Key points:

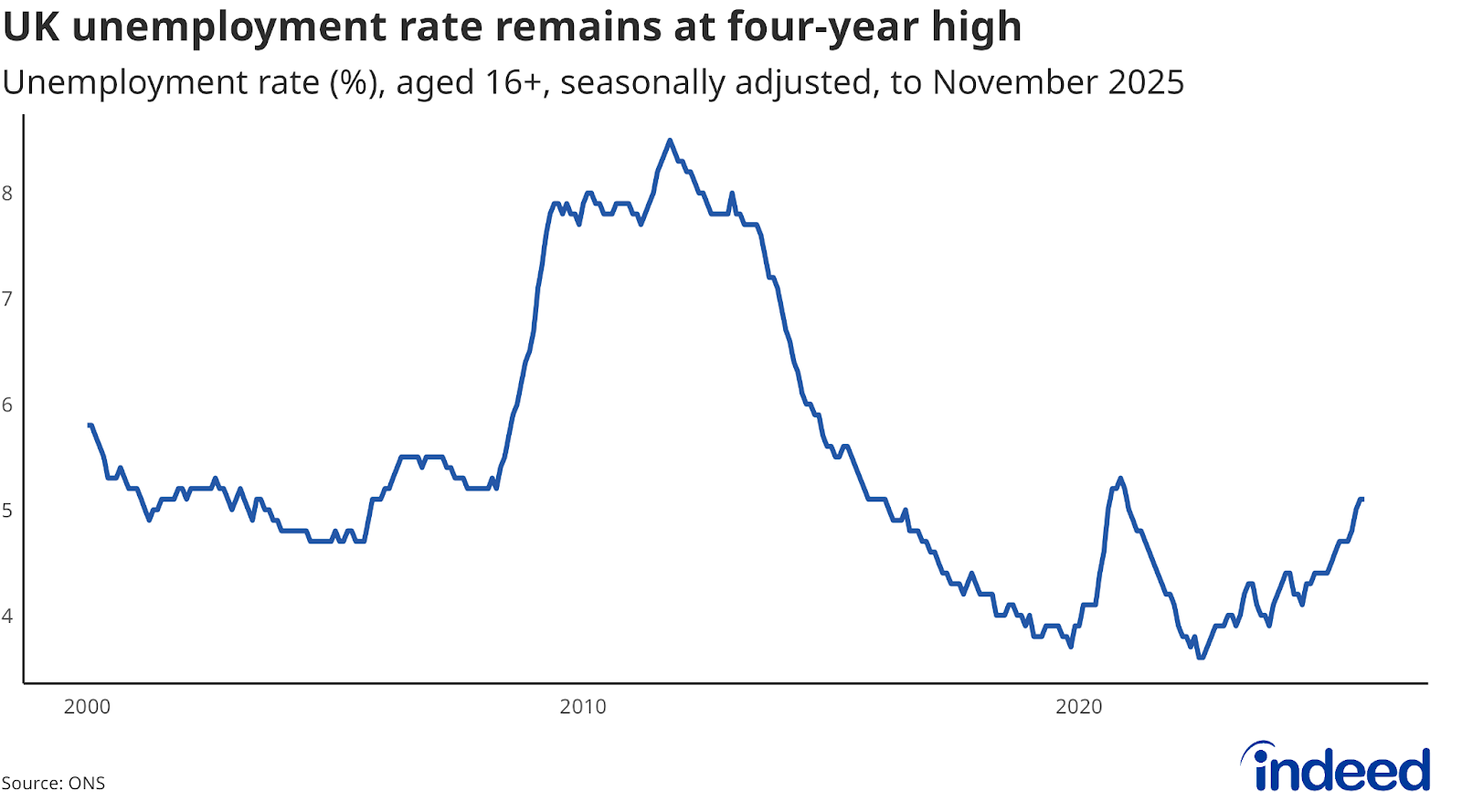

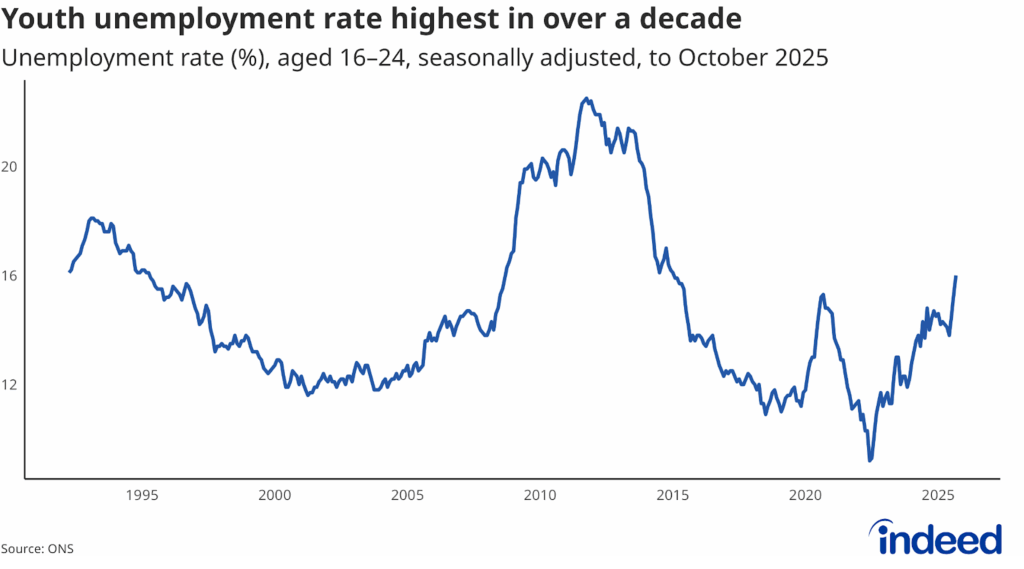

- The unemployment rate remained at a four-year high of 5.1% in the three months to November, while payrolled employment continued to fall.

- Slowing wage growth should reassure the Bank of England that inflation pressures are easing, opening the door to further interest rate cuts.

Further signs of softening in the labour market, alongside easing wage growth, strengthen the case for additional interest rate cuts from the Bank of England in the coming months, as inflation pressures continue to fade.

Unemployment remained at a four-year high of 5.1% in the three months to the end of November, up from 4.4% a year earlier. The number of people on company payrolls continued to decline, falling by 184,000 over the same period, with retail and hospitality accounting for much of the weakness.

Pay growth also continues to cool. Average weekly earnings excluding bonuses rose by 4.5% year on year, in line with expectations and slightly down from 4.6% in the three months to October. Pertinently for policymakers, private-sector wage growth slowed more sharply to 3.6%, down from 3.9% the previous month and the lowest in five years, signalling easing underlying inflationary pressure.

Employers remain cautious, with confidence still fragile. Uncertainty has eased somewhat following the Budget and the passage of the Employment Rights Act, albeit some of the latter’s provisions are still to be finalised.

One relative bright spot is that vacancies have stabilised in recent months. However, a clearer improvement in the UK economic outlook is likely needed before hiring activity picks up more meaningfully. Lower interest rates would be the most obvious catalyst, potentially supporting consumer spending. Until businesses sense a more durable improvement in the outlook, the labour market looks set to remain subdued.