Key Points:

- The US economy added 228,000 jobs in March while the unemployment rate rose slightly to 4.2%, according to the Bureau of Labor Statistics.

- Healthcare and social assistance continued their streak of adding a large share of total jobs, accounting for 34% of March’s gain.

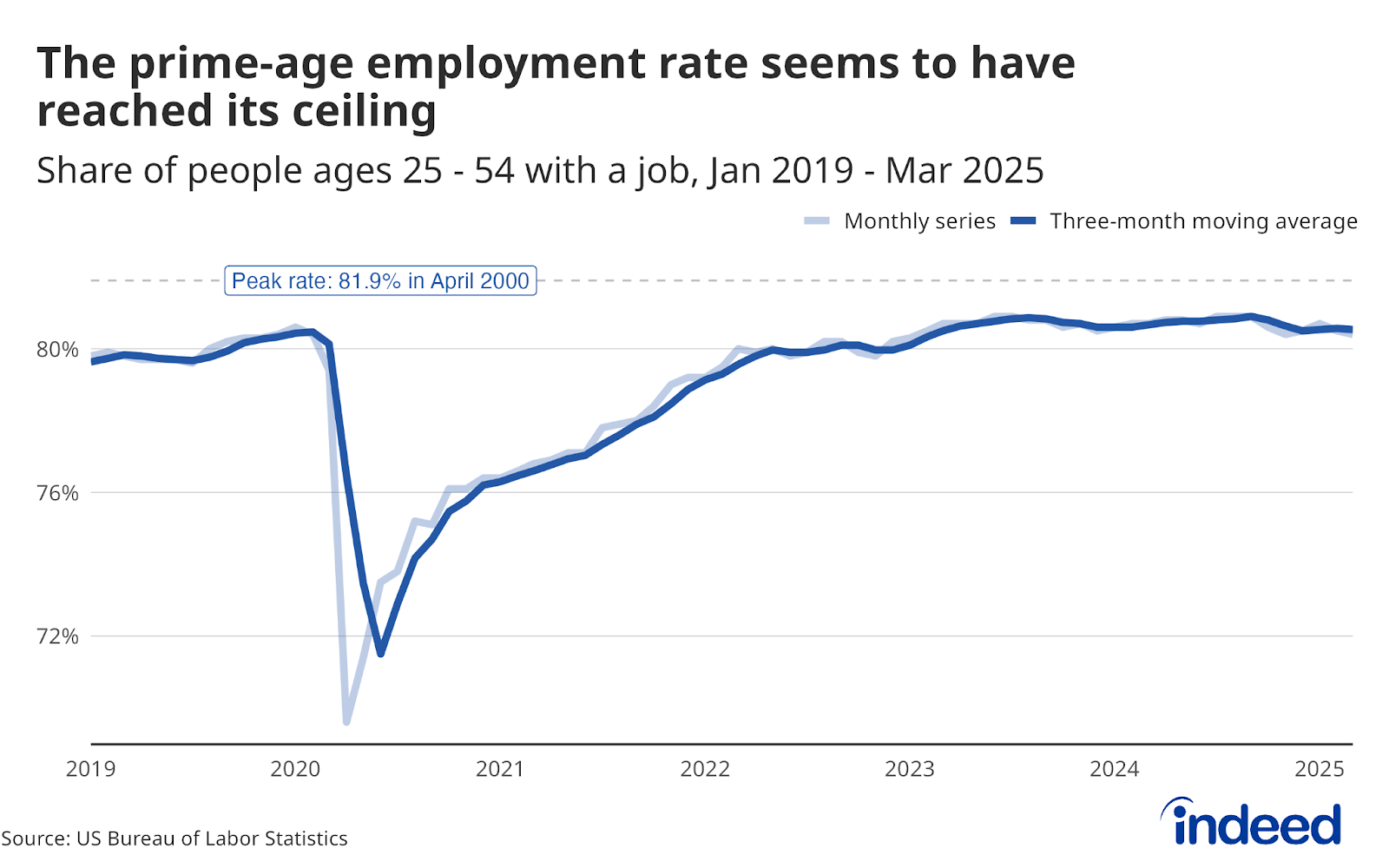

- The prime-age labor force participation rate and employment-population ratio both appear to have reached a ceiling, suggesting labor supply issues could soon become a challenge for the market.

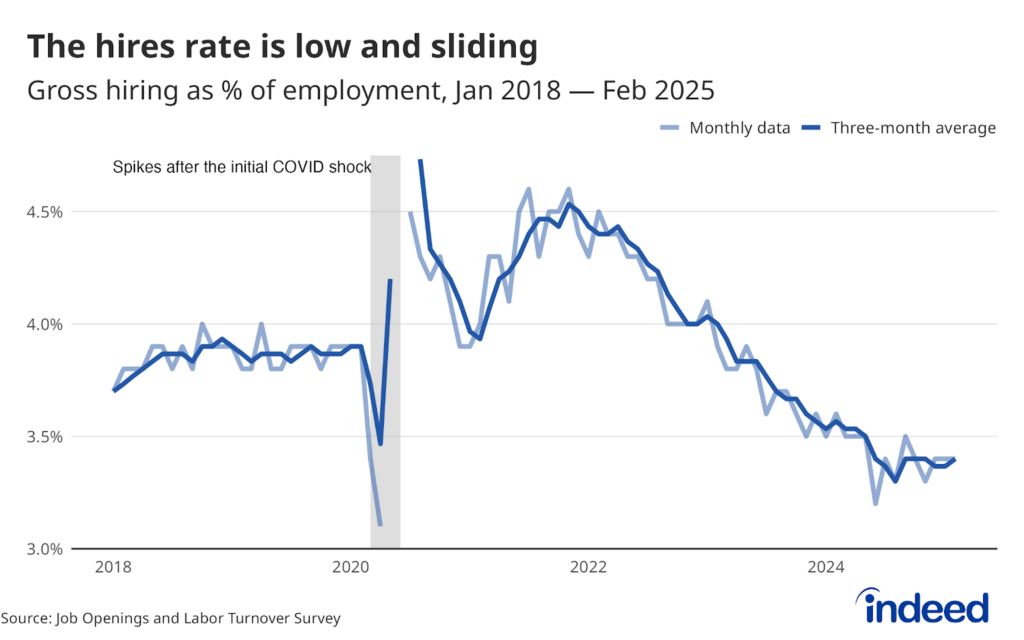

The US labor market held steady through March, continuing to outperform expectations even in the face of continued uncertainty and the looming threat of changes to trade policy. But while the headline numbers may be somewhat calming, it has become clear that events are moving faster than the data can keep up with. Now that the so-called Liberation Day tariffs and policy changes have been announced, and as they begin to be implemented, these days of relative calm seem numbered. The residual confidence and optimism that helped buoy the labor market through the first quarter reversed virtually overnight after this week’s announcements, and there is likely no going back. The velocity with which these policy changes are now happening is so fast that many employers will find it challenging to find the stability needed to maintain business as usual.

Payroll jobs grew by 228,000 in March, while the two previous months were revised down by a collective 48,000 jobs. Healthcare and social assistance continued its streak of adding a large share of the total jobs, accounting for 34% of March’s gain. The unemployment rate ticked up slightly to 4.2% but remained stable on a three-month moving average basis.

Adding to the challenges posed by trade policy changes, there are signs that the structural and demographic problems that have been lurking on the horizon for years are becoming clearer. Alongside severely restricted immigration, the prime-age labor force participation rate and employment-population ratio both appear to have reached their ceiling. As they plateau or begin to fall, labor supply issues will start to be felt. There is an argument that some amount of short-term pain in the market could lead to longer-term gains to come on the other side. But sudden changes to policy of this magnitude, combined with long-simmering structural challenges, suggest that the market is simply not in need of some kind of juice fast or quick shock.