Key points:

- Job postings overall are 4% higher than their pre-pandemic baseline, but 7% lower than last year.

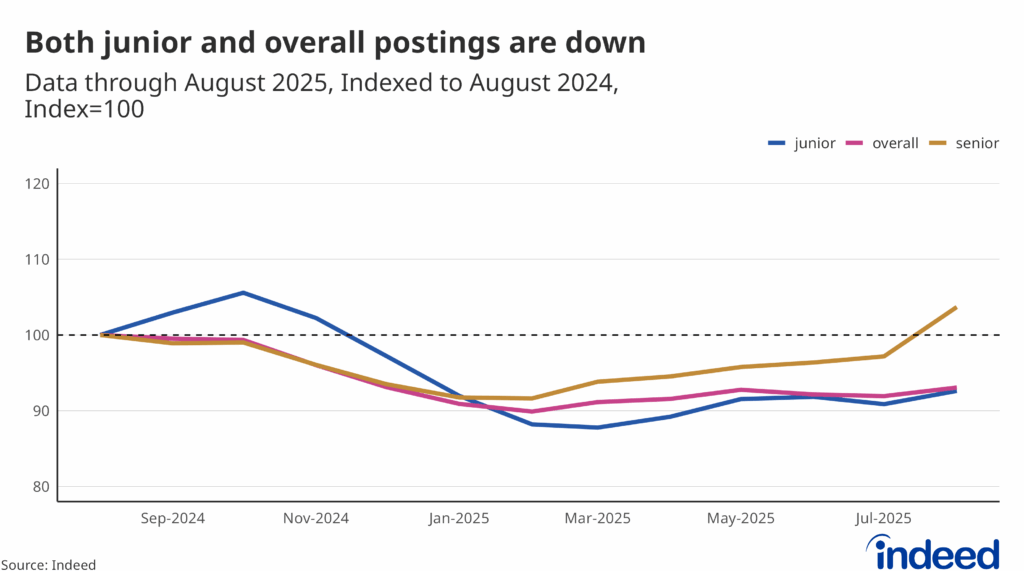

- Mirroring the overall job posting decline, postings for senior job titles are up 4% year-over-year, while postings for junior titles are down 7% from last year.

- Junior workers’ struggles likely stem more from the overall decline in available jobs rather than from employers pulling back on junior-level roles specifically.

Our monthly Labor Market Update examines significant trends using Indeed and other labor market data, and our US Labor Market Overview chartbook provides a more comprehensive view of the US labor market. Data from our Job Postings Index — which stood 4.3% above its pre-pandemic baseline as of September 12th — and the Indeed Wage Tracker (including sector-level data) are regularly updated on our data portal.

Today’s job market is a bit confusing: Indeed’s Job Posting Index was about 4% above its pre-pandemic baseline as of early September, but 7% lower than at the same time last year. Despite the recent slowdown in hiring demand, layoffs remain low, and unemployment has stayed steady. Fewer workers are quitting — a signal of caution in the overall market — and the pace of job creation has slowed considerably. For workers who do have a job, these statistics may be a bit easier to overlook. But for job seekers, the environment is discouraging, especially for new entrants to the market who are most likely to seek the kinds of junior or entry-level roles that are currently shrinking the fastest.

New graduates in a stagnant market

In recent months, a larger share of the unemployed has been made up of new entrants to the labor force — often recent high school or college graduates seeking their first job and hoping to launch their careers. While overall labor market conditions remain decent, these new entrants face serious headwinds, including declining job postings and weak hiring rates. As of June 2025, the unemployment rate for college graduates aged 22 to 27 was 4.8%, notably higher than the overall rate (at the time) of 4.0%. This gap underscores a growing vulnerability for young workers struggling to secure opportunities in today’s low-layoff, low-hiring environment.

Where have the junior roles gone?

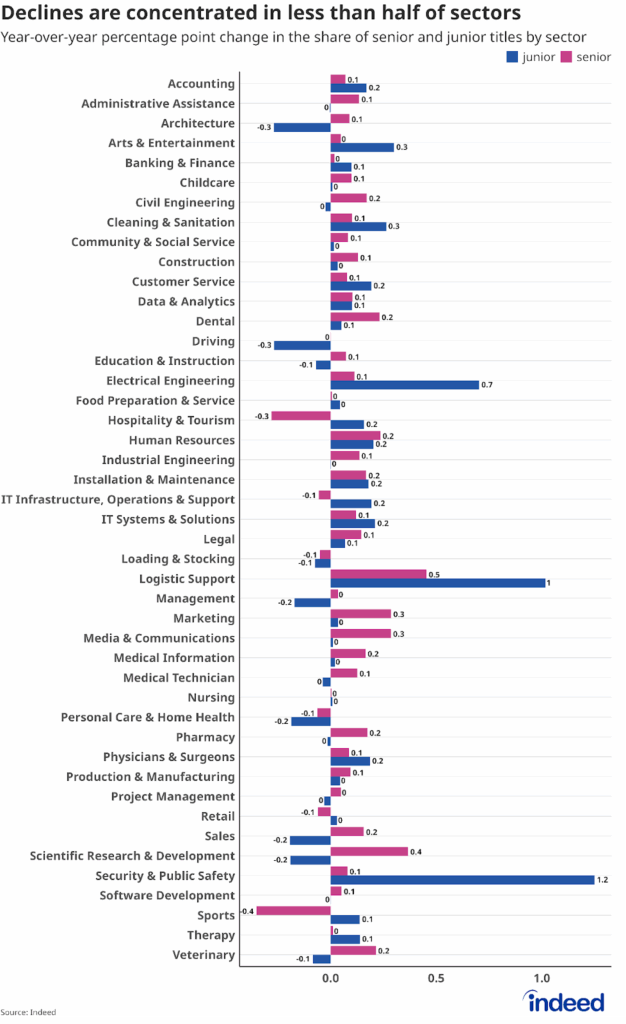

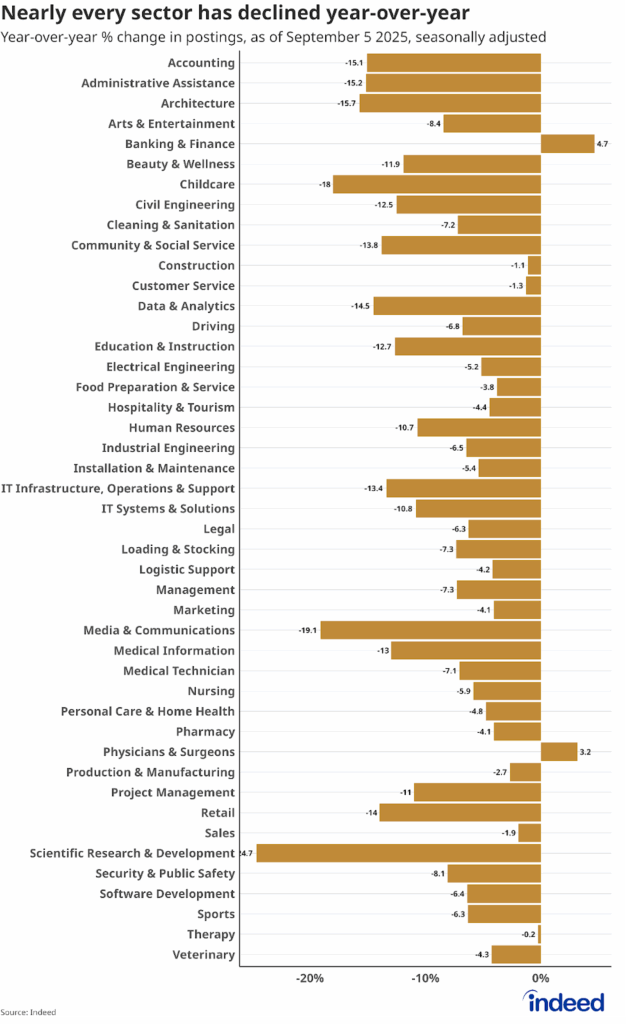

One possible reason new graduates are struggling is the shrinking pool of junior-level positions. Between August 2024 and August 2025, job postings advertising junior job titles dropped by 7%. Meanwhile, senior-level postings edged up by about 4%. At first glance, employers may seem to be deliberately favoring experienced candidates as the labor market loosens. But the reality is potentially more complex. Junior postings have fallen in line with the overall slowdown in hiring, and while senior postings have grown, they haven’t appeared to do so at the expense of junior titles.

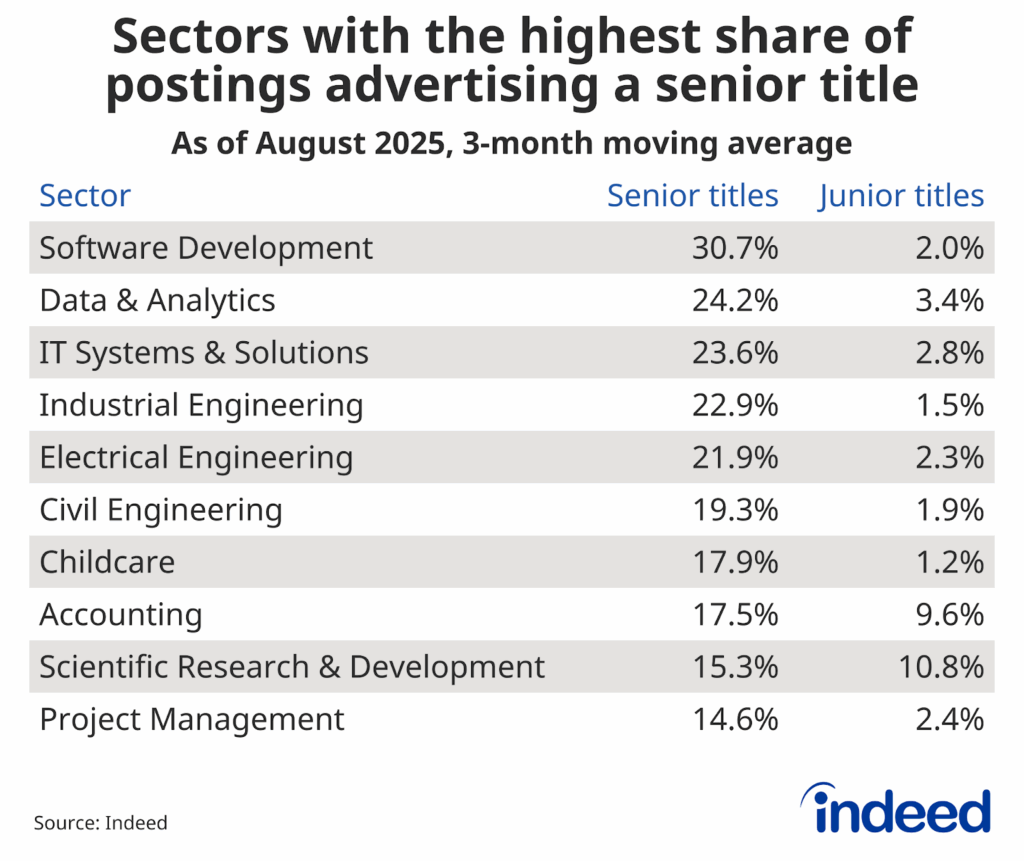

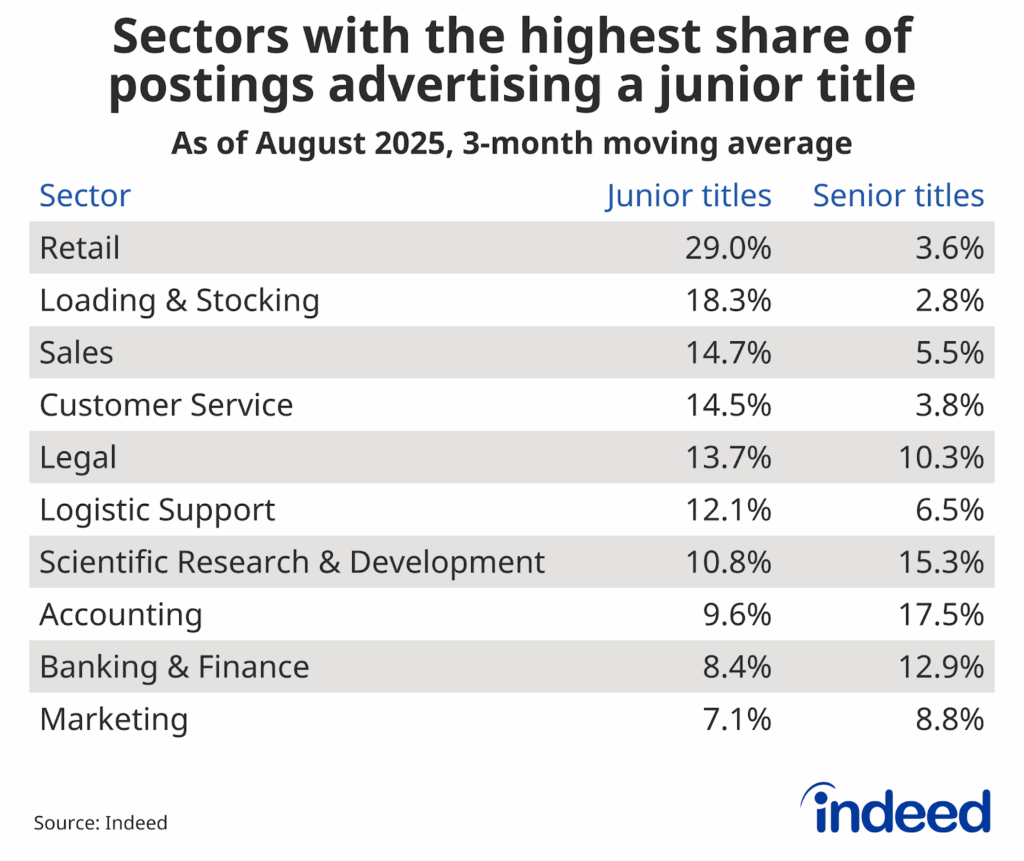

Looking more closely, it becomes clear that there’s also a divide between sectors that tend to offer more junior positions, including sales or banking, and those that tend to offer more senior positions, like software development. In the tech and engineering sectors, for instance, senior-level roles dominate. Employers are looking for specialized talent, and opportunities advertised specifically to beginners are scarce. As of August, fewer than 2% of postings in these fields are for junior roles, a percentage closely aligned with pre-pandemic norms. By contrast, retail, loading & stocking, and sales continue to offer the highest shares of junior postings —in line with pre-pandemic shares. These fields traditionally serve as vital entry points for workers with little or no prior experience. Yet they often come with a problem: advancement. Senior roles are almost nonexistent in these fields, leaving workers with fewer pathways to move upward once they get a foot in the door.

Interestingly enough, there are some areas of overlap. Scientific research & development is a striking case, with both junior and senior postings representing a meaningful share of opportunities at 10.8% and 15.3% of postings, respectively. Accounting and banking & finance also show relatively even distributions between junior and senior roles. These balanced pipelines suggest that in certain industries, newcomers can still enter, learn, and eventually progress into higher-level positions. However, in most cases, senior and junior positions are advertised in different sectors entirely.

The story becomes even more nuanced when looking at junior and senior postings as a share of each sector’s total openings. Junior postings are down year-over-year in raw numbers, but as a share of total postings, the decline is far less pronounced. In fact, only about one-third of sectors show a decrease in the proportion of junior roles relative to their sector’s overall postings. This means that while fewer junior jobs are available in absolute terms, they are not disappearing faster than postings overall. In many cases, junior roles have held steady — or even grown — as a share of total postings, even as the labor market broadly contracts. Put differently, while more employers focus their hiring towards senior roles, the challenge for new graduates is not that junior roles are being uniquely squeezed out, but that the entire market is shrinking, leaving fewer openings to pursue.

This year-over-year decline in job postings is nearly universal, with positive growth recorded in only 2 of the 45 sectors tracked by Hiring Lab. Aside from banking & finance and physicians & surgeons, every sector has seen opportunities shrink over the past year. The Bureau of Labor Statistics shows that only 22,000 jobs were added in August, following a trend of declining gains. Even though overall postings remain above their pre-pandemic baseline, the downward trend is unmistakable. For workers who already have jobs, this may not feel alarming. But for those searching for work, or even considering a change, the environment feels like an uphill battle simply because fewer openings are available.

Conclusion

So far, the 2025 labor market tells a story of contraction, with opportunities shrinking across nearly every corner of the labor market. And while almost all sectors have seen year-over-year declines in postings, this slowdown does not appear to amount to a crisis. Instead, the market is stagnating. Openings are harder to find, mobility is limited, and newcomers face the strongest headwinds. While new labor market entrants may be most affected by this slowdown, their struggles stem less from employers pulling back on junior roles specifically and more from the overall decline in available jobs.

Methodology

Data on non-seasonally adjusted Indeed job postings are an index of the number of job postings on a given day, using a seven-day trailing average. February 1, 2020, is our pre-pandemic baseline, so the index is set to 100 on that day. Data for several dates in 2021 and 2022 are missing and were interpolated.

Keywords used in junior postings were “junior” and “associate.” Keywords used in senior postings were “senior,” “lead,” and “principal.” Postings for senior and junior titles were grouped monthly, with a 3-month moving average applied.

The number of job postings on Indeed.com, whether related to paid or unpaid job solicitations, is not indicative of potential revenue or earnings of Indeed, which comprises a significant percentage of the HR Technology segment of its parent company, Recruit Holdings Co., Ltd. Job posting numbers are provided for information purposes only and should not be viewed as an indicator of performance of Indeed or Recruit. Please refer to the Recruit Holdings investor relations website and regulatory filings in Japan for more detailed information on revenue generation by Recruit’s HR Technology segment.