Workers still have a considerable amount of leverage in the US labor market, according to the most recent Job Openings and Labor Turnover Survey (JOLTS) report. The outlook for hiring remains strong as job openings remain elevated, even if their growth has slowed in recent months.

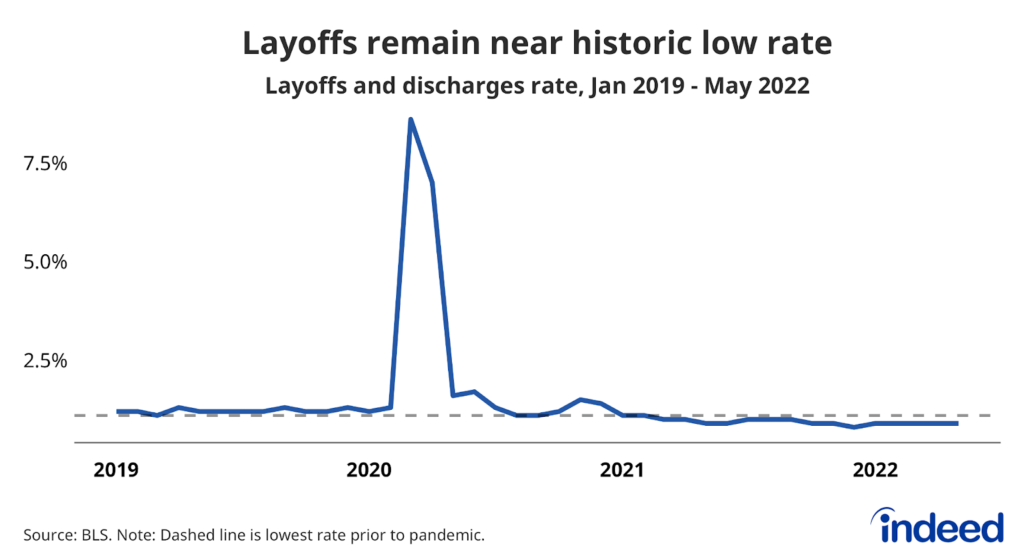

The quits rate is lingering near its recent multi-decade high as employers’ strong hiring appetite provides the opportunity for many job seekers to leave their old jobs and take new ones. As companies try to retain workers they are also loath to let them go; the layoff rate was at a series low in April. Workers are having their moment in the sun, but some clouds are likely to come along and darken the outlook.

Job openings declined in April, falling to 11.4 million, with revised data showing openings in March were just under 12 million. The result is that while there were 1.9 job openings for every unemployed worker in April, that was down slightly from 2 in March. Of course, this ratio is still much higher than what it was before the pandemic. But as the Federal Reserve focuses on this metric, a further decline could represent a cooling labor market.

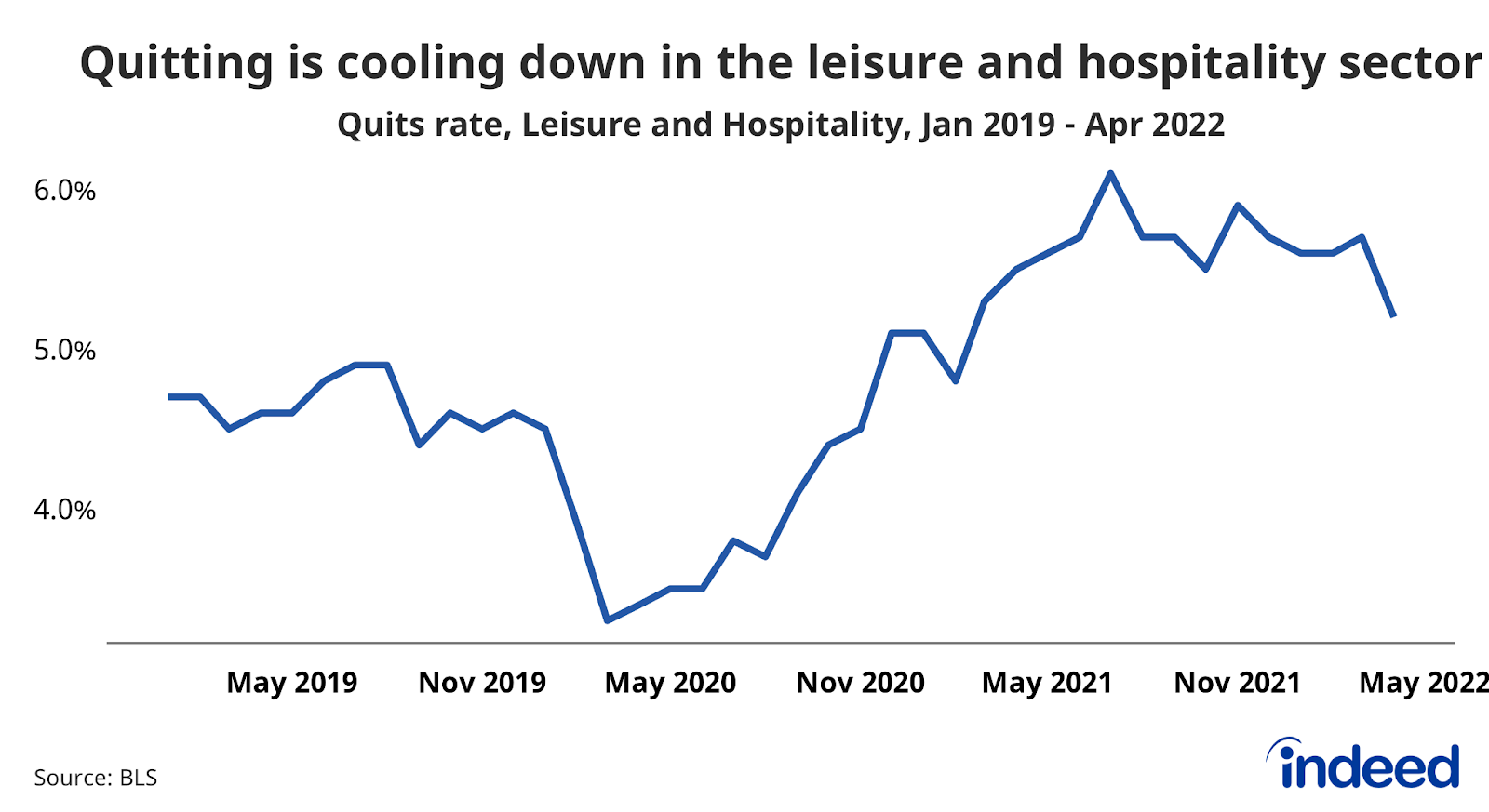

In the aggregate, the quits rate held steady at 2.9% which is just below its series high. However, there are indications that the epicenters of quitting are shifting. The quits rate in the leisure and hospitality sector declined to 5.2% from 5.7% in March, as one of the former leaders of 2021’s quits surge continues to fade. At the same time, the construction and financial activities sectors have seen quitting pick up in recent months. A reallocation of the industries where quitting is rising up would change which kinds of workers are benefiting from the trend and could mean the aggregate quits rate could remain elevated.

The labor market continues to benefit job seekers as employers work hard to hire and retain employees. However, this year is very unlikely to see the rapid improvements of last year. At the same time, some of the sectors that saw the swiftest increases in quitting and wage growth are starting to cool. Times are still good for workers, but they are unlikely to get much better.