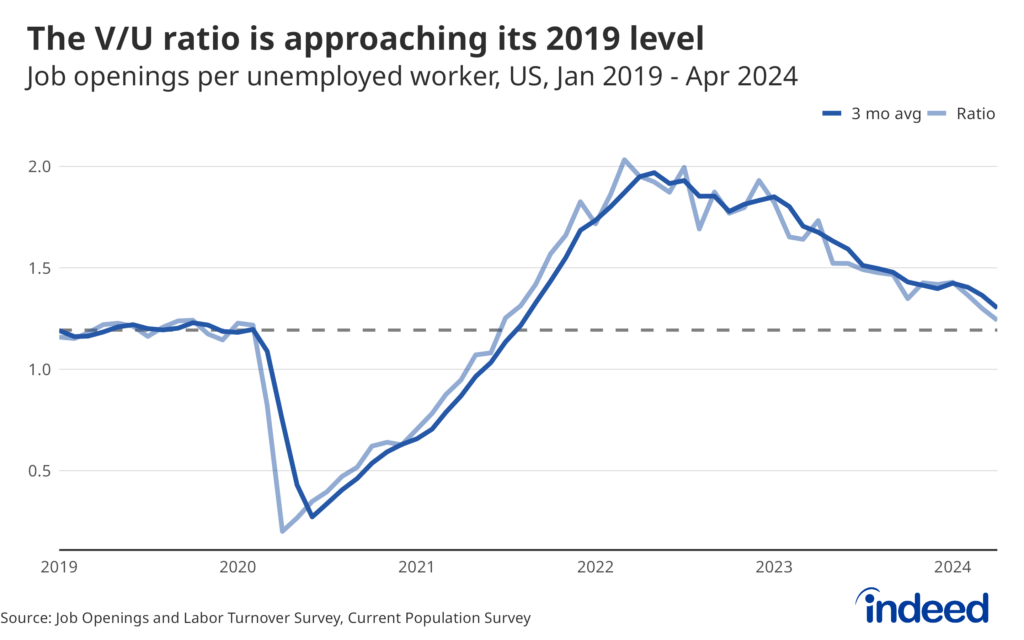

Today’s statement and projections from the Federal Open Markets Committee make clear the Fed is in no rush to cut interest rates. Inflation is still elevated, and there hasn’t been enough progress to make most of the committee feel comfortable reducing rates. But while keeping rates higher for longer might bring down inflation, this strategy risks pushing the limits of the labor market’s resilience. As Chair Powell implied in his press conference, labor market conditions are roughly back to where they were before the pandemic. The ratio of job openings to unemployed workers is back to the level we saw before the pandemic. Continued restrictive policy risks pushing labor demand down too much and unemployment higher than the 4% we saw in May, and where the Fed is projecting it to land at the end of the year. The labor market has seemed invincible for much of the past two years, but its armor can’t last forever.

June 2024 FOMC Statement: Patience Isn’t Always a Virtue

June 12, 2024