Key points:

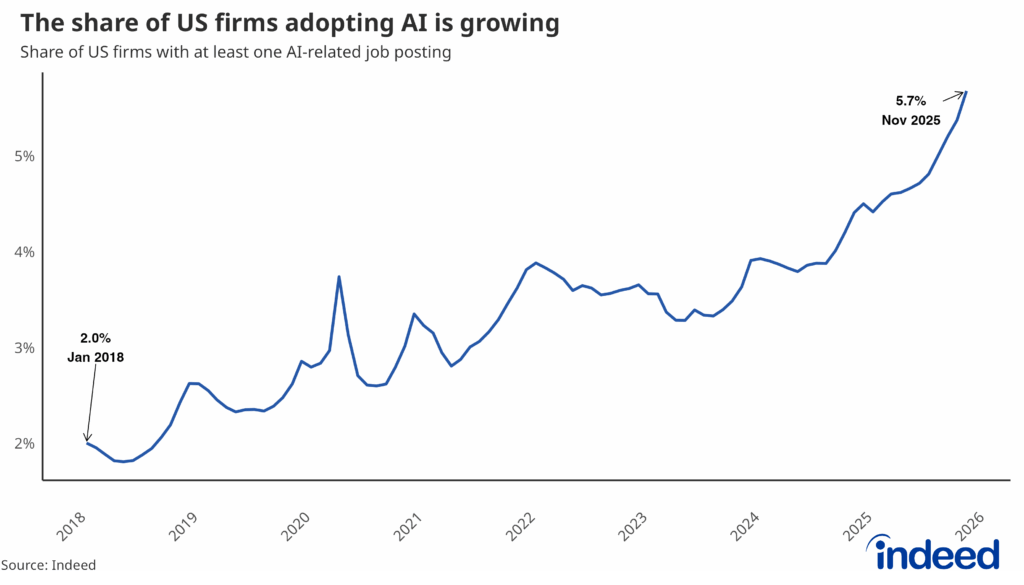

- The share of firms with at least one job posting that mentions AI has increased significantly, from approximately 2% in 2018 to almost 6% by the end of 2025.

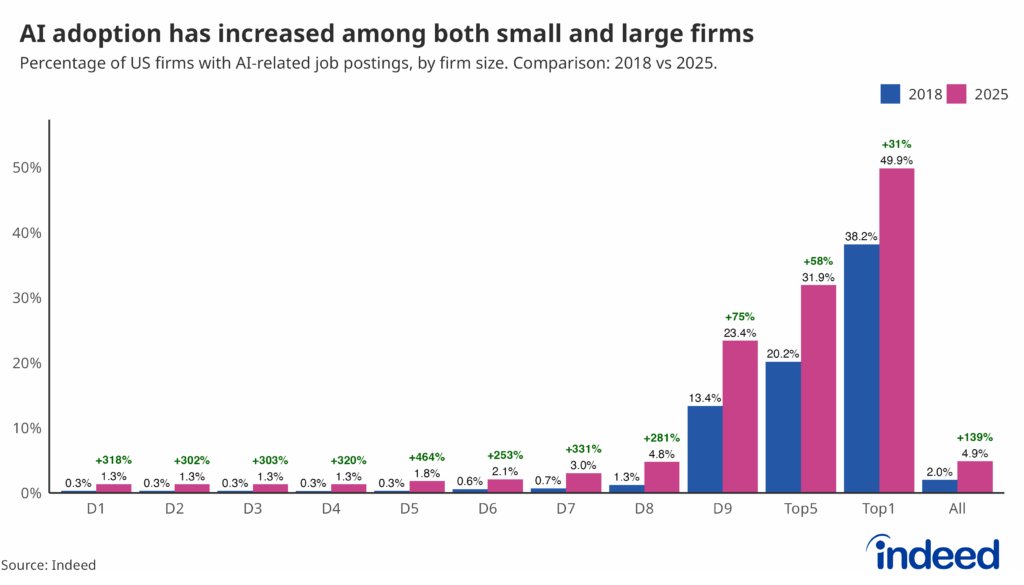

- This measure of AI adoption is heavily skewed towards the largest firms. Half of the top 1% of firms with the most job postings on Indeed have adopted AI, while few smaller firms have done so.

- If AI adoption remains the domain of a few very large employers, this raises concerns about the uneven diffusion of potential AI-related productivity gains across the economy.

While it is still early days, recent data suggest that the initial phase of AI adoption has been uneven, with the largest companies leading and smaller firms lagging in adopting the tools and posting AI-related jobs. As of late 2025, only about 1 in 20 companies had at least 1 job posting that mentioned AI on Indeed, according to a Hiring Lab analysis, and almost 90% of all AI-related postings came from just 1% of companies.

The economic impact of AI depends critically on how widely the technology is adopted. If AI use remains confined to a small set of firms, its aggregate effects may be limited or uneven. If adoption is more widespread, the implications for workers, employers, and the broader economy are likely to be much greater. Hiring Lab measured AI adoption across firms of different sizes by analyzing the prevalence of AI-related keywords in job descriptions, providing a timely, granular window into firms’ strategic investments and hiring priorities. While a mention of AI in a job posting can reflect a range of contexts, mentions in job descriptions indicate the importance of AI to the firm’s workforce and hiring strategy. By aggregating this data across firms and over time, we can identify patterns in AI adoption and highlight any differences across small, medium, and large firms.

Most firms have not yet adopted AI

We found that AI adoption is growing quickly, but remains highly concentrated among the largest firms. Strikingly, almost 90% of all AI-related job postings were found at just 1% of hiring firms in 2025. While adoption among small firms is growing, the overall pattern is still highly uneven. This means any economic benefits of AI are currently accessible primarily to a small subset of firms, potentially widening gaps in productivity and competitive positioning between small and large firms.

We define AI adoption as the presence of at least one job posting explicitly mentioning AI. Using this definition, the share of firms adopting AI or related technologies has almost tripled, from 2% in 2018 to 5.7% by November 2025. In other words, while nearly 6% of US firms had at least one AI-related job posting, 94% had none, suggesting that strategic AI investment remains concentrated among a minority of firms.

Even so, adoption has accelerated sharply, especially in the past two years. Between the start of 2024 and the end of 2025, the share of firms posting AI-related jobs increased 1.8 percentage points — a gain roughly equivalent to the cumulative increase over the previous six years — with no sign of slowing. This suggests the adoption of AI tools continues to gain steam.

Larger firms are more likely to adopt AI

AI adoption is unevenly distributed across small, medium, and large firms. The larger the firm, the more likely it is to have adopted AI. When firms were ranked by the number of job postings they have on Indeed (a proxy for overall firm size), only 1.3% of firms in the bottom one-third of the size distribution (i.e., the smallest firms) mentioned AI in job postings (on average, across 2025). This share increases to 2.0% in the middle third of the size distribution, and 11.1% in the top third (i.e., the largest firms). Among the largest firms, AI adoption is high. Among the top 1% of the largest firms, nearly half (49.9%) have adopted AI. Aggregate AI-driven productivity gains depend on the mass adoption of these technologies, and this concentration might reflect bottlenecks that limit the much-discussed potential productivity gains.

The adoption rate has increased over time across all firm size groups. Between 2018 and 2025, smaller firms have increased adoption at relatively higher rates than larger ones. For example, the adoption rate among small firms in the bottom third of the size distribution quadrupled from 0.3% to 1.3% in the past six years, whereas the adoption rate “only” doubled among firms in the upper third of the size distribution. However, small firms still have a long way to go before their adoption rates reach similar levels to those of larger firms.

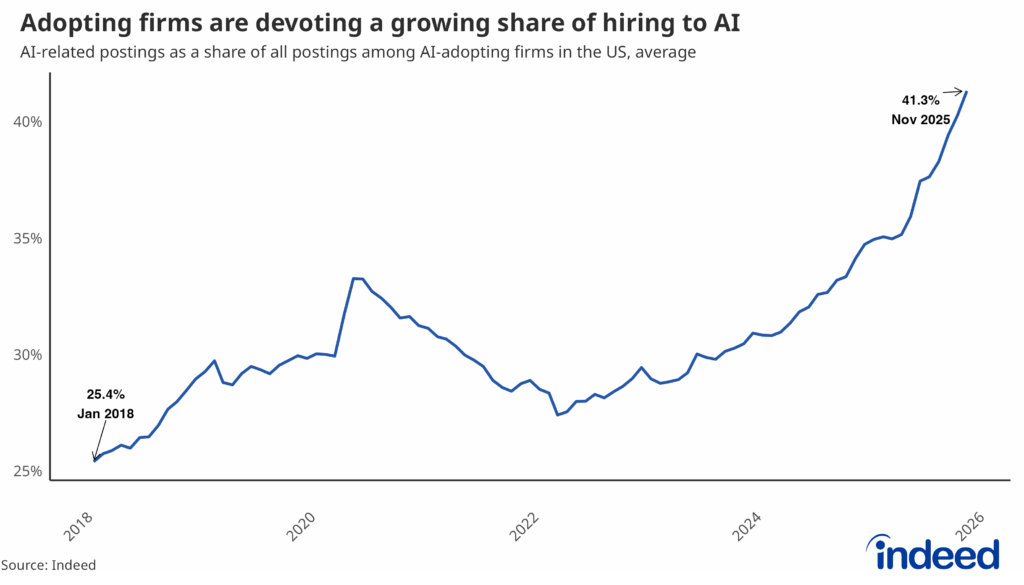

How much to adopt?

Once firms adopt AI, they face a second decision: how many AI-related positions do they need? We can measure this AI intensity as the share of an AI-adopting firm’s postings that mention AI-related terms. Among adopting firms, AI intensity has risen sharply, particularly after mid-2022, following the emergence of generative AI tools including ChatGPT and Midjourney. By late 2025, among the ~6% of firms that had adopted AI, on average, more than 40% of their job postings mentioned AI-related keywords.

Conclusion

AI adoption in US firms is growing across all sizes, but remains most concentrated among the largest firms. The vast majority of firms hiring (roughly 95%) have yet to post an AI-related job, highlighting the uneven spread of AI across the economy. How this adoption unfolds across small and medium firms will have major implications for productivity, workforce skills, and competitive positioning across firms of different sizes.

Methodology

This analysis uses US job postings on Indeed between 2018 and 2025. AI-related postings are identified using keywords from job descriptions in line with the Indeed AI Tracker. Firms are defined by standardized employer identifiers. A firm is considered an AI adopter if it posts at least one AI-related job in a given period. AI intensity is calculated as the share of a firm’s postings that mention AI. Firm size is proxied by total posting volume. Results are aggregated annually unless otherwise noted.

Note that this metric differs from the one reported in the AI Tracker, as the latter reports the share of overall job postings that contain AI mentions, whereas the one we use focuses on the firm-level decision to adopt AI. Both coincide if we use the average AI intensity across firms. But both share the broad pattern of an increase in AI shares.

Note that the US Census Bureau data also shows that AI adoption has increased, and that large firms adopt more, though the Census’s overall adoption rates are higher (around 17% by the end of 2025). These differences partially reflect methodology. The Census Bureau measures broad AI use based on a survey. Since November 2025, they have asked: “In the last two weeks, did this business use Artificial Intelligence (AI) in any of its business functions (Examples of AI: machine learning, natural language processing, virtual agents, voice recognition, etc.)?” Our approach focuses narrowly on AI-related hiring. As AI becomes embedded in everyday software, general usage may be widespread even when the relevance of AI in the hiring process and for specialized jobs remains limited. Furthermore, our data suggests greater concentration in AI adoption than in the Census data, but this might also reflect differences in the definition of size (the Census’s largest firm bucket is 250 employees or more).

While there are pros and cons of each dataset, one is particularly worth mentioning: While the Census data reveals information about what a sample of firms say they do, Indeed’s dataset reveals information about what the universe of firms is actually doing in their posted hiring intentions. The granularity and longer time series of Indeed’s microdata help shed light on this important issue. For instance, we analyze the long tail of firm distribution in greater detail (e.g., the top 1% of firms).