Key points:

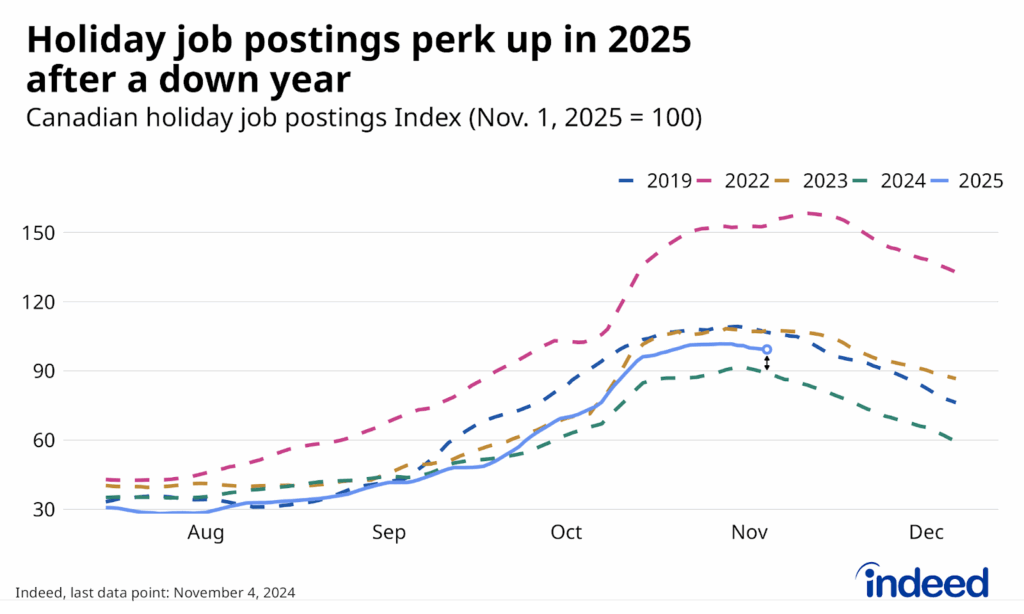

- Canadian holiday job postings were up 12% year-over-year as of early November, though remained relatively weak compared to earlier years.

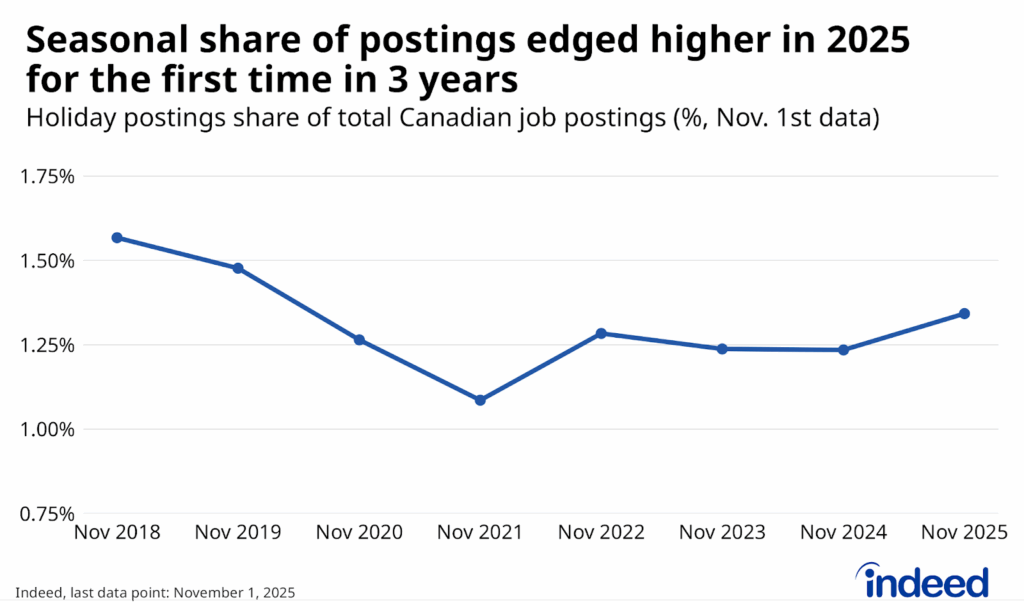

- The uptick in seasonal postings compared to 2024 comes amid flat overall job postings, pushing the seasonal share of total postings up for the first time since 2022. The trend could be related to solid 2025 sales at brick-and-mortar retailers.

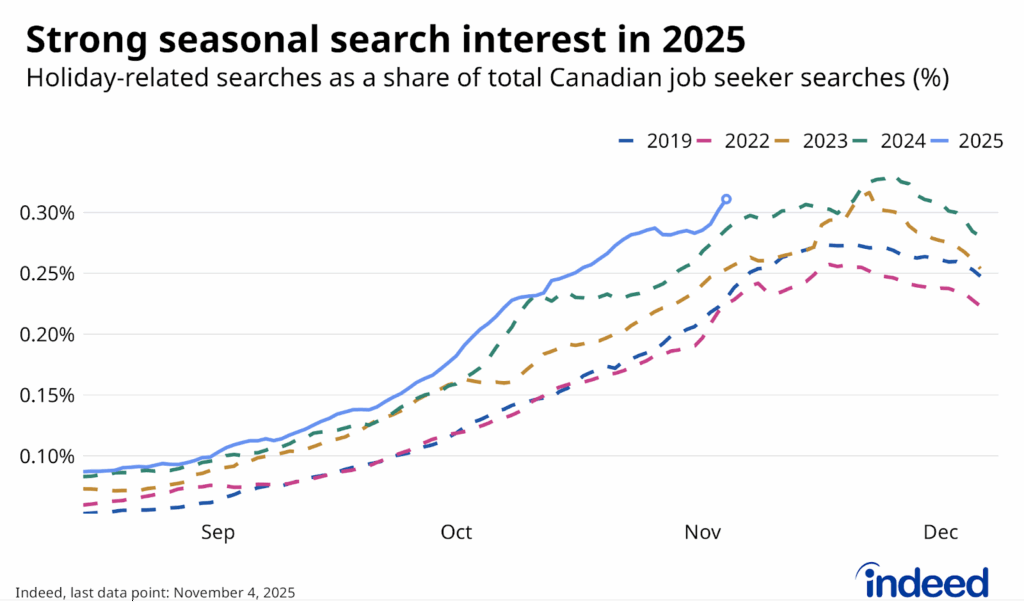

- The share of Canadian job seeker searches containing seasonal terms rose for a third straight year in 2025, suggesting the weaker job market is leading job seekers to increasingly consider temporary positions.

Every year, starting in September, Canadian employers in the retail and customer service sectors begin recruiting seasonal workers to supplement employment around the holidays, with recruiting activity typically peaking at the end of October. This year has been no different, and so far, the spike in holiday job postings has been somewhat stronger than in 2024.

As of November 4, Canadian seasonal job postings on Indeed — roles with terms including “seasonal,” “holiday,” and “Christmas” in their job titles — were up 12% from a year earlier. Demand for these workers isn’t particularly robust compared to earlier years, with holiday job postings down by 8% and 35% compared to where they stood at this time in 2023 and 2022, respectively. Nonetheless, the break in the downward trend is still good news for those seeking temporary employment around year-end.

The decline in seasonal postings from 2022 to 2024 was part of the broader cooling of employer hiring appetite following the pandemic. However, over that two-year period, the overall share of jobs that were explicitly seasonal held steady, as both holiday and total postings fell similarly. The partial rebound in 2025 appears different, with total postings roughly flat from the prior November, even as seasonal demand perked up. The result has been a slight uptick in the seasonal share of Canadian job postings, from 1.23% at the start of November 2024 to 1.34% in 2025.

With the most common seasonal job types being in retail and customer service, ongoing trends in online spending are likely influencing demand for workers, on top of trends in the broader economy. For instance, the rise of e-commerce since the late 2010s likely weighed on employer demand for customer-facing retail workers, helping to push down seasonal postings as a share of total postings. But amid a solid year for overall consumer spending, there are signs that the e-commerce share of Canadian retail sales has stabilized compared to a year earlier, at about 6%. This (at least temporary) pause in the shift to online shopping could be a factor in why demand for seasonal workers has firmed in 2025.

Job seeker interest in seasonal work rises again

As employers start to ramp up their seasonal recruiting every September, Canadian job seekers also begin looking for holiday work. And as the labour market has softened in recent years, the share of job seeker searches on Indeed containing seasonally related phrases has increased. In early November 2025, 3.1 per 1,000 Canadian job searches included one of these terms, up slightly from 2024, and more substantially from the 2.5 and 2.2 per 1,000 rates in November 2023 and 2022, respectively.

Stronger interest in seasonal work isn’t a great sign for the health of the overall labour market. Canadian job seekers across a range of circumstances have been struggling to find work, and for some, landing a temporary position during the holiday season might be making the best of a difficult situation. The uptick in seasonal posts in 2025 means there will be slightly more of these opportunities. For seasonal employers, though, finding workers to fill these openings will likely remain easier than in the past, due to both still-soft demand and a greater share of job seekers looking for holiday work.

Methodology

We track holiday-related job postings by tallying job postings on Indeed Canada that use terms including ‘Christmas,’ ‘xmas,’ ‘santa,’ ‘holiday,’ ‘seasonal,’ ‘advent,’ and their French equivalents. We exclude terms including ‘technician,’ ‘labourer,’ ‘lifeguard,’ and ‘tax’ that aren’t unique to the holiday season. We track job seeker interest in seasonal jobs by counting the number of searchers on Indeed Canada using these same terms. All numbers in this post represent seven-day moving averages.

The number of job postings on Indeed, whether related to paid or unpaid job solicitations, is not indicative of potential revenue or earnings of Indeed, which comprises a significant percentage of the HR Technology segment of its parent company, Recruit Holdings Co., Ltd. Job posting numbers are provided for information purposes only and should not be viewed as an indicator of performance of Indeed or Recruit. Please refer to the Recruit Holdings investor relations website and regulatory filings in Japan for more detailed information on revenue generation by Recruit’s HR Technology segment.