The Canadian labour market kicked off 2026 on the soft side, but the news was more mixed than just the soft headline number. The number of people working slipped by 25,000, led by a dip in Ontario manufacturing employment, the first decline since August. At the same time, a rise in full-time jobs helped total hours worked post its strongest showing of the past year. Adding to the cloudy picture, the unemployment rate fell 0.3 percentage points because fewer people searched for work.

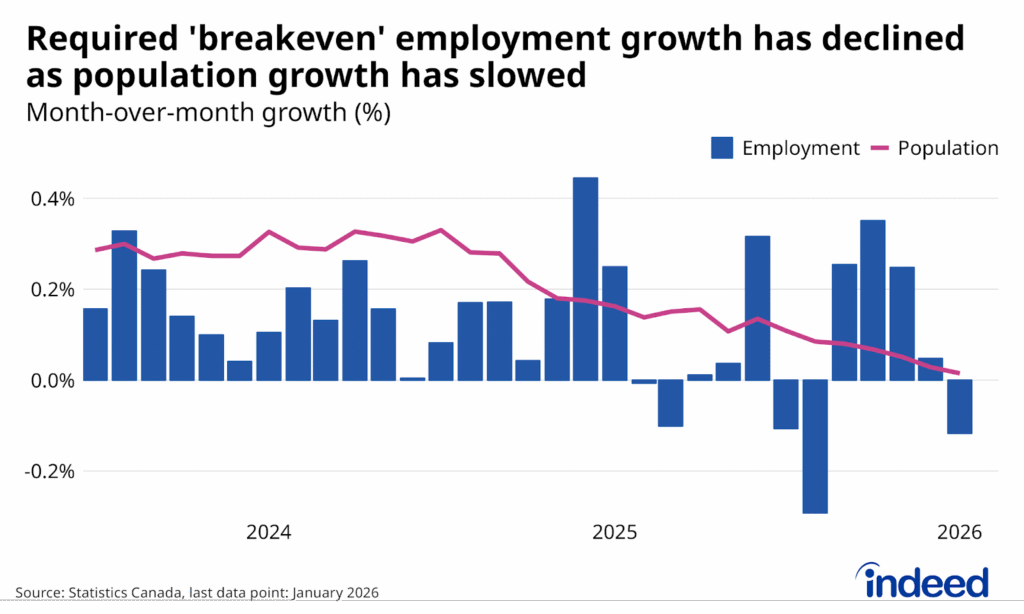

The negative headline employment number isn’t good news, but with slowing population growth, the signal from the data point means something different today than it did just one year ago. Though somewhat lagged, the LFS estimates of population growth have slowed to nearly zero, meaning the benchmark for job growth that signifies stable conditions for Canadian workers has also eased. A negative 25,000 employment change isn’t as concerning when the population only increased by 5,000 (what the LFS reported in January 2026) instead of 56,000 (the pace a year earlier).

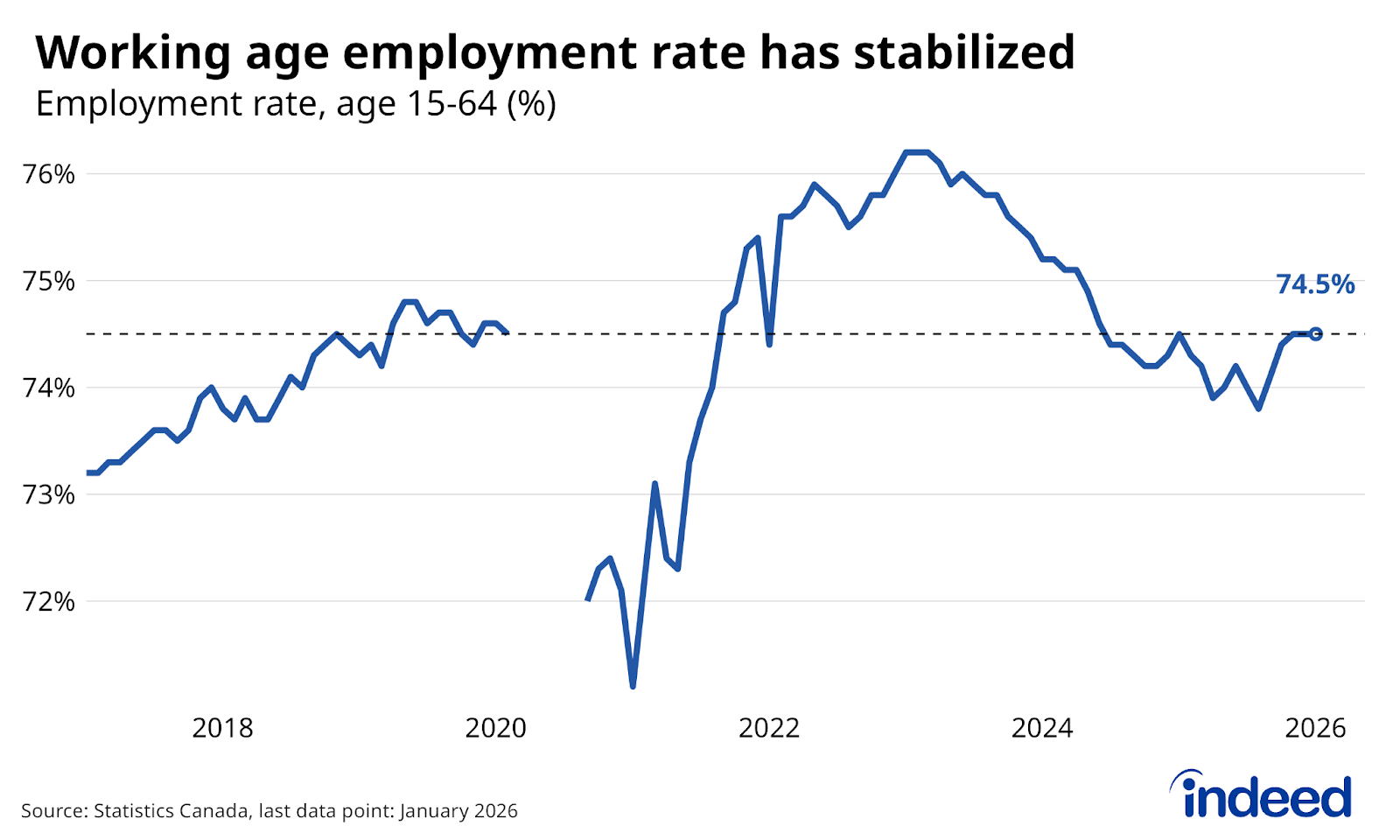

In this case, the working-age (15-64-year-olds) employment rate provides a useful gauge of conditions, net of shifts in both population and job search activity. Overall, the share of working-age Canadians with a job was flat at 74.5% for a third consecutive month, up somewhat from Q3, but matching where it stood a year earlier. Many of the themes facing the labour market in recent years will likely persist into 2026, and they’re not all positive. Without an economic spark on the horizon to kickstart hiring, and sectors like manufacturing taking another hit in January, we’re treading water for the time being.