Takeaways

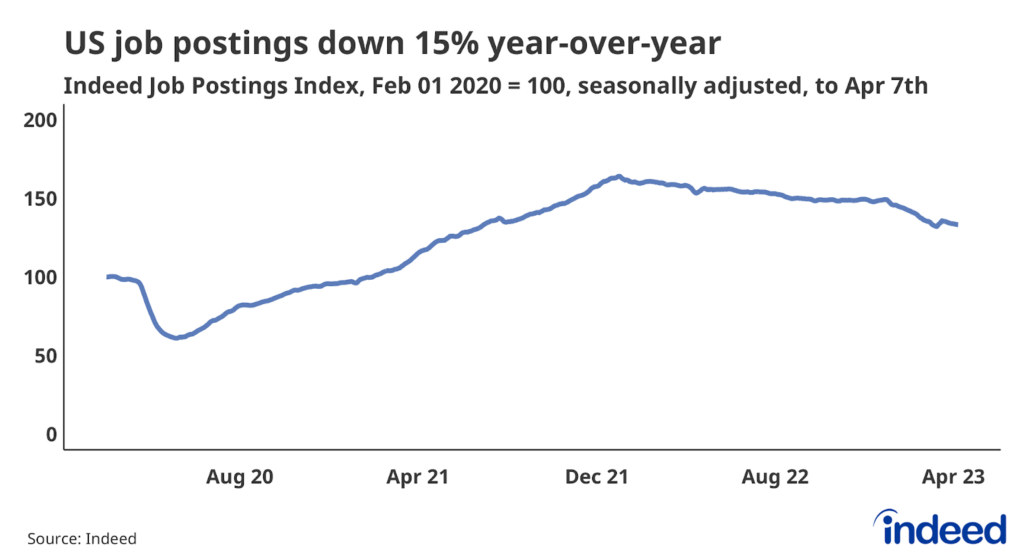

- Although job postings on the Indeed site are down 15% year-over-year, they still remain well above pre-pandemic levels

- Construction and Education & Instruction have added job postings since last year

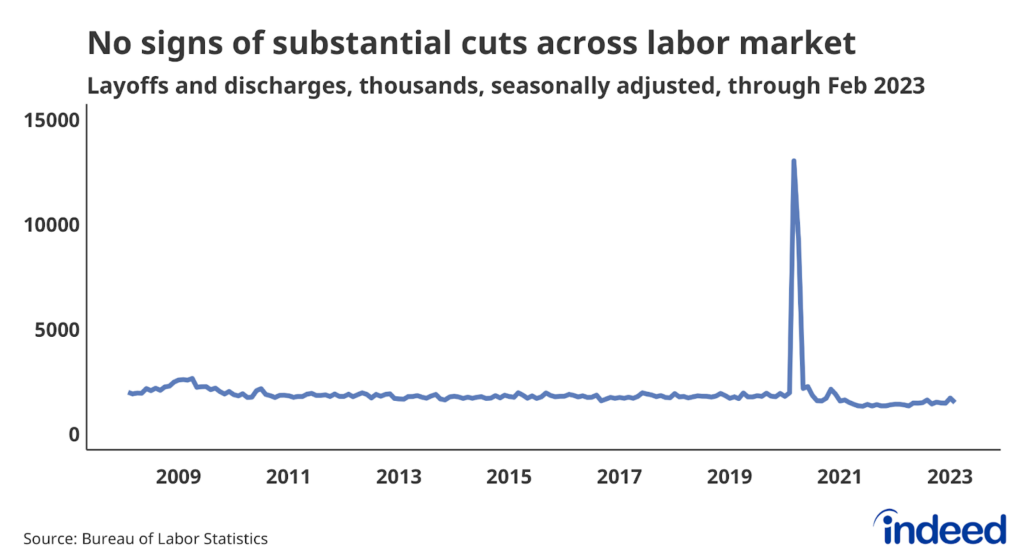

- Layoffs across the total labor market remain historically low

- Worker turnover has declined in the Professional & business services industry

Indeed job postings

Through the first quarter of 2023, Indeed job postings have continued to reflect the cooling labor market. As of April 7th, job postings are down 15% from the same time last year. However, demand for workers remains quite strong. As of April 7th, the Indeed Job Postings Index registered at 133, meaning job postings remain 33% above their pre-pandemic base line.

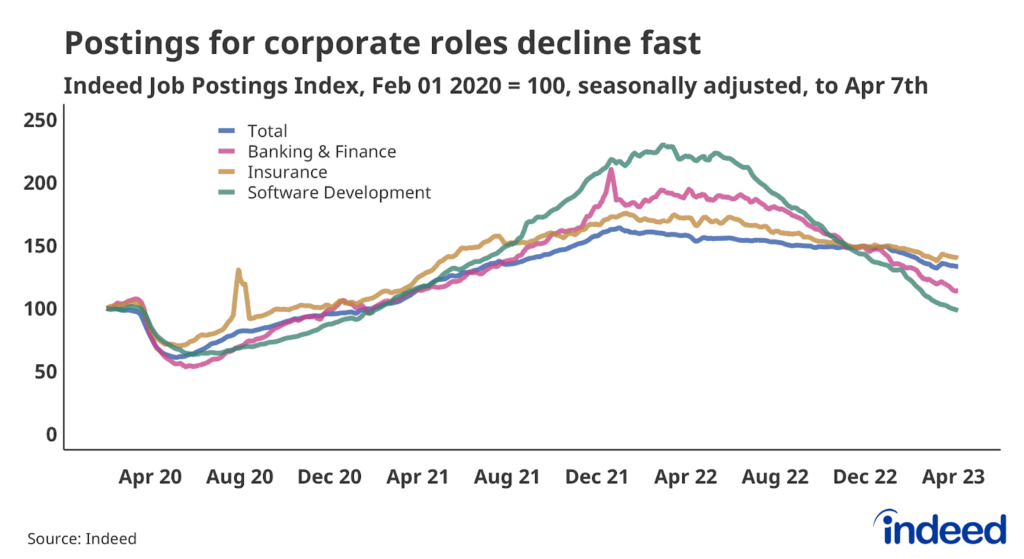

Business-to-business postings

Job posting trends for specific segments have continued to slow alongside the overall labor market. The most noticeable decline reflects the pullback in the tech sector, with Software Development job postings down 55.4% from the same time last year. Meanwhile, Banking & Finance postings are down 41% from the same time last year, while Insurance postings are down 18.5%.

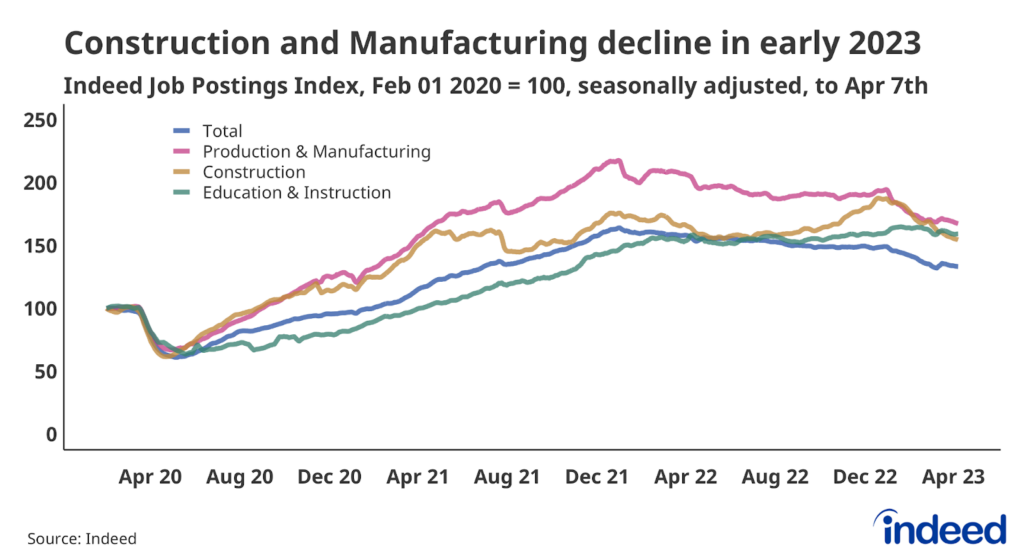

Nearly all other categories also show declines. Production & Manufacturing and Construction postings are losing steam with the rest of the labor market, down 18.4% and 6%, respectively, from this time last year. Education & Instruction postings remain the exception, up 0.9% over the same period.

No sign of substantial turmoil despite layoffs in tech

While some technology and finance jobs reflect soft spots in our labor market, recent turmoil hasn’t been enough to move the needle across the broader labor market. The below chart shows layoffs and discharges for all types of jobs, as measured by the Bureau of Labor Statistics. The trend in layoffs is nearly as flat and as low as it has ever been, even below its pre-pandemic baseline.

A slowdown in worker turnover

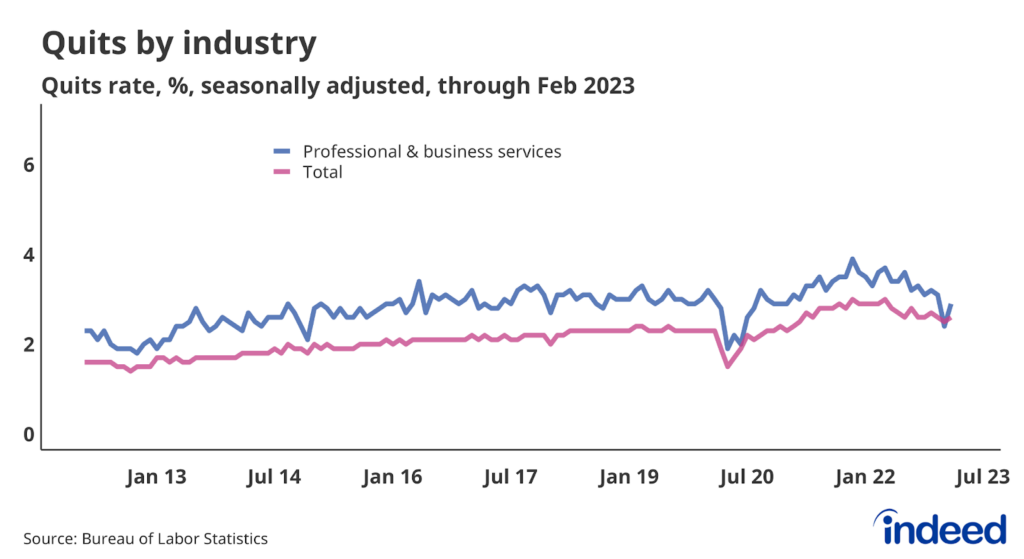

One encouraging sign for recruiting in the business-to-business category is a decline in worker turnover. The quits rate in the Professional & business services industry has fallen to its pre-pandemic level as workers become more cautious about switching roles in an industry that has slowed over the past year.

For more labor market insights from the Indeed Hiring Lab, follow along on our blog at hiringlab.org.