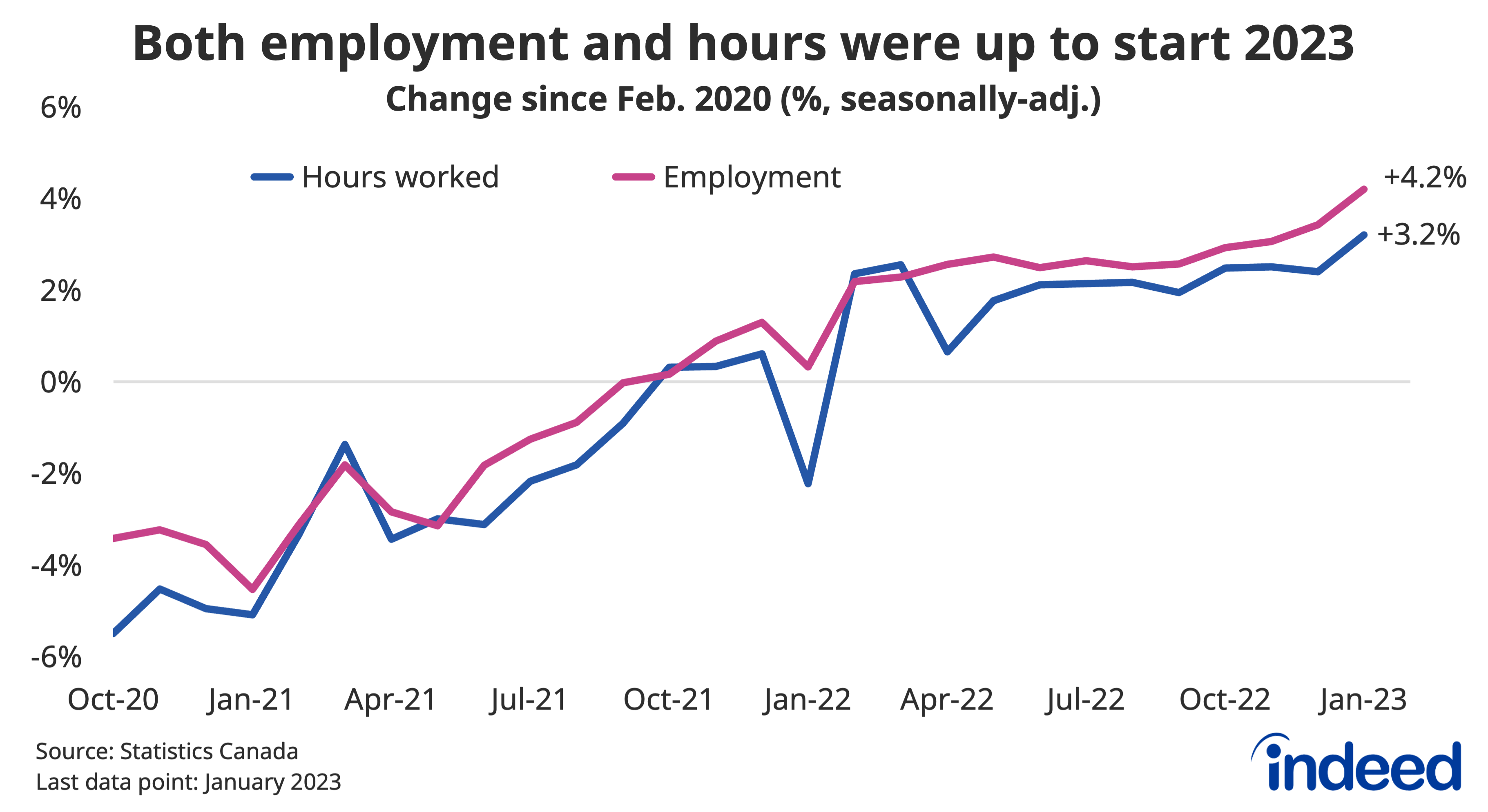

Business and consumer sentiment might be down, but for the Canadian job market, it’s still full-steam ahead. Employment growth in January didn’t just keep up with the solid gains to end 2022, but instead blew them out of the water. Gains were broad-based across industries, mainly concentrated in full-time jobs, and also showed up in total hours worked, which had been a bit softer than other recent indicators.

As with all LFS releases, it’s important not to miss the forest for the trees. Employment in retail and wholesale jumped after sliding throughout the second half of 2022, some of the earlier weakness perhaps a tad exaggerated. Still, blips in the data notwithstanding, the trend is looking solid.

Other encouraging industry-level trends help provide context for the broader ongoing progress in recent months. First, accommodation and food, as well as other services (which includes personal care) have made steady gains in recent months, finally starting to close the gap with their pre-pandemic levels, a process that could have further room to run. Meanwhile, jobs vulnerable to the slowing economy have held steady in the case of professional services, and are actually up in construction, despite a weaker housing market. That said, industries aren’t out of the woods yet.

January’s upside surprise comes at a time amid signs that employer demand is waning from elevated levels. Fewer job vacancies also have the potential to translate into slower wage growth, which did tick down from a 4.8% to 4.5% year-over-year pace, though the deceleration wasn’t uniform across sectors. A key question for the year ahead is whether labour incomes can outpace inflation, through a combination of job and wage growth. 2023 has started off on a strong note on the jobs side, but now the question is whether inflation will cooperate.