Key points:

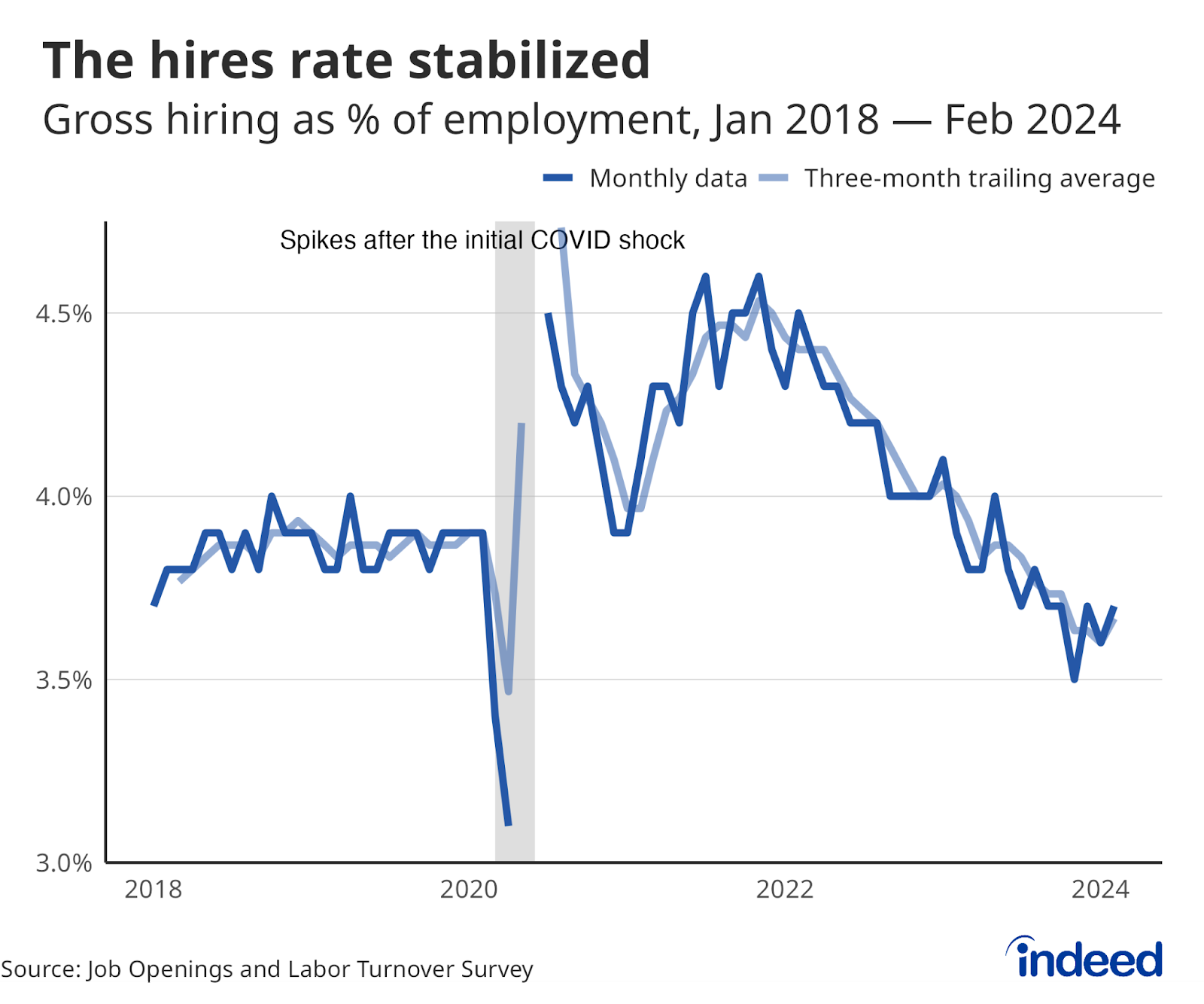

- The hires rate — or hiring as a share of employment — has stabilized, a sign that demand for workers is holding steady.

- The quits rate did not move much and remains below what we saw before the pandemic.

- While the data are not exciting on a month-to-month basis, the rapid cool-off in the US labor market is evident when you look at the data compared to two years ago.

After dramatically heating up and cooling off, the US labor market is largely steady. The February JOLTS data will likely calm some nerves after the past several reports raised concerns that hiring might be falling too rapidly for the labor market to remain robust. The hires rate is now rising, when viewed on a three-month average basis, but is still below pre-pandemic levels. And the quits rate appears to be stabilizing at levels similar to what we saw in 2017. The labor market isn’t reigniting; it’s at a steady boil.

The drama of the past few years led a lot of JOLTS data — including openings, layoffs, and quits — to hit new all-time highs or lows. These reports are boring now. The phrase “changed little” appears five times, and “little changed” four times in the February JOLTS report. This is particularly welcome when it comes to the hires rate, which had fallen below pre-pandemic levels and was trending down prior to leveling off the past few months. The stabilization in this series is a good sign that demand for workers is holding steady and that unemployment won’t creep higher as unemployed workers take more time to find work. The continued, very-low layoff rate — just 1.1% in February — also points toward low unemployment in the short term.

Even if these data are a bit of a snoozefest compared to January’s data, they are remarkable, considering what we saw a few years ago. Since the spring of 2022, job openings, quits, and hires have all fallen dramatically. Openings are down 28% since March 2022, while the quits rate has fallen 0.8 percentage points since its April 2022 peak. At the same time, the unemployment and layoff rates have ticked up only slightly, and they both remain near historically low levels. The cooldown of the US labor market hasn’t been entirely painless, but the shock has been muted compared to both expectations and historical precedent. After that kind of descent, now is the time for boring.