The Indeed Hiring Lab tracks business-to-business (B2B) employment trends, analyzing the latest Indeed data. We examine overall labor market trends and dive deeper into job posting trends in various B2B occupational categories. Finally, we focus on recent developments in layoffs and worker turnover.

Takeaways

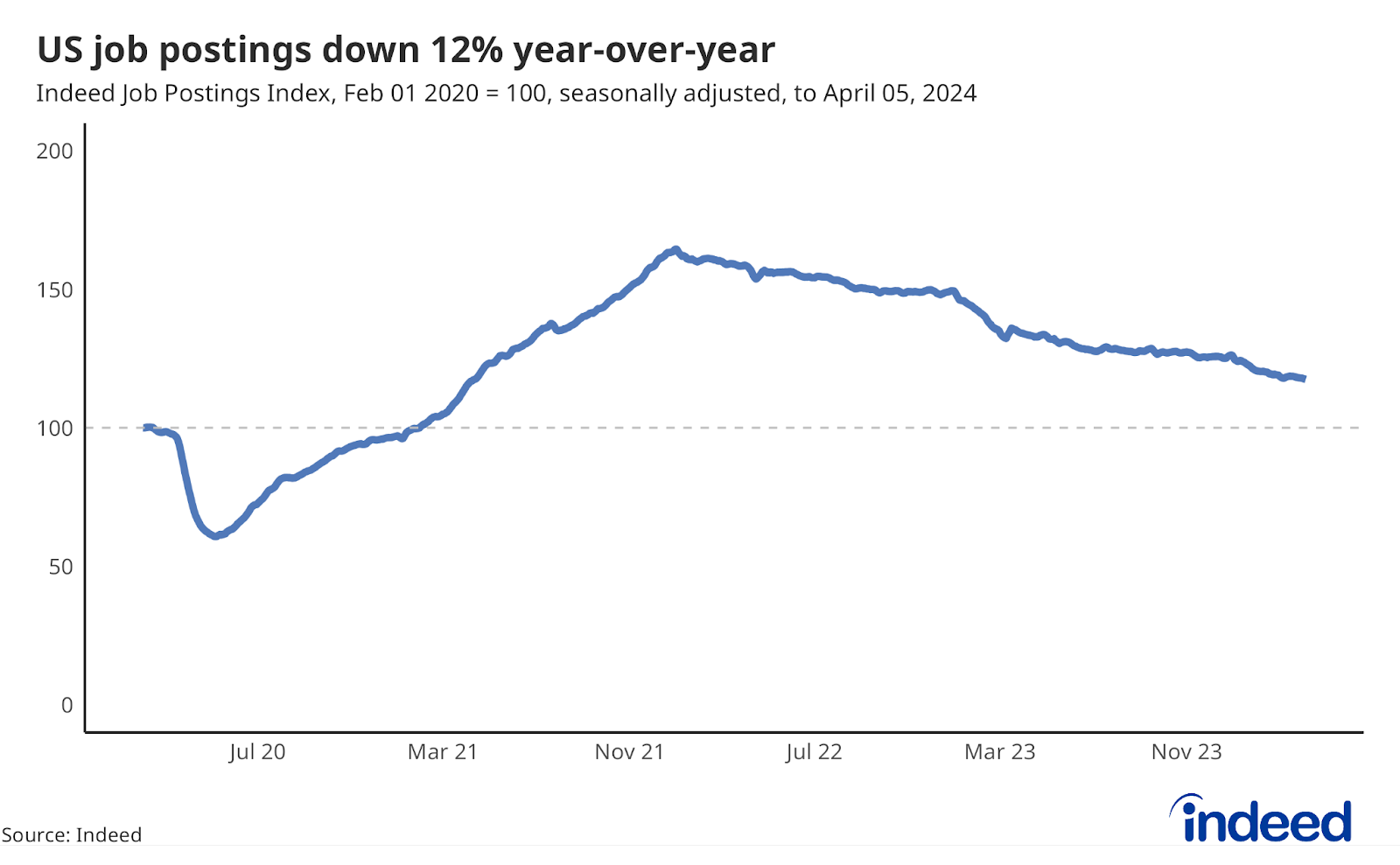

- Indeed job postings reflect a labor market that continues to slow down, falling 12% from April 5, 2023.

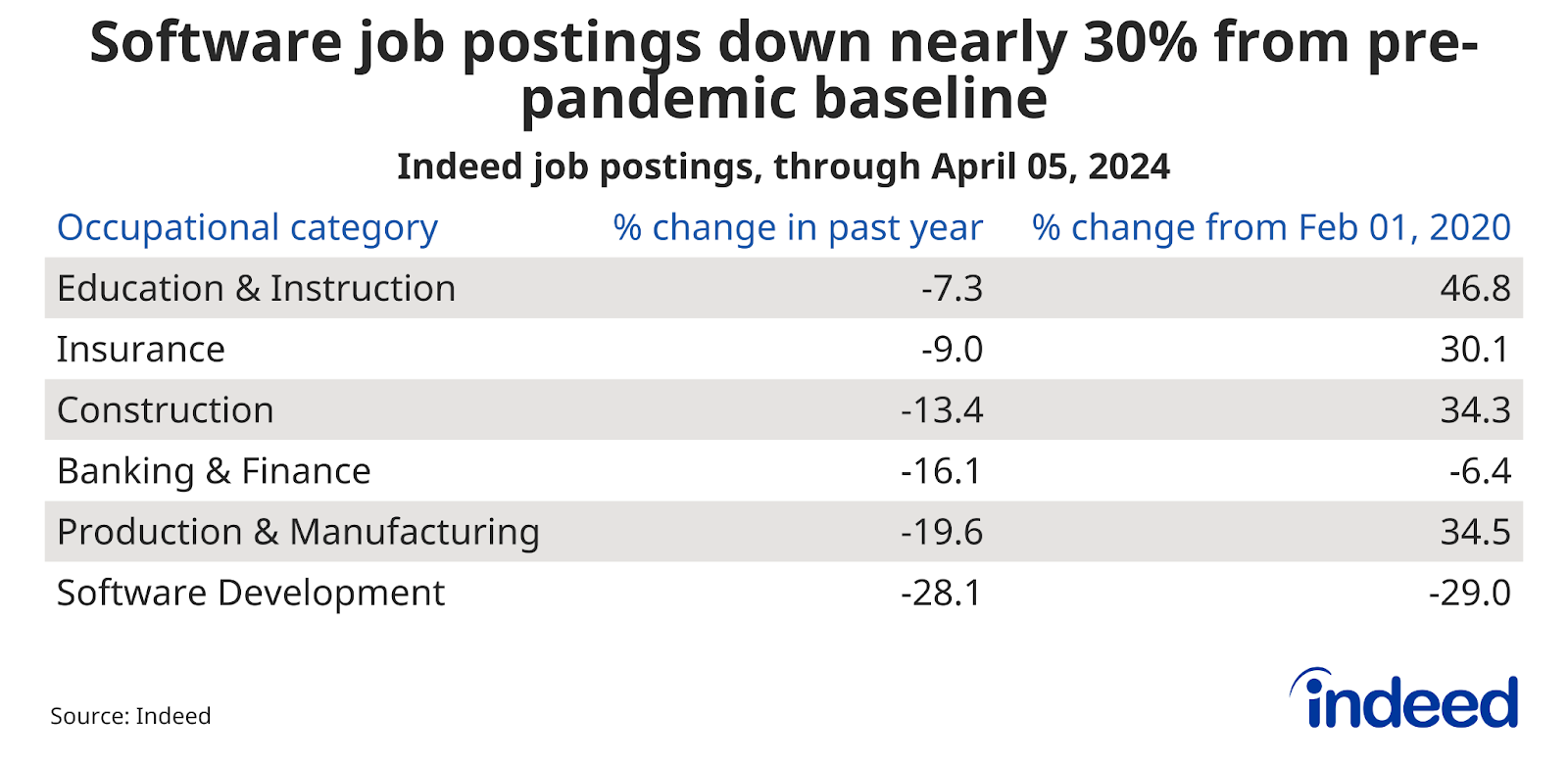

- Software Development job postings are still in decline, albeit at a slower pace.

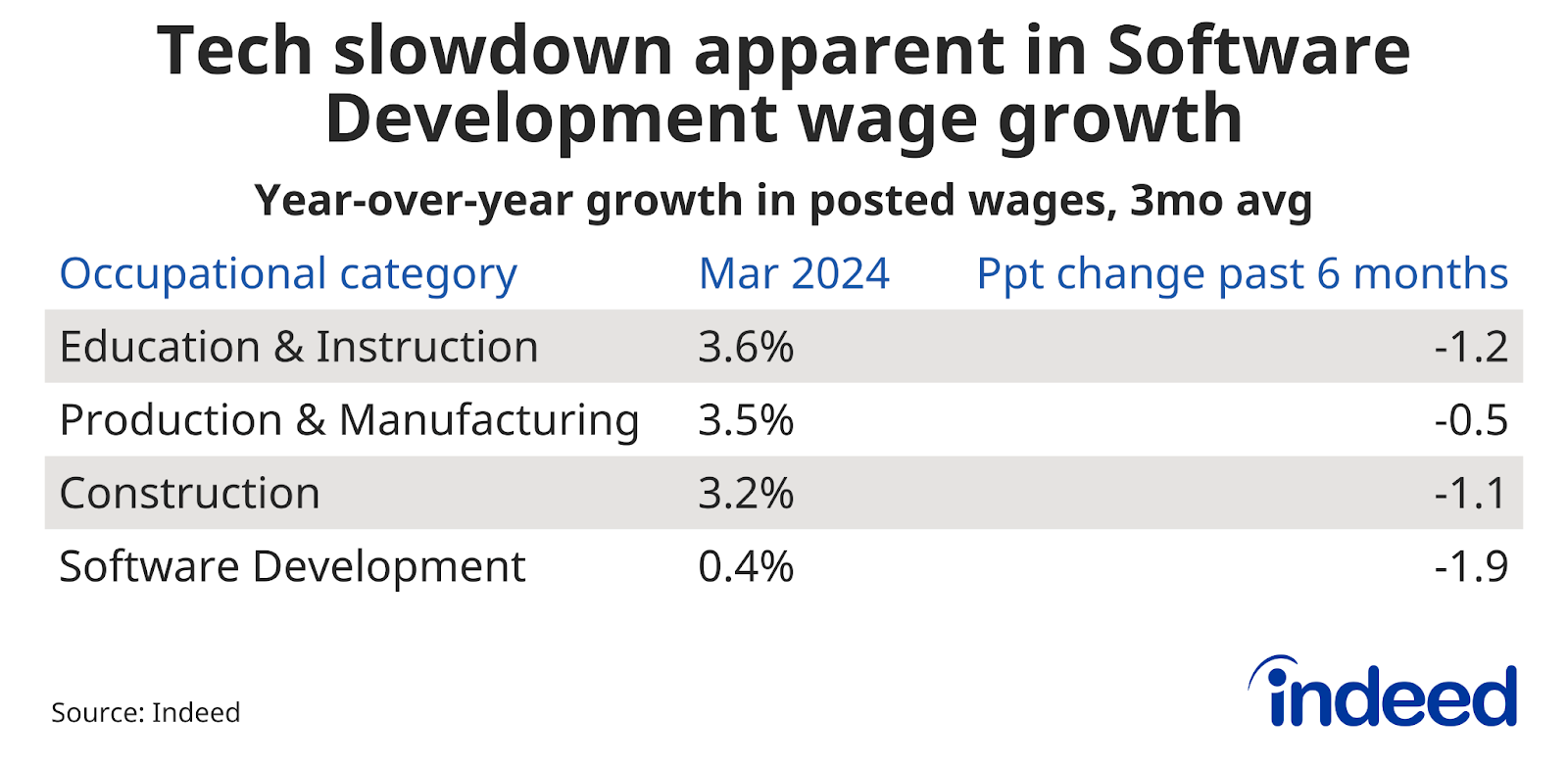

- Wage growth in most B2B categories is in line with the labor market average of 3.1%.

Indeed job postings

The Indeed Job Postings Index (JPI) indicates that employers continued to pull back on hiring in the first quarter, as postings have now notched more than two years of declines. At the end of the first quarter, postings were down 12% year-over-year, showing the pace of the annual decline slowed a bit from the beginning of the year when postings were falling at a rate of 15%. However, employer demand for workers remains elevated, as the JPI stood at a respectable 117.5 on April 5, meaning total postings were still more than 17% above their Feb 1, 2020 level.

Business-to-business postings

While job postings across all categories in the B2B vertical declined over the past year, only Software Development and Banking & Finance are below their pre-pandemic baseline, by 29% and 6.4%, respectively. However, the slowdown in Software Development postings has cooled, as job postings were down 28% year-over-year through April 5, 2024, compared to steep declines of about 40% observed at the turn of the year. All other categories remain above their pre-pandemic baseline of February 1, 2020. Production & Manufacturing job postings are down 19.6% over the past year, while the slide in Education & Instruction postings is much more muted at 7.3%.

B2B wage growth

All categories in the B2B vertical experienced slowing wage growth in the past six months.

Production & Manufacturing wage growth is a bit more stable than the other categories, only dropping 0.5 percentage points in the past six months. The steep reduction in Software Development job postings over the past two years is likely weighing on wage growth, which is nearly flat at 0.4% year-over-year through March 2024.

For more labor market insights from the Indeed Hiring Lab, visit us at hiringlab.org.