Key points:

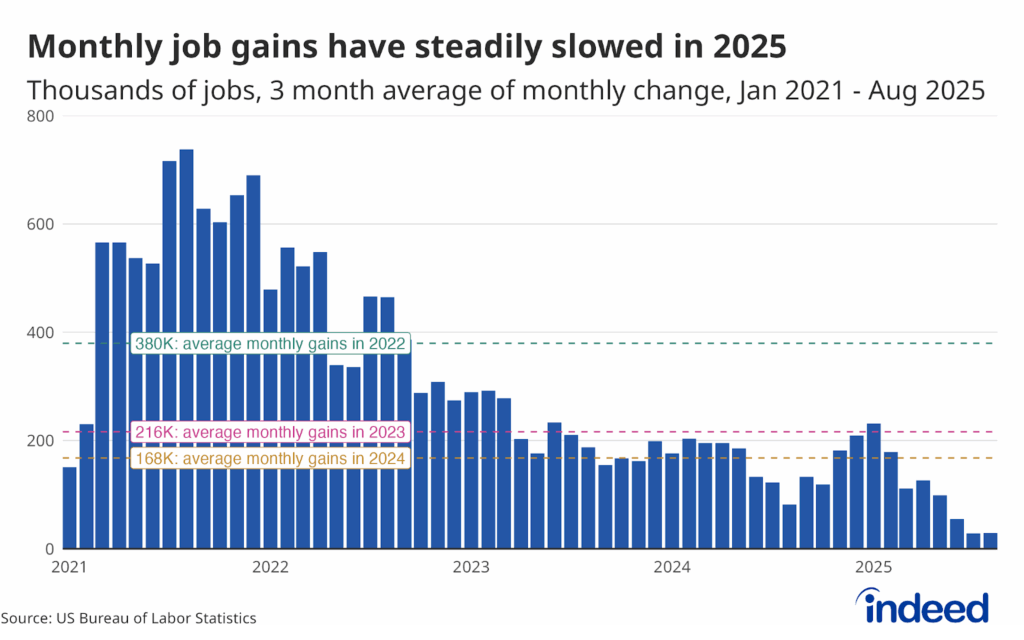

- US employers added just 22,000 jobs in August, according to the Bureau of Labor Statistics, and the prior two months’ gains were revised down by a combined 21,000.

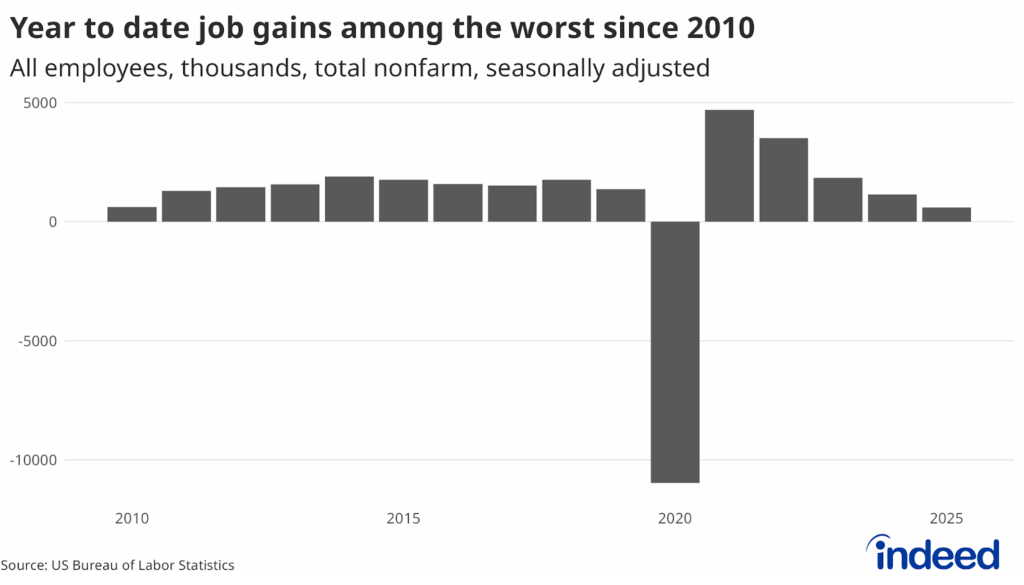

- Excluding the pandemic period, total employment gains since January represent the fewest jobs added in the first 8 months of the year since 2010.

- The unemployment rate rose to 4.3%, still historically low but the highest level since October 2021. Excluding the pandemic period, it is the highest it has been since September 2017.

The US labor market isn’t just slowing — it is now dangerously close to stalling. The addition of just 22,000 jobs in August, along with net downward revisions of previous months, shows an economy straining under the immense economic uncertainty and significant policy changes of 2025. Outside of the pandemic, the US economy has not added this few jobs in the first eight months of a year since 2010, when there were 17 million fewer people in the US labor force and the economy was still firmly in the grips of the Great Recession. This anemic pace of job creation is not enough to keep unemployment from rising — a disturbing development in an environment where job openings, in addition to hiring, remain weak.

The unemployment rate increased by just 0.1 percentage point in August, to 4.3 percent — still low by historic standards, but also the highest on record since October 2021. Ignoring the pandemic period, the unemployment rate has not been this high since September 2017. Continued decent hiring for certain healthcare and hospitality roles represents a relative bright spot in this report, but their modest growth is no longer enough to offset losses in most of the rest of the economy. Looking forward, there’s a risk that healthcare hiring slows further as the impacts of reduced federal Medicaid and social assistance funding begin to emerge in the coming months and years.

Continued jobs reports of 22,000 would undoubtedly increase that rate to higher levels and could quickly indicate a broader softening of the economy.

In addition to an overall weak report, the jobs report also uncovered some interesting details that give insight into which segments of the labor market are under the greatest pressure. The healthcare and social assistance subsector continued to grow in August, adding 46,800 jobs, further exacerbating the unbalanced job growth that has defined the market for some time.

Losses were observed in several sectors, including manufacturing, wholesale trade, and professional and business services. Goods-producing sectors, as a whole, lost 25,000 jobs in August while service-providing sectors gained 63,000, buoyed by healthcare and social assistance and leisure and hospitality. Interestingly, outside of these two sectors, no individual sector lost or gained more than 20,000 jobs, showing broad-based stagnation across nearly all sectors.

This report leaves no doubt that the labor market is in a very different position than at the start of the year. No single factor can be blamed for the slowdown, but uncertainty is clearly weighing on a broad spectrum of the US economy. This data will certainly play a pivotal role in the FOMC discussion later this month, with the probability of a rate cut increasing significantly.