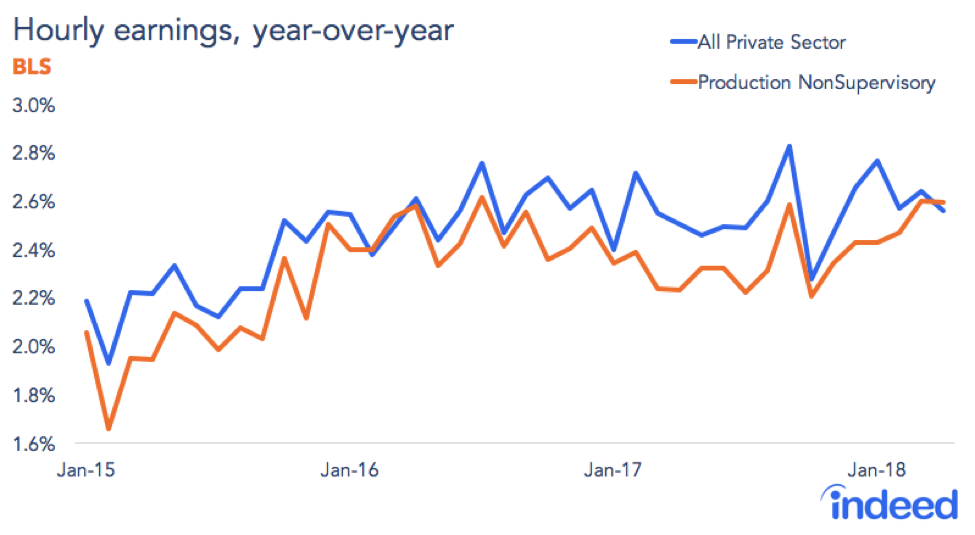

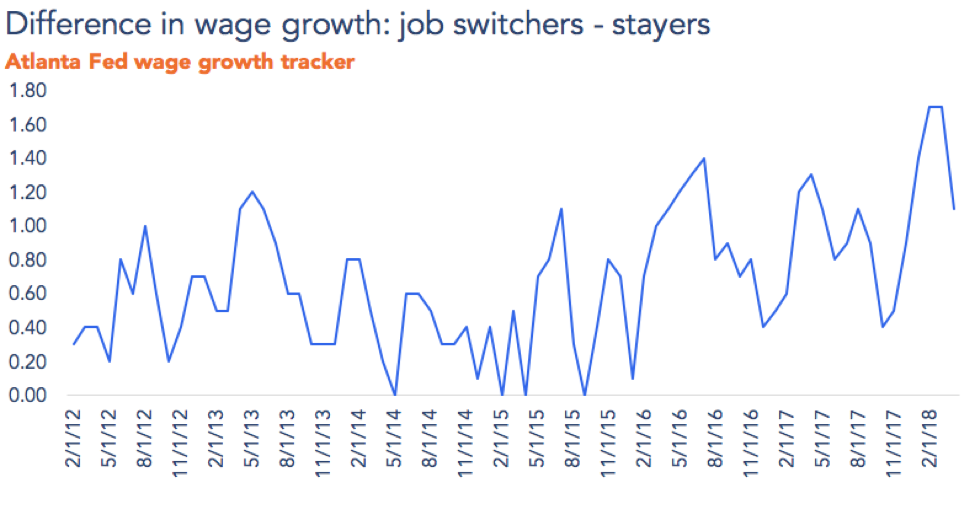

How can workers finally see wage growth? Do they need to find a new job to see their wages increase? Though the unemployment rate dropped to 3.9% in April and job growth continues to chug along, wage growth for all private-sector workers has hovered around 2.6% since the end of 2015. Historically workers who switch jobs see large wage gains, and with the quits rate reaching new highs in this recovery we might expect that to contribute to higher wage growth.

Job switchers are indeed seeing higher wage gains than stayers: in fact, the difference in wage gains between job switches and stayers has been trending up in recent months. In addition, new research from the Kansas City Fed shows that over 14% of workers who are in the same job as a year ago have seen no increase in their wages – relative to a low of 11% right before the Great Recession. That percent also appears to have been creeping up in recent months—surprising at this point in a recovery. Thus, outcomes for workers who stay at their jobs, relative to those who leave, appear to be particularly poor at the moment.

That being said, even workers who switch jobs are still seeing wage gains below where they were right before the recession: in fact, wage gains for job switchers are currently where they were for job stayers in late 2007.

So why aren’t wages starting to pick up at this point in a recovery? Some have hypothesized that the Great Recession has made employers skittish about raising wages (although a tight labor market should eventually force them to do just that) or that the growth in larger firms has reduced how much companies have to compete with each other for workers, which would restrict how much they have to bid wages up. If these explanations are what is going on, we may need to see more months of ultra-low unemployment before wages start going up, if they ever do.

But another possibility is that there are still workers coming into the labor force that are providing employers with an alternative set of workers to hire, which means that employers don’t have to start a bidding war for talent yet. Research from Hiring Lab has shown that some of the fastest growing job search terms on our website include searches like “full-time”, “hiring immediately”, “no background checks”, and “Monday through Friday.” Those searches suggest that there is still a pool of talent that has not found jobs that provide even basic benefits like full-time work. This is confirmed by data from the Bureau of Labor Statistics that shows that the share of the labor force working part-time for economic reasons still remains elevated above its pre-recession low, and that the share of the prime-age working population has not returned to its all-time high in 2000. It could be that those measures reflect a changing American work environment and will simply never return to past recovery levels. But with wage growth still not picking up, it seems too soon to write off the idea that we still have more workers to place into steady work. When the May employment numbers are released, we’ll be looking to see if wage growth is picking up and if there are still more workers coming into the labor force.