Key Points:

- Employers added 50,000 jobs in December and the unemployment rate fell to 4.4%, according to the US Bureau of Labor Statistics.

- Previously reported data for October and November was revised downward by a combined 76,000 jobs.

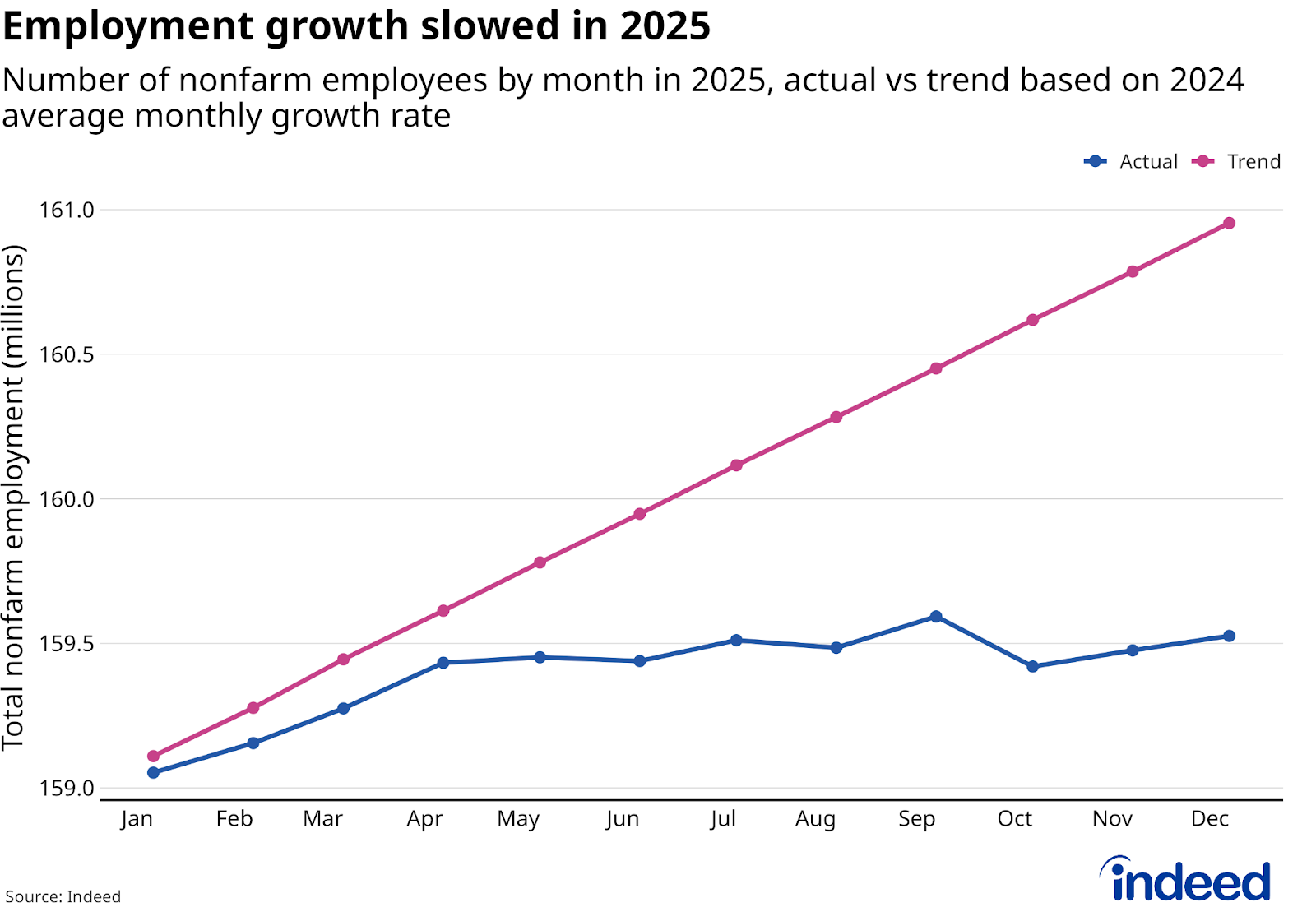

- There wasn’t a single month in 2025 in which employers added more jobs than the average monthly gain in 2024.

Another month, another mediocre jobs report. The US added 50,000 jobs in December, and the unemployment rate fell slightly to 4.4% from a downwardly revised 4.5% in November. While this isn’t terrible news, the reality is that in all of 2025, there wasn’t a single month when employers added more than 168,000 jobs — the average monthly gain in 2024. Overall, the 2025 data was mixed with some relatively strong reports in March and April, weaker reports in June, August, and October, and largely unremarkable in the remaining seven months.

But being unremarkable can be remarkable in its own way, and that’s what’s happening in today’s labor market. If the pace of job creation had been roughly even with 2024 (which was in itself well below levels seen in 2021-2023), employers would have added more than 1.4 million more jobs in 2025 than were actually realized. This would have resulted in 1.3% growth in employment in 2025 rather than the 0.4% growth that was recorded. Payroll employment was revised downward for both October and November, resulting in 76,000 fewer jobs added than previously announced. In total, US employers added an estimated 584,000 jobs in 2025, the worst year since 2009 (outside of COVID) and far below the 2 million added in 2024.

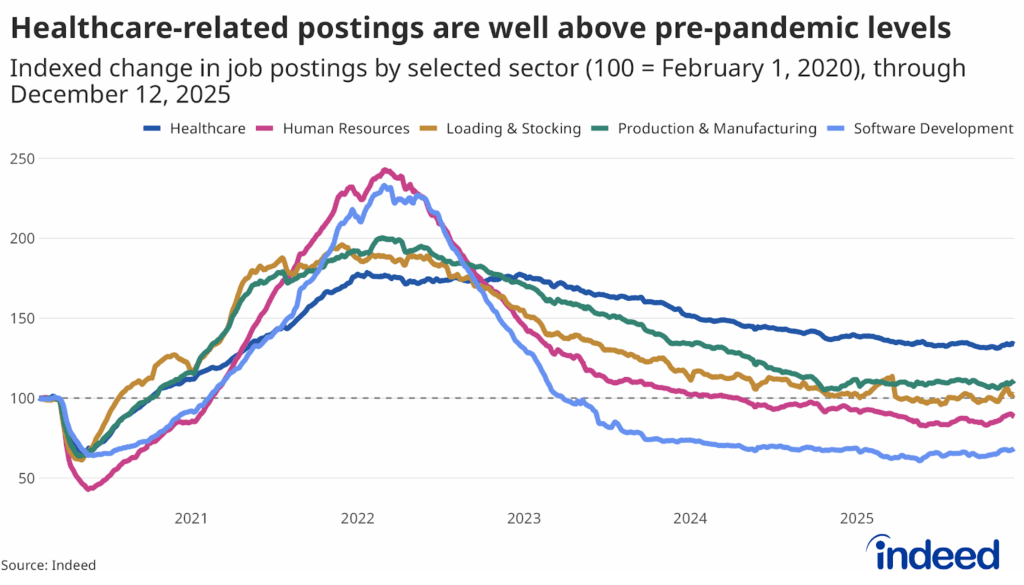

December showed continued strength in healthcare and social assistance, and continued weakness in business and professional services and manufacturing. Some 713,000 jobs were added in healthcare and social assistance in 2025, while the latter two sectors lost 97,000 and 68,000 jobs, respectively. Indeed data supports this pattern, as job postings remain elevated in almost all healthcare occupations, but are below pre-COVID levels in sectors including human resources, marketing, and data and analytics. This highly concentrated job growth only helps to further sideline and lengthen the job hunt for job seekers looking for work outside of the small handful of growing sectors. The number of long-term unemployed workers (those out of work and actively searching for at least 27 weeks) rose by almost 400,000 people in 2025, and they represented more than a quarter of unemployed workers in December.

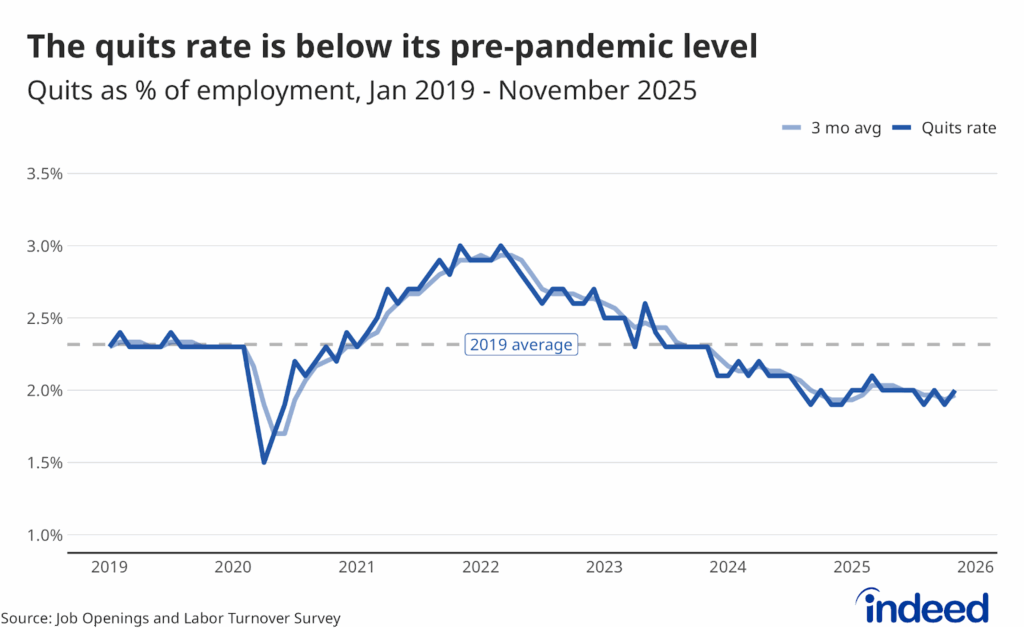

Nothing in the BLS data or Indeed data points towards a significant, near-term change to this now familiar pattern. That said, a low-hire/low-fire environment can’t last forever in a growing economy. While a long-stagnant labor market might not be as directly alarming as an obviously broken one, it can still feel quite broken for many job seekers.