Social jobs (roles in the Care, Education and Healthcare sectors) have generally grown faster than jobs overall in more than a dozen nations worldwide, according to a Hiring Lab analysis conducted in partnership with the World Economic Forum. But while those jobs are relatively plentiful, they also generally take longer to fill than the average job.

Hiring Lab partnered with the World Economic Forum to help produce the Future of Jobs Report 2023, featuring Indeed job postings and relative time-to-fill data. As the world’s top job and hiring site, Indeed provided unique insights into real-time labor market trends to complement the Future of Work survey fielded by the World Economic Forum, which underpins the broader report. Hiring Lab’s findings show that social sectors such as healthcare, education, and others are less dependent on consumer demand and are unlikely to waver due to macroeconomic headwinds.

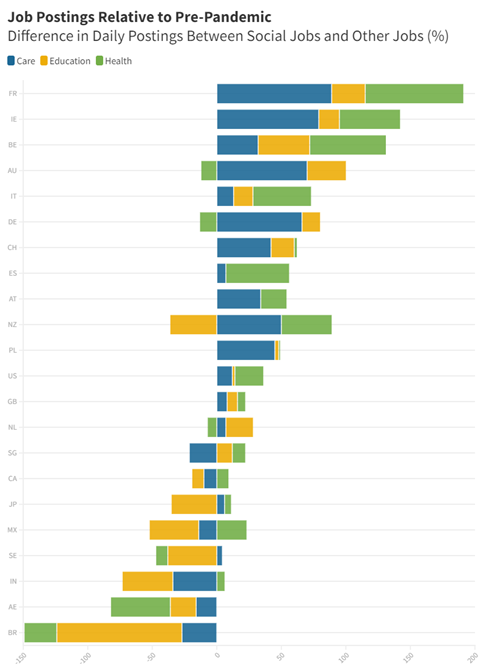

Indeed data show that in 15 of 22 countries analyzed, social jobs have grown faster than other jobs. Healthcare and Care jobs have grown faster than other jobs in 16 of the 22 countries, while education jobs have grown faster than other jobs in 12 of 20 countries with available data. Social job growth in France, Ireland, and Belgium was particularly strong relative to other countries. Brazil, United Arab Emirates, and India were amongst the 7 countries where job growth was slower for social jobs than others.

The relative strength of employer demand for social jobs compared to other sectors may be largely because social sectors are less dependent on consumer demand. Education, health, and care are always going to be in demand given schools, hospitals, and long-term care facilities must operate regardless of the macroeconomic environment. These sectors generally hold up better during recessions, for example, because demand for these social services is relatively stable.

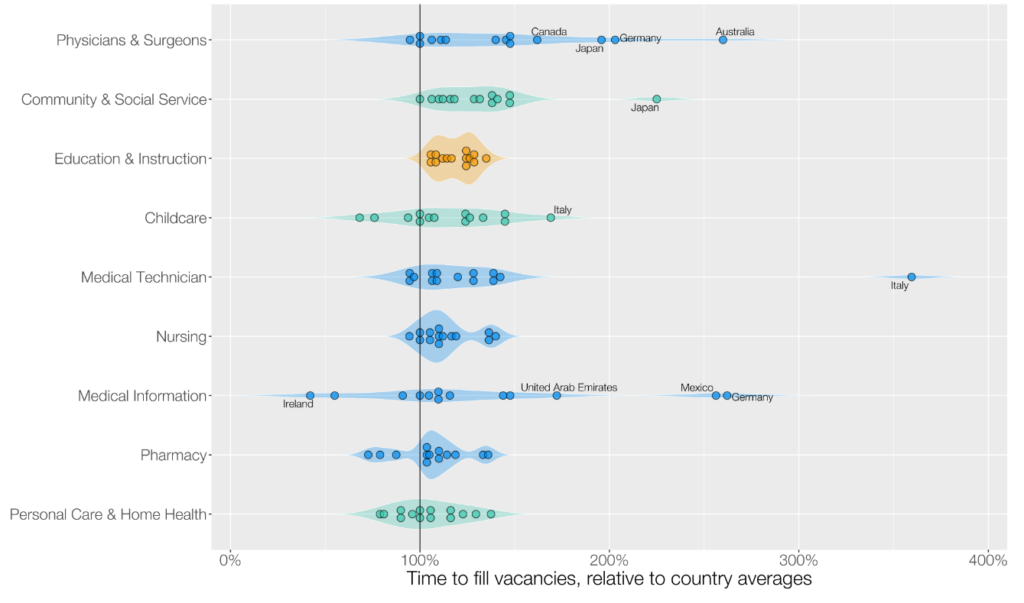

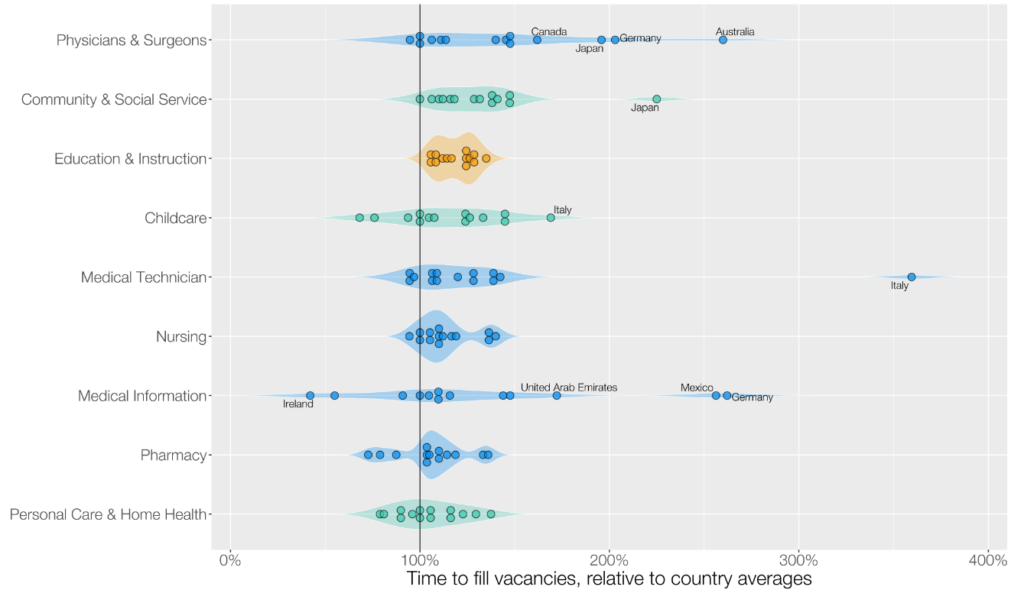

But an analysis of supplemental data including labor market tightness, size of candidate pool, and qualification/formality requirements (e.g. security clearance) showed that social job postings generally take longer to fill than the average job. This trend is relatively consistent across countries, and may be attributable to necessary occupational licensing and in-person work requirements unique to these roles. Hiring Lab has only scratched the surface of the relative time-to-fill data, and hopes to uncover further insights in coming months.

The Future of Jobs report provides a window into how the job market is evolving, identifying emerging skills and highlighting the impact of technological advancements and demographic changes. The report will be released at the World Economic Forum’s Growth Summit being held in Geneva Switzerland, May 2-3, 2023. Download the full report here.

Methodology

Time-to-fill data measures the percentage changes in median time-to-fill (measured in days) for job postings on Indeed by sector and country, compared to country-wide median time-to-fill values, across the H2 (1st July – 31st December) 2022 period.

The time-to-fill data is derived from multiple signals from employers and jobseekers that a job has been filled on Indeed. There are multiple signals we focus on, including a prompt an employer completes as to why they are taking down a job posting, and a job application tracking page that gives job seekers the option of marking a job as “hired”. We are able to extract signals from job postings, with the majority of those being within the Indeed’s Apply Funnel, i.e. where job seekers are able to apply to a job posting directly from Indeed. We recognize the job postings within Indeed’s Apply Funnel are both a subset of, and have a different distribution than, the Indeed job postings universe. To correct for this, we re-weight the distribution of the Apply Funnel to match the overall distribution of job postings on Indeed. The data are not seasonally adjusted and is only available when sample size specifications are met. Job fills within a certain job category, in a given country, are suppressed if less than 1,000 job fills are observed. In addition, any country with less than 10,000 job fills in total has been removed outright.

We calculate the time-to-fill for each job by counting the number of days since the job was created to the date of hire. Within each country, we re-weighted the sample by job category to match the distribution Indeed job postings overall and calculated the median time-to-fill observed at a country-level. Next, we calculate the median time-to-fill for each country-job category combination. Finally, the percentage change across country-wide time-to-fill and sector-specific time-to-fill (by country) is calculated.