Key points

- Total Canadian job postings on Indeed were up 72% on May 20, 2022 compared to their pre-pandemic level, up marginally from a month earlier.

- New job postings continue to be added at a solid pace, although not quite as quickly as their average rate between February and March.

- Hiring appetite is elevated across almost all sectors, but recent momentum has been more mixed, with demand in certain high-flying areas like human resources and construction cooling in recent weeks, in contrast to strong growth in lower-paying fields like food services, as well as hospitality and tourism.

As of May 20th, total Canadian job postings on Indeed were up 72% from their February 1, 2020 levels, after adjusting for seasonal trends. Postings increased by one percentage point from a month earlier, and growth in general has cooled in recent months, plateauing at an elevated level.

The cooler growth in overall postings partly reflects a steadier pace that new postings are being added to Indeed. The number of new Canadian job postings on Indeed (seven days old or less) on May 20th were up 68% from their pre-pandemic pace, similar to their pace in mid-April. While this rate was still quite strong, it’s down somewhat from the even more striking 74% average increase in new posting rate than prevailed between February and March. Trends in new postings will remain key to watch in the coming months for signs of whether monetary policy tightening by the Bank of Canada starts to weigh on labour demand, but so far hiring appetite remains strong.

Strong levels across the board, but recent momentum mixed

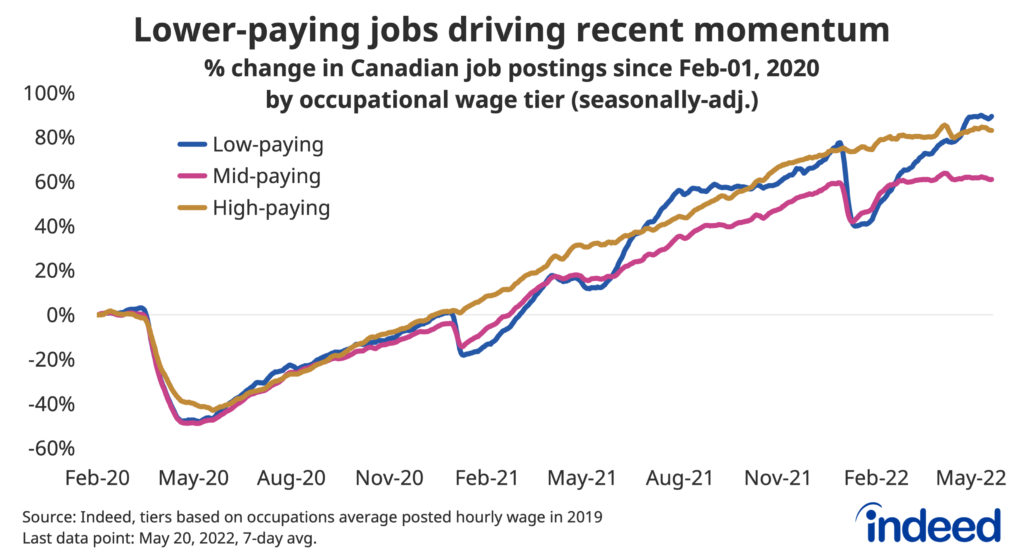

While job postings are elevated across the wage spectrum, demand is further above pre-pandemic levels among higher-, and especially lower-paying job types than mid-wage ones. As of May 20th, postings for low-paying occupations were up 89% from their February 2020 levels, showing solid growth over the past month, while higher-wage ones were relatively stable at a still strong 83%. Meanwhile, after rebounding from a modest drop in early January, mid-wage job postings have been flat, currently up 61% from their pre-pandemic level.

Recent momentum varies even more across different occupational sectors. Postings in software development have been steady, but at still exceptional levels over the past two months, while demand in food services has surged from earlier this year, surpassing its peaks in late 2021. Conversely, while demand is also quite elevated in construction and human resources, postings have slipped as of late.

Job postings are well above their February 2020 levels, similar to the economy-wide trend across a range of sectors. In some cases like driving and management, hiring appetite has been relatively stable since mid-March. Meanwhile, job postings in hospitality and tourism have bounced up over the past two months, similarly to food services, though demand isn’t quite as strong. Lastly, job postings are above pre-pandemic levels, but not to the same extent as elsewhere in certain areas of health, like therapy, while recent momentum has been stronger in sales than marketing. Overall, the shift towards a job seekers’ market has persisted, but recent trends are increasingly mixed compared earlier in the recovery.

Methodology

All job postings figures in this blogpost are the percentage change in seasonally-adjusted job postings since February 1, 2020, using a seven-day trailing average. February 1, 2020, is our pre-pandemic baseline. We seasonally adjust each series based on historical patterns in 2017, 2018, and 2019. Each series, including the national trend, occupational sectors, and sub-national geographies, is seasonally adjusted separately. This week we applied our quarterly revision, which updates seasonal factors and fixes data anomalies. Historical numbers have been revised and may differ from originally reported values. New job postings are posts that are 7-days old or less.

The number of job postings on Indeed, whether related to paid or unpaid job solicitations, is not indicative of potential revenue or earnings of Indeed, which comprises a significant percentage of the HR Technology segment of its parent company, Recruit Holdings Co., Ltd. Job posting numbers are provided for information purposes only and should not be viewed as an indicator of performance of Indeed or Recruit. Please refer to the Recruit Holdings investor relations website and regulatory filings in Japan for more detailed information on revenue generation by Recruit’s HR Technology segment.