Key Points:

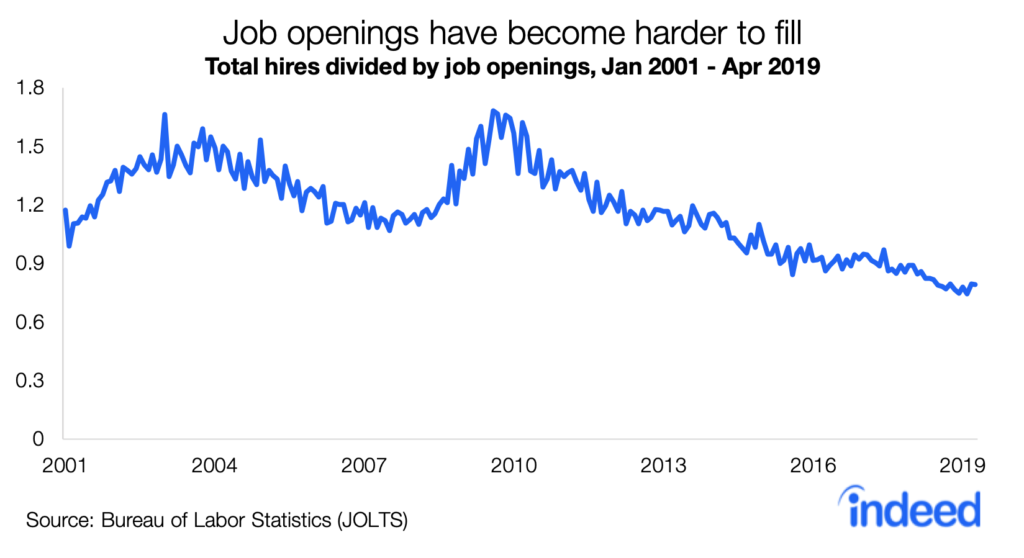

- Job openings are difficult to fill in the strong US labor market, with only 0.8 hires per month for every opening.

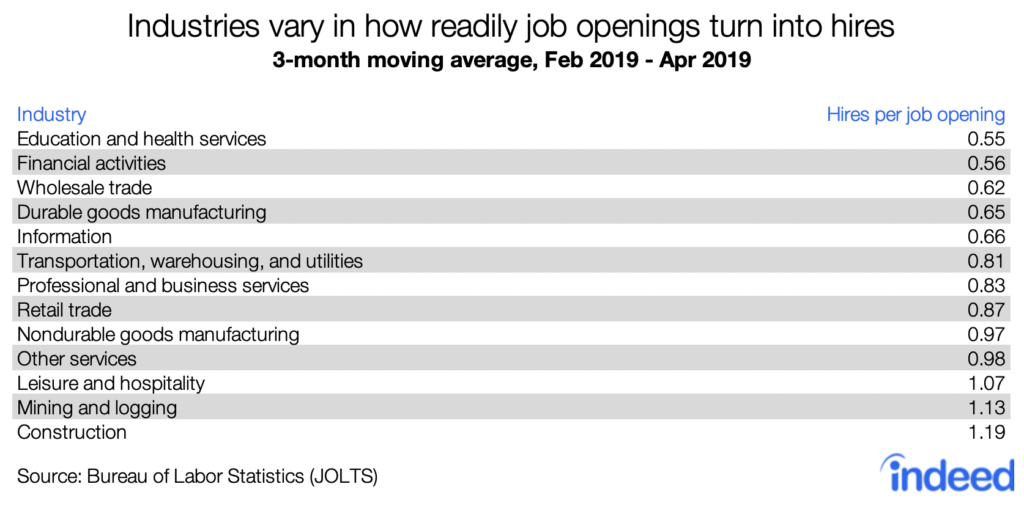

- Hiring is especially tough in certain industries, such as education and health services, financial activities, and wholesale trade.

- Employers looking to fill positions in a healthy job market can ease the hiring crunch by pushing wages up at a faster pace.

Filling an open job is not an easy task even in the best of times. But hiring has become particularly difficult over the past few years. This is mostly the result of a positive trend — the strong US labor market. Industries where the job market is particularly tight, with strong employer demand for workers and a smaller pool of unemployed workers, are having an especially challenging time filling positions.

Employers can take action though to make hiring easier. At the top of the list — they can raise wages faster. Industries with more rapid wage growth generally see an uptick in hiring. That’s especially true in more competitive labor markets in which boosting the pace of pay growth could make it easier to fill positions necessary for expansion.

A tighter labor market means hiring is more difficult

In a strong labor market, the competition for workers increases. More employers are trying to fill positions to grow their businesses at the same time the pool of unemployed workers is shrinking. The result? Job openings are less likely to turn into actual hires.

A good way to measure this is to look at how many workers were hired in a given month compared with the number of jobs that were open at the beginning of the month. Economists call this the job-filling rate. A job opening can result in less than one hire if enough open jobs remain unfilled at the end of the month. Conversely, the average opening results in more than one hire if jobs are posted and then filled during the month. In that case, they add to the number of hires, but don’t register in the count of openings at the end of the month.

Currently in the US, when an employer posts a job, it yields on average less than one hire over a month. In April 2019, the average opening resulted in 0.8 hires. That’s an extraordinarily low job-filling rate. Even when the labor market was at its tightest level before the Great Recession more than a decade ago, the job filling rate was 1.1 hires per opening.

During the recession, the rate jumped. In August 2009, the average job vacancy resulted in 1.7 hires during the month, the highest level ever seen for this measure, signaling a weak labor market in which hiring was easy.

Industries vary in how easily job openings turn into hires

The relationship between a robust job market and difficulty filling openings holds up when we look at data by industry. The health of each industry’s job market is strongly related to its job-filling rate. It makes intuitive sense — the fewer unemployed workers per open job in an industry, the lower the rate of filling jobs.

Education and health services is the industry that receives the fewest hires per job opening. It also has one of the strongest job markets. In healthcare and social assistance, there was almost one unemployed worker for every three open jobs in April 2019. Healthcare also has a high degree of mismatch between the experiences of job seekers and the positions posted by employers, according to Indeed resumes and job postings. More mismatch between the jobs employers want to fill and the backgrounds job seekers have makes for a tighter labor market in which hiring is tougher. Overall though, this mismatch between the supply of job seekers and employers’ demands has declined over the past four years.

Construction lies on the other end of the spectrum from healthcare. Its labor market is one of the weakest. That makes filling job openings relatively easy, with 1.1 hires for each opening in April 2019. However, by historical standards, the construction job market is relatively tight. During the Great Recession, the construction industry averaged almost five hires for every job opening.

Faster wage growth may be the price of easier hiring

In a more competitive job market, employers aren’t powerless. Industries with higher wage growth tend to have an easier time filling job openings, and this is true even after accounting for the health of the industry’s labor market. Faster wage growth signals that employers are using the best tool they have to attract potential new hires.

One industry’s experience is a cautionary tale for what can happen if wage growth is low. Durable goods manufacturers are having a hard time filling open slots. Only three industries have a lower job-filling rate. Yet the durable goods manufacturing job market isn’t particularly tight. Its unemployment-to-open-job ratio is in the middle of the pack.

What’s going on? On average over the past three months, wages in durable goods manufacturing have grown at a 2.4% annual rate. Not only is that slower than overall US wage growth, but it also doesn’t stack up well against similar industries. In the similarly healthy transportation, warehousing, and utilities industries, wages were up at a 3.1% pace. And in mining and logging, wages shot up at a 6.1% rate. Not surprisingly, both mining and logging, and transportation, warehousing, and utilities have higher job-filling rates than durable goods manufacturing.

Conclusion: Wage growth is an important tool for employers

Faster wage growth isn’t always the solution to hiring difficulties. It seems to have a bigger impact in industries that often hire from the pool of already-employed workers, such as manufacturing, financial activities, and education and health services. It’s likely that employers need to use higher pay to lure potential hires away from their current jobs. Still, quicker wage growth is an important arrow in the quiver for employers regardless of industry.

Another option is to hire job seekers who might have been overlooked in the past, such as those who haven’t worked in some time or whose credentials don’t exactly match what an employer is looking for. Competition for these workers is less fierce.

A strong job market will continue to complicate hiring in the near term. Employers need to be clever and nimble to fill positions — and be prepared to dig a little deeper in the pay department. Still, higher wages may end up being cheaper than falling behind in the competition for workers.

Methodology

The job-filling rate is calculated by dividing the number of hires in a month by the number of job openings at the end of the previous month. For example, the job filling rate for April 2019 is the number of hires in April divided by the number of job openings at the end of March 2019.

We established the degree of correlation between the strength of an industry’s labor market and the ease of filling jobs by regressing the log of the ratio of hires to job openings in an industry on the log of the ratio of unemployed workers to job openings. We found a correlation of 0.69. The regression coefficient on the log of the ratio of unemployed workers to job openings was positive and statistically significant at the 1% level.

We ran this regression again including year-over-year average wage growth in an industry. The coefficient on the log of unemployment per opening was essentially unchanged. The regression coefficient on average wage growth was positive and statistically significant at the 1% level.

To see if this relationship varies by industry, we ran this last regression with fixed effects for each industry and an interaction of wage growth and industry-fixed effects. We found that wage growth had a positive and statistically significant relationship with the job-filling rate in the following industries: durable goods manufacturing, education and health services, financial activities, information, nondurable goods manufacturing, professional and business services, mining and logging, and wholesale trade. When we added the logarithm of the average wage in the industry to the regression, the main results were similar.