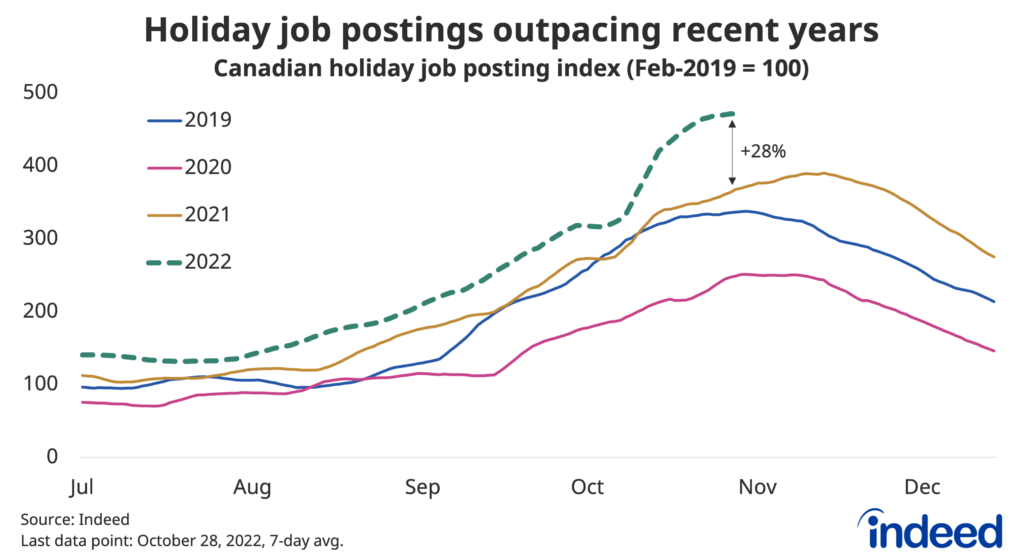

- Seasonal hiring appetite is strong this year, with Canadian holiday job postings on Indeed up 28% from 2021 as of October 28, and even further above 2019 levels.

- Job seeker searches for seasonal work as a share of total activity have rebounded to just below their pre-pandemic rate, standing 25% above last October.

- These trends are consistent with more normal holiday hiring after two years in which the pandemic weighed on seasonal employment, though employers will face challenges filling holiday jobs similar to those for nonseasonal vacancies.

Every September, Canadian employers start recruiting workers for the holiday season. However, seasonal hiring appetite was relatively weak over the first two years of the pandemic. This year though, holiday job postings ramped up early. Through October, they were running well above both 2021 and 2019 levels. At the same time, job seeker interest in seasonal roles is stronger than it was last year, with the seasonal share of total Canadian job searches tracking just below its level before the pandemic. The combination of stronger demand for seasonal workers and greater job seeker interest points to a pickup in overall hiring this holiday season, but finding workers will probably be a challenge for some employers.

Seasonal demand stronger than recent years

We track holiday-related job postings by tallying the number of job ads on Indeed that include terms like “holiday,” “seasonal,” “Christmas,” and, of course, “Santa” in job titles, while excluding certain non-holiday terms like “labourer.” Seasonal demand is mainly concentrated in the retail industry. The four most common winter holiday job titles on Indeed are primarily customer-facing retail positions, together accounting for over half of this year’s holiday postings.

Seasonal postings ran at a similar rate in September and October 2021 as they did in 2019, a bounceback from depressed 2020 levels. However, that recovery paled compared with the surge in overall Canadian job postings throughout 2021. As a result, the seasonal share of total Canadian job ads remained low, peaking at 1.1% of postings compared with 1.5% before the pandemic.

Seasonal demand took a further leap forward this year. As of October 28, 2022, holiday job postings were 28% and 40% above 2021 and 2019 levels, respectively. Customer service positions have led the growth, while retail and sales postings have also edged up. At 1.3%, the holiday share of total Canadian job postings has not returned to its pre-pandemic level, but it’s catching up.

Seasonal job searches also rebound

By itself, the rise in holiday hiring appetite would suggest seasonal employers are going to have a tough time filling job openings, like the challenges faced throughout the economy. However, a rebound in job seeker interest in seasonal work could be a saving grace for hiring managers.

After two years of little job seeker enthusiasm, Canadian searches on Indeed containing seasonal terms are up substantially this year. As of October 28, the seasonal share of total Canadian job searches stood at 1.8 per 1000 searches, just shy of where it was at the same point in 2019, and up 25% from its 1.4-per-1000 share last year.

Conclusion

The pandemic held back seasonal hiring over the past two holiday seasons. This was evident in Indeed data, as well as Statistics Canada payroll data. Jobs in highly seasonal segments of retail like clothing stores rose less than usual toward the end of 2020 and 2021, unlike the rest of the sector.

More normal conditions, including a rebound in job seeker interest in holiday positions, suggest this year could resemble pre-pandemic years compared with 2020 and 2021. However, the tight labour market that has emerged from the pandemic persists. Holiday job postings have grown more than job seeker interest since 2019, which means filling openings will be a challenge for some employers. Adjusting wages to attract new hires, along with offering scheduling flexibility, will remain top of mind for employers struggling to attract seasonal candidates.

Methodology

We track holiday-related job postings by tallying job postings on Indeed Canada that use terms like ‘Christmas,’ ‘xmas,’ ‘santa,’ ‘holiday,’ ‘seasonal,’‘advent,’ as well as their French equivalents, while excluding terms like ‘technician,’ ‘labourer,’ ‘lifeguard’ that aren’t unique to the holiday season. We track job seeker interest in seasonal jobs by counting the number of searchers on Indeed Canada using these same terms. All numbers in the post represent seven-day moving averages.

The number of job postings on Indeed, whether related to paid or unpaid job solicitations, is not indicative of potential revenue or earnings of Indeed, which comprises a significant percentage of the HR Technology segment of its parent company, Recruit Holdings Co., Ltd. Job posting numbers are provided for information purposes only and should not be viewed as an indicator of performance of Indeed or Recruit. Please refer to the Recruit Holdings investor relations website and regulatory filings in Japan for more detailed information on revenue generation by Recruit’s HR Technology segment.