As representatives of the United States, Canada and Mexico wrangle over the North American Free Trade Agreement with the deadline for a new agreement looming, many issues, including Canada’s wish to expand free movement of businesspeople, hang in the balance. Whether a deal can be hammered out, and what impact it would have on the ability of workers to take jobs across borders, remains to be seen.

Indeed data show that job searches between the United States and Mexico have shifted in the past year. Job seekers in Mexico are less interested in the United States than they were a year ago. At the same time though, the share of searches from the US for jobs in Mexico has increased. Meanwhile, the job search flow between the United States and Canada has remained more or less stable.

Labor market mobility is important to a healthy economy. International migration allows workers to relocate where their skills are most valued and enables countries to fill talent shortages with foreign workers. This relationship particularly holds for neighboring countries because migrants are most likely to move to the closest foreign locations.

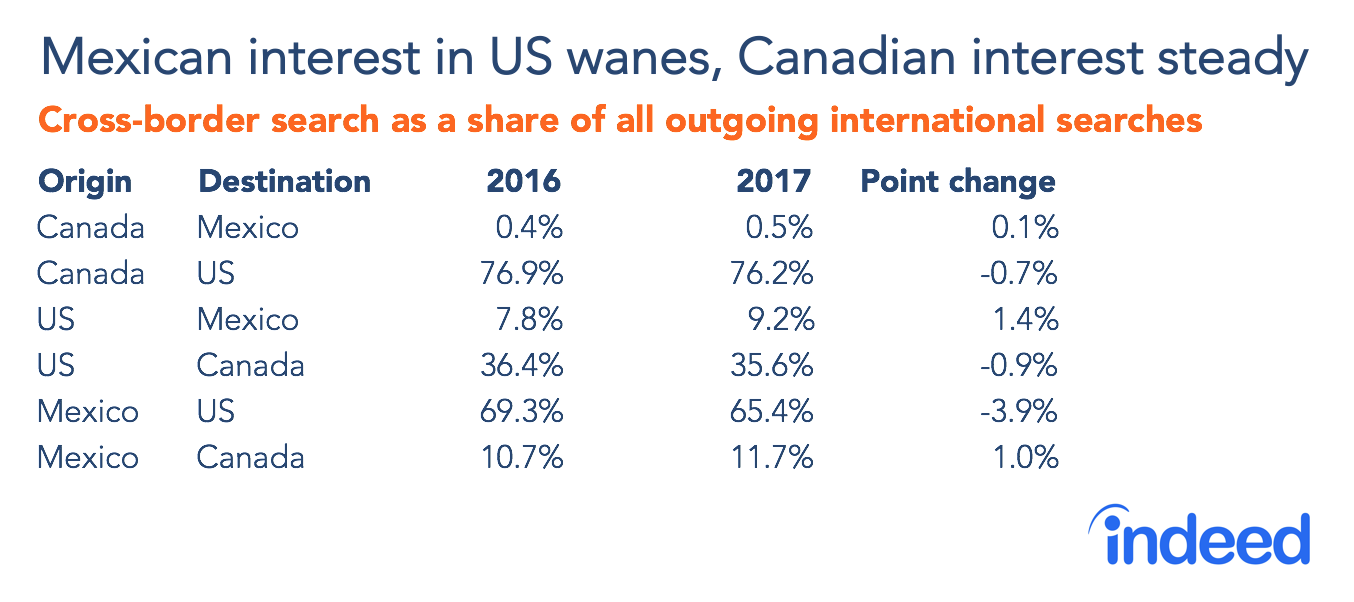

Not surprisingly, the data show that the three North American markets are heavily intertwined. When Canadians and Mexicans look for work outside their home country, three out of four searches are in North America. By contrast, only about 44% of US searches for foreign jobs stay within the continent. In addition, most of the Mexican and Canadian traffic that stays in North America goes to the US—about two-thirds of Mexico’s and 76% of Canada’s outgoing international search traffic is for US jobs.

Changing dynamics on the southern border

Searches from Mexico for US jobs have declined. From 2016 to 2017, the share of Mexico’s outgoing international searches that went to the US fell from 69.3% to 65.4%. Meanwhile, searches from the US to Mexico rose from 7.8% to 9.2%. The changes in job search traffic between the US and Mexico probably reflect shifting migration patterns between the two countries.

This is nothing new. Mexican immigration to the United States has been falling for years. Moody’s Analytics research suggests this trend began at the turn of the century and quickened during the Great Recession when a contracting US economy gave little incentive for Mexicans to move north for work. There are several theories about the long-term decline. The income gap between the US and Mexico that encourages migration remains substantial. But, from 2000 to 2015, inflation-adjusted wages increased in the poorest Mexican states, the ones that typically account for most northbound migration. In addition, Mexican fertility rates have been plummeting for decades, meaning slower growth in the labor supply, fewer workers per job and less incentive for migration.

It’s difficult to tell whether the Trump administration has had any impact on the volume of US searches from Mexico, but it may be contributing to the drop.

Notably, the overall share of Mexican job search traffic directed outside the country has remained stable, suggesting that emigration has not lost its appeal. What has fallen is Mexican interest in US jobs. Searches from Mexico for Canadian work have actually climbed. From 2016 to 2017, the share of Mexico’s international searches directed to Canada rose from 10.7% to 11.7%, handing Canada an opportunity to capitalize on falling Mexican interest in the US.

All quiet on the northern front

In contrast to the shifts in job search traffic between the US and Mexico, flows between the US and Canada changed little from 2016 to 2017. As a share of all US outgoing international searches, those for jobs in Canada declined slightly. However, the drop was small, with the share hovering near 36%. It was the same in the opposite direction, with the share of Canadian outgoing searches to the US falling marginally, but staying close to 76%.

However, Indeed data has previously found spikes of interest in Canada from US job seekers, particularly for higher-skilled tech workers. These surges have closely tracked significant, headline-grabbing political events.

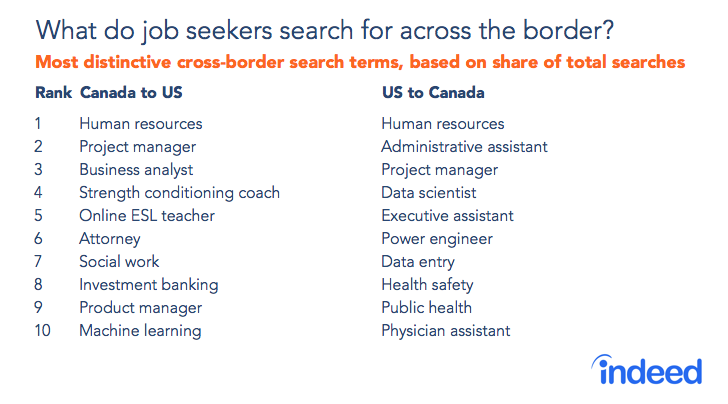

The terms US and Canadian job seekers use when searching across the border tell much about the types of workers looking to make a move. The table below shows the search terms most distinctive of workers looking for jobs across the border–that is, which search terms job seekers use at higher rates across the border than at home.

These lists demonstrate that international job search is important to all aspects of an economy. A wide range of workers search across the border. Importantly, some of the terms used disproportionately in searches between Canada and the US refer to high-skilled jobs. Canadians seeking work in the US focus across the board on terms related to such skilled jobs, including attorney, investment banking and machine learning. In the other direction, high-skilled and in-demand roles in healthcare and data science top the list.

These North American job search flows bear watching because they are vital to each country’s economy and heavily influence their long-term growth prospects. Previous Hiring Lab research indicates that the US occupations most likely to be affected by major immigration policy changes are mostly lower-skilled roles in agriculture and food service. However, some higher-skilled positions in the production and the computer and mathematical categories would also feel significant effects. It is critical to keep an eye on these patterns as Nafta renegotiations unfold and the US administration further shapes its policy.

Methodology

For this research, we focused on job seekers searching for work outside their current country, which was determined by the users IP location. For each international job search flow, we examined this search traffic as a share of all international searches from the origin country to account for growth and changes over time at Indeed sites across the globe. The time periods used in this analysis are the last four months of 2016 and 2017.

The distinct search term analysis compares the rate at which job seekers use a particular search term domestically with the rate at which they use that term in other markets, that is, the term’s share of total search traffic. The search terms that job seekers use at a much higher rate in cross-border searches are deemed distinct.