Key points:

- September’s job report was not released due to the ongoing government shutdown.

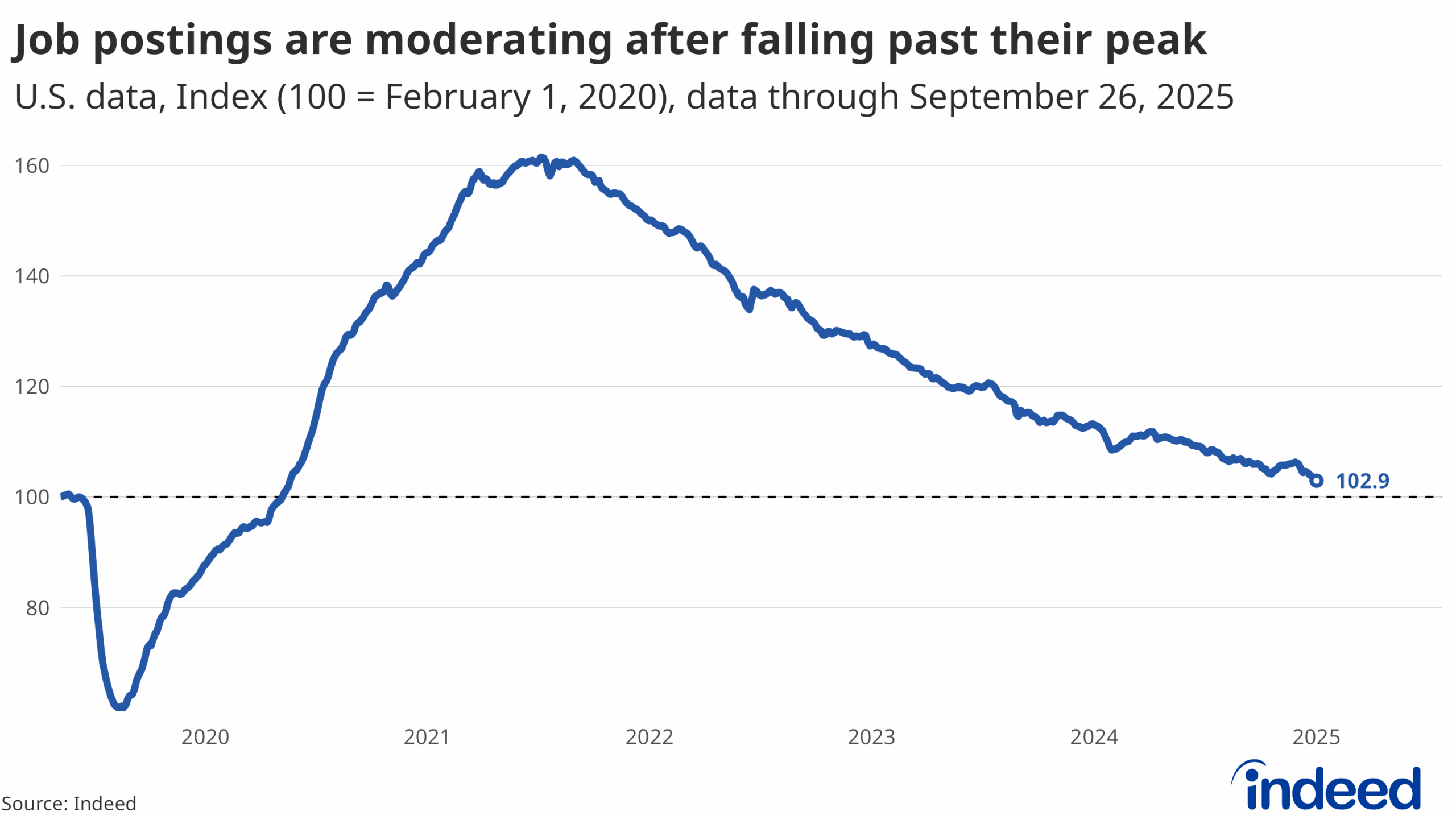

- Real-time data from the Indeed Job Posting Index suggests that the labor market cooled further in September, as postings were down 2.5% from the month prior.

- The Indeed Wage Tracker shows that annual wage growth has slowed consistently throughout the year, a sign of less demand for workers.

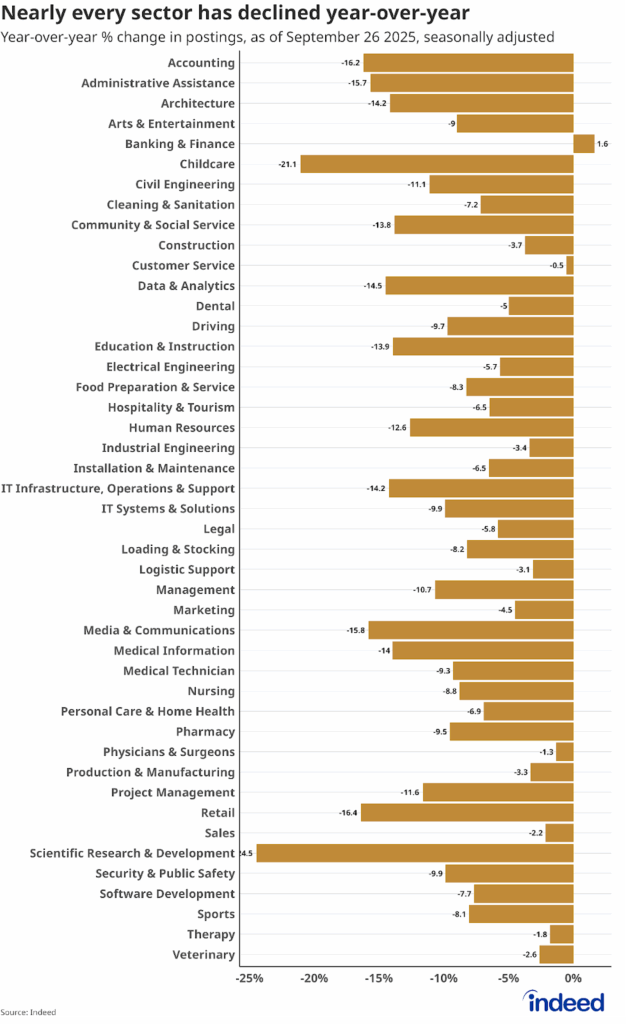

The Indeed Job Postings Index, a real-time view of hiring demand based on millions of job postings, shows that the labor market cooled further in September, continuing the softening trend observed in recent months. As of September 26, overall job postings on Indeed were still up 2.9% from pre-pandemic levels, but were down 2.5% from the month prior. Indeed data also reflects a broad-based slowdown in hiring across sectors — of the 45 professional sectors tracked by Indeed, banking & finance was the only one in which postings grew year-over-year.

The Indeed Wage Tracker, sourced from advertised salaries in job postings, also shows that annual wage growth has slowed consistently throughout the year, and is currently growing more slowly than the annual pace of inflation. This dynamic could present a challenge going forward as consumers struggle to keep pace with higher costs of living.

Businesses, job seekers, and policymakers lean heavily on data to make decisions during periods of uncertainty, and the delayed release of September’s national jobs data is only deepening the uncertainty that has defined the economy this year. Reliable federal data, especially related to price levels and inflation, is hard to replace, and there are no perfect substitutes. There are, however, complementary data sources we can look to for signs of economic health or distress. In the absence of government data, real-time measures like the Indeed Job Postings Index and Indeed Wage Tracker help fill in the picture, offering timely insights into labor market activity. We’ll continue tracking trends in job postings, wages, and job seeker behavior, including potential impacts on federal workers, as the shutdown continues.