Key points:

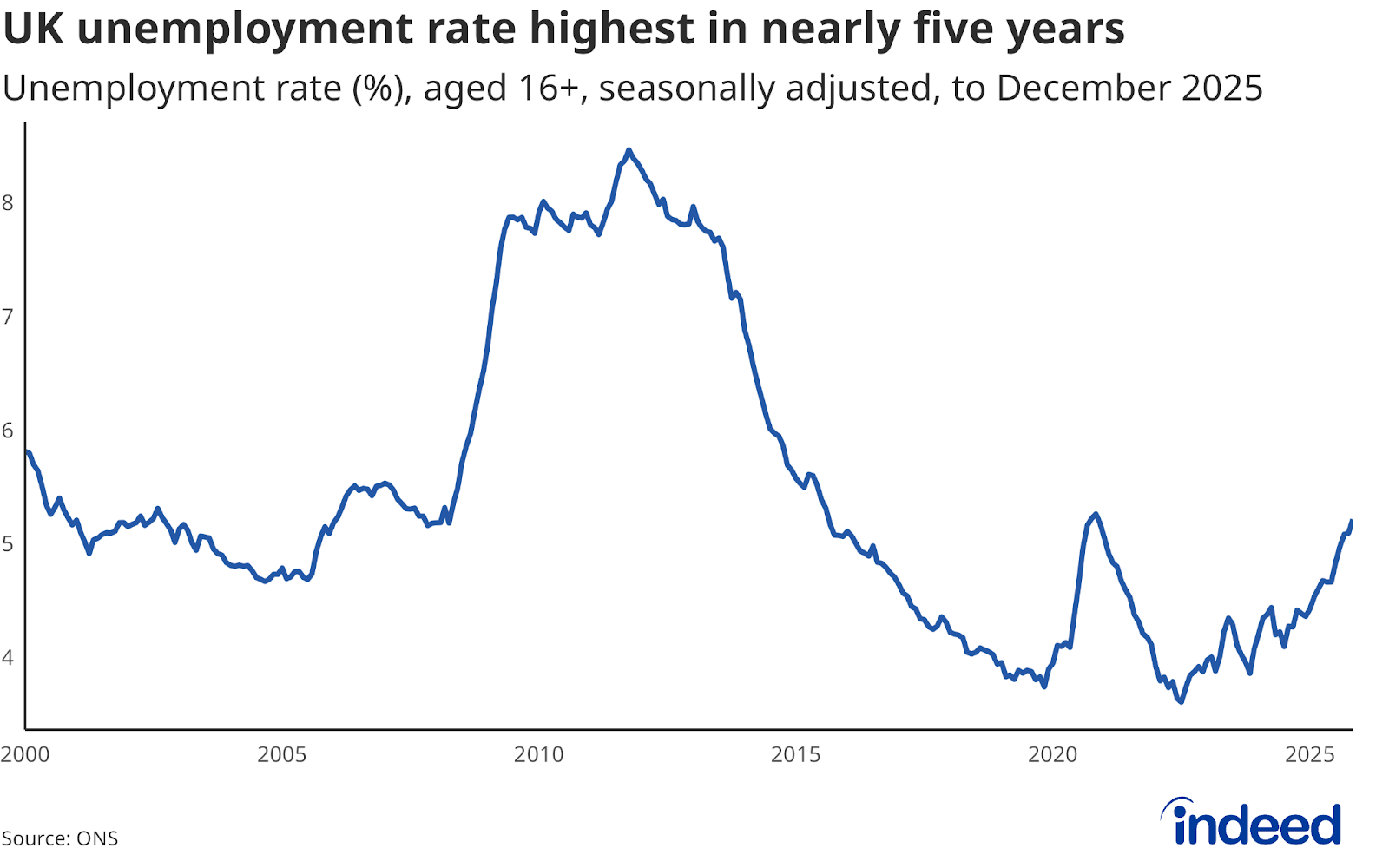

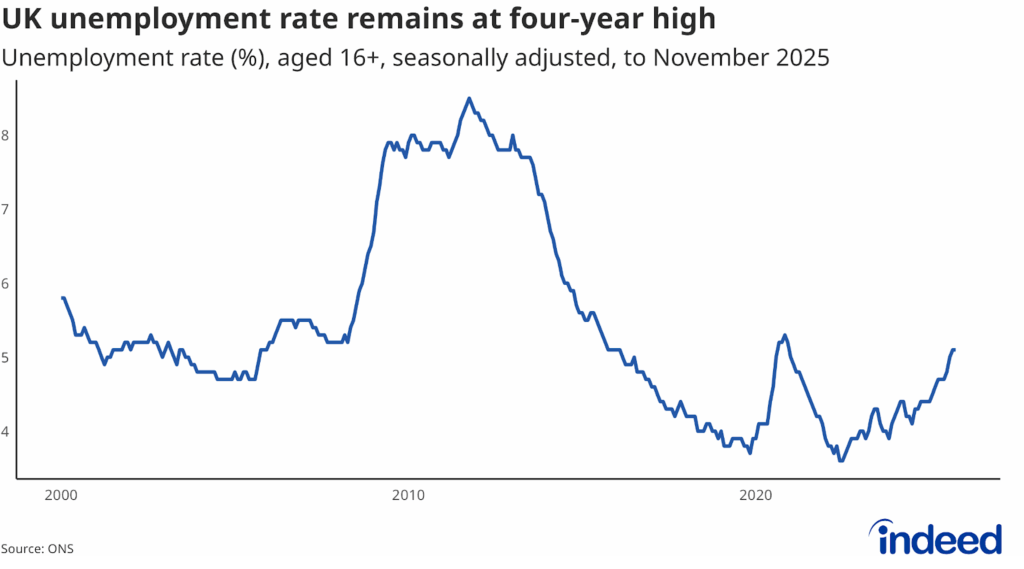

- The unemployment rate climbed to 5.2%, its highest level in nearly five years.

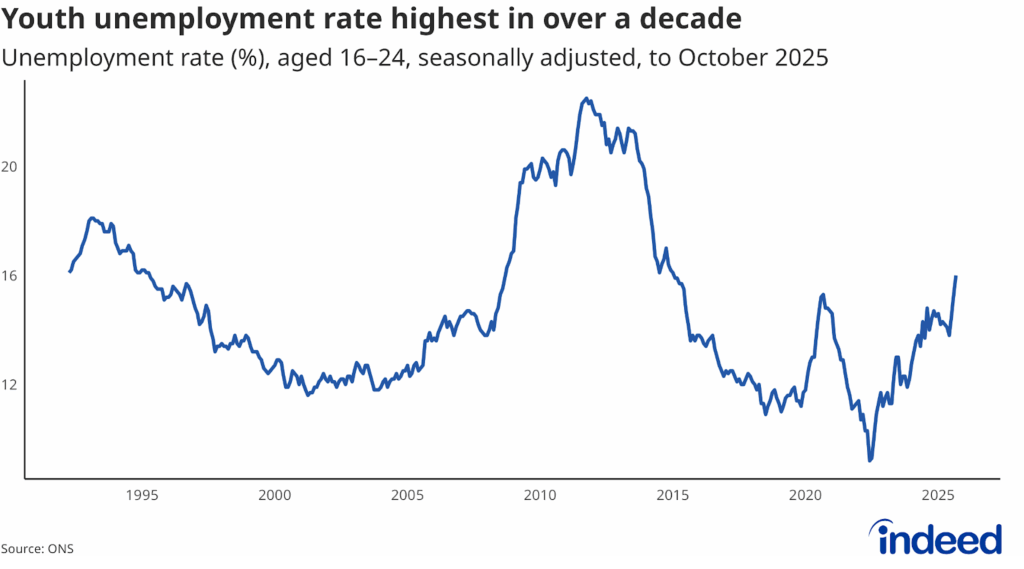

- Youth unemployment continues to climb, now standing at 16.1%.

- Wage growth continued to ease, suggesting diminishing risks of inflation persistence.

The latest official figures show a further weakening of the UK labour market, with the case for further Bank of England interest rate cuts continuing to grow. With labour market slack building, a March reduction looks increasingly likely – and more may follow.

Wage growth continued its gradual descent, with annual growth in average weekly earnings excluding bonuses slowing to 4.2% in the three months to December, down from 4.4% in the previous period. More encouragingly for the Bank of England, private sector wage growth eased to 3.4% – edging closer to the level the Monetary Policy Committee considers consistent with its 2% inflation target.

Slowing wage growth is a double-edged sword. While it may comfort policymakers worried about inflation persistence, it also reflects genuine weakness in labour demand. Employers are managing costs carefully and are still feeling the impact of the National Insurance increase, which hit businesses just as confidence was already fragile. Many are opting to do more with existing staff rather than hire, which may help explain some of the recent productivity growth we’ve been seeing.

Employer caution is widespread across sectors. Businesses are essentially in wait-and-see mode, reluctant to commit to expanding their workforce until they have greater clarity on the economic outlook.

What’s particularly concerning is the weakness at entry level. Employers are navigating a difficult environment – higher payroll costs, fragile business confidence and persistent uncertainty around growth – and they’re responding by pulling back on junior hiring. This makes it harder for younger workers to get that crucial first foot on the career ladder, and we’re seeing this reflected in rising youth unemployment. This isn’t just a short-term problem; delayed career starts can have lasting effects on earnings and progression.