Key points:

- The US labor market ended the year strong, but the relative weakness in the hiring rate is something to keep in mind as we start the new year.

- Job openings rose in December, with employers saying they had 9 million unfilled positions at the end of the month.

- The layoff rate remains below its pre-pandemic rate and has only been above its pre-pandemic low for one month of the last three years.

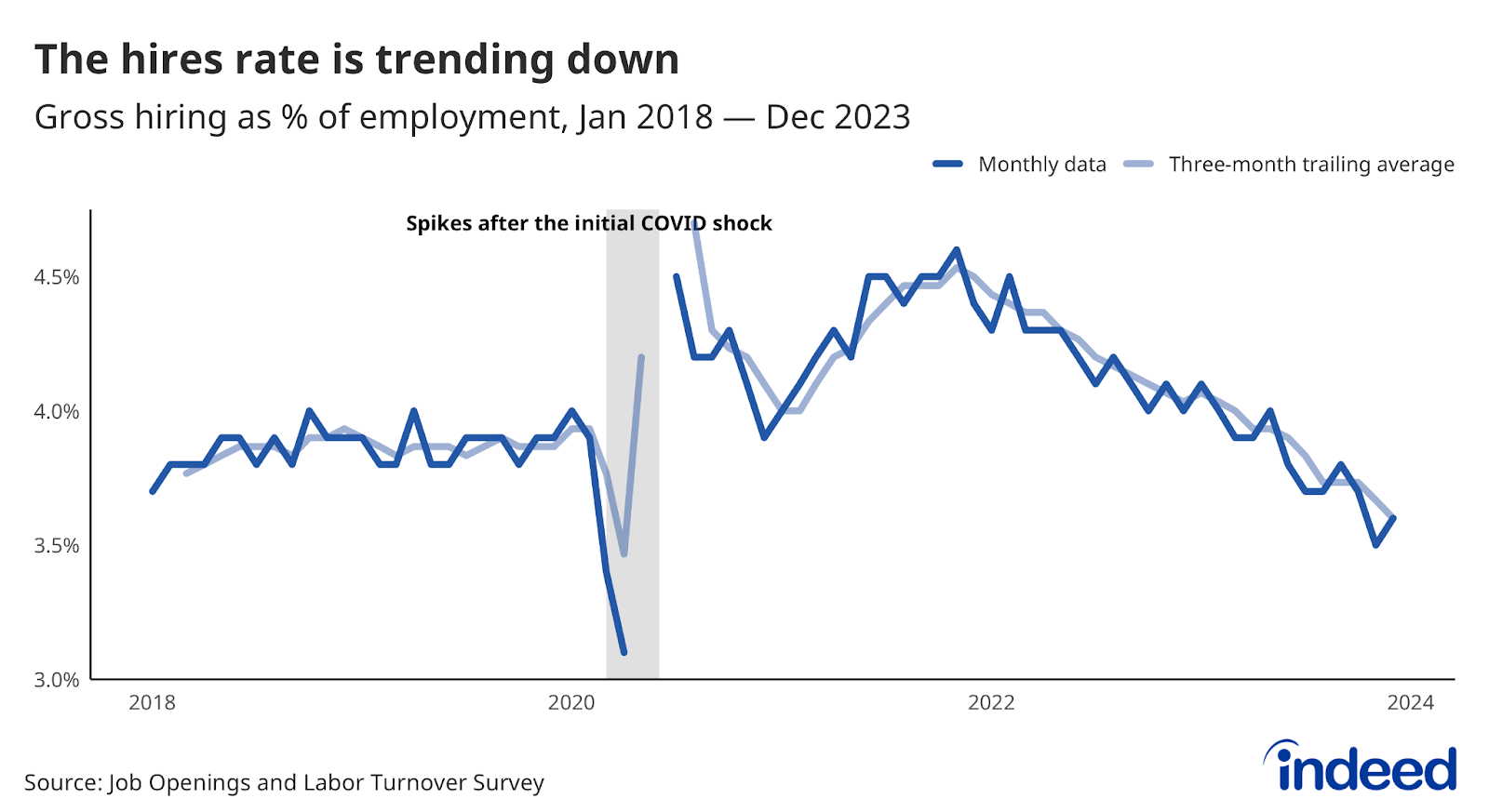

The usual data stars of the JOLTS report are still shining bright — layoffs are still low, openings are robust, and quitting is back to pre-pandemic levels. But it’s the report’s hires data, a series that traditionally gets less attention, that should be getting its close-up moment. The hires rate did tick up after last month’s drop, but it remains below the levels of a few months ago and continues to trend down. If hiring continues to lose steam, the moderation of the labor market will become more painful as workers have a harder time finding work.

The hires rate, a close cousin of the payroll growth numbers we’ll get on Friday morning, captures all hires, not just net new jobs. For the most part, the reduction in hiring has been due to reduced churn as fewer workers leave old jobs for new ones. But while quitting has returned to pre-pandemic levels, hiring is currently below its pre-pandemic threshold. The overall hire rate is down, especially in the critical healthcare and social assistance sectors, down 0.6 percentage points in December from November. This is a startling drop in industries that to date have represented a large portion of newly added jobs over the past several years. However, these data can be volatile and this decline might reverse in the months ahead.

Lower hiring can lead to a higher unemployment rate as workers out of a job have a harder time finding work. The good news is that the ranks of the newly jobless are unlikely to increase — the layoff rate is still very low and has only been above its pre-pandemic low for one month of the last three years. The most recent wave of tech and media layoffs to start the year won’t show up in this data from December 2023, but the layoff rate in the Information sectors (which include many tech and media companies) is still slightly below its pre-pandemic level.

Openings surprised to the upside in December, and the November number was revised upward — continued strength that should maybe come as little surprise. At the end of December, job openings were up 25.6% from their pre-pandemic level. On the same day, the Indeed Job Postings Index — which measures the level of jobs employers are advertising on Indeed — was up an almost identical 26.2% from its pre-pandemic baseline.

Last year’s labor market got rave reviews, and for good reason. The labor market moderated but stayed resilient. Job seekers still have plenty of job opportunities, employers are finding hiring less difficult, and policymakers have been pleasantly surprised with prospects for a soft landing. But as we enter the new year, it’s worth keeping an eye on what could upset this positive trajectory. Policymakers at the Federal Reserve should accept the reality that the labor market is not a major threat to sustainably low inflation.