Key points:

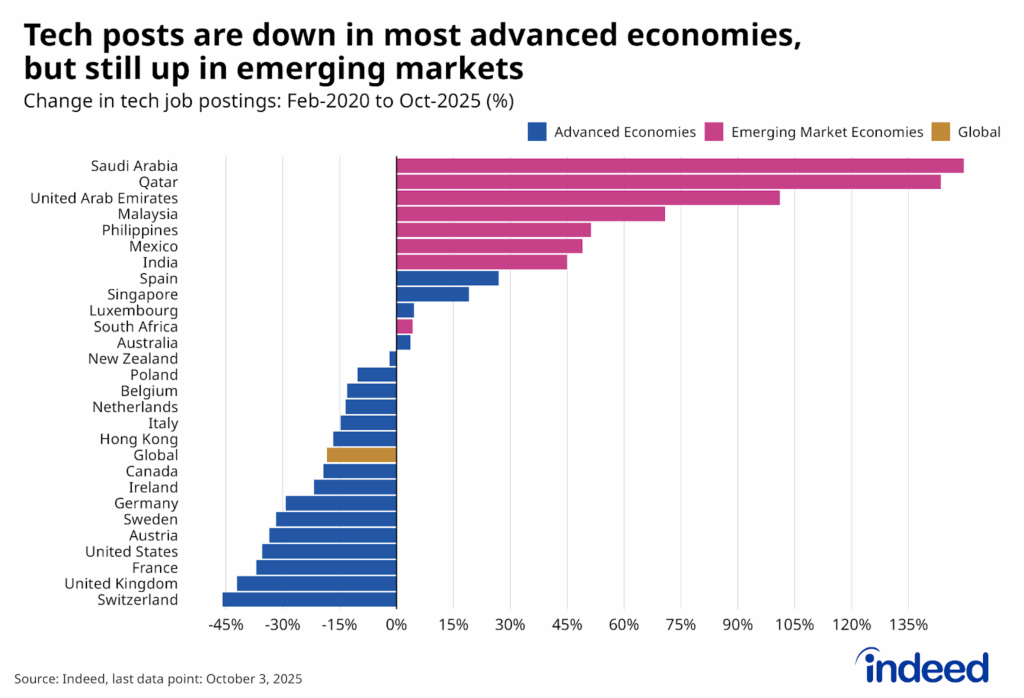

- Tech job postings in emerging markets have slipped since 2022, but remain 47% above their pre-pandemic levels as of October 3, 2025, in contrast to substantial declines in the US and most other advanced economies.

- Given its size, India accounts for most emerging market tech postings among countries tracked by Indeed, but Mexico, the Philippines, and some countries in the Middle East have also seen substantial growth.

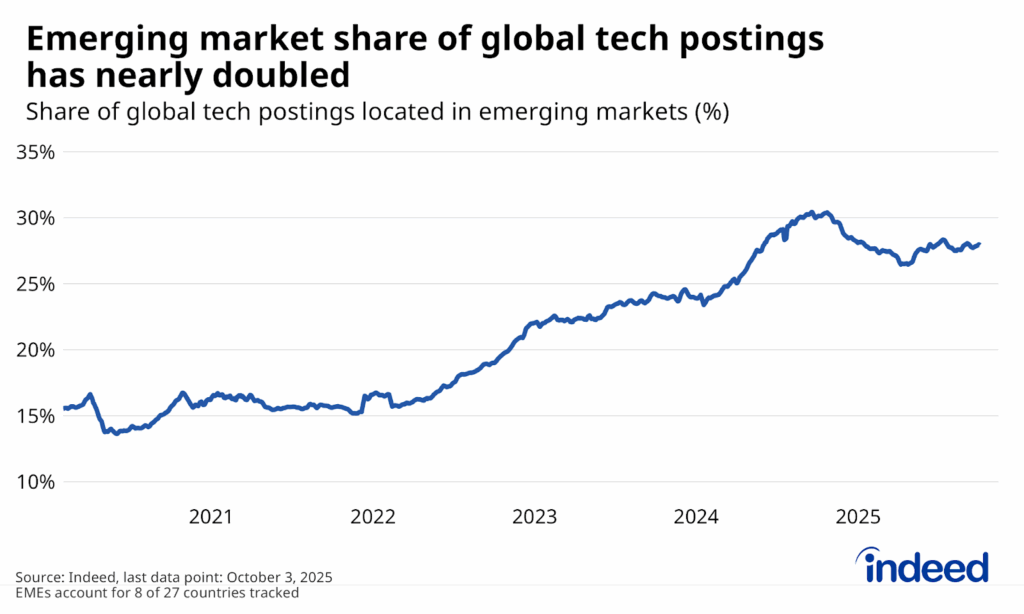

- Stronger posting trends in emerging markets have pushed their share of global tech job postings (among countries tracked by Indeed) from 16% in early 2020 to 28% as of mid-2025.

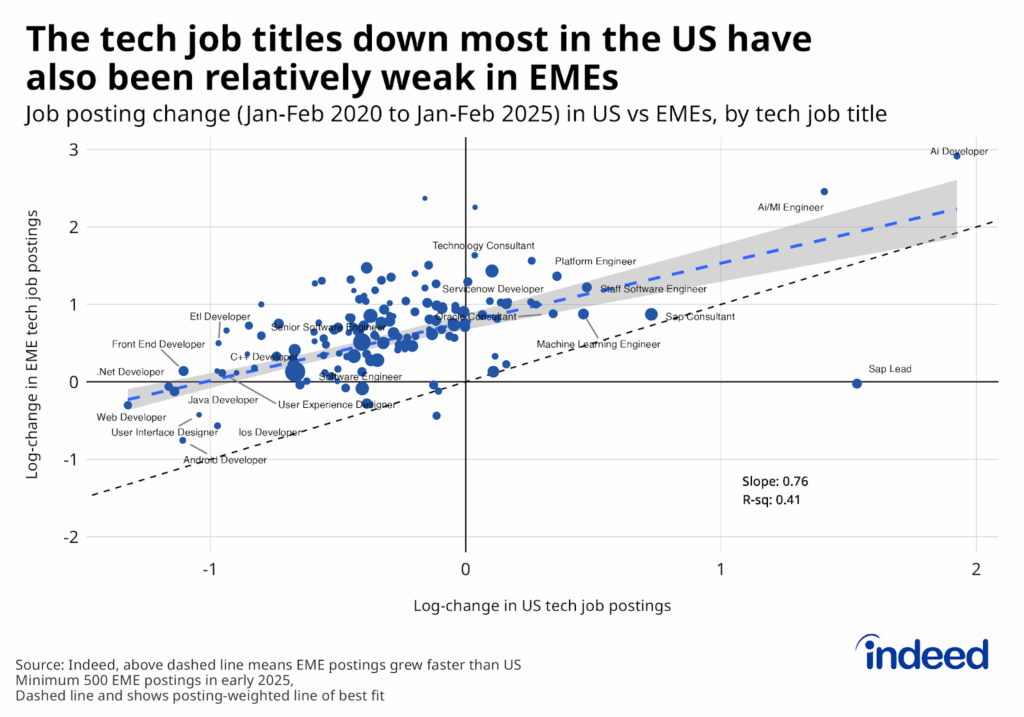

- It’s possible some of this rise in share could reflect outsourcing from advanced economies, but among individual tech job titles, the roles where postings are down most in the US have also been relatively weak in emerging economies.

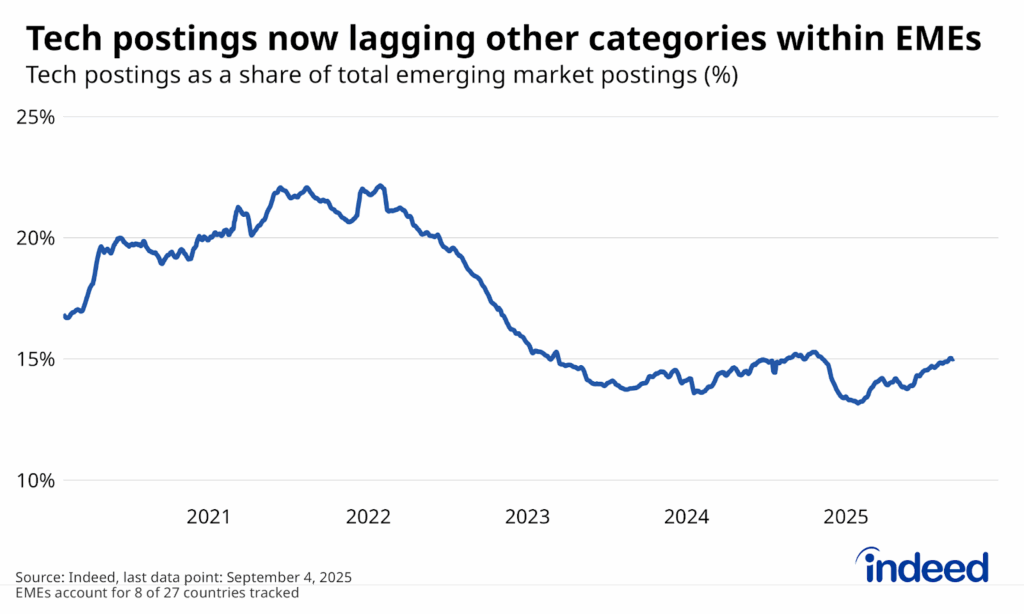

- At the same time, within emerging markets, tech postings have been weaker than postings for other occupations, suggesting the factors weighing down tech postings in advanced economies are likely impacting the rest of the world, too.

US tech workers haven’t been alone in facing a tough job market since tech hiring demand went from boom to bust. The 35% drop in US tech and mathematics job postings on Indeed between February 2020 and October 3, 2025, has been similar to declines in the UK, France, Germany, and Canada. A few other advanced economies (AEs) fared better (including Spain and Australia), but overall across the 27 countries tracked by Indeed, global tech job postings were down 18%.

The global decline hasn’t been as sharp as the drops in large AEs because tech job postings remain elevated in emerging market economies (EMEs). While our coverage of EMEs is limited to 8 countries, all 8 recorded net increases in tech postings compared to pre-pandemic levels, versus only 4-of-19 among AEs. Taken together, tech postings in EMEs were still up 47% from their pre-pandemic level as of August 2025. Tech postings in India, which account for about three-quarters of total EME tech postings, were the main contributor to the overall increase, up 45%. However, growth was even faster elsewhere, including in Mexico and the Philippines, which account for the second- and third-most tech postings in EMEs, respectively.

Emerging market tech postings have slipped, rather than plunged from their peak

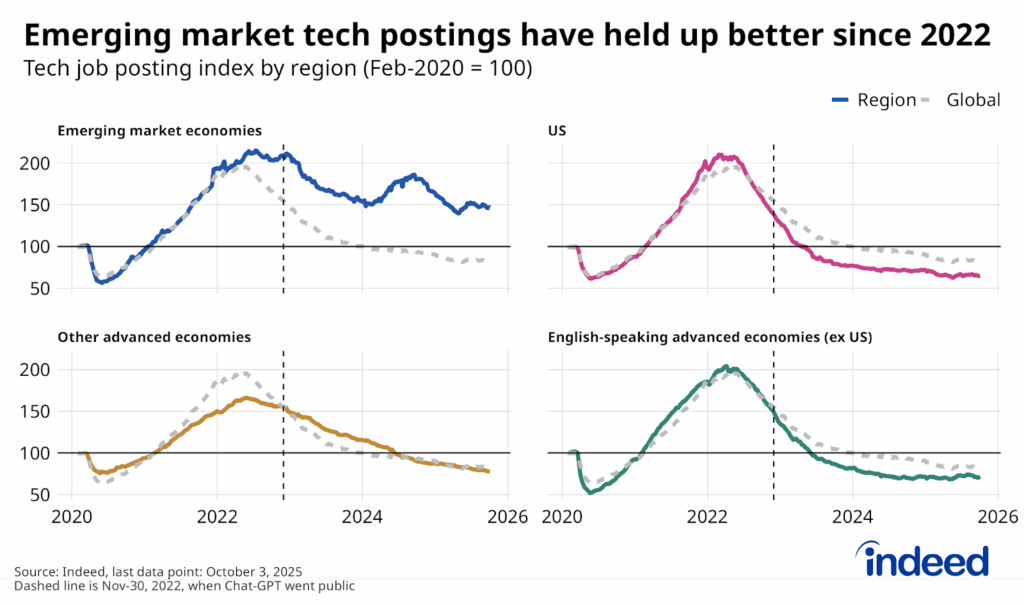

Tech hiring appetite evolved quite similarly across many countries during the boom. Postings roughly doubled between early 2020 and early 2022 in the US, other English-speaking advanced economies, and EMEs alike (the rise wasn’t as sharp in most of Europe).

However, trends then started to diverge. Tech postings in the US and other AEs started dropping sharply in mid-2022, fully reversing the prior boom not long after. In EMEs, tech postings plateaued, rather than plunged, before easing in fits and starts beginning in 2023. While global tech postings are down 58% from their 2022 peak, in EMEs they’ve declined by a net 32%, offsetting roughly half their earlier increase rather than crashing below pre-pandemic levels.

A growing share of global tech job postings are in emerging markets

The divergence in tech posting trends has reshaped the global geography of opportunities for tech job seekers. Among the sample of countries tracked by Indeed, EMEs were home to roughly 16% of total tech job postings between 2020 and 2022. However, with trends in these countries holding up better since then, their share of the market has nearly doubled, to 28% of total tech postings as of September 2025.

A natural question is whether the recent relative strength in EME tech postings could be at the expense of tech postings in AEs. Given the location flexibility of tech jobs, some of the rise in the EME share of the global market could reflect the offshoring of positions to economies with lower wages. A detailed analysis of posting behavior by individual companies is beyond the scope of this blog. That said, comparing how postings for different individual tech job titles have evolved in the US with emerging markets suggests perhaps a subtle, but not primary, role of outsourcing as a driver of the divergence.

One sign of outsourcing would be if the types of tech job titles for which postings have dropped most in the US since 2020 — such as web and other specialized developers — were among the stronger categories in EMEs. However, the data shows these tech jobs have also been weak in EMEs. Meanwhile, the types of US tech jobs where postings have been strongest — often AI-related roles including machine learning and AI/ML engineers — have also done relatively well in EMEs. Postings have increased more (or declined by less) in EMEs than the US across nearly all tech job titles, but within each region, similar patterns are observable in the types of jobs that have fared better or worse, a sign of common technological trends across markets.

Where the comparison might suggest some outsourcing effect is that posting trends for some of the weaker categories in EMEs — like front-end, and .Net developers — could have fared even worse than they did (see methodology for further discussion). Nonetheless, given the overall solid correlation between posting growth across regions, this impact was likely more subtle, rather than a main driver of aggregate trends.

Conclusion: Tech hiring appetite in emerging markets isn’t frozen, but there’s a chill

Countries like India, Mexico, and the Philippines haven’t experienced the same tech hiring freeze as the US and other AEs, but the market has still shifted. Tech postings in EMEs remain above their pre-pandemic levels but are down from their 2022 peaks. With overall EME job postings holding up better than tech since 2022, the tech share of total job postings within these countries has also dropped from 22% at their peak to 15% as of September 2025, below its pre-pandemic 17% share. Like in the US and Canada, the tech share was already dropping in mid-2022, before Chat-GPT went public, and has held relatively steady since mid-2023.

These signs of softness, occurring at similar times as the plunge in North America and Europe, highlight how many of the trends weighing on demand for tech workers in AEs are probably impacting the rest of the world too, even as the EME share of the global tech marketplace has. Tech job seekers in EMEs aren’t facing the same hiring freeze as elsewhere. Still, in the shadow of the earlier boom, and with the potential for AI-related automation ahead, the market continues to experience a chill that could linger unless global trends turn around.

Methodology

For the purposes of this post, job postings for tech and mathematics occupations refer to job titles classified as one of the following occupational categories according to Indeed’s taxonomy structure: software development, information design and technology, IT operations and help desk, and mathematics. These categories include many management positions, but might miss some tech-related job titles that are classified under the “management” occupational category.

Time series data in this post is presented as 7-day moving averages, seasonally adjusted, while cross-sectional data is not seasonally adjusted.

The comparison of job titles across regions might signal subtle outsourcing effects because the correlation between the two trends could be somewhat tighter. While the types of tech jobs that’ve dropped most in the US have also been relatively weak in EMEs, some could have fared worse. For instance, shifts in postings from AEs to EMEs could be a reason why job ads have remained at pre-pandemic levels in EMEs, rather than fallen further. Seen graphically, the slope of the (posting-weighted) relationship between AE and EME posting growth rates was 0.76, positive and clearly statistically significant (T-stat above 9), but still less than one.

The number of job postings on Indeed, whether related to paid or unpaid job solicitations, is not indicative of potential revenue or earnings of Indeed, which comprises a significant percentage of the HR Technology segment of its parent company, Recruit Holdings Co., Ltd. Job posting numbers are provided for information purposes only and should not be viewed as an indicator of performance of Indeed or Recruit. Please refer to the Recruit Holdings investor relations website and regulatory filings in Japan for more detailed information on revenue generation by Recruit’s HR Technology segment.