Key points:

- Job openings were flat over the month with 8.8 million job openings at the end of November, according to the latest BLS data.

- Employers continued to slow down on hiring as the hires rate ticked down. And fewer workers left old jobs on their own accord, as the quits rate declined as well.

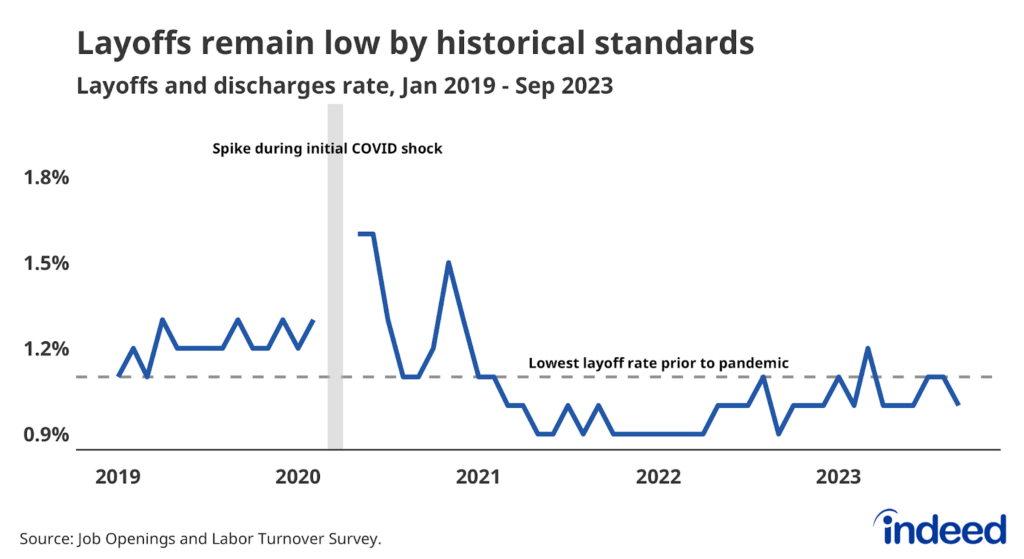

- Layoffs remained very low and have been equal to or below their pre-pandemic all-time low since April.

After a string of excellent reports, today’s new batch of JOLTS data is a bit lackluster. The US labor market is still strong, but there are some signs around the edges that hiring continues to lose momentum. Last year’s hiring pullback was generally benign, in large part because employers were slowing from a very rapid pace. But if hiring continues to decline and layoffs rise even modestly, the unemployment rate will start to accelerate swiftly. Then the soft landing will start to get a bit bumpy.

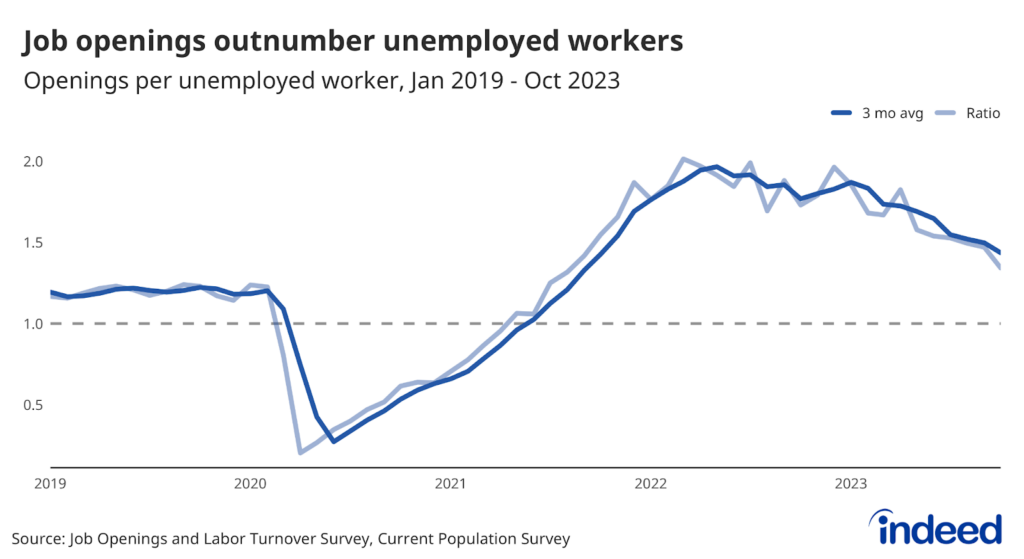

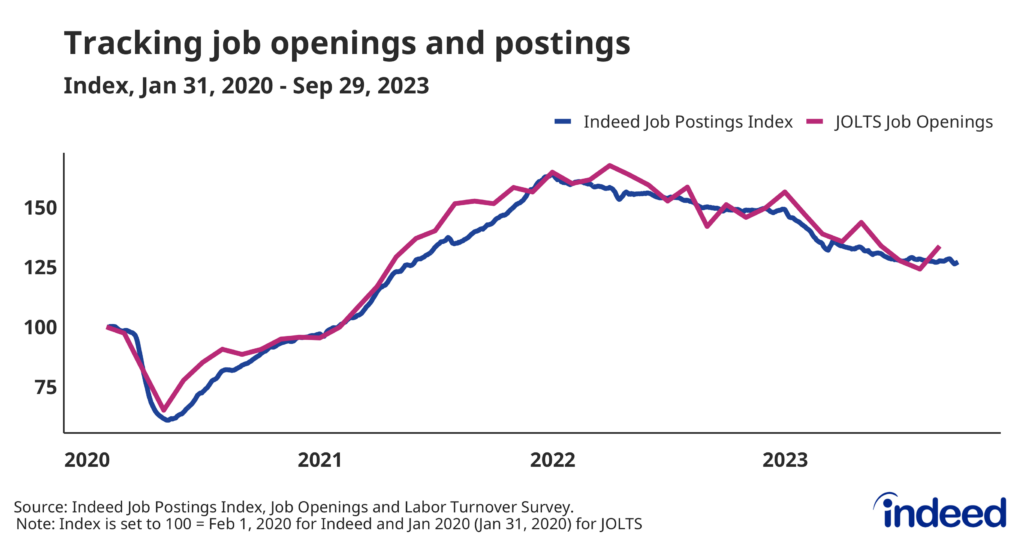

Job openings were essentially unchanged in November and continued to outnumber unemployed workers. Demand for new workers was still elevated, and more recent data from the Indeed Job Postings Index showed postings up 26% from pre-pandemic levels at the end of December.

Yet hiring rates ticked down in November, led by the Professional & Business Services and Leisure & Hospitality sectors. The drop in hiring can be explained in part by reduced churn — fewer quits leads to fewer hires. For example, the quits rate among Leisure & Hospitality workers fell by 0.8 percentage points between September and November, while the hiring rate fell by 1.2 points over the same period. A cooldown largely driven by a reduction in churn isn’t really a threat to the ongoing normalization of the market. But if more unemployed workers are out of work for longer, then the trend becomes much more troubling.

Fortunately, the layoff rate — the linchpin of the soft landing — continues to be historically low. The overall layoff rate has been equal to or below its pre-pandemic all-time low since April, and has been above that low for only one month since December 2020. This resilience is also broad-based, with layoff rates below pre-pandemic levels in industries as diverse as Retail Trade, Leisure & Hospitality, and Manufacturing.

There are hints of deterioration in this report. But remember, it’s just one report. For now, the US labor market remains strong. But we should continue to be on the lookout for any other signs of weakness, particularly on the hiring front. Most indications are that Friday’s jobs report will show job creation is still robust, but it will be good to see confirmation.