Key points

- Total Canadian job postings on Indeed were up 69% on June 17, 2022, compared to their pre-pandemic level, down 3% from their peak in early May.

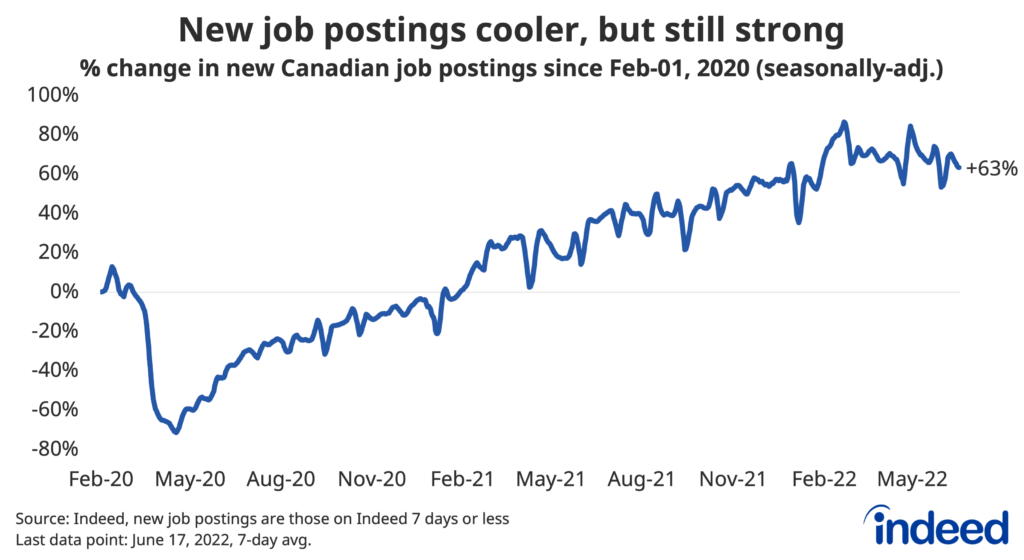

- New job postings continue to be added at a solid pace, although not as quickly as their average rate between February and May.

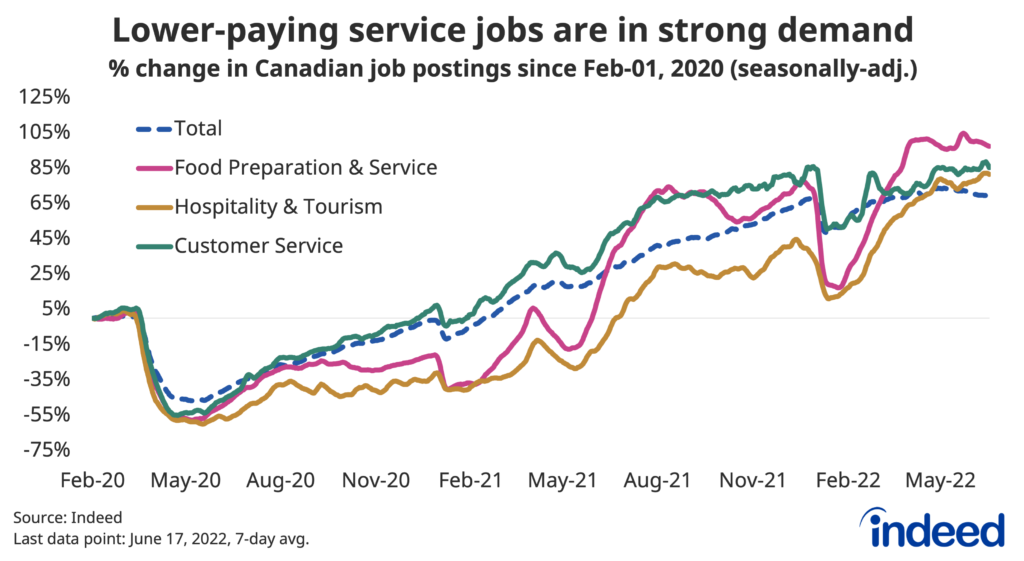

- Hiring appetite is elevated across almost all sectors, but recent momentum has been mixed, with postings slipping in goods-producing industries, while software development, banking and finance, and lower-paying services have been steadier.

- As provincial vaccine mandates have relaxed, mentions of vaccine requirements in job postings have started to decline, with 9.5% of English-language postings in late May mentioning vaccines, down from their 11.7% peak in February.

As of June 17th, total Canadian job postings on Indeed were up 69% from their February 1, 2020 levels, after adjusting for seasonal trends. Postings have eased 3% from their peak reached in early May, when they were 74% above their pre-pandemic level, but still remain quite elevated.

The cooler growth in overall postings partly reflect new postings being added at a less blistering pace. The number of new Canadian job postings on Indeed (seven days old or less) on June 17th were up 63% from their pre-pandemic pace, down somewhat from the 71% average increase in new posting rate that prevailed between February and May. However, despite the downshift, new postings continue to be added more quickly than at the rates that prevailed throughout nearly all of 2021. Trends in new postings remain key to watch for signs of a major slowdown in hiring appetite.

Postings in software development and other white collar fields remain steady, despite reports of hiring freezes.

Job postings are elevated compared to pre-pandemic levels across the vast majority of occupations, but recent momentum has been mixed. While recent reports have highlighted hiring freezes and layoffs among some companies in the tech sector, overall job postings in software development remain exceptionally high, just shy of where they stood in early May, similar to banking and finance. Demand in accounting has also remained relatively solid in recent months, though postings aren’t as far above pre-pandemic levels.

Recent weakness in goods-producing sectors

In contrast, momentum has been weak of late in goods-producing sectors. Construction in particular has seen postings slip in recent weeks, albeit from quite elevated levels. Hiring appetite has also softened to a greater degree than the headline trend in areas like production and manufacturing, and installation and maintenance. Continuation of this recent weakness could be a warning sign for Canadian economic growth, as employment in goods-producing industries has historically been highly cyclical.

Finally, the ongoing return of economic activity impacted by the pandemic has kept demand in lower-paying services in strong shape. Job postings have held up well in recent weeks in areas like food services and customer service, while recent momentum in hospitality and tourism postings have them further above their pre-pandemic level than the economy-wide trend for the first time since early 2020. The near-term question in these areas of the economy is less so around the level of demand for workers, and instead what adjustments employers will make to attract job seekers when there are ample opportunities for work elsewhere.

Vaccine requirements still prevalent, but starting to fade

After soaring during the second half of 2021, the share of Canadian job postings mentioning vaccine requirements has started to come down, as provincial vaccine mandates have loosened. Mentions of vaccine requirements went from being quite rare, to appearing in 11.7% of English language job postings as of mid-February 2022. However the trend has gradually been reversing since then, with vaccine mentions falling back to 9.5% of postings as of the end of May.

Overall, mentions of vaccine requirements were less common in late-May than mid-February across a majority of sectors. Nonetheless, the share remains over 15% of english-language postings in several fields, including a range of occupations in healthcare and social assistance, many of which hadn’t seen much change over the prior three months. Even though the trend in vaccine requirements has stopped growing, it appears they’ll remain common in these areas in the months ahead. That said, one exception is for job postings in dentistry, which in May had the lowest proportion of postings mentioning vaccine requirements across the economy.

Methodology

All job postings figures in this blogpost are the percentage change in seasonally-adjusted job postings since February 1, 2020, using a seven-day trailing average. February 1, 2020, is our pre-pandemic baseline. We seasonally adjust each series based on historical patterns in 2017, 2018, and 2019. Each series, including the national trend, occupational sectors, and sub-national geographies, is seasonally adjusted separately. This week we applied our quarterly revision, which updates seasonal factors and fixes data anomalies. Historical numbers have been revised and may differ from originally reported values. New job postings are posts that are 7-days old or less.

The number of job postings on Indeed, whether related to paid or unpaid job solicitations, is not indicative of potential revenue or earnings of Indeed, which comprises a significant percentage of the HR Technology segment of its parent company, Recruit Holdings Co., Ltd. Job posting numbers are provided for information purposes only and should not be viewed as an indicator of performance of Indeed or Recruit. Please refer to the Recruit Holdings investor relations website and regulatory filings in Japan for more detailed information on revenue generation by Recruit’s HR Technology segment.