Key Points:

- US job openings fell to 7.2 million in March, from a downwardly revised 7.5 million in February, according to the US Bureau of Labor Statistics.

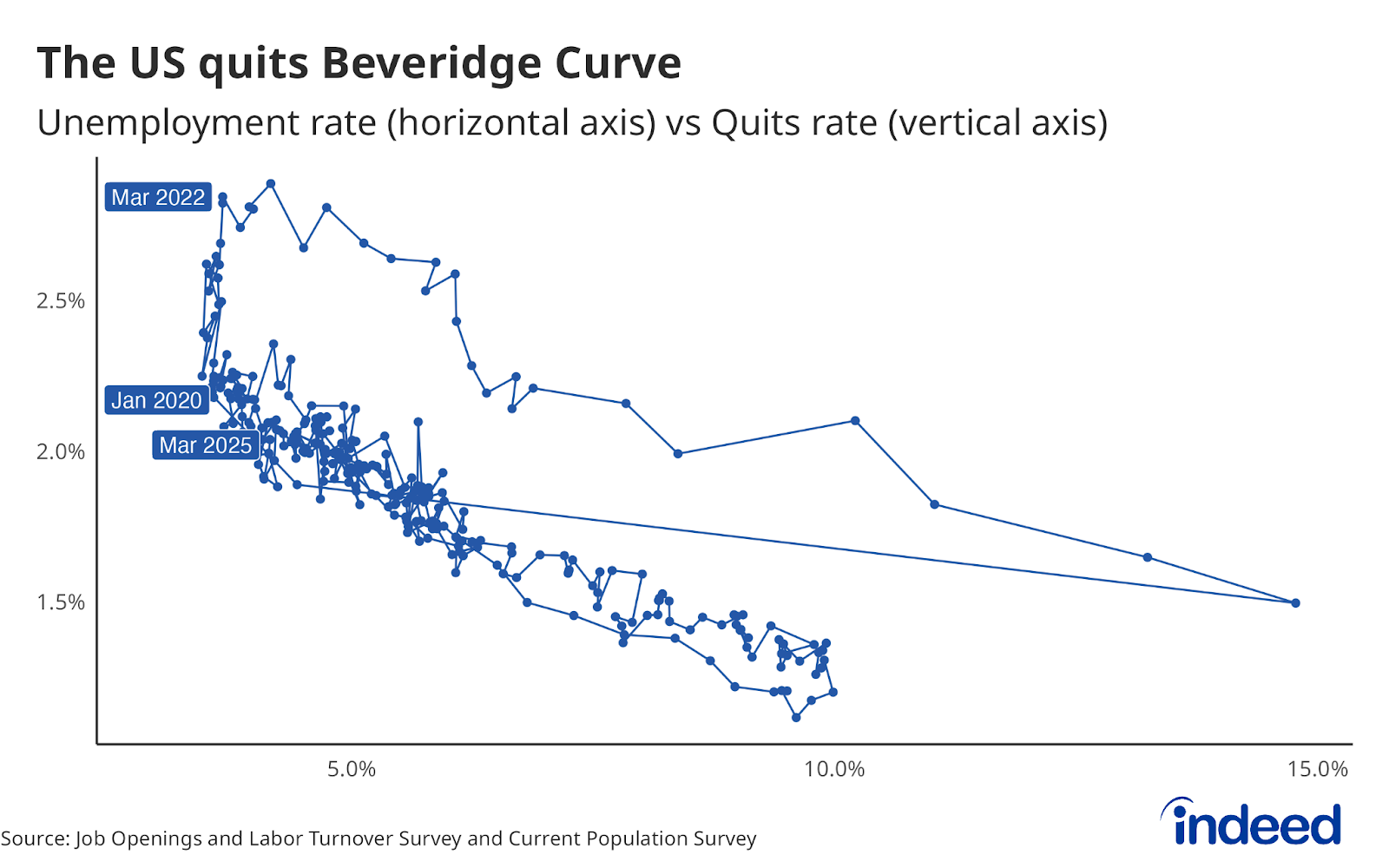

- There were 3.3 million quits in March, unchanged from the prior month, and the quits rate stood at 2.1%.

- Total layoffs and discharges fell slightly, and the layoff rate remained largely unchanged at 1%.

Today’s JOLTS data offers another, possibly final glimpse of yesterday’s labor market dynamics — but only from the rearview mirror. This data is from March, and while the road behind us appears relatively smooth, a lot has happened since then and the view forward through the windshield is marred by growing concerns around US trade policy and tariffs. Despite a 90-day pause in implementing the April 2 tariffs on many countries, the disruption caused by the announcement — and a still-elevated tariff rate on most goods from China — is likely to lead some businesses to slam on the hiring brakes. When paired with continued cuts to both federal employment and spending and labor supply challenges that may arise from tighter immigration policy, the risk of more substantive and rapid declines in the coming months is growing.

Job openings peaked at an all-time high of 12.1 million in March 2022. Since then, openings have fallen by 41% and the openings rate has dropped by 3.1 percentage points. Over the same period, the unemployment rate increased from 3.7% to 4.2%, though most of that movement occurred in the year preceding July 2024, and the rate has been fairly stable since. The fact that unemployment has remained relatively low despite a significant decline in job openings is unprecedented. Unfortunately, however impressive that past performance might have been, it is no guarantee of future labor market resilience.

Around this time last year, many people expected the wheels to hit the ground and signal a soft landing. Expectations have shifted considerably since, and fears of an impending recession have drowned out the calls for a soft landing. Since economic decisions are often shaped by expectations, it’s possible that conditions may worsen in the coming months if people start behaving like they are in a recession. Softening some of the recent trade policy changes may ease some business concerns, but it may already be too late.