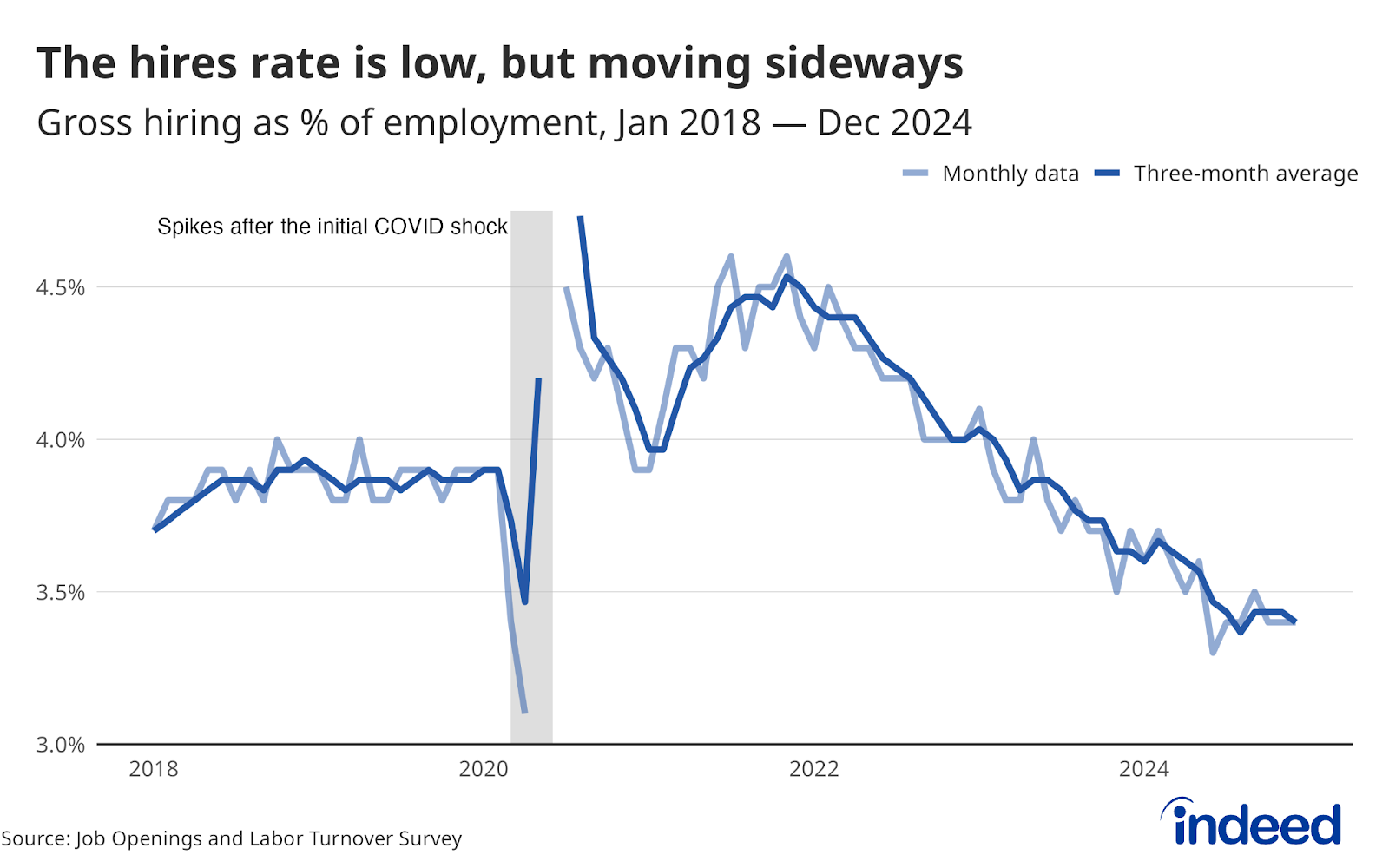

While job openings in December fell short of expectations, reversing some recent gains, sideways movements in quits and hires helped to reinforce the emerging narrative of gradual stabilization in the job market after two-plus years of steady slowdowns. To be clear, both the quits and hires rates are low relative to historic norms and suggest that employers and job seekers still lack complete confidence in their ability to hire or get a new job quickly. But their consistent sideways movements over the past several months at least suggest they aren’t getting any worse, and may be primed for a rebound in the coming months – if current conditions hold. In a market looking for stability, however, any confusion or uncertainty around large economic policies, including trade and immigration, will likely weigh on confidence.

Job openings fell by about 1.1 million over the course of 2024, from 8.7 million in January to 7.6 million on the last business day of December. Job openings remain 9% above pre-pandemic levels, a sign that overall employer demand remains elevated despite consistent labor market cooling since mid-2022. While many job opportunities are still available, it is not uniform across industries. Last month’s JOLTS data showed signs of a pickup in demand for knowledge workers in industries including professional & business services and finance & insurance, but both saw six-figure declines in openings in December. However, the finance & insurance industry added 70% of the private-sector hires in December, which suggests that some of that decline in openings can be explained by filling those positions.

Today’s JOLTS report and other economic indicators continue to reflect a generally solid labor market. It remains uncertain, however, whether the Federal Reserve can fully bring inflation down to its 2% target without undue economic pain – especially amid major shifts in policy under the new presidential administration. While hires and quits rates remain historically low, their stabilization in recent months may be signaling an inflection point. More recent January data from the Indeed Job Postings Index also points to a potential impending turnaround in job openings. The labor market currently sits on a very stable foundation of limited layoffs, low unemployment, and healthy wage growth. The sturdiness of that foundation may yet be tested, but for the moment, it appears strong enough to weather even the kinds of early, sweeping changes we’ve seen proposed so far from the current administration.