Takeaways

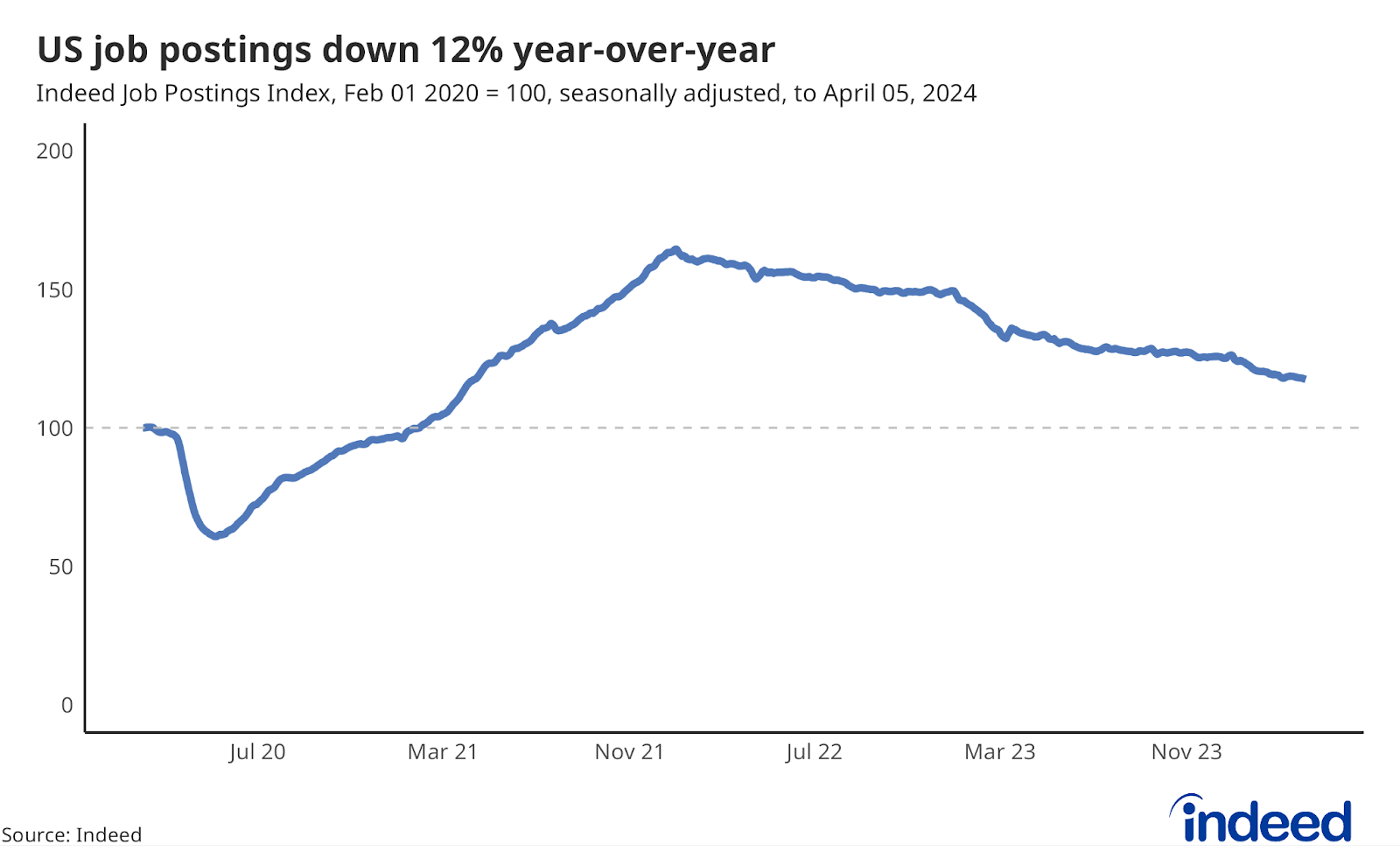

- Indeed job postings across the US market reflect a labor market that continues to slow down, falling 12% from April 5, 2023.

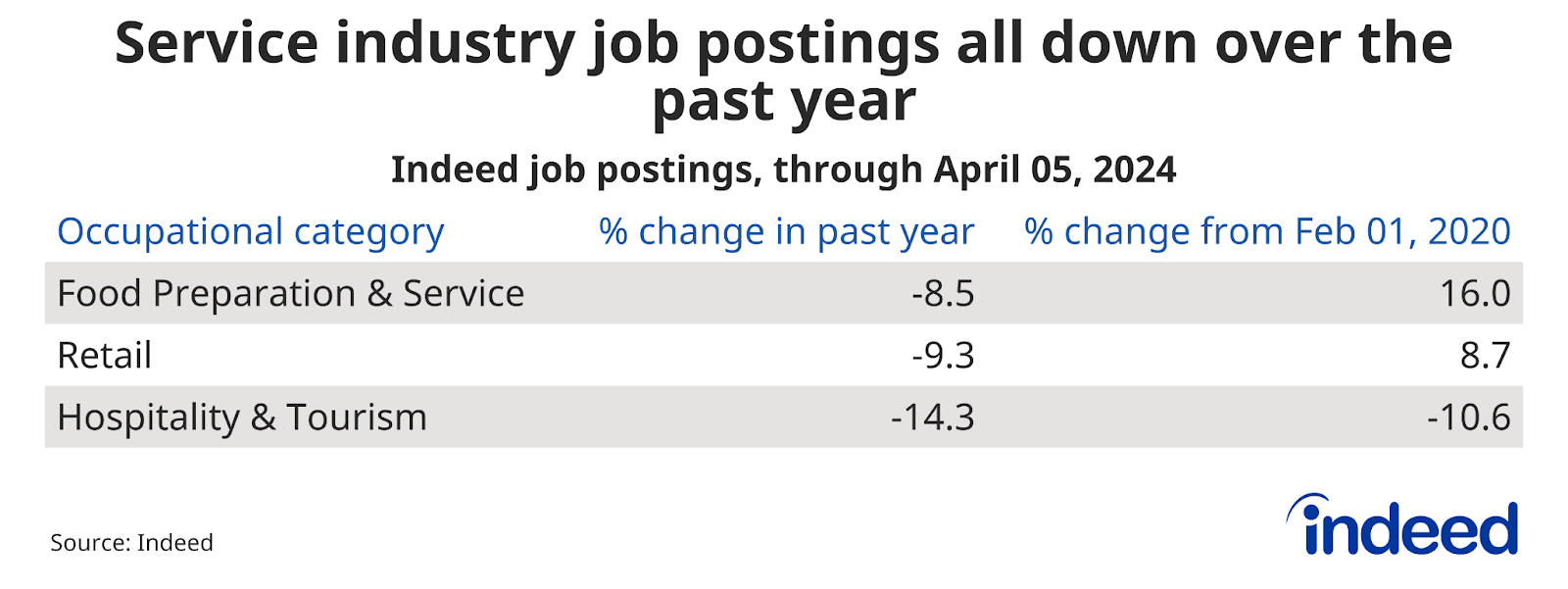

- All job posting categories in the Retail vertical are down over the past year.

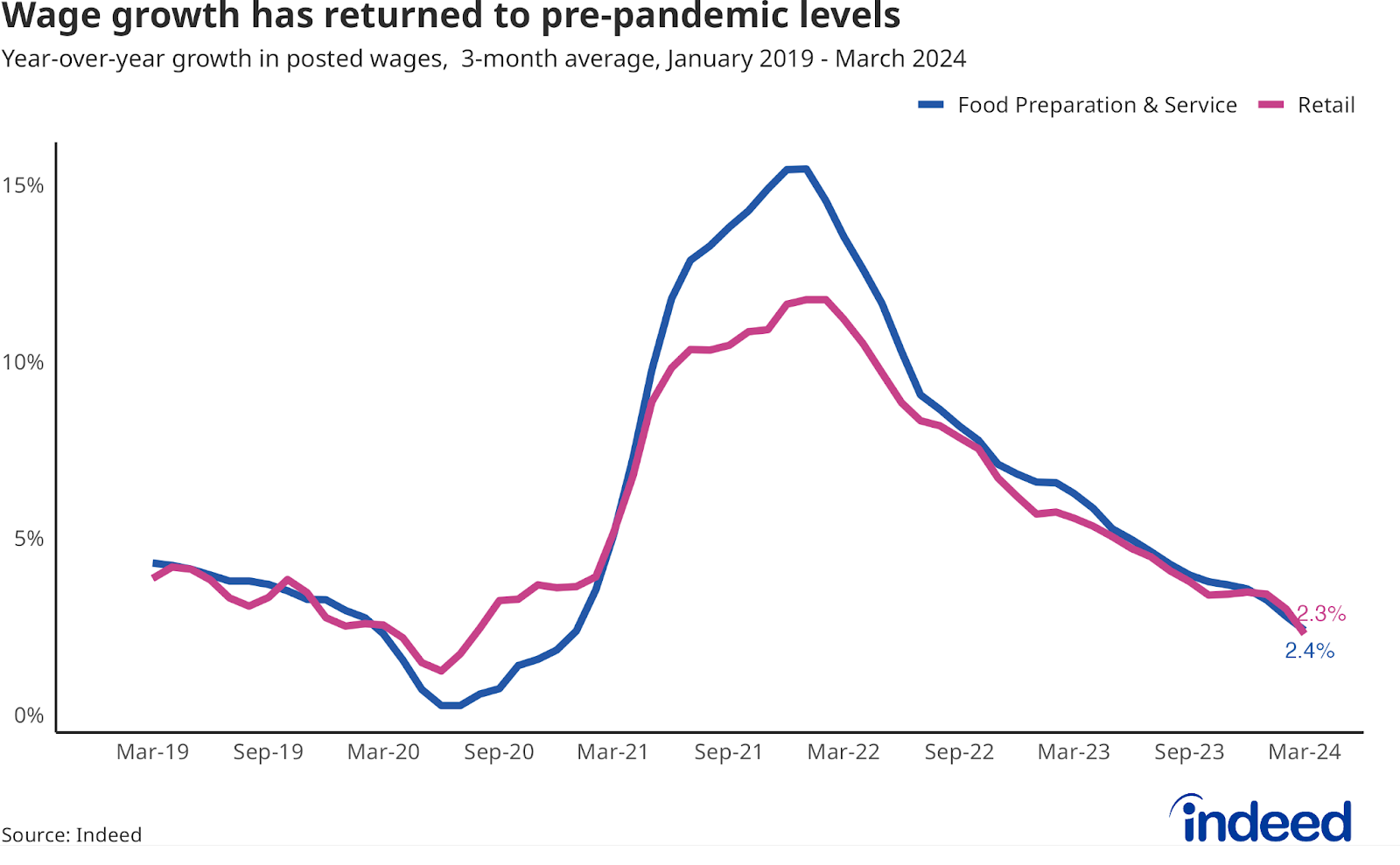

- Wage growth continues to slow, and is just below pre-pandemic trends.

Indeed job postings

The Indeed Job Postings Index (JPI) indicates that employers continued to pull back on hiring in the first quarter, as postings have now notched more than two years of declines. At the end of the first quarter, postings were down 12% year-over-year, showing the pace of the annual decline slowed a bit from the beginning of the year when postings were falling at a rate of 15%. However, employer demand for workers remains elevated, as the JPI stood at a respectable 117.5 on April 5, meaning total postings were still more than 17% above their Feb 1, 2020 level.

Retail job postings

Some segments of the Retail vertical are holding up a bit better than the rest of the labor market. Job posting declines in Food Preparation & Service and Retail, of 8.5% and 9.3%, respectively, are softer than the labor market average. Meanwhile, Hospitality & Tourism postings are down 14.3% over the past year and are 10.6% lower than their pre-pandemic baseline.

Retail wage growth

Retail and Food Preparation & Service wage growth trends have been on a steady decline and are below the labor market average of 3.1% through March 2024. Food Preparation & Service wage growth, at 2.4% year-over-year, is just above that of Retail, which registered a year-over-year gain of 2.3%. Pay gains in both categories are just below their pre-pandemic levels.

For more labor market insights from the Indeed Hiring Lab, follow along on our blog at hiringlab.org.