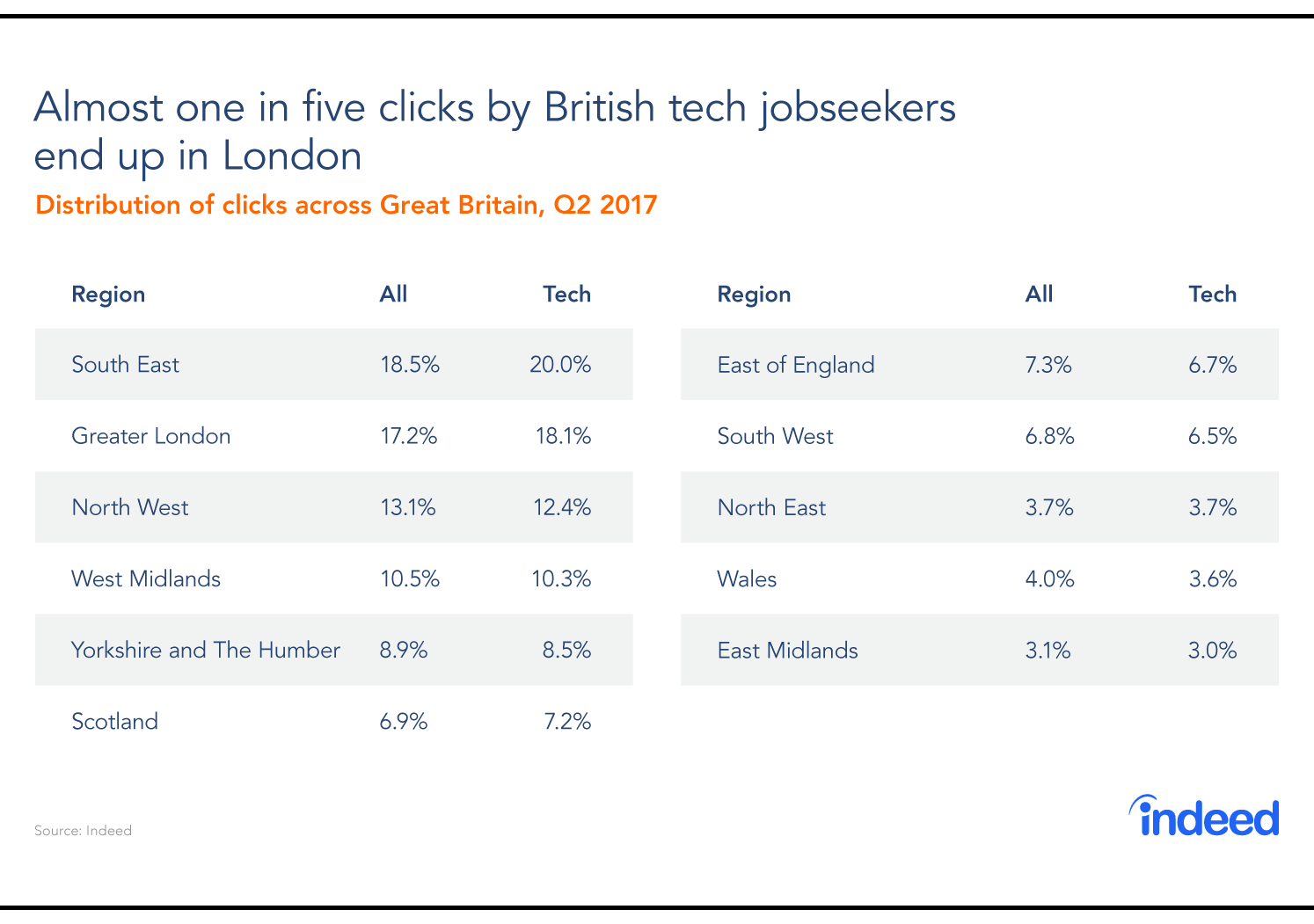

Despite differing regional concentrations of tech jobs, the likelihood of a job seeker clicking on a tech opening is pretty much the same everywhere in the country—roughly 4%. The only exception is remote jobs, that is, jobs where an employee need not work in a central workplace: Almost one in six clicks on remote job postings are for technology positions. London gets 18.1% of the clicks of British job seekers interested in tech positions—the second highest share nationally. However, that is below London’s 30.6% share of overall British tech postings.

Uneasy lies the head that wears the crown?

The data leave little room for doubt—whether it’s job seeker interest or job opportunities, London stands out as Britain’s main tech cluster. London is the only region that has a significantly larger share of technology postings than all job postings. What is more, London’s concentration of tech roles is high even by international standards. At 10.8% of all jobs, Greater London’s technology jobs share is only slightly below that of San Francisco’s 10.9% and above those of Austin and Boston.

But all is not well in London’s tech realm—the workforce is restless. London-based tech job seekers are much more likely than the average Londoner to look for work in other parts of Britain, but no more likely than average to look within London or the neighboring South East region. At the same time, compared with the average job seeker, tech job seekers from the rest of the UK or coming from abroad are just as likely to click on jobs in the rest of England and Scotland as on jobs in London—though less likely to look for opportunities in Wales—suggesting that an influx of tech job seekers from other places will not make up for the outflow.

Undoubtedly, London, with its high share of technology roles, holds many attractions for tech job seekers. Nonetheless, workers in London are more likely to look for tech roles outside of the prosperous South East and Greater London area. Why would they do so? The region’s very high cost of living is probably a major push factor. Even though London house prices have recently been rising less than in other parts of the country, in August 2017 the average London property price was still more than double the national average, according to the Office for National Statistics. The pronounced difference in living costs, coupled with an increasing availability of tech roles in other regions, appears to be luring some London-based job seekers.

These dynamics are mirrored in official internal migration statistics. The latest population estimates indicate that all regions outside London had net positive inflows in 2015. The South West registered the highest rate, with 26.8 moves per 1,000 population. During the same period, London had the highest outflow rate—33.6 moves per 1,000 population. In addition, internal migration estimates from previous years point toward a large net outflow from London.

Life outside the tech hub?

With 61% of all British tech jobs located in the Greater London, South East and West regions, the geography of British tech jobs is more concentrated than the US geography. London holds the crown, with almost a third of the nation’s tech jobs. Yet, despite London’s prominent position as the nation’s tech centre and a global tech hub, London-based tech job seekers are more likely to look for opportunities outside the city. Availability of work in other regions and lower living costs appear to be the strongest push factors. While London’s position as the main hub is likely not up for grabs, this trend may make it harder for many London employers to fill vacant tech slots.