Key points:

- As of early May, Canadian summer job postings were down 22% from a year earlier. Summer job ads have now evolved similarly to overall job postings since 2023, after holding relatively steady in 2024.

- Postings were down 32% for summer camp roles, while other jobs like painters, lifeguards, and customer service representatives also fell from the same point in 2024.

- The dip in job postings comes at a time when growth in youth employment has fallen far short of rapid population growth over the past two years, suggesting 2025 could be another difficult summer for seasonal job seekers.

There’s a chill to Canadian summer job postings in 2025. As of May 9, job postings on Indeed containing the word “summer” (or “été”) in their title were down 22% from the same period a year earlier. This decline is catching up with the trend in overall Canadian job postings, as seasonal demand held up relatively well in 2024, but is now down similarly as the overall market since 2023. Summer job postings typically peak in the mid-April to mid-May period, suggesting a soft season for hiring ahead as students go on break.

One driver of the dip in summer job postings is fading demand for summer camp counselors. Camp-related postings, including counselors, managers, and leads, are typically the largest single category of summer job ads, accounting for between 10% and 15% of summer postings. After holding steady at elevated levels between 2022 and 2024, postings for these roles were down 32% in early May 2025 from a year earlier, back to where they stood in 2019.

While camp counselors were the largest contributors to the overall decline in summer job postings between April 2024 and 2025, seasonal demand waned for several other types of jobs too. Postings for summer painters dropped sharply (partly because fewer were classified as seasonal), while demand also slipped for other manual labor jobs, including labourers and maintenance persons. Other jobs in recreation, including for lifeguards and instructors, also came in soft, while demand for seasonal customer service representatives likewise was down from a year earlier, matching broader trends in the retail sector.

Weak summer demand won’t help youth employment trends

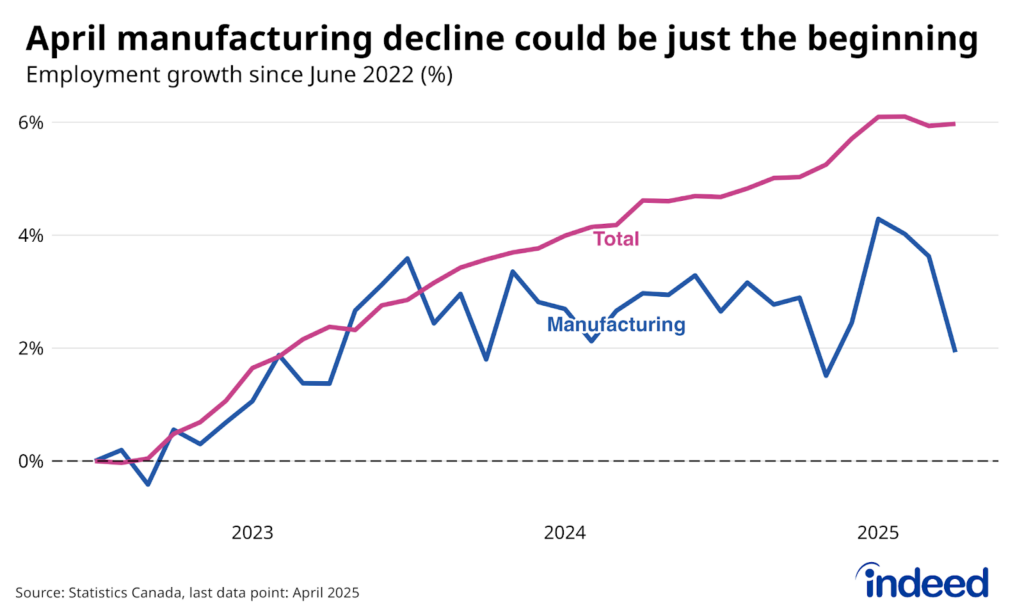

Seasonal employment conditions look rough for young workers this year, continuing a trend from last summer 2024. The number of 15-to-24-year-olds working at the peak of the summer market in July 2024 matched the same period in 2023. But the employment rate of this age group plunged, as employment failed to keep pace with the 7.2% growth in their population over the same period. With supply soaring past demand and limited response from wages, youth employment rates plunged.

Three-panel line chart titled “Youth employment hasn’t kept up with population” shows Canadian youth employment, population, and employment rate in different panels between February and October, with different coloured lines representing their non-seasonally adjusted values in 2023, 2024, and 2025. Youth employment rates are down sharply because population growth has surged, while employment has held steady.

There’s little sign of a turnaround going into this summer. Summer job postings are down compared to last May, and while youth population growth has slowed, it was still up 3.7% from a year ago, according to the April Labour Force Survey. With other risks to the Canadian labour market looming, there are few signs of near-term turnaround amid what’s already a troubled job market for youth.

Methodology

We track summer hiring appetite by tallying Canadian job postings on Indeed that include the term “summer” or “été” in the job title, excluding postings with job titles that also include “intern” or “internship”. We track internship postings separately, tallying the presence of the latter two terms in job titles. This method doesn’t capture the full extent of seasonal demand but provides a gauge of recent trends and how season postings compare to the prior year. All posting data presented reflects 7-day trailing moving averages.

The number of job postings on Indeed, whether related to paid or unpaid job solicitations, is not indicative of potential revenue or earnings of Indeed, which comprises a significant percentage of the HR Technology segment of its parent company, Recruit Holdings Co., Ltd. Job posting numbers are provided for information purposes only and should not be viewed as an indicator of performance of Indeed or Recruit. Please refer to the Recruit Holdings investor relations website and regulatory filings in Japan for more detailed information on revenue generation by Recruit’s HR Technology segment.