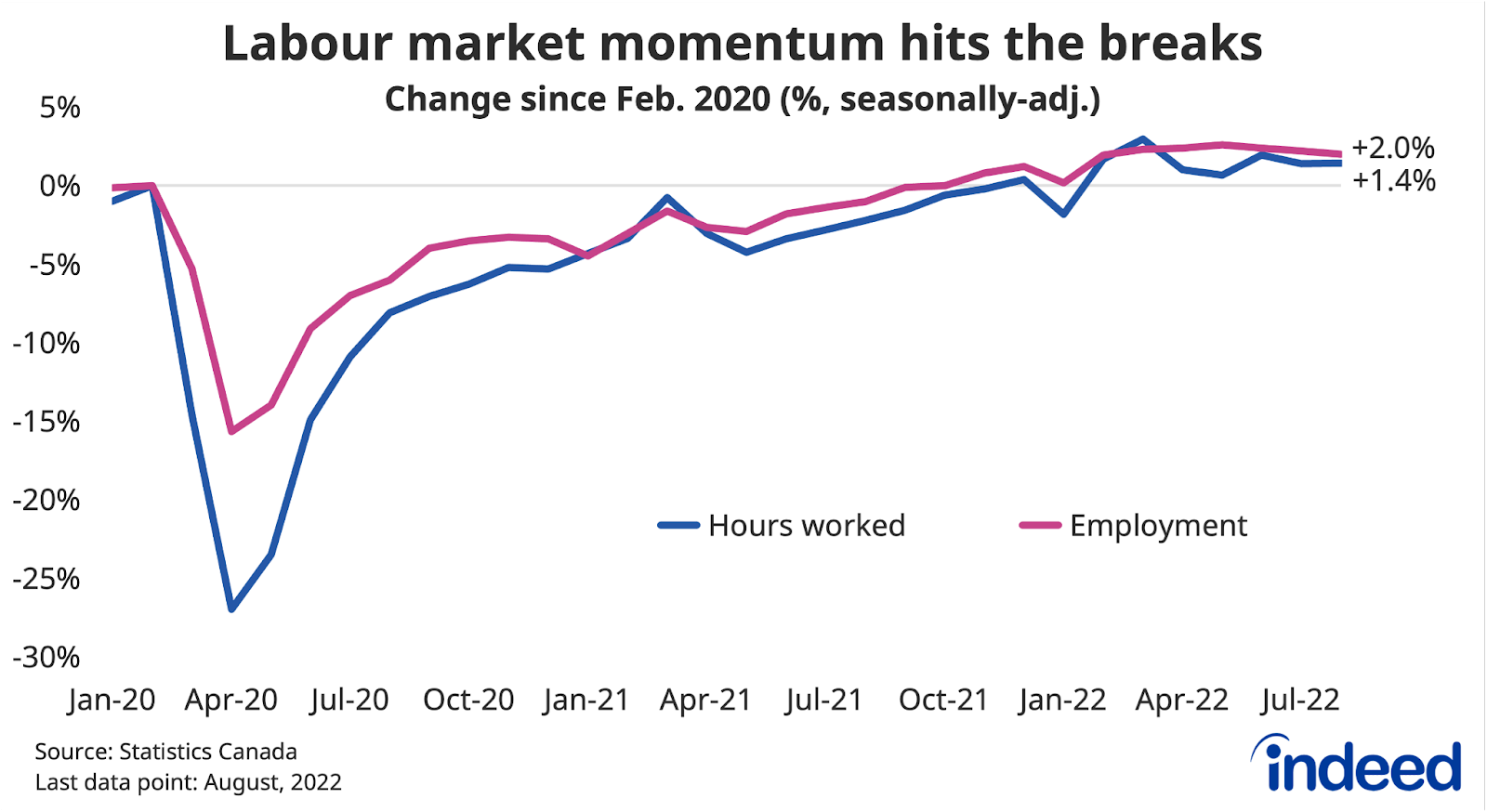

The alarm bells shouldn’t be ringing yet, but the recent weakness in Canadian job numbers does raise eyebrows. August marked a third consecutive slip in Canadian employment, but this time we also had a notable uptick in the unemployment rate. However, not all details were as weak, as total hours worked held steady. Also reassuring was that layoffs weren’t particularly elevated during the month. Nonetheless, the August report does reinforce the downshift in momentum we’ve seen since the start of summer.

The downbeat headline number was mainly driven by two industries: construction slipped, reversing gains from the prior two months, while educational services fell by even more, continuing their recent slide. Statistics Canada mentioned the timing of the school year as a potential factor influencing education employment, but the latest dip from elevated levels could also be a sign of a pull-back in extra pandemic-associated staffing. Meanwhile, other sectors that have been in the spotlight of late, like professional and technical services, as well as finance and real estate, both edged up in August.

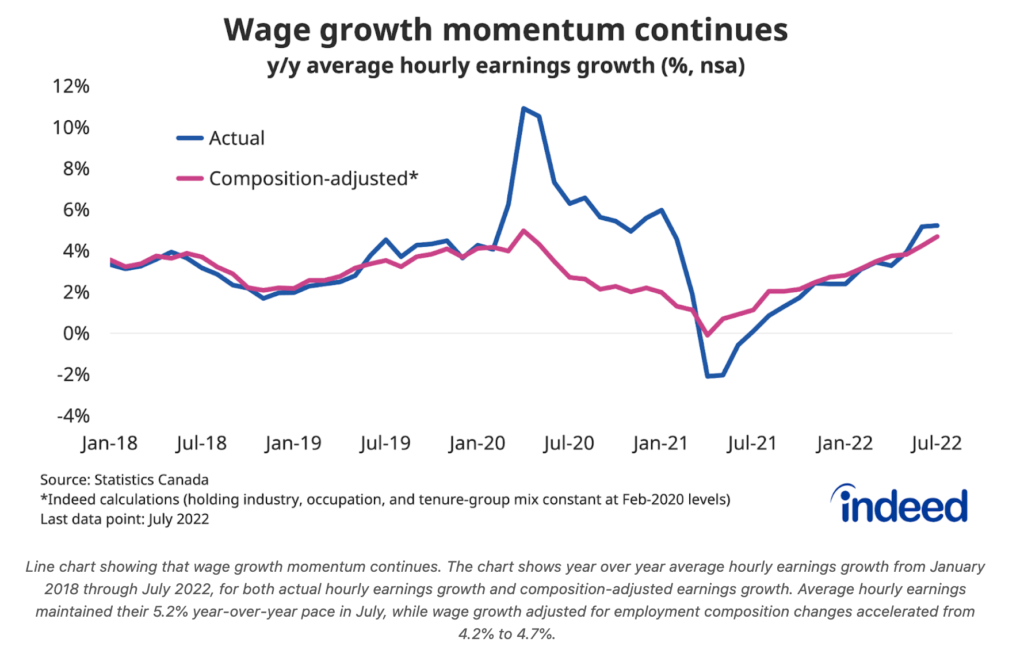

On the wage front, average hourly earnings grew at a slightly faster annual rate in August, a third straight month above 5%. This pace is a decent clip by historical standards, but paychecks continue to lag inflation. Wages might be adding some pressure to the costs of production, but the pace of growth isn’t gathering steam like earlier in the year. For Canadians to regain their lost purchasing power due to the recent surge in inflation, either wage growth has to ramp up, or prices have to cool down. With signs of employer demand in Indeed job postings easing, albeit from elevated levels, slower price growth might have to do the heavy lifting.