Key points:

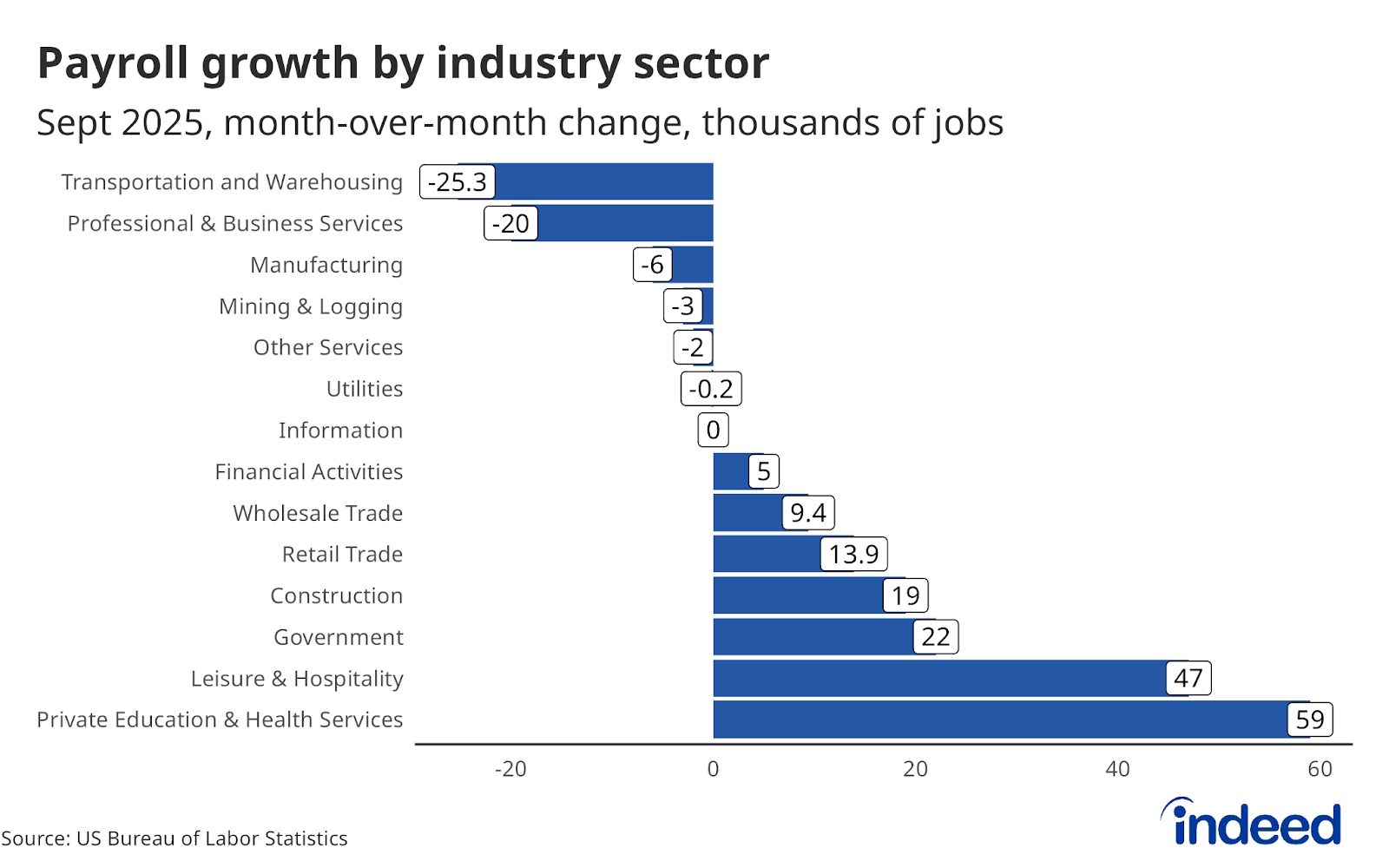

- US employers added 119,000 jobs in September and the unemployment rate ticked up to 4.4%, according to the Bureau of Labor Statistics.

- Job gains continue to be concentrated in a few industries, with healthcare & social assistance, and leisure & hospitality adding 87% of the jobs in September.

- Preliminary job growth from July and August was revised down by a combined 33,000 jobs.

Today’s jobs report, originally scheduled for release on October 3, shows that unemployment edged up slightly to 4.4% while employers added 119,000 jobs in September. The headline job gains are encouraging, but the roughly seven-week delay limits the report’s usefulness for assessing current conditions. What it does show is that the sectors of the economy that were strong prior to the shutdown — namely, healthcare and hospitality — remained strong through at least the early fall, even as other fields continued to weaken. Other data is less encouraging. Long-term unemployment is climbing, and restated August data showed the economy lost jobs in that month, the second negative month in the past four, after having recorded none since 2020. Job gains have slowed considerably this year and have recorded their worst year-to-date performance since 2010 (excluding the pandemic).

So far this year, the economy has added an average of 76,000 jobs per month, roughly in line with the updated estimates of job creation needed to keep pace with population growth. But as immigration and job gains continue to slow, both sides of the labor market are adjusting, and that breakeven number is becoming harder to calculate. The key signal now comes from households. If job growth cools while unemployment holds steady or declines, policymakers can take some comfort that workers are still finding opportunities. If, on the other hand, falling job gains are accompanied by rising unemployment, it would suggest that job opportunities are fading faster than the supply of workers, which is much more concerning.

Today’s (delayed) report is unlikely to shift businesses’ or policymakers’ outlook much, and the pervasive uncertainty that is paralyzing the labor market appears likely to carry forward into 2026. The next major reading on labor market conditions arrives on December 16, when the government will release payroll data for both October and November, though October household survey data will still be missing due to the shutdown. That household data tells us how the workers who make up the backbone of the economy are faring in the face of an uncertain economic environment, and has become increasingly important in contextualizing the headline numbers. Any holes in that data mean employers, policymakers, analysts, and job seekers alike will continue to fly somewhat blindly into 2026.